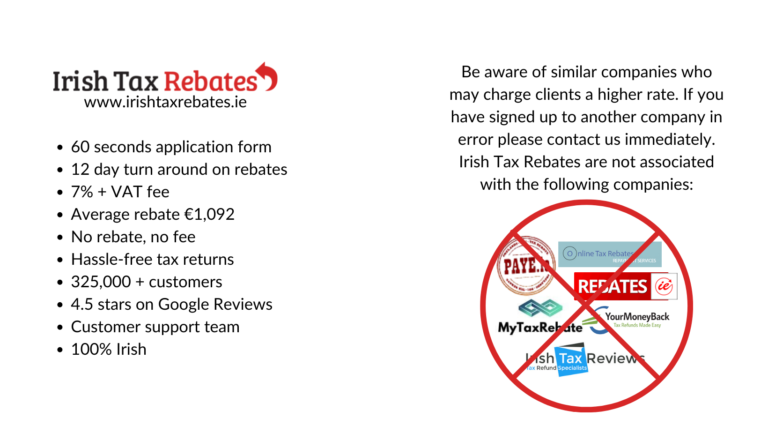

Irish Tax Rebates Contact Web Irish Tax Rebates ensure you get back all the tax that is owed to you for this year and the previous three Our comprehensive review will check overpaid income tax medical

Web Collector General s Division For enquiries relating to filing returns and making tax payments ROS payments debt management tax clearance and direct debits Central Repayments Web PPS Number How can we help Irish Tax Rebates will not use or share this data for marketing purposes For more information on how we share and process your data

