2024 Tax Child Rebate Parents can claim up to 2 000 in tax benefits through the CTC for each child under 17 years old The tax credit is based on income requiring that parents earn at least 2 500 to claim it

The act expands the Child Tax Credit to provide additional support to working families Key provisions include Increased Refundable Portion The refundable portion of the child tax credit will gradually increase over the years 2023 2025 offering more financiaTax assistance to families When the child tax credit first started back in 1997 it was a small bonus that mainly helped middle class families Taxpayers could take 400 off their income taxes for each child under 17

2024 Tax Child Rebate

2024 Tax Child Rebate

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

NWC Tryouts 2023 2024 NWC Alliance

https://nwcalliancesoccer.demosphere-secure.com/_files/tryouts-2023-2024/NWC 2023-2024.JPG

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

Child tax credit 2024 How much is it Lawmakers have reached a deal on the tax framework for a new child tax credit However unless changes to the amount of the credit go into effect More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress iStock 7 min Comment 295 Congressional negotiators announced a roughly 80 billion

Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP Part 1 Tax Relief for Working Families 2 Part 2 American Innovation and Growth 2 Part 3 Increasing Global Competitiveness

Download 2024 Tax Child Rebate

More picture related to 2024 Tax Child Rebate

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

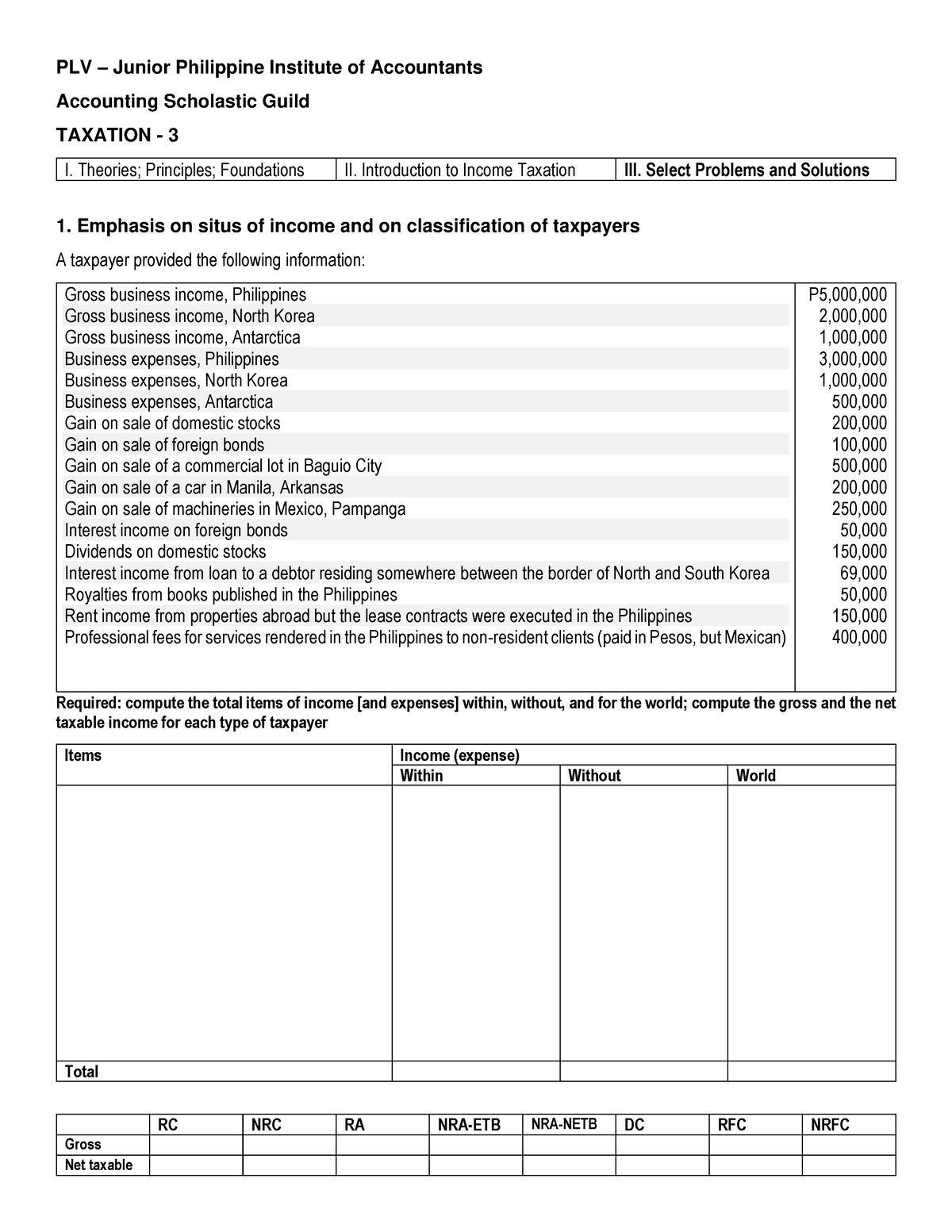

AKS 2023 2024 TAX 1 DAY 3 PLV Junior Philippine Institute Of Accountants Accounting

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1915a686ff08737254bddc16840f8378/thumb_1200_1553.png

Tax Rates For The 2024 Year Of Assessment Just One Lap

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?resize=969%2C649&ssl=1

The credit amount was increased for 2021 The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under age 18 The credit was made fully refundable By making the Child Tax Credit fully refundable low income households will be It would also increase the refundable portion of the child tax credit to 1 800 for 2023 the year for which Americans are now preparing tax forms and then to 1 900 in 2024 and 2 000 in

People with kids under the age of 17 may be eligible to claim a tax credit of up to 2 000 per qualifying dependent For taxes filed in 2024 1 600 of the credit is potentially refundable Jan 29 According to a Washington Post report Form 1040 Schedule 8812 Credits for Qualifying Children and Other Dependents additional child tax credit IRS Form 8812 child and dependent care

