2024 State Of Illinois Tax Rebates Illinois Department of Revenue Announces Start to 2024 Income Tax Season Mission Vision and Value FY 2024 18 What s New for Illinois Income Taxes FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees Illinois Department of Revenue Announces Start to 2024 Income Tax Season

CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue See the following page for a list of other Illinois tax and fee Acts to which this change also applies The Cigarette Machine Operators Occupation Tax Act Section 1 45 the Cigarette Tax Act Section 9a the Cigarette Use Tax Act Section 13 and The Liquor Control Act Section 8 5 are amended to include

2024 State Of Illinois Tax Rebates

2024 State Of Illinois Tax Rebates

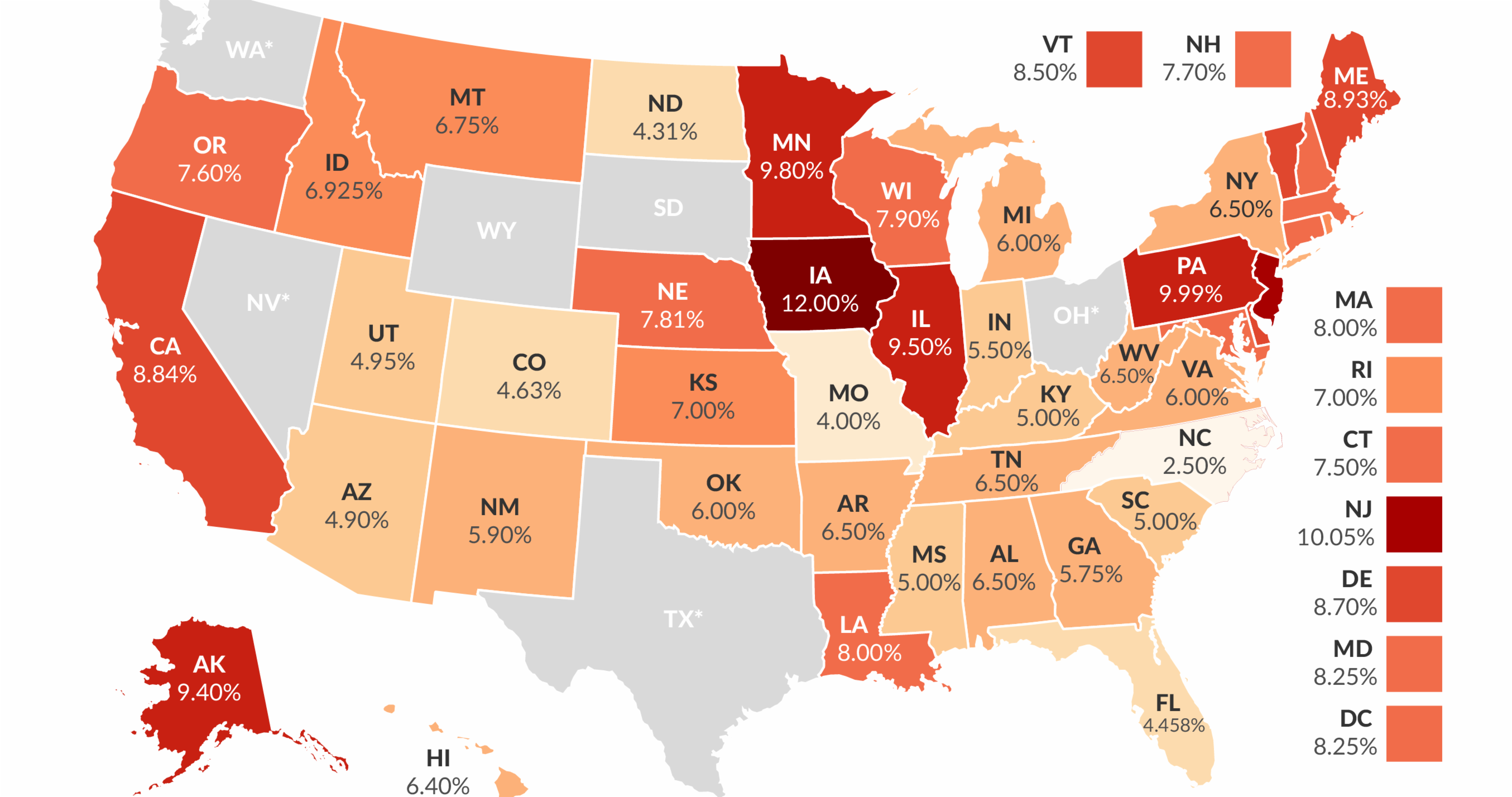

https://files.taxfoundation.org/20200127173134/linkedin-In-Stream_Wide___2020-State-Corporate-Income-Tax-Rates-01.png