Irish Tax Rebates Contact

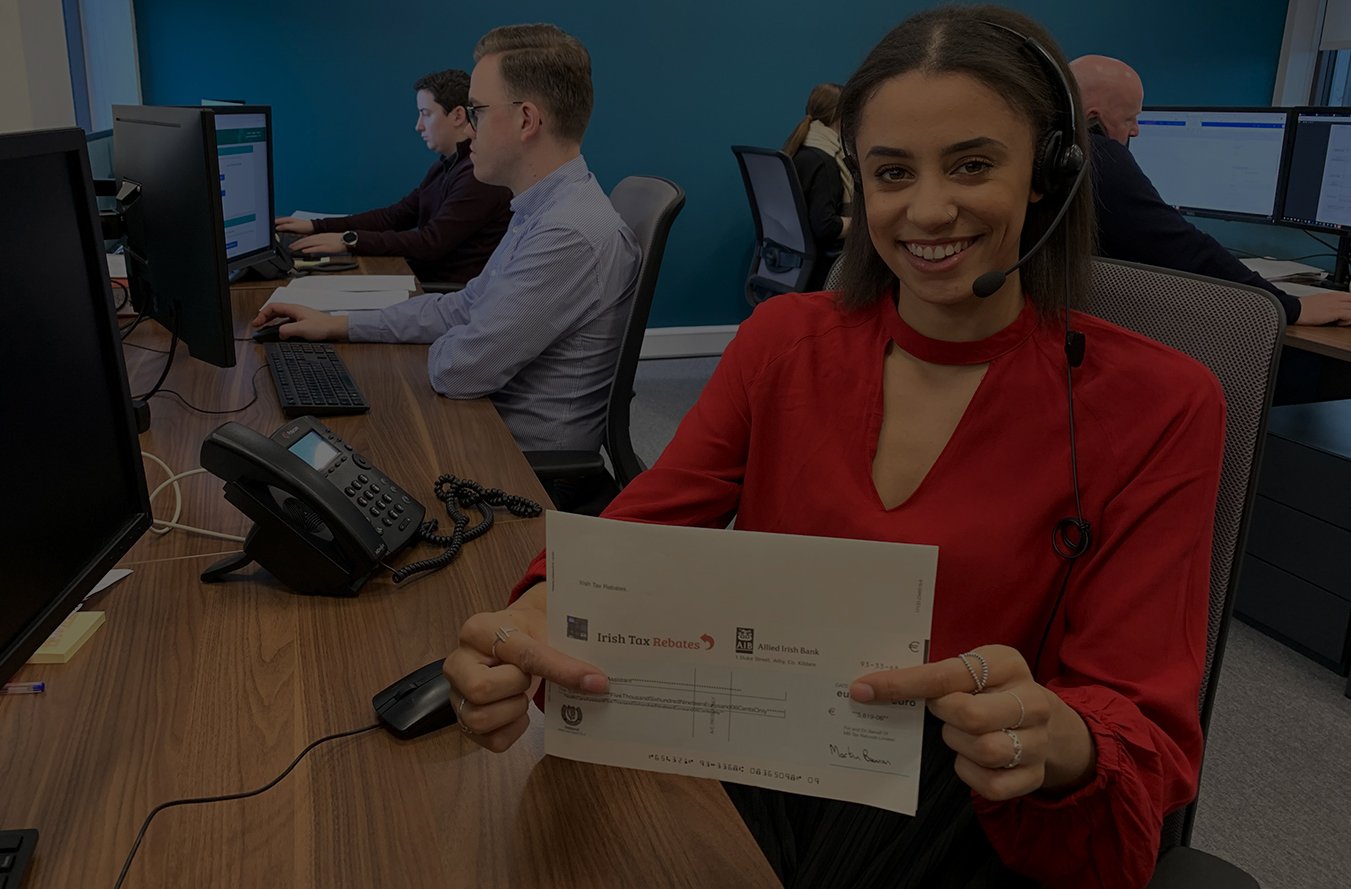

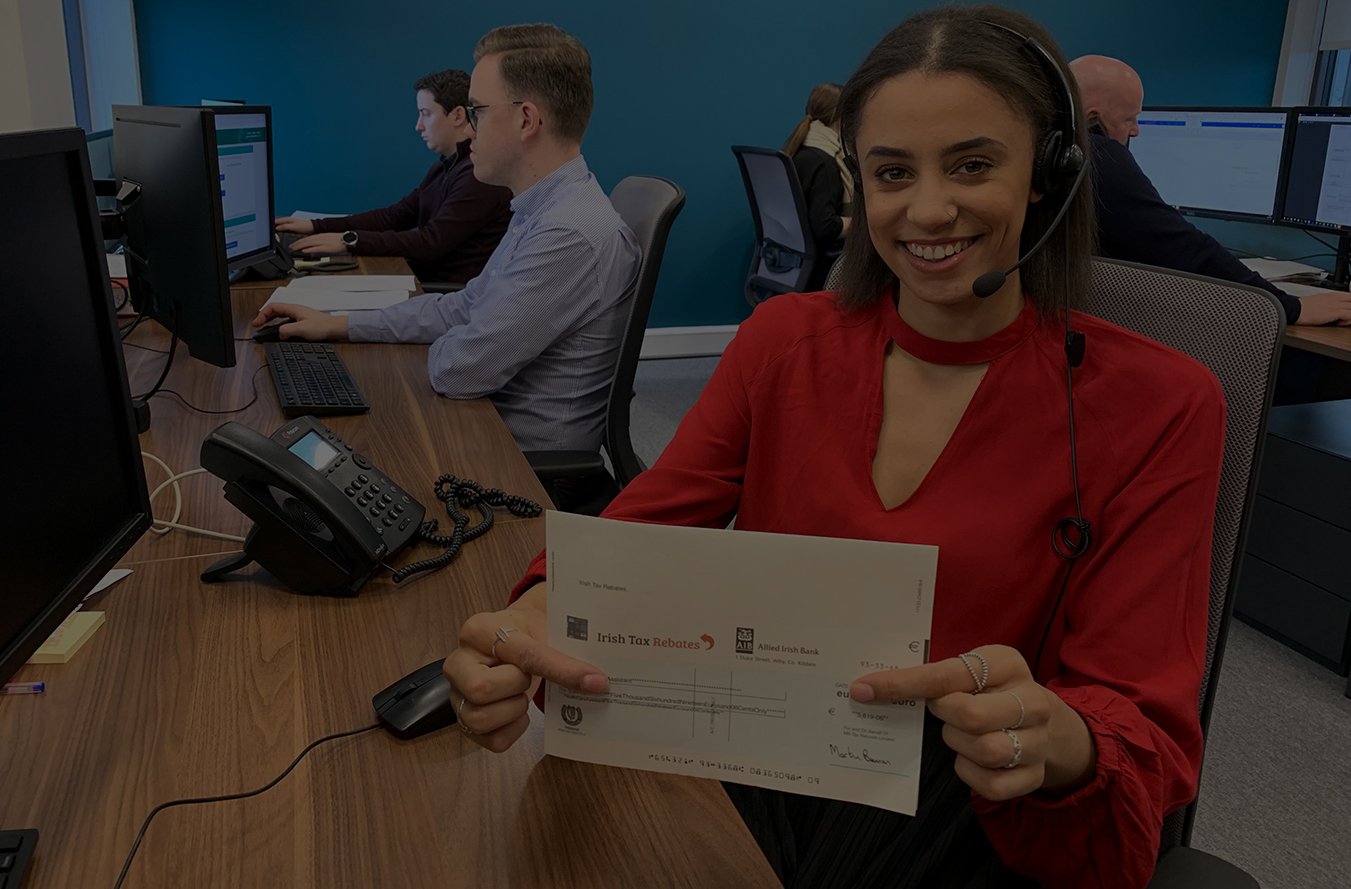

Irish Tax Rebates Contact

https://www.irishtaxrebates.ie/img/xirish_tax_rebates_contact_2.jpg.pagespeed.ic.8xfCdDliKv.jpg

