Federal Tax Rebates For Hybrid Cars Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500

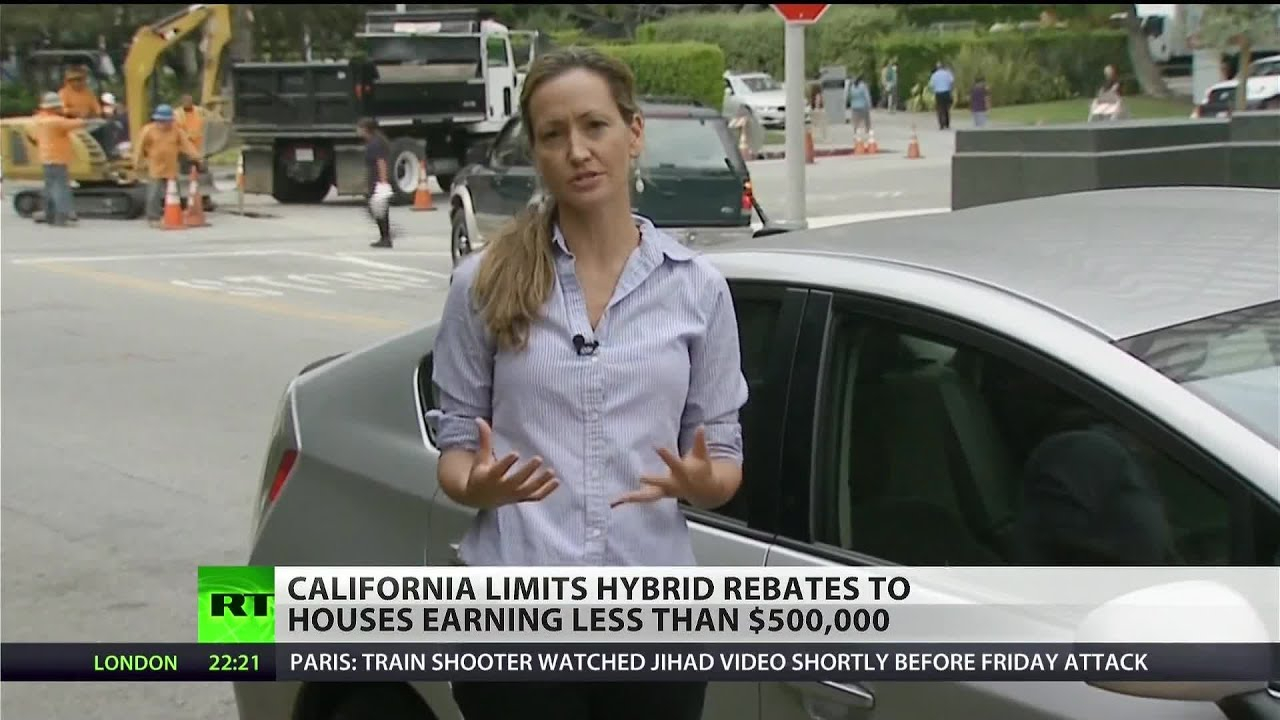

Web 17 ao 251 t 2022 nbsp 0183 32 Plug in hybrids PHEVs and electric vehicles EVs purchased in or after 2010 may be eligible for a federal income tax credit of up to 7 500 Save up to 7 500 Web 18 ao 251 t 2022 nbsp 0183 32 Only 16 of the 65 plug in hybrid and all electric vehicles sold in the U S remain eligible for the federal tax credit incentive from now through Dec 31

Federal Tax Rebates For Hybrid Cars

Federal Tax Rebates For Hybrid Cars

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-7.jpg?resize=840%2C473&ssl=1

The Florida Hybrid Car Rebate Save Money And Help The Environment

https://cdn.osvehicle.com/do_hybrid_cars_get_a_tax_rebate.png

Federal Tax Rebate For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-rebate-on-hybrid-cars-2023-carrebate.png

Web 29 d 233 c 2022 nbsp 0183 32 Here is a partial list of electric and plug in hybrid vehicles that will qualify for federal tax credits in 2023 The Ford F 150 Lightning is among the vehicles that qualify for federal tax Web 1 janv 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a

Web Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to Web 17 oct 2022 nbsp 0183 32 Only vehicles below 55 000 for sedans and below 80 000 for vans trucks and SUVs are eligible for the credit Meanwhile the income cap for the credit is 150 000 for single filers 300 000 for

Download Federal Tax Rebates For Hybrid Cars

More picture related to Federal Tax Rebates For Hybrid Cars

Tax Rebates For Electric Cars Michigan 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/michigan-increases-taxes-to-fund-road-repairs-hybrids-and-electrics-1-scaled.jpg

Federal Rebates For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/where-federal-rebates-for-toyota-and-lexus-hybrids-stand-as-of-oct-1.jpg

Rebates For Buying A Hybrid Car 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/hybrid-cars-may-not-save-you-money-good-money-sense-hybrid-car-gas.png

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed Web 12 janv 2023 nbsp 0183 32 Many more EVs and plug in hybrids are eligible for the federal tax subsidy of up to 7 500 including vehicles built outside North America as long as drivers lease them or buy used rather

Web 25 juil 2023 nbsp 0183 32 Federal EV tax credits are just one factor driving a buying boom this summer Some cars and trucks also qualify for a state rebate or tax credit Together those Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

Federal Plug In Hybrid Rebate Used Cars 2022 Carrebate

https://www.californiarebates.net/wp-content/uploads/2023/04/federal-plug-in-hybrid-rebate-used-cars-2022-carrebate-6.jpg

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/2022-tax-brackets-jeanxyzander-5.jpg

https://www.consumerreports.org/cars/hybrids-evs/electric-cars-plug-in...

Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500

https://fueleconomy.gov/feg/tax2022.shtml

Web 17 ao 251 t 2022 nbsp 0183 32 Plug in hybrids PHEVs and electric vehicles EVs purchased in or after 2010 may be eligible for a federal income tax credit of up to 7 500 Save up to 7 500

Federal Rebates For Hybrid Cars 2023 Carrebate

Federal Plug In Hybrid Rebate Used Cars 2022 Carrebate

Hybrid Car California Rebate 2022 Carrebate Californiarebates

Government Tax Rebates For Hybrid Cars 2023 Carrebate

Tax Rebates For Electric Cars Michigan 2022 Carrebate

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Rebate For Hybrid Car 2023 Carrebate

Rebates For Hybrid Cars In California 2023 Carrebate

Current Hybrid Car Rebates 2023 Carrebate

Federal Tax Rebates For Hybrid Cars - Web 17 avr 2023 nbsp 0183 32 Under the new rule consumers can get up to 7 500 back in tax credits on eligible cars 2022 Ford Escape Plug in Hybrid 2022 Lincoln Corsair Grand Touring