Relief And Rebate In Income Tax Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web Key Difference Tax Relief is any program or incentive that helps reduce the tax in some way or another This tax relief can be in the form of a tax deduction or a tax credit A tax deduction is basically a deduction of tax Web 2 mars 2023 nbsp 0183 32 Tax relief is any program or incentive that reduces the amount of tax owed by an individual or business entity Examples of tax relief include the allowable deduction for pension contributions

Relief And Rebate In Income Tax

Relief And Rebate In Income Tax

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2021/10/REBATE-AND-RELIEFS-UNDER-INCOME-TAX.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

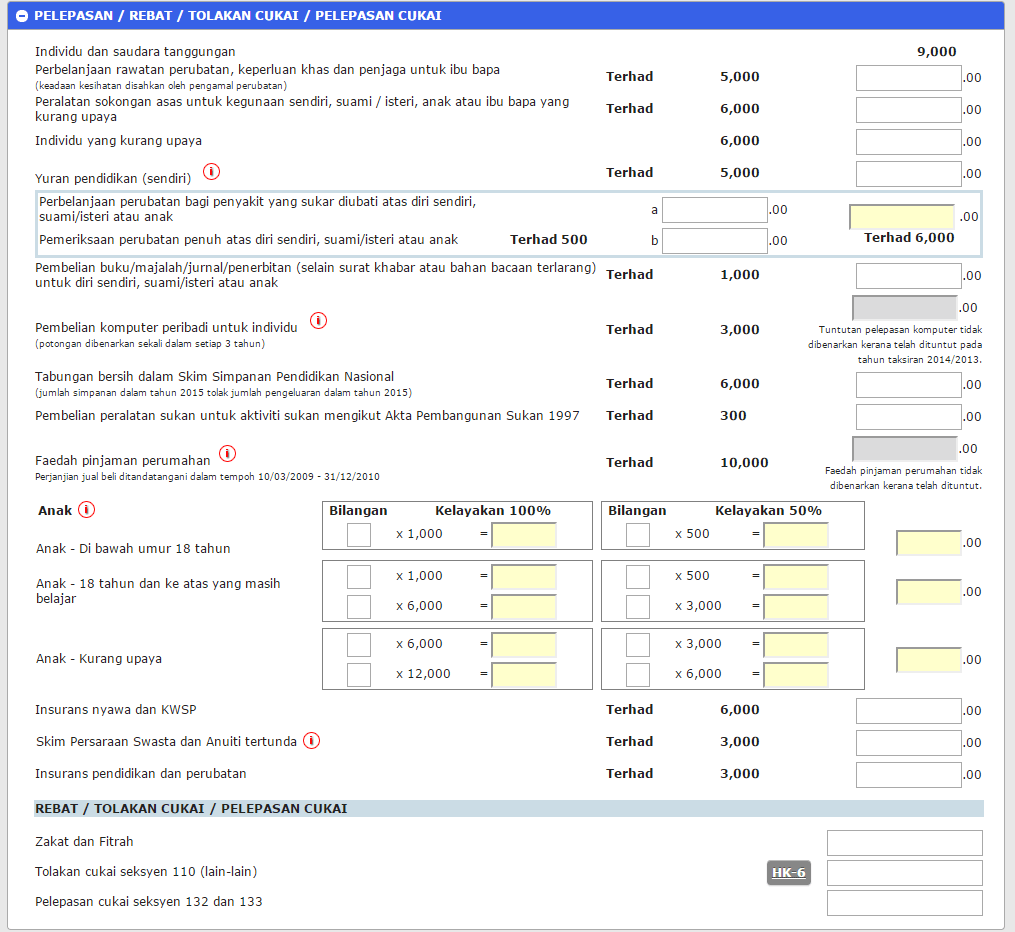

Malaysia Personal Income Tax Guide 2020 YA 2019

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/tax-reliefs-rebates-income-tax.png?is-pending-load=1

