What Is Rebate In Income Tax Understanding Tax Rebates and Adjustments Rebates These are partial or full refunds of taxes you ve already paid Adjustments These reduce your taxable income before calculating your tax liability Claiming Your Tax Benefits Here s a breakdown of common adjustments and rebates available in Pakistan 1 Utility Bill Adjustments

Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old regime in FY 2023 24 Your income tax liability becomes nil after claiming the rebate under Section 87A Income Tax Refund Refund can be only claimed if the person has filed their Income Tax Return electronically A manual Return does not entitle you to a refund The refund amount should be clearly reflected in your Income Tax Return in Iris

What Is Rebate In Income Tax

What Is Rebate In Income Tax

https://www.pdffiller.com/preview/630/36/630036795/large.png

MCTR Payment Activate Card California Middle Class Tax Refund

https://www.ftb.ca.gov/images/MCTR_Envelope_Card_Logo.png

How To Calculate Tax Rebate In Income Tax Of Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2017/08/Calculate-tax-rebate-1024x768.jpg

2024 Google LLC Finance Minister Nirmala Sitharaman in the Union Budget 2023 24 presented on Feb 1 tweaked the slabs to provide some relief to the middle class by announc A tax rebate essentially entails a reduction in the tax amount that individuals are required to pay It serves as an incentive offered by the government to encourage savings and is specifically outlined in Section 237 of the Income Tax Act

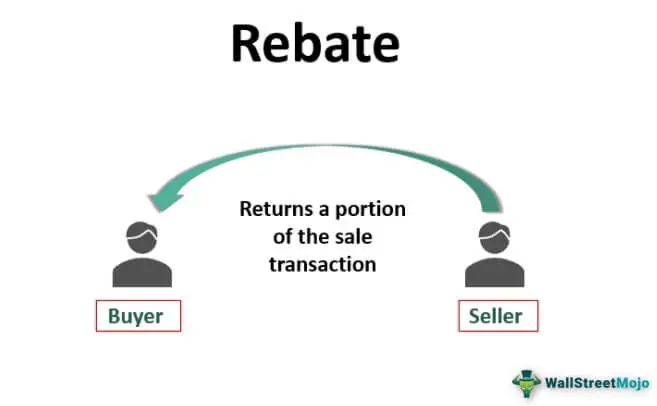

A tax rebate refers to a tax refund when the actual tax liability is lower than the taxes paid For example if your actual tax liability is Rs 40 000 but your employer has deducted a TDS of Rs 50 000 you are eligible for a refund of Rs 10 000 Taxable Income means Total Income reduced by donations qualifying straight for deductions and certain deductible allowances Total Income is the aggregate of Income chargeable to Tax under each head of Income Head of Income Under the Income Tax Ordinance 2001 all Income are broadly divided into following five heads of Income

Download What Is Rebate In Income Tax

More picture related to What Is Rebate In Income Tax

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Rebate What Is It Example Vs Discount Types Regulations

https://www.wallstreetmojo.com/wp-content/uploads/2021/01/Rebate.jpg.webp

It is a benefit provided by the government to incentivize and provide relief to certain categories of taxpayers The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2023 24 under the old regime Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax rebate effectively makes zero tax outgo of an individual

[desc-10] [desc-11]

2022 Tax Brackets JeanXyzander

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

https://taxationpk.com/understanding-tax...

Understanding Tax Rebates and Adjustments Rebates These are partial or full refunds of taxes you ve already paid Adjustments These reduce your taxable income before calculating your tax liability Claiming Your Tax Benefits Here s a breakdown of common adjustments and rebates available in Pakistan 1 Utility Bill Adjustments

https://cleartax.in/s/income-tax-rebate-us-87a

Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old regime in FY 2023 24 Your income tax liability becomes nil after claiming the rebate under Section 87A

Melham Deadline For ANCHOR Rebate Applications Extended To Jan 31

2022 Tax Brackets JeanXyzander

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Rebating Meaning In Insurance What Is Insurance Rebating The

Rebating Meaning In Insurance What Is Insurance Rebating The

Income Tax Rebate Under Section 87A

Cukai Pendapatan How To File Income Tax In Malaysia JobStreet Malaysia

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

What Is Rebate In Income Tax - A tax rebate refers to a tax refund when the actual tax liability is lower than the taxes paid For example if your actual tax liability is Rs 40 000 but your employer has deducted a TDS of Rs 50 000 you are eligible for a refund of Rs 10 000