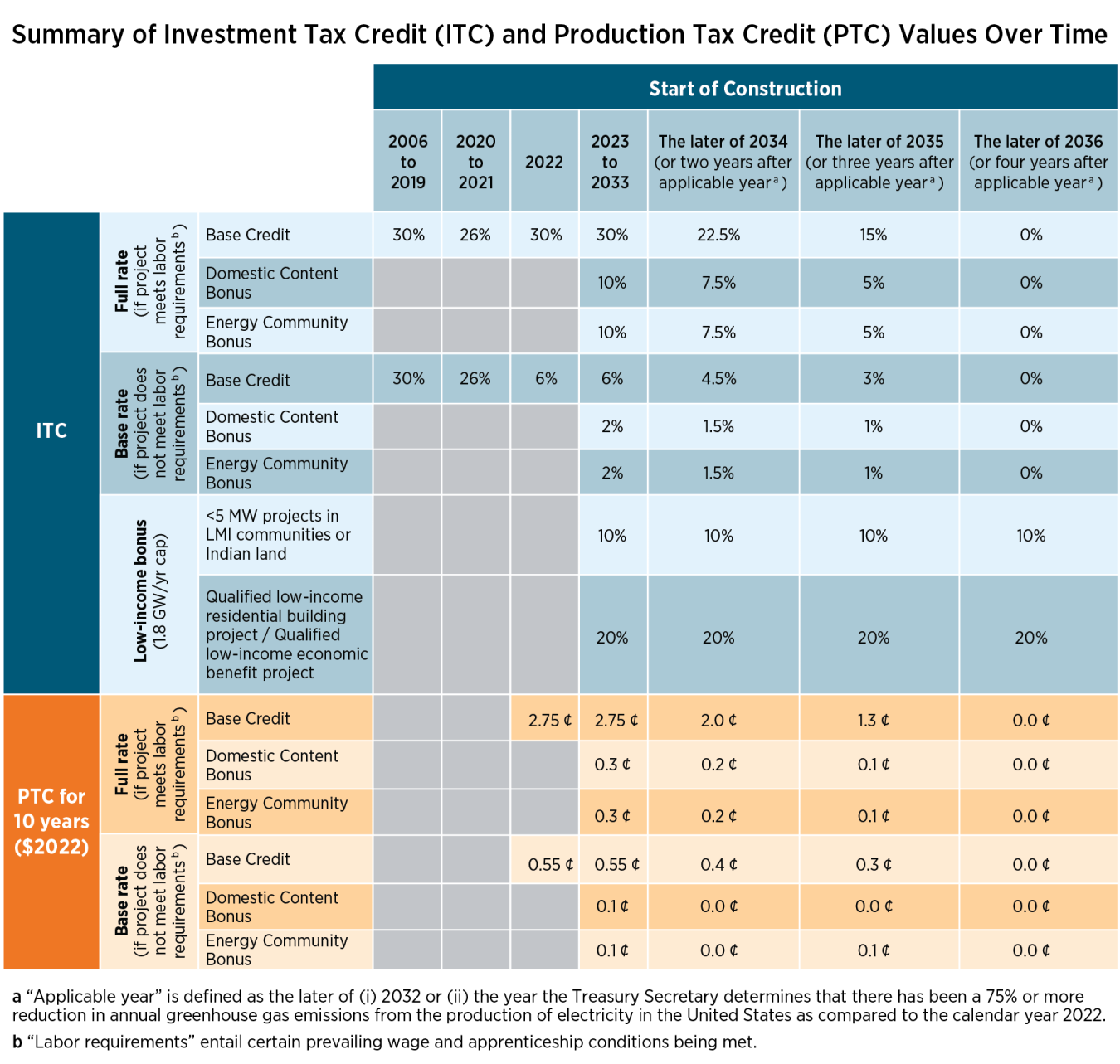

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

https://repsnessil66.com/wp-content/uploads/2022/09/2022-IL-Tax-Rebates_post.jpg

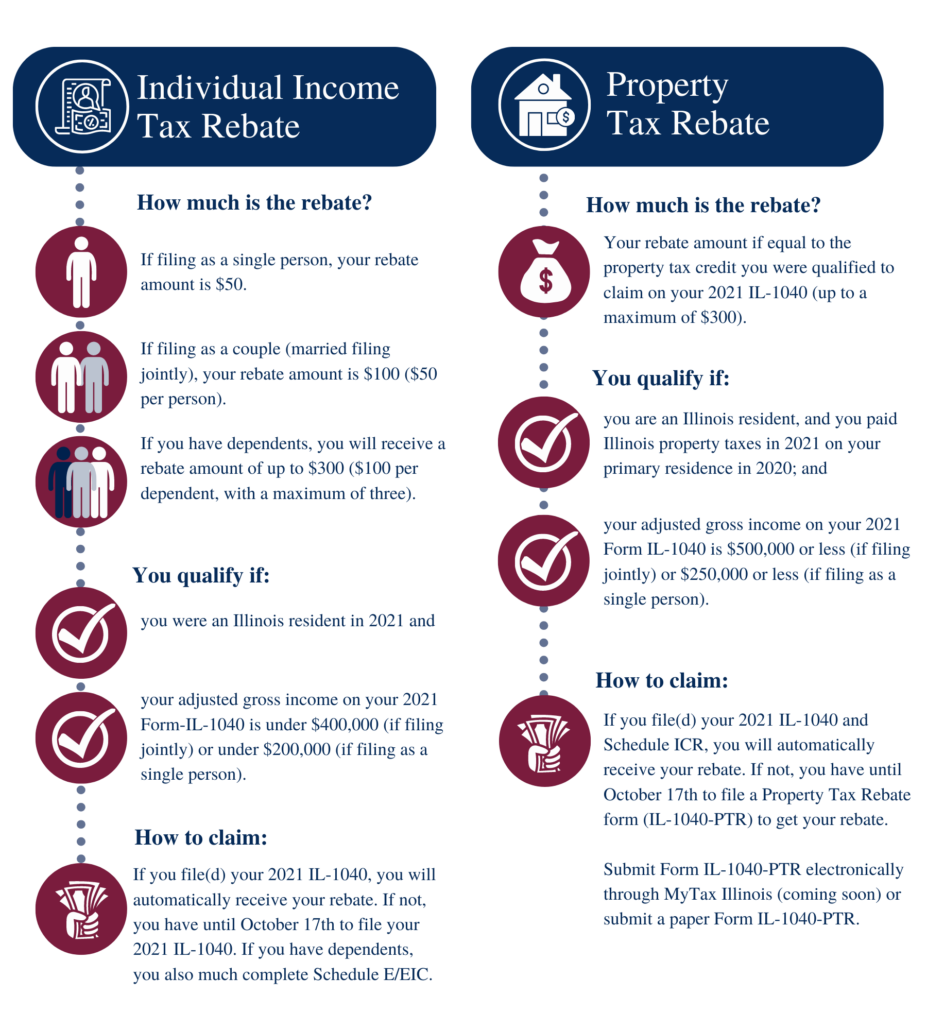

The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300 Taxpayers who did not file or are not required to file their 2021 IL 1040 individual income tax returns but want to claim both the property tax and individual income tax rebatesmust file Form IL

