What Is Housing Loan Rebate In Income Tax Verkko 18 jouluk 2023 nbsp 0183 32 The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans

Verkko 5 helmik 2023 nbsp 0183 32 Home Loan Tax Benefit Income Tax Benefit on House Loan know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and Verkko 26 hein 228 k 2018 nbsp 0183 32 In case you are living in the house for which home loan is taken both of you shall be entitled to deduction in the ratio 3 1 on account of interest on borrowed money up to a maximum of Rs 2 lakh individually Rs 1 50 Lakh up to A Y 2014 15

What Is Housing Loan Rebate In Income Tax

What Is Housing Loan Rebate In Income Tax

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

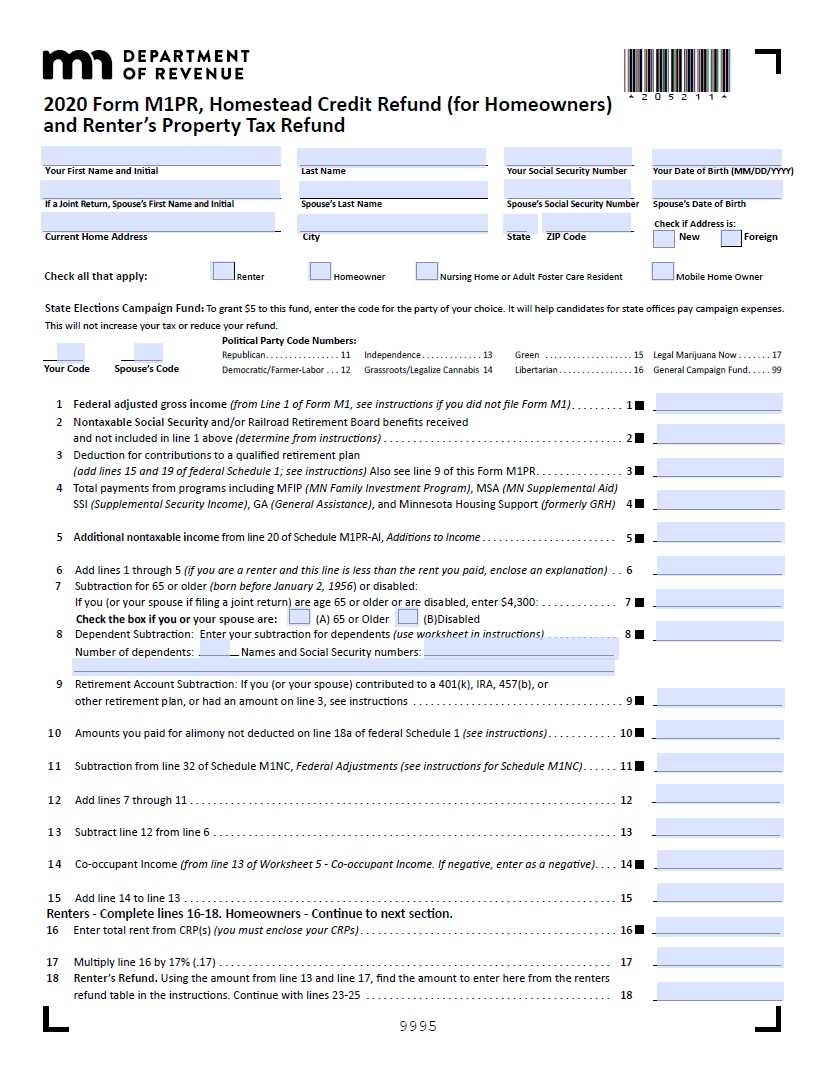

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Rebate Allowable Under Section 87A Of Income Tax Act

https://taxguru.in/wp-content/uploads/2020/08/Tax-Rebate.jpg

Verkko 31 toukok 2022 nbsp 0183 32 What are the Income Tax Benefits that come with Home Loans How to Claim Tax Benefits for Home Loan Repayment Tax Benefits on Joint Home Loan Tax Benefits for a Second Home Loan Tax Benefit for a Property Under Construction Loan Tax Exemptions on Home Loans and House Rent Allowance HRA Eligibility Criteria Verkko Tax Benefits under Section 80EE Allows you to avail tax benefits of up to Rs 1 5 lakh on the interest component paid on a home loan The benefit can be availed over and above the existing exemption of Rs 2 lakh under Section 24 b The value of property must be less than Rs 45 lakh

