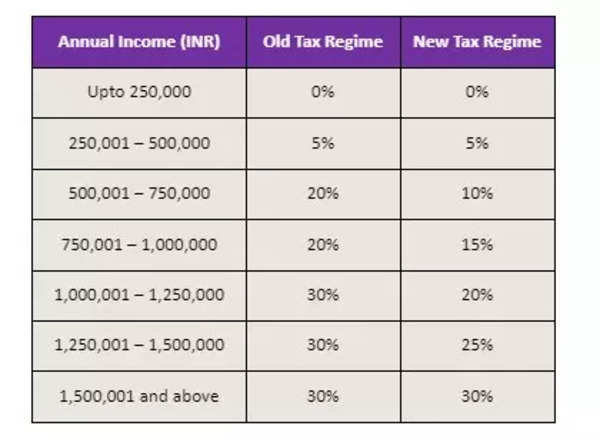

House Loan Exemption In Income Tax New Regime Verkko 26 lokak 2021 nbsp 0183 32 The new tax structure introduced in Budget 2020 does away with 70 odd tax deductions and exemptions and lowers tax rates for annual incomes up to

Verkko 18 jouluk 2023 nbsp 0183 32 Know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and Verkko 31 toukok 2022 nbsp 0183 32 Home Loans Tax Benefits Exemptions Under Section 80C 24 b 80EE amp 80EEA One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which

House Loan Exemption In Income Tax New Regime

House Loan Exemption In Income Tax New Regime

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Verkko In case of a self occupied property taxpayers cannot claim a deduction on interest for a housing loan under the new tax regime The deduction of Rs 2 lakh allowable under the existing system is not available in Verkko 18 huhtik 2023 nbsp 0183 32 If a taxpayer has a home loan as well as an 80C deduction of 1 5 lakh and a standard deduction of 50 000 they can save more money on taxes under

Verkko If you are serving Home Loan on both the homes you are eligible for tax exemption on the principal amount of both Home Loans capped maximum at INR 1 5 lakhs Verkko 22 maalisk 2023 nbsp 0183 32 The total tax deduction for home loans for two homes cannot exceed Rs 2 lakhs in a fiscal year Additional deduction on buying an affordable house An

Download House Loan Exemption In Income Tax New Regime

More picture related to House Loan Exemption In Income Tax New Regime

Income Tax Under New Regime Understand Everything

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/New-Regime-under-Income-Tax-819x1024.jpeg

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

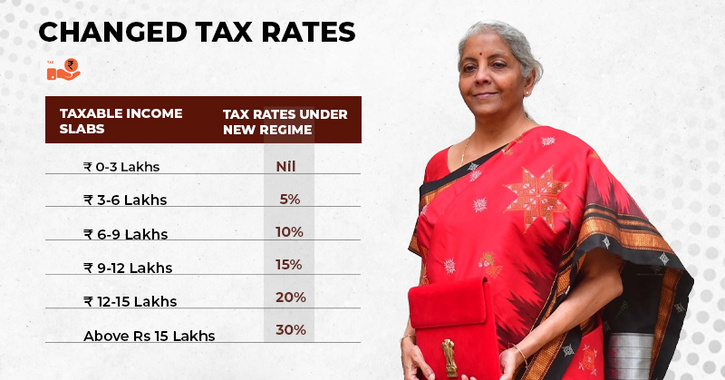

Verkko 5 helmik 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan Verkko 10 helmik 2023 nbsp 0183 32 Union Budget 2023 made the new tax regime attractive by reducing rates You have two options continue with the old regime and keep taking tax deductions or opt for the new one lower

Verkko 12 hein 228 k 2023 nbsp 0183 32 To calculate income from house property one needs to calculate the gross annual value GAV of a house property This GAV is needed only if you have Verkko 4 elok 2023 nbsp 0183 32 New Tax Regime A new tax regime was introduced in Budget 2020 wherein the tax slabs were altered and taxpayers were offered concessional tax

Old Income Tax Regime Vs New Regime Filing Of Return After Due Date

http://cachandanagarwal.com/wp-content/uploads/2022/03/Income-Tax-3-1024x576.jpeg

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

https://www.livemint.com/money/personal-finance/switching-to-new-tax...