Property Tax Rebate The rebate amount is equal to the property tax credit you were qualified to claim on your 2021 tax forms up to a maximum of 300 How Will Rebates Be Sent Out Who is eligible for 2022 Illinois tax rebates There are residency and income requirements attached to the income and property tax rebates Both require residency in the state as of

Download 2024 State Of Illinois Tax Rebates

More picture related to 2024 State Of Illinois Tax Rebates

Nemaha Central USD 115 Calendar 2024 PublicHolidays

https://publicholidays.com/wp-content/uploads/2017/10/US_School1851_Output.jpg

K A Report Kakenmaster Tax Accounting

https://images.squarespace-cdn.com/content/v1/5c1eaa01266c07c75d02f75d/1663866031393-BZ5N0TOHL8NXCZPZEIB8/unsplash-image-H_KabGs8FMw.jpg

2022 State Of Illinois Tax Rebates Scheffel Boyle

https://scheffelboyle.com/wp-content/uploads/2022/07/2022-State-of-IL-Tax-Rebates-927x1030.png

The property tax rebate is a maximum of 300 per household that is equal to the credit claimed for residential real estate property taxes on the 2021 Illinois income tax return The individual income tax rebate is 50 per individual 100 for couples who file married filing jointly provided their federal adjusted gross income is less than Allowance of retroactive rebates for the Home Efficiency Rebate Program Section 50121 that are initiated on or after August 16 2022 meet all USDOE requirements and all state program requirements Allowance of virtual inspections for the Home Electrification and Appliance Rebate Program Section 50122

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to 2024 Illinois Solar Incentives Guide Tax Credits Rebates EcoWatch Illinois Solar Incentives Rebates Tax Credits More in 2023 In this guide to solar benefits and incentive programs available in Illinois you ll learn How do solar incentives affect the cost of solar panels in Illinois

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

https://1075914428.rsc.cdn77.org/data/thumbs/full/270850/820/0/0/0/tax-rebates-2023-eligible-americans-to-receive-up-to-3-000-heres-when-and-how.jpg