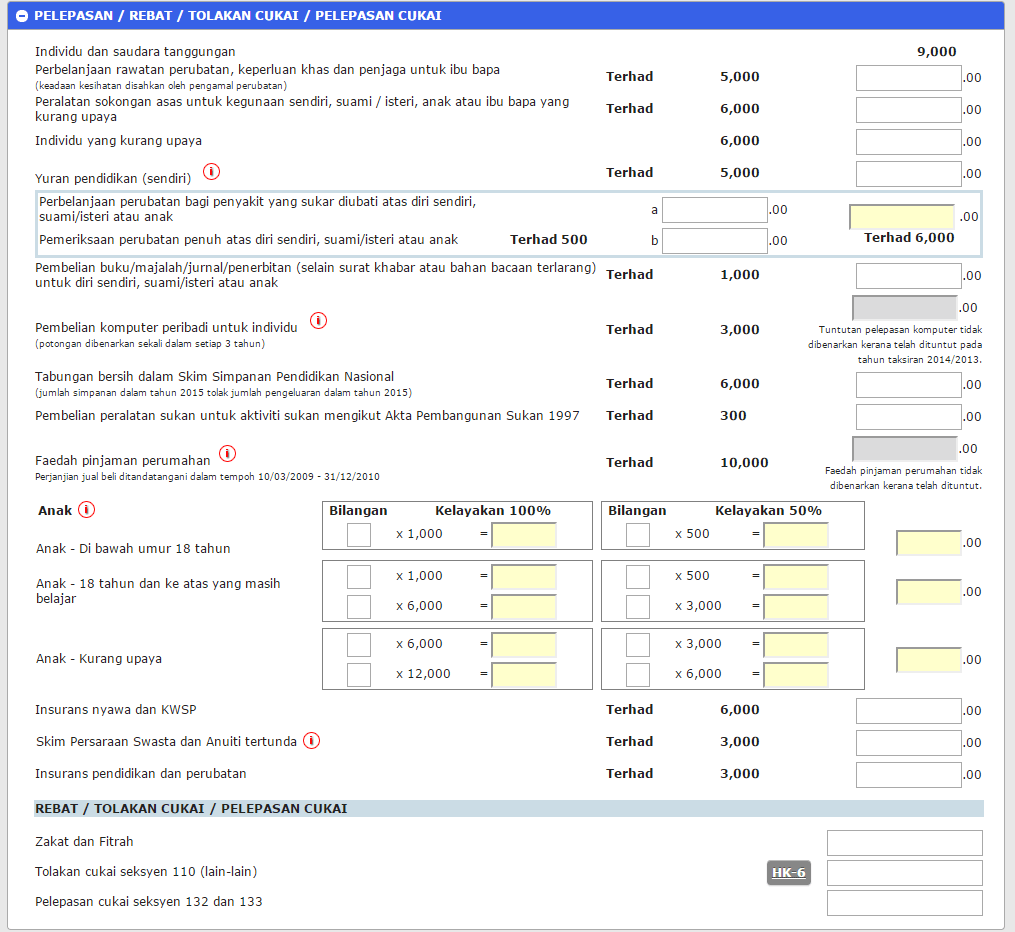

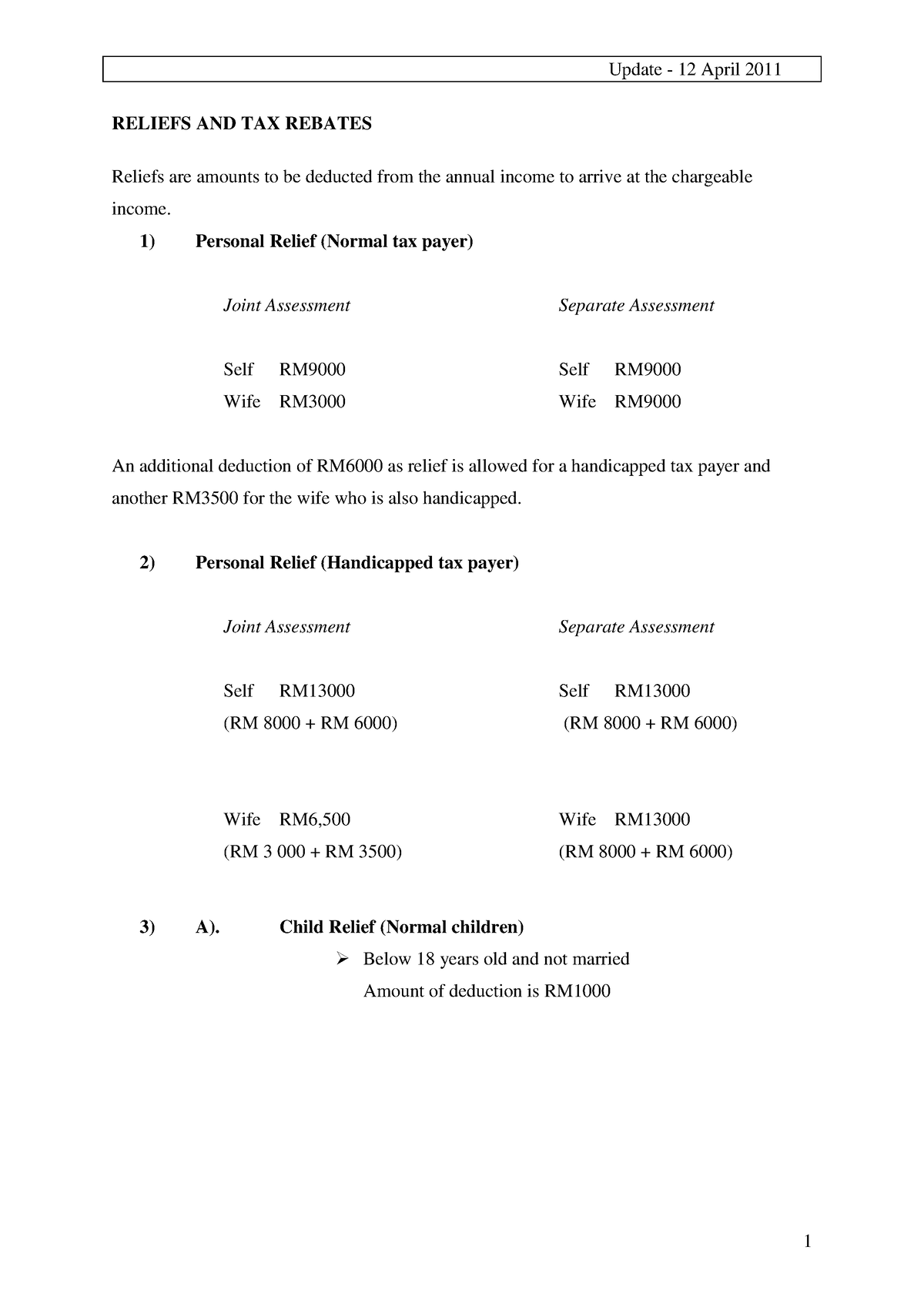

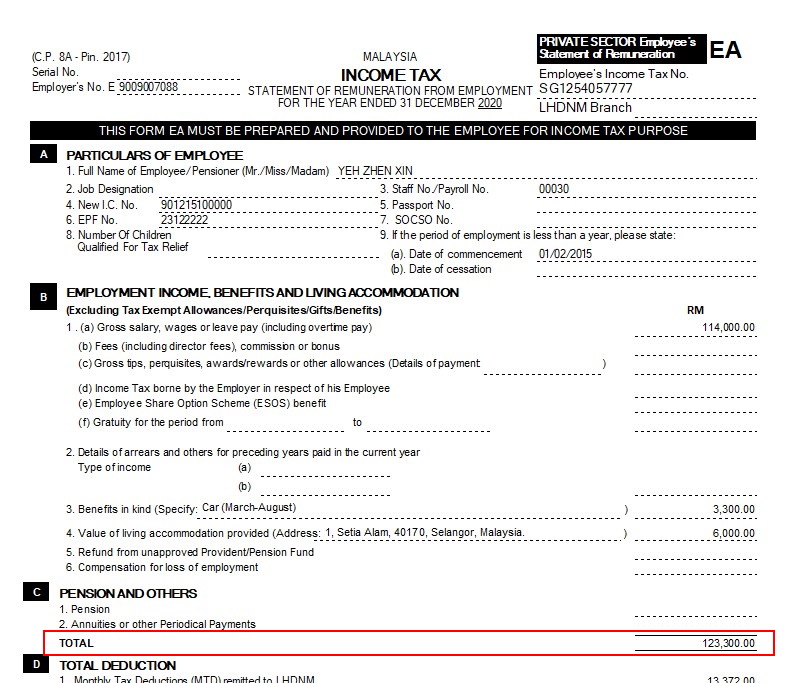

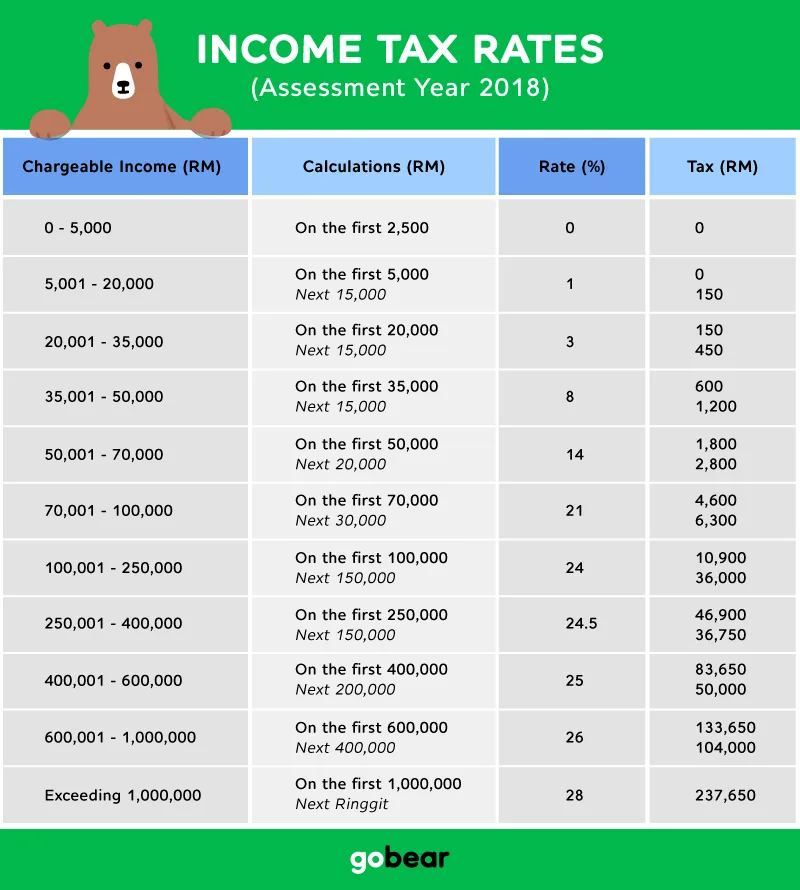

Web 6 avr 2021 nbsp 0183 32 Tax reliefs and tax exemptions are deducted from your total annual income After deduction this amount is known as chargeable income Meanwhile tax rebate is Web 20 ao 251 t 2022 nbsp 0183 32 Through this article you can go through comprehensive knowledge and facts about provisions related to Rebates and Reliefs allowed under the Act Chapter 8 of

Web 19 oct 2021 nbsp 0183 32 Rebate and Reliefs under income tax Taxblock 19 October 2021 Share REBATE UNDER SECTION 87A Rebate under section 87A of the Income Tax Act is a Web 10 f 233 vr 2023 nbsp 0183 32 Most taxpayers are entitled to exemptions to reduce their tax liability In other words expenditure income or investments on which no tax is levied to reduce the

Download Relief And Rebate In Income Tax

More picture related to Relief And Rebate In Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

Income Tax Deduction Malaysia Joseph Randall

https://d3q48uqppez4lq.cloudfront.net/wp-content/uploads/2020/12/malaysia-tax-relief-2020-mypf.png