Verkko 11 tammik 2023 nbsp 0183 32 On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at length how these Verkko The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions Principal repayment of home loans can net annual tax deductions of up to Rs 1 5 lakh under Section 80C of the ITA

Download What Is Housing Loan Rebate In Income Tax

More picture related to What Is Housing Loan Rebate In Income Tax

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

What Is A Rebate In Income Tax

https://www.mudranidhi.com/wp-content/uploads/2023/12/What-is-a-Rebate-in-Income-Tax-1024x576.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/FeatureImage_Income-tax-rebate-on-home-loan-768x524.jpg

Verkko 9 syysk 2022 nbsp 0183 32 If you have taken a home loan you can avail of rebates on your income tax liability under various sections of the Income Tax Act in India An income tax rebate is allowed on both the principal and the interest throughout the repayment tenure of your home loan under the following sections Verkko Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a home loan interest deduction of up to Rs 50 000 per financial year as per this section You can continue to claim until you have fully repaid the loan

Verkko 20 lokak 2023 nbsp 0183 32 Updated 20 10 2023 09 45 45 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b To boost affordable housing Verkko Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

https://feeds.abplive.com/onecms/images/uploaded-images/2022/04/02/f76f68da854ba91279b6eb80f97615cb_original.jpg?impolicy=abp_cdn&imwidth=1200&imheight=628

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

https://cleartax.in/s/home-loan-tax-benefits

Verkko 18 jouluk 2023 nbsp 0183 32 The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans

https://cleartax.in/s/home-loan-tax-benefit

Verkko 5 helmik 2023 nbsp 0183 32 Home Loan Tax Benefit Income Tax Benefit on House Loan know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

Form For Renters Rebate RentersRebate

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Tax Benefits On Home Loan Loanfasttrack

