2024 Illinois Tax Rebates The tax filing deadline is Monday April 15 2024 Tax Credits Depending on circumstances taxpayers may be able to reduce the amount of taxes owed through tax credits explained Harris Some popular tax credits include the Illinois K 12 Education Expense Credit and the Property Tax Credit and the Illinois Earned Income Tax Credit EITC

Illinois Department of Revenue Announces Start to 2024 Income Tax Season Mission Vision and Value FY 2024 18 What s New for Illinois Income Taxes FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees Illinois Department of Revenue Announces Start to 2024 Income Tax Season Assistance for Taxpayers To receive assistance Illinois taxpayers may call 1 800 732 8866 or 217 782 3336 For the latest updates and information visit IDOR s website Federal Income Tax

2024 Illinois Tax Rebates

2024 Illinois Tax Rebates

https://www.usmint.gov/wordpress/wp-content/uploads/2022/06/IL-14.jpg

2024 American Innovation IL 1 CCAC Images U S Mint

https://www.usmint.gov/wordpress/wp-content/uploads/2022/06/IL-06B.jpg

Primary Rebate South Africa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022.png

The Illinois Earned Income Tax Credit EITC was increased this year to 20 of the Federal EITC and expanded to include taxpayers 18 years of age or older with or without qualifying child those 65 years of age or older without qualifying child and those with an IRS issued Individual Taxpayer Identification Number ITIN The current law states that the inflationary index will be reimposed for tax year 2024 But it promises to come with a significant price tag approximately 200 million according to an estimate by the legislature s non partisan budget arm the Commission on Government Forecasting Accountability

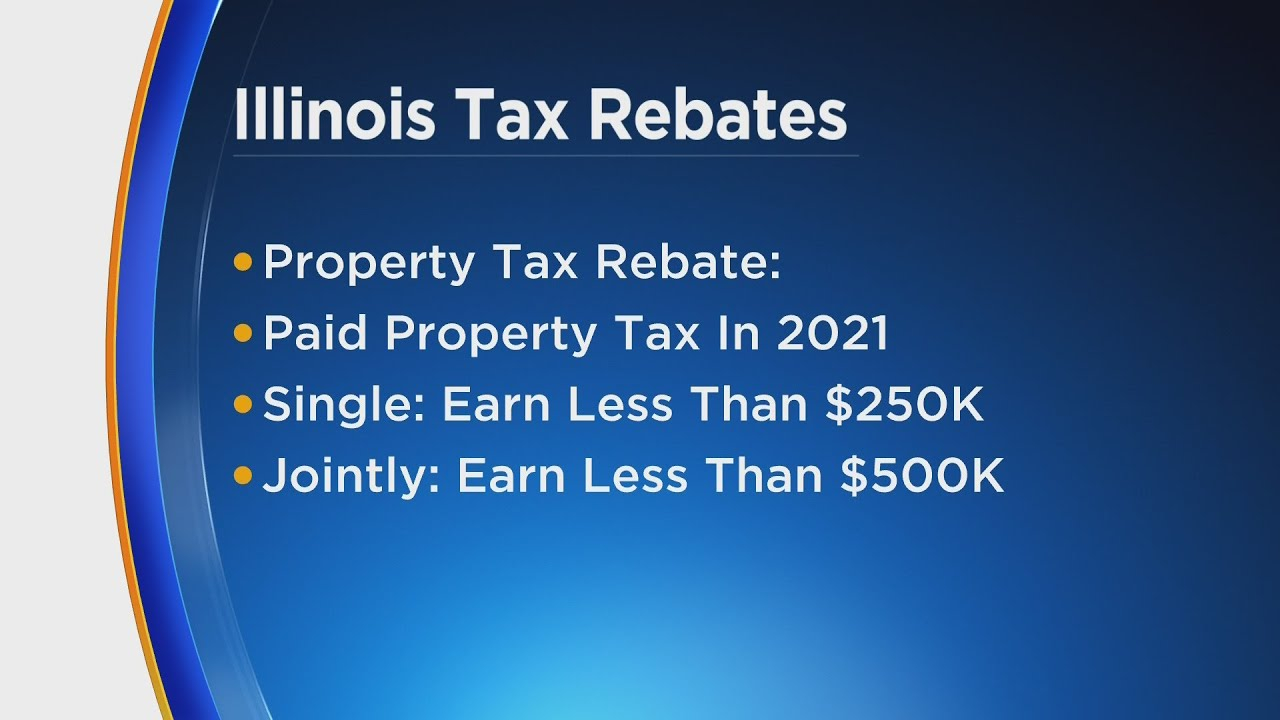

What are the effects of this change On and after January 1 2024 if you do not agree with a protestable assessment for a sales use or excise tax or fee you have two options In regard to the Individual Income Tax Rebate a person qualifies if they were an Illinois resident in 2021 and their adjusted gross income was under 400 000 if filing jointly or 200 000 if