Verkko 26 lokak 2021 nbsp 0183 32 The new tax structure introduced in Budget 2020 does away with 70 odd tax deductions and exemptions and lowers tax rates for annual incomes up to

https://cleartax.in/s/home-loan-tax-benefits

Verkko 18 jouluk 2023 nbsp 0183 32 Know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and

Budget 2023 Income Tax New Vs Old Tax Regime What Lies Ahead Times

Old Income Tax Regime Vs New Regime Filing Of Return After Due Date

10 FAQs About The New Income Tax Regime s Changes Effective From FY 2023 24

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

HRA Exemption Calculator In Excel House Rent Allowance Calculation

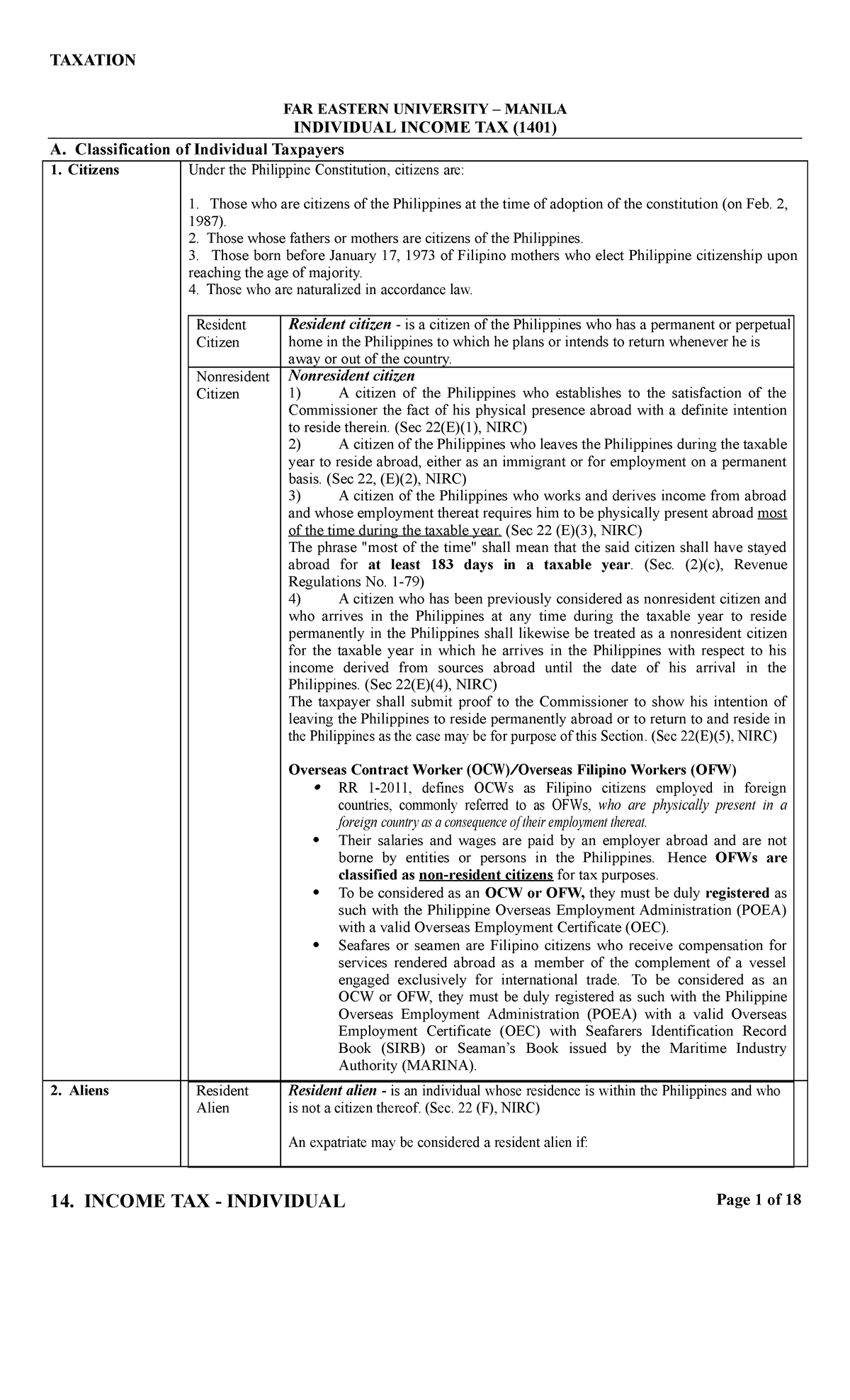

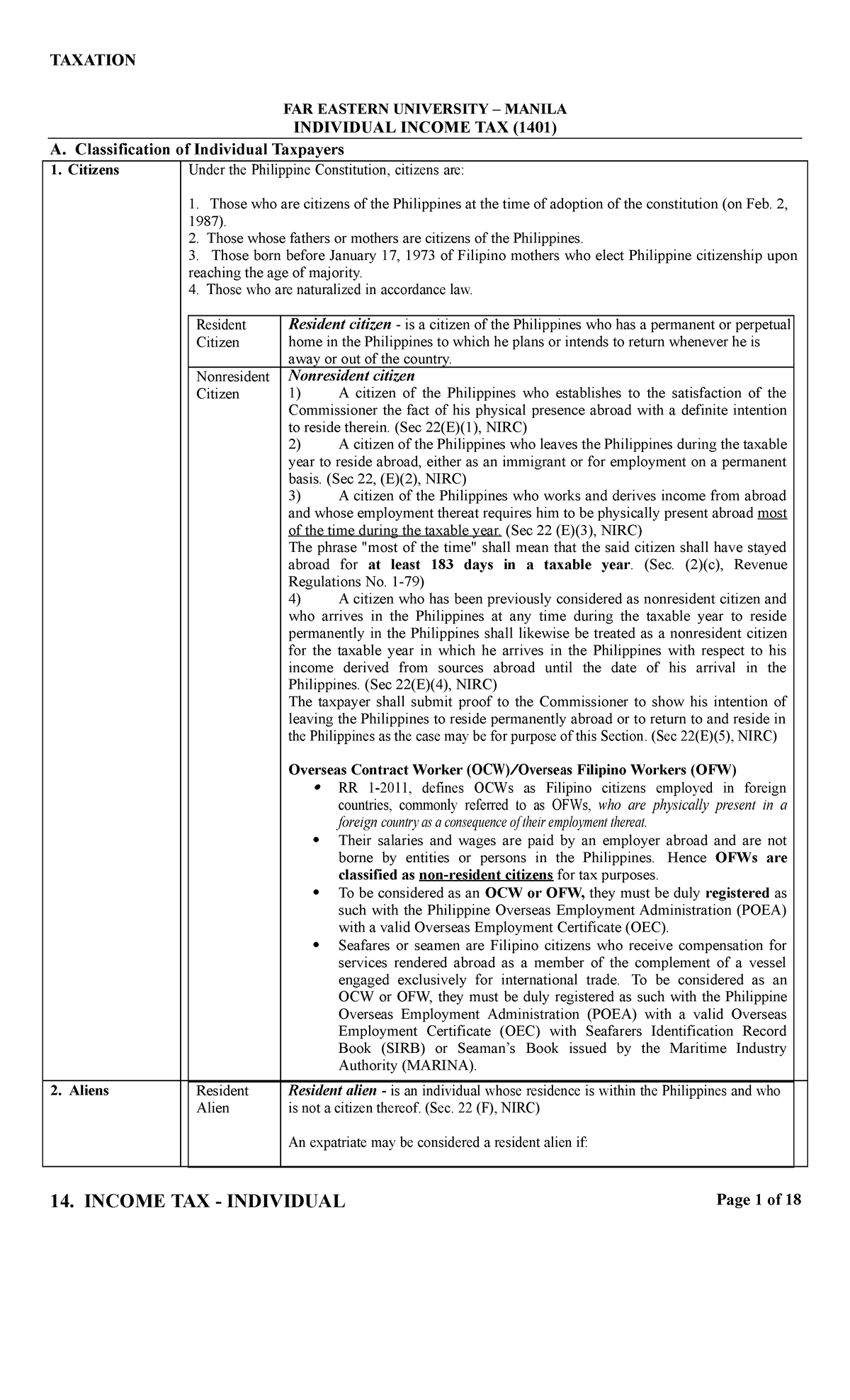

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

New Vs Old Income Tax Regime Why Taxpayers Must Choose Regime In April

Share

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

House Loan Exemption In Income Tax New Regime - Verkko 22 maalisk 2023 nbsp 0183 32 The total tax deduction for home loans for two homes cannot exceed Rs 2 lakhs in a fiscal year Additional deduction on buying an affordable house An