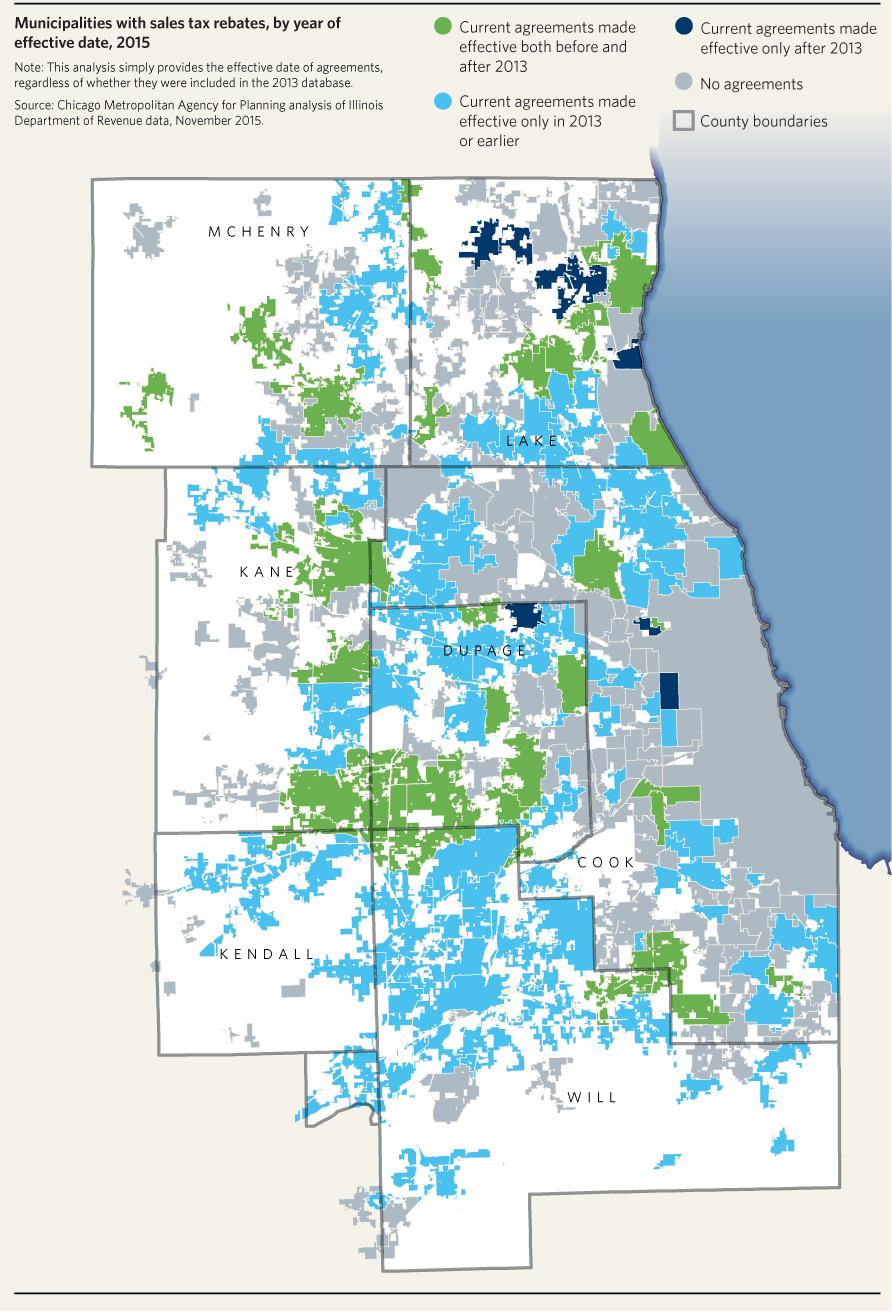

Sales Tax Rebates Remain Prevalent In Northeastern Illinois CMAP

http://www.cmap.illinois.gov/documents/10180/542501/salestaxrebates-agreement-age-rev_revised.png/5541dd1a-eb4d-4eae-89a5-bd280cca24c9?t=1463588683542

https://tax.illinois.gov/research/news/illinois-department-of-revenue-announces-start-to-2024-income-ta.html

Illinois Department of Revenue Announces Start to 2024 Income Tax Season Mission Vision and Value FY 2024 18 What s New for Illinois Income Taxes FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees Illinois Department of Revenue Announces Start to 2024 Income Tax Season

https://news.yahoo.com/illinois-tax-season-2024-heres-210017466.html

CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue

Tax Rebate FAQs Rep Thaddeus Jones

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

Stimulus Check Update 2022 Everything You Need To Know About Illinois State Tax Rebates

Illinois Tax Rebates For Solar Panels Electric Cars And Chargers Save Money And Environment