Download 2024 Illinois Tax Rebates

More picture related to 2024 Illinois Tax Rebates

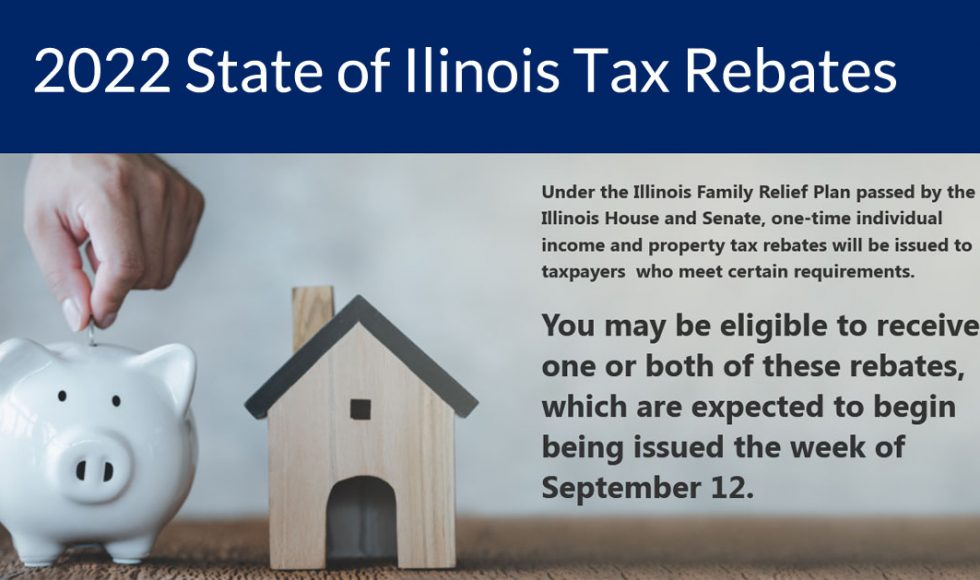

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

https://repsnessil66.com/wp-content/uploads/2022/09/2022-IL-Tax-Rebates_post.jpg

4 Things To Know About Illinois Income Property Tax Rebates

https://townsquare.media/site/723/files/2022/09/attachment-You.jpg?w=980&q=75

2023 2024 Income Eligibility Guidelines CDPHE WIC

https://www.coloradowic.gov/sites/default/files/media/image/IEG 22-23 English_02.png

From August 5 14 Illinois will have a sales tax holiday in which sales tax rates on school related items no cap and eligible clothing and footwear items cannot exceed 125 each will be reduced Applicable items will have a state sales tax of 1 25 instead of the existing 6 25 rate The local sales taxes will unfortunately still apply Those rebates passed as part of the state s fiscal year 2023 budget were given to individuals who made less than 200 000 or couples who made less than 400 000 Those rebates returned 50 to

2024 State Tax Changes Effective January 1st Tax Foundation Home Research State Tax Changes Taking Effect January 1 2024 State Tax Changes Taking Effect January 1 2024 December 21 202317 min read By Manish Bhatt Benjamin Jaros Latest Updates See Full Timeline Updated Jan 25 2024 03 51 PM CST ROCKFORD Ill WTVO The Illinois Department of Revenue IDOR announced Thursday that it will begin accepting and processing 2023 tax returns on January

Illinois Tax Rebates Are Coming In Time For The Election WTOP News

https://wtop.com/wp-content/uploads/2022/09/Illinois_Budget_Tax_Rebates_65831-scaled.jpg