Irish Tax Rebates We Do The Checking You Get The Cheque YouTube

https://i.ytimg.com/vi/kULnmAVqClw/maxresdefault.jpg

Claiming Tax Back FAQ s Irish Tax Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2015/10/itr-infographic-faq.jpg

Web Frequently Asked Questions Your Tax Rebate FAQs Here are some of our most frequently asked questions about Irish Tax Rebates If you have a question that s not answered Web 31 mars 2022 nbsp 0183 32 To claim a refund log into PAYE Services within myAccount and select Claim unemployment repayment If you are not e enabled you will need to send the

Web Starting work emergency tax claiming a refund calculating your tax understanding entitlements pensions being tax compliant Personal tax credits reliefs and Web Apply for refund of Value Added Tax VAT on sea fishing vessels and equipment Apply for refund of Value Added Tax VAT on marine diesel File a Mineral Oil Tax MOT e

Download Irish Tax Rebates Contact

More picture related to Irish Tax Rebates Contact

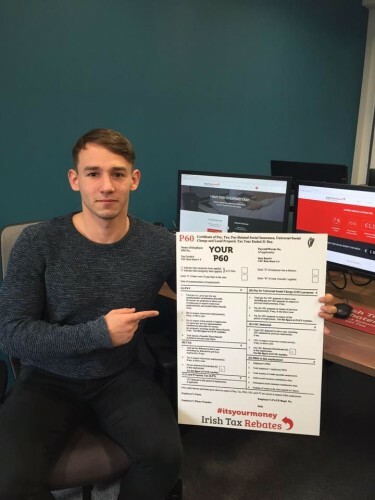

An Irish Tax Rebates Facebook Page Has Produced An Unlikely Celebrity

https://img2.thejournal.ie/inline/3781569/original/?width=375&version=3781569

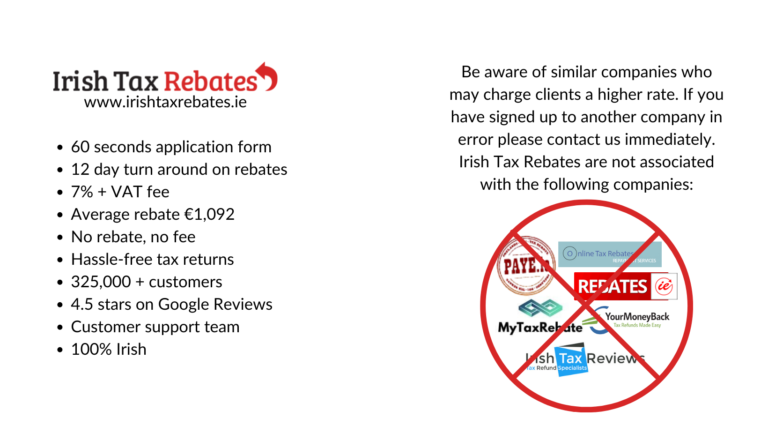

5 Reason To Apply With 100 Confidence To Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2020/03/itr-infographic-100-confidence.jpg

Irish Tax Rebates Claim Your Tax Back

https://www.irishtaxrebates.ie/img/open_graph/itrog.jpg

Web Calculating your Income Tax Rent Tax Credit Tax rates bands and reliefs Differences between tax credits reliefs and exemptions Real Time Credits Land and property Web The following tables show the tax rates rate bands and tax reliefs for the tax year 2023 and the previous tax years Calculating your Income Tax gives more information on how

Web 1 Fill and sign our 60 second online form 2 We complete our comprehensive tax review within 12 working days 3 We send you your tax rebate by bank transfer or cheque The Web In order to securely send us your bank details and receive your rebate in the quickest way possible please Log In and submit your IBAN details User Name is your email address

5 Reason To Apply With 100 Confidence To Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2020/03/Revoked-768x433.png

Irish Tax Rebates How It Works YouTube

https://i.ytimg.com/vi/qM2ejC0-6O4/maxresdefault.jpg

https://www.irishtaxrebates.ie

Web Irish Tax Rebates ensure you get back all the tax that is owed to you for this year and the previous three Our comprehensive review will check overpaid income tax medical

https://www.revenue.ie/en/contact-us

Web Collector General s Division For enquiries relating to filing returns and making tax payments ROS payments debt management tax clearance and direct debits Central Repayments