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

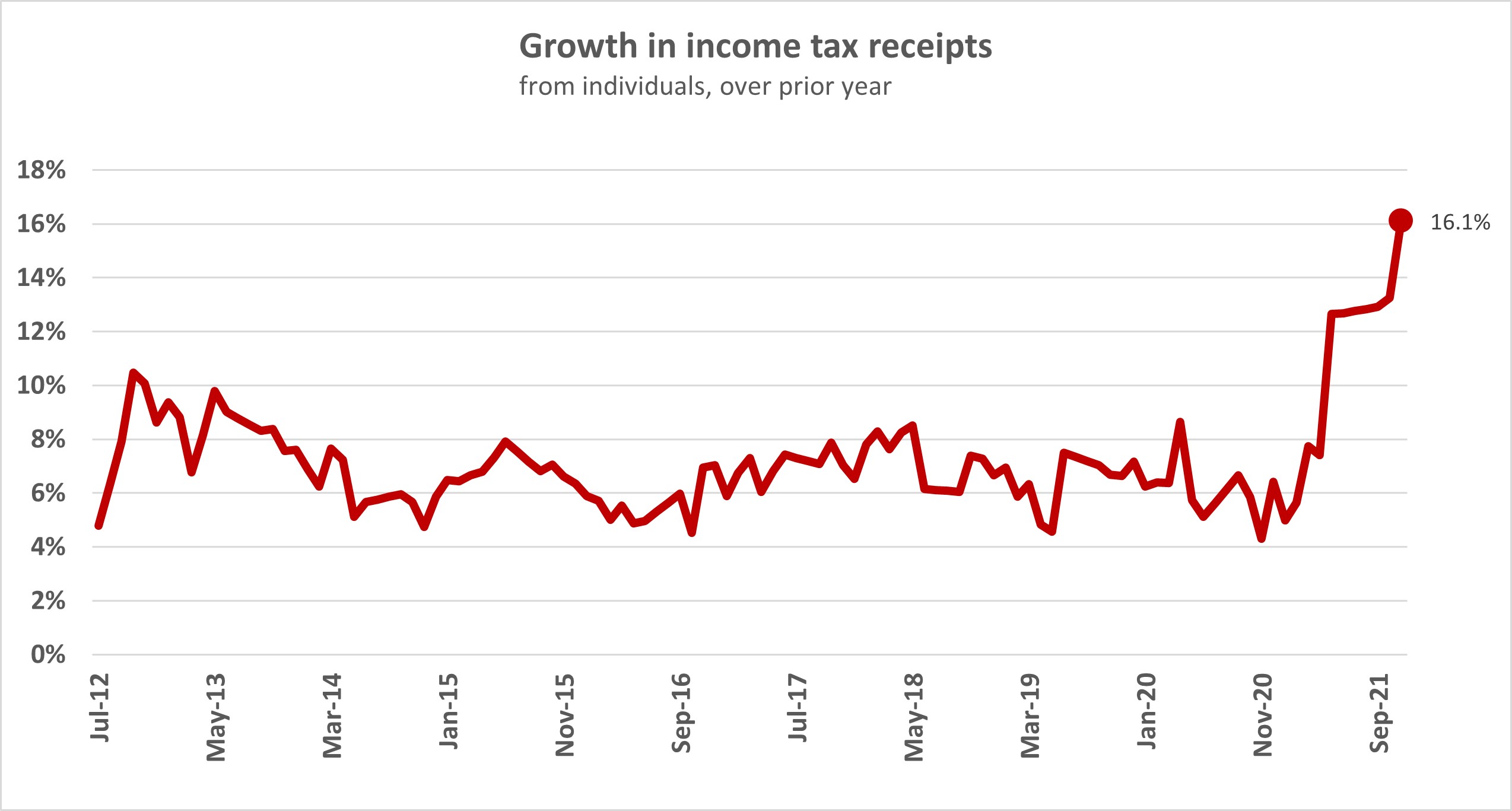

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

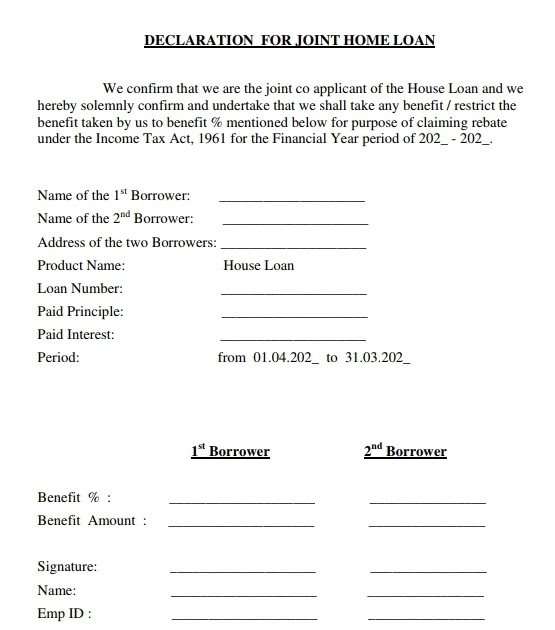

Joint Home Loan Declaration Form For Income Tax Savings And Non

7 Ways To Improve Your Chances Of Getting A Housing Loan Approval

What Is Housing Loan Rebate In Income Tax - Verkko Tax Benefits under Section 80EE Allows you to avail tax benefits of up to Rs 1 5 lakh on the interest component paid on a home loan The benefit can be availed over and above the existing exemption of Rs 2 lakh under Section 24 b The value of property must be less than Rs 45 lakh