2024 Homeowner Tax Rebate Credit Homeowners filing taxes jointly can deduct all payments for mortgage interest on loans up to 1 million or loans up to 750 000 if made after Dec 15 2017 Single filers get half those amounts

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners To claim the credit taxpayers need to file Form 5695 Residential Energy Credits Part II with their tax return Speed tax refunds with direct deposit Filing electronically and choosing direct deposit is the fastest way for taxpayers to get their tax refund Direct deposit gives individuals access to their refund faster than a paper check

2024 Homeowner Tax Rebate Credit

2024 Homeowner Tax Rebate Credit

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1920&h=1080&crop=1

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

As of January 23 2024 the First Time Homebuyer Act has not been enacted President Biden first announced the 15 000 tax credit on his 2020 campaign trail and the program became known as the Biden First Time Home Buyer Tax Credit The bill did not survive the last Congress and the tax credit is also not dead The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

For joint filers deductions apply to mortgage interest payments on loans up to 1 million or 750 000 for loans made after Dec 15 2017 Single filers can claim half these amounts 500 000 or 375 000 respectively To claim this deduction use IRS Form 1098 provided by your lender in early 2024 entering the amount from Line 1 onto Line Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs

Download 2024 Homeowner Tax Rebate Credit

More picture related to 2024 Homeowner Tax Rebate Credit

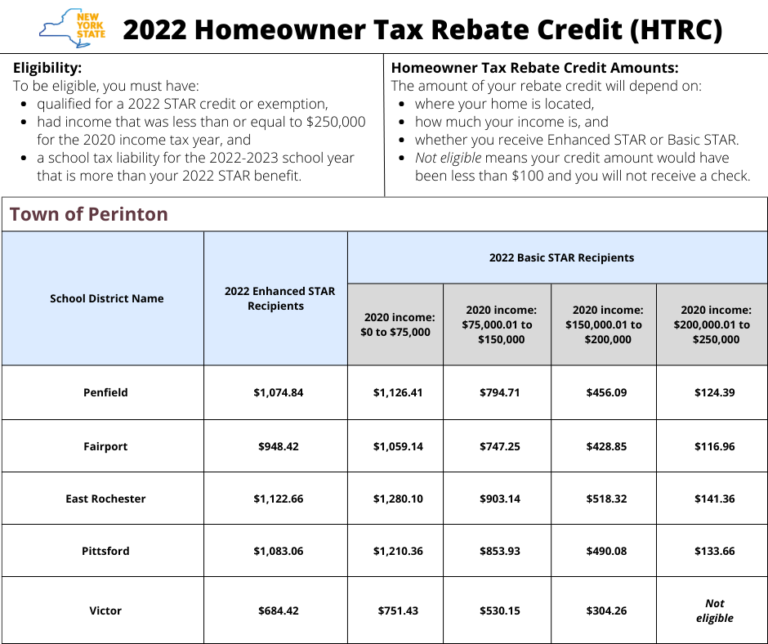

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-768x644.png

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check WRGB

https://cbs6albany.com/resources/media2/16x9/full/1015/center/80/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

https://i.ytimg.com/vi/_vD5dD4pZ7Q/maxresdefault.jpg

Under the law the HOMES rebate should be available to whole house energy saving retrofits that begin after the Inflation Reduction Act became law on August 16 2022 and completed before Here s an overview of tax credits many first time homebuyers can claim 10 Tax Breaks You Have as a New Homebuyer Tax credits and breaks for first time home buyers can be an attractive incentive that makes purchasing a home more affordable These credits are designed to support new buyers and stimulate the housing market

Key Takeaways President Biden signed the Inflation Reduction Act into law on Aug 16 2022 Consumers might qualify for 10 000 or more in tax breaks and rebates The tax incentives help make 10 of the cost of improvements for insulation roofs and doors with a maximum credit of 500 10 of the cost of windows with a maximum of credit of 200 Windows must meet new Energy Star requirements 150 maximum credit for furnaces and boilers with minimum 95 AFUE requirement on all types

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

https://i.ytimg.com/vi/ZN9k_nErOQE/maxresdefault.jpg

The Ultimate List Of Homeowner Tax Credits For 2020 Lifestyle

https://blog.nhregister.com/lifestyle/files/2020/07/homeowner-tax-credits-768x512.jpeg

https://www.cnet.com/personal-finance/taxes/all-the-tax-breaks-homeowners-can-take-for-a-maximum-tax-refund-in-2024/

Homeowners filing taxes jointly can deduct all payments for mortgage interest on loans up to 1 million or loans up to 750 000 if made after Dec 15 2017 Single filers get half those amounts

https://todayshomeowner.com/hvac/guides/hvac-tax-credit/

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

NYS Homeowner Tax Rebate Credit Checks Being Mailed Out

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Direct Payments Worth Up To 1 050 Being Sent To Millions Of Americans NOW Are You Eligible

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

NYS 2023 Homeowner Tax Rebate Tax Rebate

2024 Homeowner Tax Rebate Credit - For joint filers deductions apply to mortgage interest payments on loans up to 1 million or 750 000 for loans made after Dec 15 2017 Single filers can claim half these amounts 500 000 or 375 000 respectively To claim this deduction use IRS Form 1098 provided by your lender in early 2024 entering the amount from Line 1 onto Line