Illinois Tax Rebate Tracker Rebate2022

State Withholding Tax Form 2023 Printable Forms Free Online

State Withholding Tax Form 2023 Printable Forms Free Online

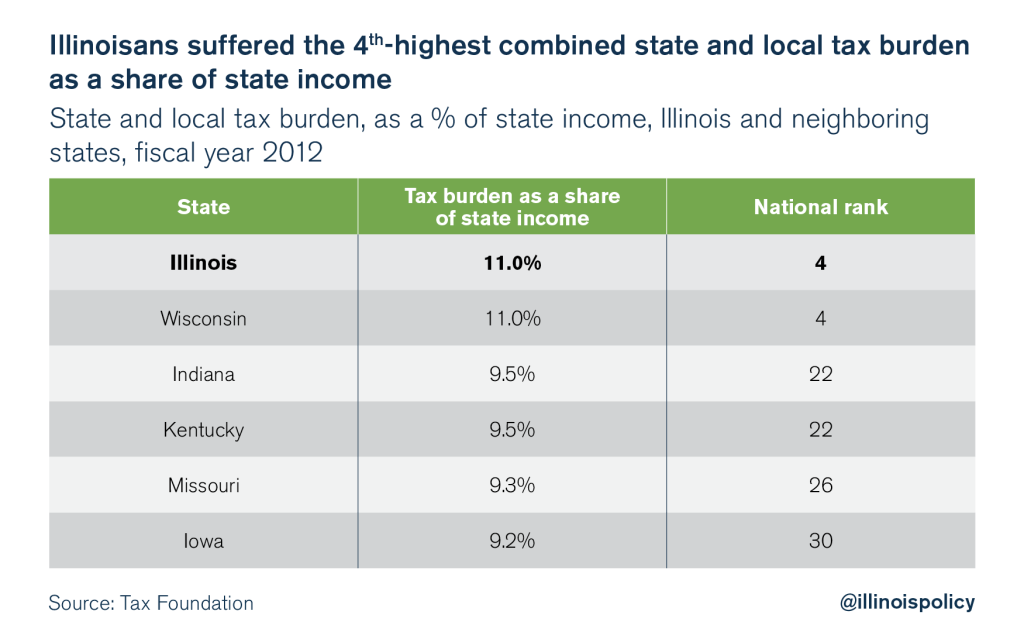

Illinois Is A High tax State Illinois Policy