Income Tax Rates 2022 Ireland Milford Domingo

5 Reason To Apply With 100 Confidence To Irish Tax Rebates

Irish Tax Rebates Claim Your Tax Back

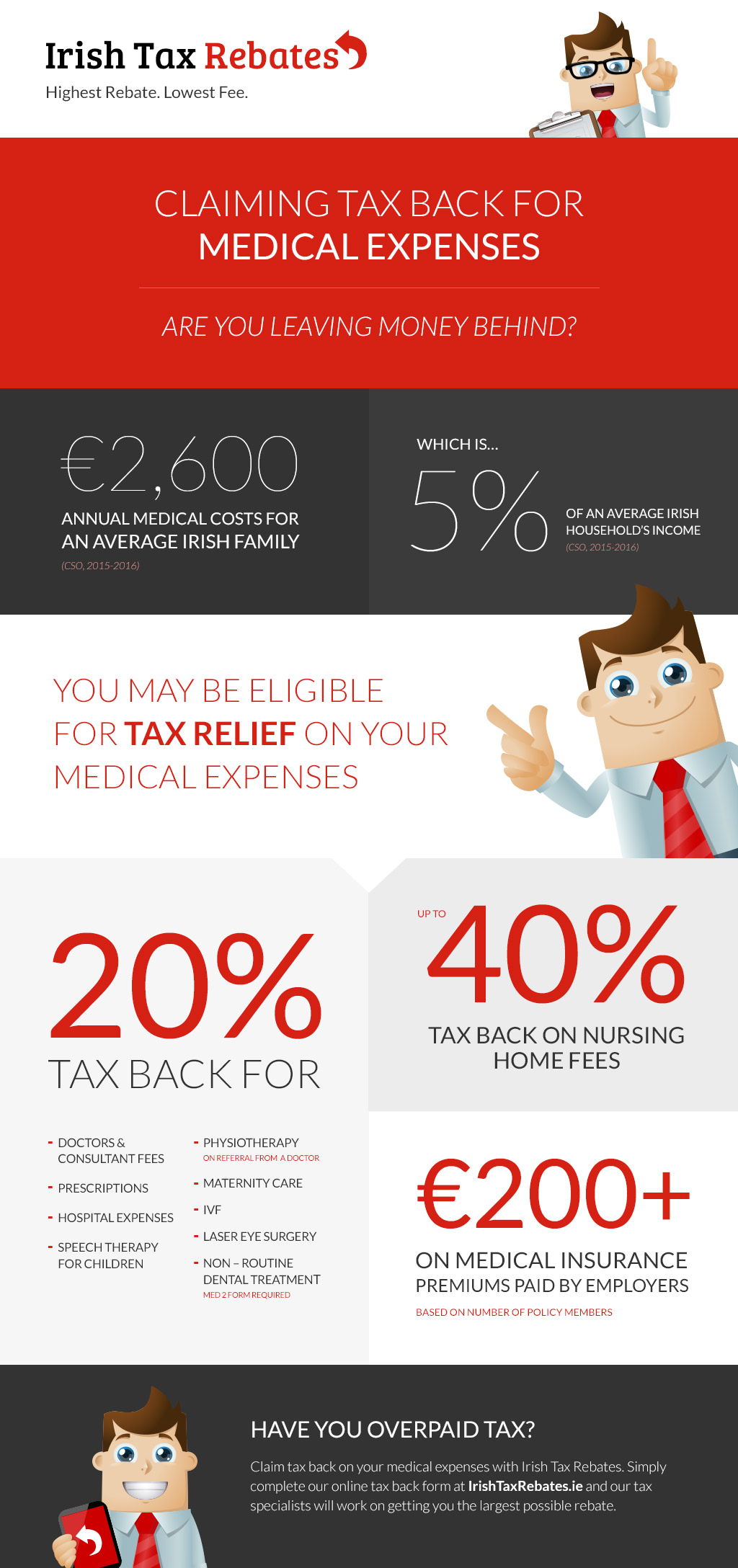

Tax Back On Medical Expenses Infographic Irish Rebates

Irish Tax Rebates Reviews Read Customer Service Reviews Of

More Tax Credits More Rebates Education Magazine

More Tax Credits More Rebates Education Magazine

Employment Irish Tax Rebates

Martin Brennan Irish Tax Rebates SFA Awards 2018 YouTube

The Universal Social Charge USC In 2017 Irish Tax Rebates

Irish Tax Rebates Contact - Web Irish Tax Rebates is trusted by over 320 000 Irish tax payers every year We carry out full and thorough reviews we check back through up to 4 years of taxes to give you the