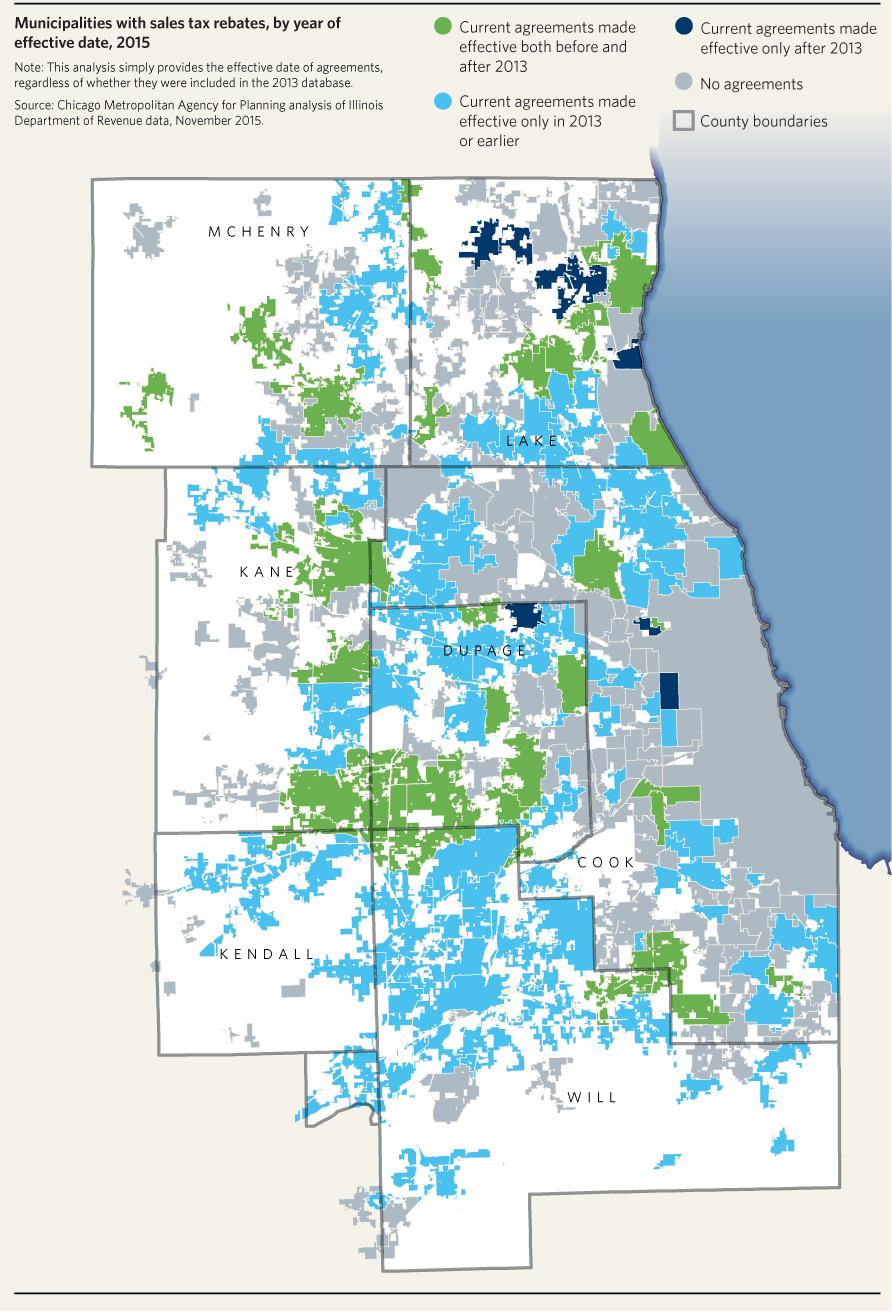

Sales Tax Rebates Remain Prevalent In Northeastern Illinois CMAP

http://www.cmap.illinois.gov/documents/10180/542501/salestaxrebates-agreement-age-rev_revised.png/5541dd1a-eb4d-4eae-89a5-bd280cca24c9?t=1463588683542

https://www.ibjonline.com/2024/01/26/illinois-department-of-revenue-announces-start-to-2024-income-tax-season/

The tax filing deadline is Monday April 15 2024 Tax Credits Depending on circumstances taxpayers may be able to reduce the amount of taxes owed through tax credits explained Harris Some popular tax credits include the Illinois K 12 Education Expense Credit and the Property Tax Credit and the Illinois Earned Income Tax Credit EITC

https://tax.illinois.gov/research/news/illinois-department-of-revenue-announces-start-to-2024-income-ta.html

Illinois Department of Revenue Announces Start to 2024 Income Tax Season Mission Vision and Value FY 2024 18 What s New for Illinois Income Taxes FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees Illinois Department of Revenue Announces Start to 2024 Income Tax Season

Tax Rebate FAQs Rep Thaddeus Jones

Illinois Tax Rebates Are Coming In Time For The Election WTOP News

Nj Property Tax Rebates 2023 PropertyRebate

Illinois Tax Rebates 2022

Stimulus Check Update 2022 Everything You Need To Know About Illinois State Tax Rebates

Illinois Tax Rebates 2022 Property Income Rebate Checks Being Sent To 6M Taxpayers Governor

Illinois Tax Rebates 2022 Property Income Rebate Checks Being Sent To 6M Taxpayers Governor

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

Illinois Income And Property Tax Rebates Begin In Less Than 1 Month NBC Chicago Patabook News

Illinois Tax Rebates For Solar Panels Electric Cars And Chargers Save Money And Environment

2024 Illinois Tax Rebates - What are the effects of this change On and after January 1 2024 if you do not agree with a protestable assessment for a sales use or excise tax or fee you have two options