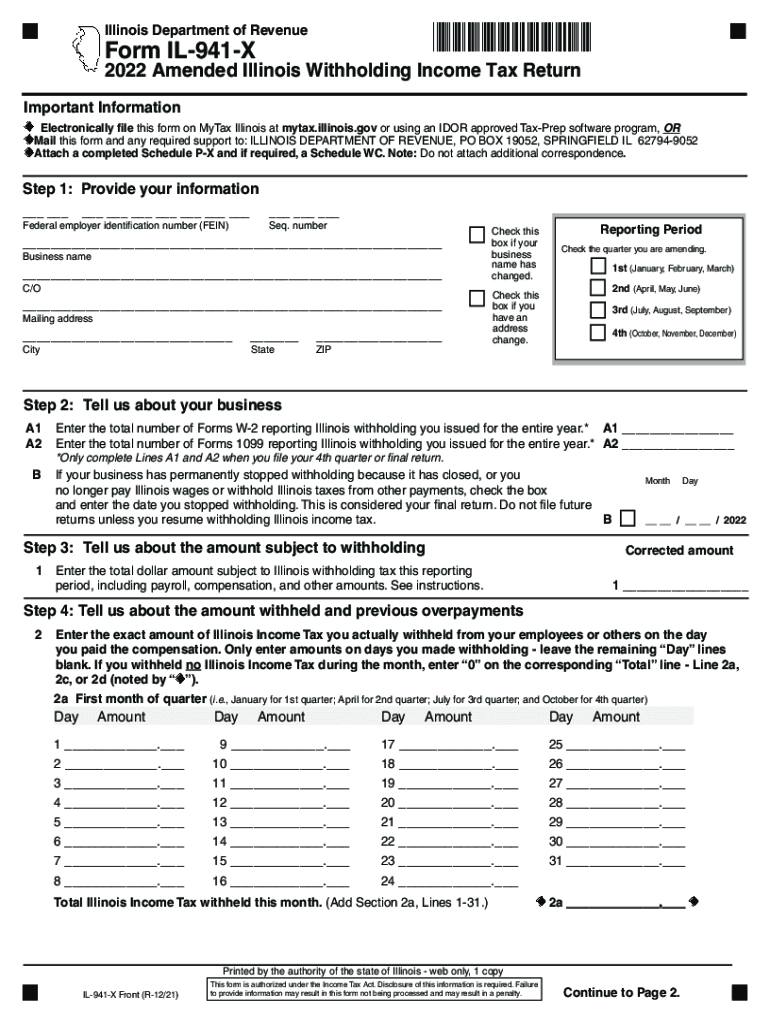

Il 941 X Fill Out Sign Online DocHub

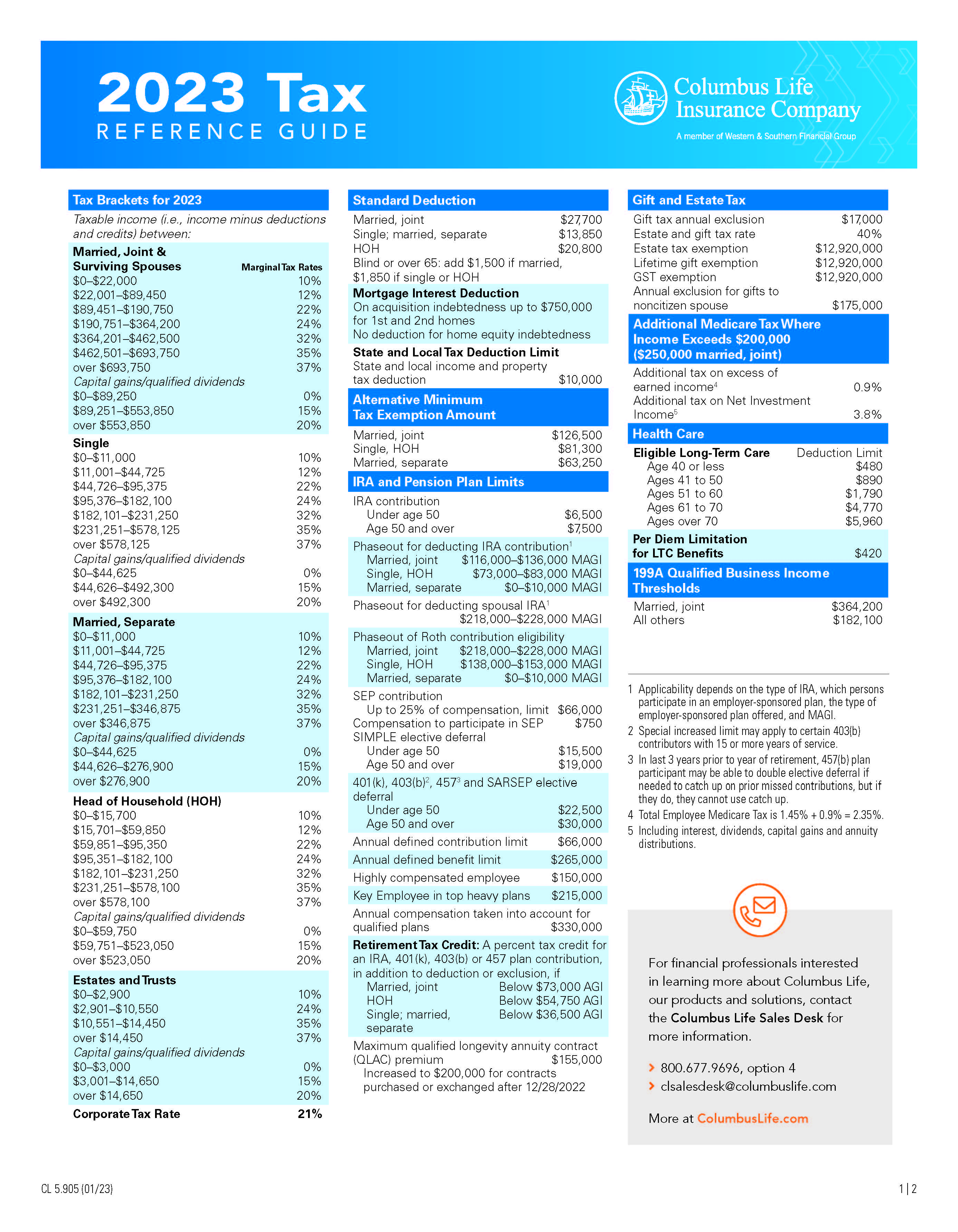

2023 Taxes Clarus Wealth

2024 State Of Illinois Tax Rebates - The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300