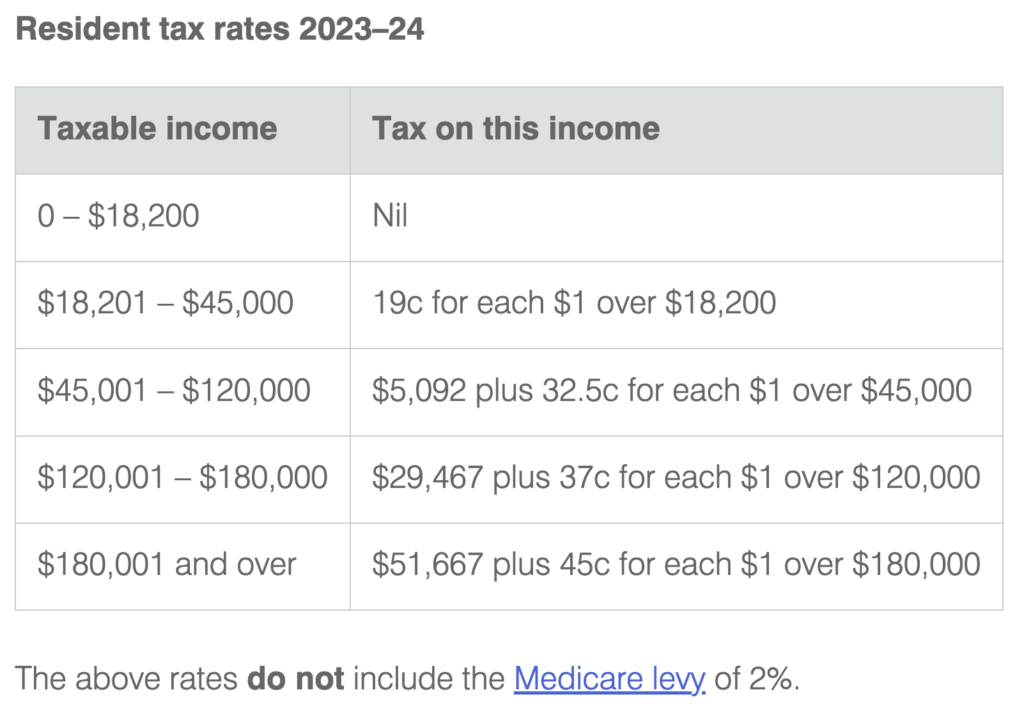

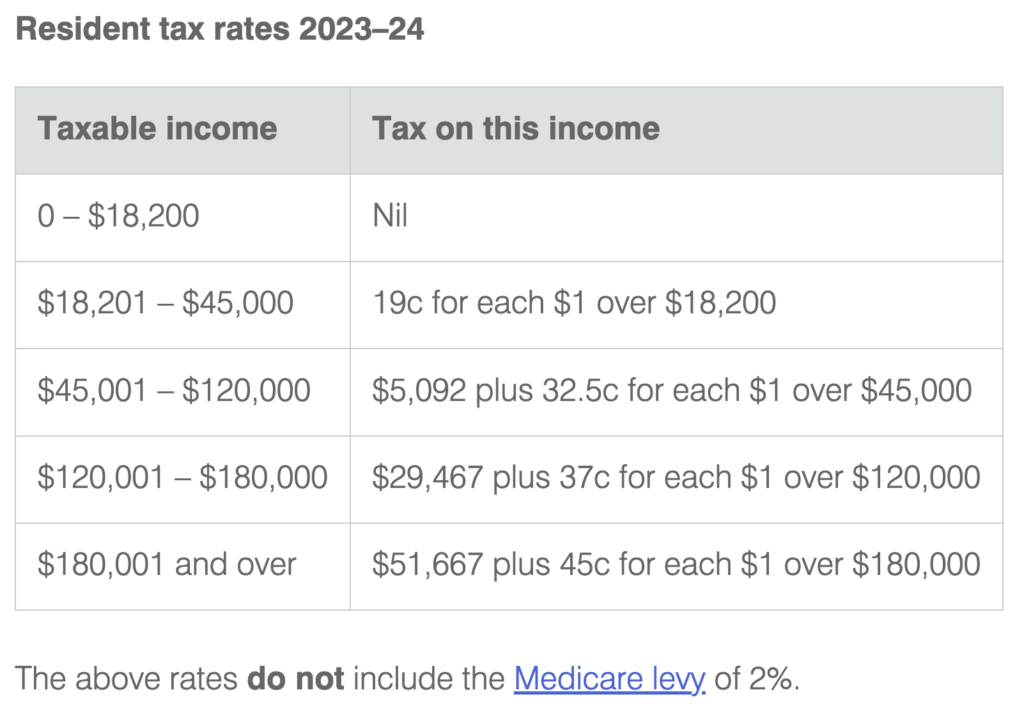

How To Save A Home Deposit In 2 Years 200 Per Week Updated 15 11 2022 Julia s Blog

https://www.bantacs.com.au/Jblog/wp-content/uploads/2022/11/resident-tax-rates-2023-2024-2-1024x715.png

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

https://www.cbsnews.com/news/child-tax-credit-increase-heres-who-would-benefit/

Parents can claim up to 2 000 in tax benefits through the CTC for each child under 17 years old The tax credit is based on income requiring that parents earn at least 2 500 to claim it

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

The act expands the Child Tax Credit to provide additional support to working families Key provisions include Increased Refundable Portion The refundable portion of the child tax credit will gradually increase over the years 2023 2025 offering more financiaTax assistance to families

Tolminator 2024

How To Save A Home Deposit In 2 Years 200 Per Week Updated 15 11 2022 Julia s Blog

Income Tax Rebate Under Section 87A

Child Tax Rebate Application 2023 Updated

Earned Income Tax Credit For Households With One Child 2023 Center On Budget And Policy

Tax Child Rebate Fechas Y C mo Obtener Un Reembolso De Hasta 750 D lares Marcausa

Tax Child Rebate Fechas Y C mo Obtener Un Reembolso De Hasta 750 D lares Marcausa

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

Call For Papers IIB 2024

Tax Child Rebate Dates And How To Get A Rebate Of Up To 750 Marca

2024 Tax Child Rebate - Part 1 Tax Relief for Working Families 2 Part 2 American Innovation and Growth 2 Part 3 Increasing Global Competitiveness