Personal Tax Relief Malaysia 2019 Income Tax Filing Malaysia 4 Ten

https://4.bp.blogspot.com/-JTsquM0HYuI/XmW7noYMLVI/AAAAAAAAIt8/upx_BvbleAMpvjOk73KfmRmQcO37CDOqwCLcBGAsYHQ/s1600/LHDN%2Btax%2Brelief%2Bassessment%2Byear%2B2019.jpg

Web 1 d 233 c 2022 nbsp 0183 32 Getting money back Federal state and local legislatures frequently issue tax rebates to encourage taxpayers to make certain types of purchases or to stimulate a flagging economy quickly by getting cash Web 11 avr 2023 nbsp 0183 32 11 April 2023 Income Tax Rebate What is rebate in income tax Income tax rebate is a benefit provided by the government to taxpayers that allows them to

Web Taxes Individual Income Tax Basics of Individual Income Tax Tax reliefs rebates and deductions Tax reliefs and rebates Check the personal tax reliefs that you may be Web Coronavirus Tax Relief and Economic Impact Payments Internal Revenue Service We re offering tax help for individuals families businesses tax exempt organizations and

How to Step By Step Income Tax E Filing Guide IMoney

https://www.imoney.my/articles/wp-content/uploads/2016/03/e-filing-3.png

Income TAX reliefs And Rebates RELIEFS AND TAX REBATES Reliefs Are

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/282139760885f52ec10c99459eb6f12f/thumb_1200_1697.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-and...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

http://www.differencebetween.info/difference …

Web Key Difference Tax Relief is any program or incentive that helps reduce the tax in some way or another This tax relief can be in the form of a tax deduction or a tax credit A tax deduction is basically a deduction of tax

DEDUCTION UNDER SECTION 80C TO 80U PDF

How to Step By Step Income Tax E Filing Guide IMoney

Income Tax Relief 2020 Malaysia You Can Claim A Tax Relief Of Up To

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

10 Ways I Declutter My Finances For The New Year Figuringgitout

Rebates And Reliefs Of Income Tax Law

Rebates And Reliefs Of Income Tax Law

Tax Rebate For Individual Deductions For Individuals reliefs

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Lhdn 2017 Tax Relief Year 2019 Income Tax Relief Table Oh Year 2019

Relief And Rebate In Income Tax - Web Tax Rebate Smart Discount on your income We are all used to haggling when it comes to paying money Perhaps keeping this aspect in mind the government introduced the