Recovery Rebate Credit Threshold Web 13 janv 2022 nbsp 0183 32 FAQs about eligibility for claiming the Recovery Rebate Credit These updated FAQs were released to the public in Fact Sheet 2022 27PDF April 13 2022

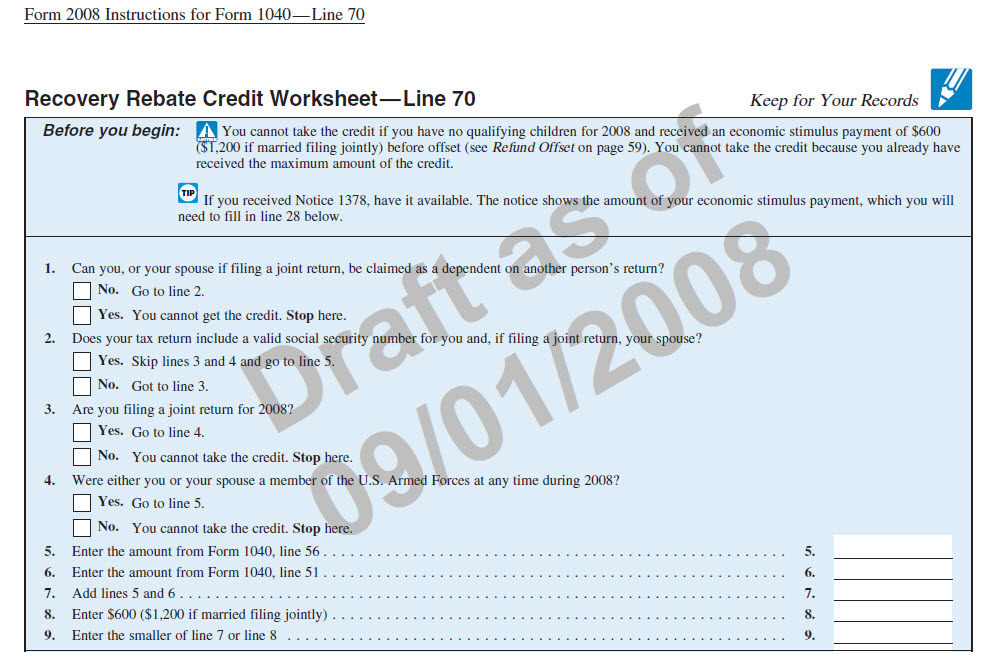

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payments you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return

Recovery Rebate Credit Threshold

Recovery Rebate Credit Threshold

https://i2.wp.com/kb.erosupport.com/assets/img_5ffe32d18d56f.png

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-example-studying-worksheets.png?w=1125&ssl=1

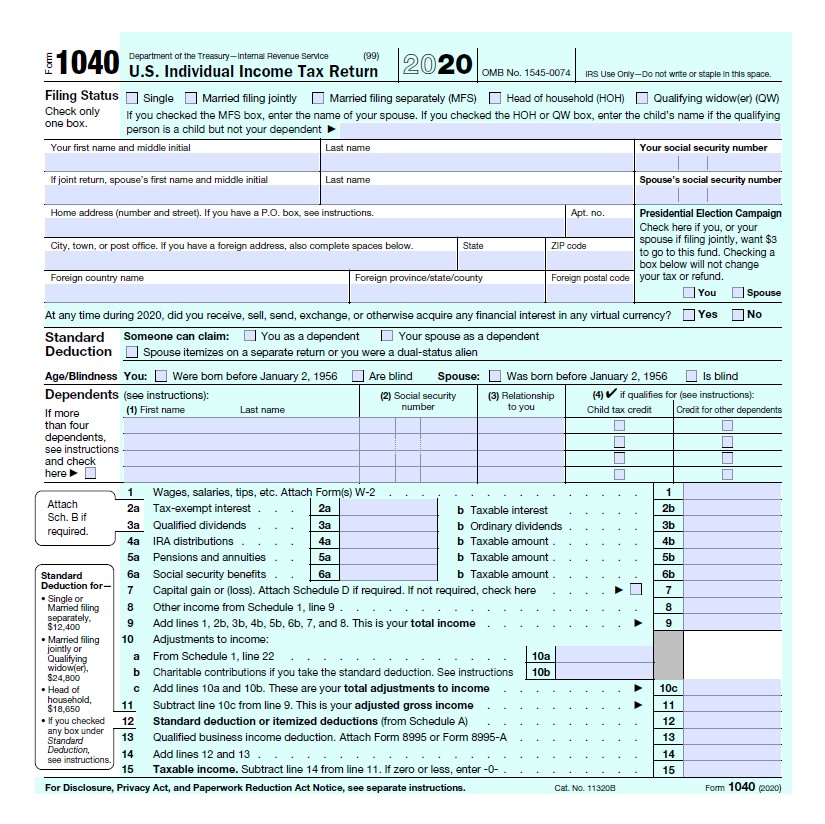

Web Recovery Rebate Credit FS 2022 27 April 2022 This Fact Sheet updates frequently asked questions FAQs for the 2021 Recovery Rebate Credit Individuals who did not Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with adjusted

Web 1 d 233 c 2022 nbsp 0183 32 This second stimulus payment distributed up to 600 per qualified recipient The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of Web 4 d 233 c 2022 nbsp 0183 32 In accordance with your earnings however your recovery credit credit could be cut Your credit score will fall to zero for those who make more than 75 000 Joint

Download Recovery Rebate Credit Threshold

More picture related to Recovery Rebate Credit Threshold

Cares Act Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-recovery-rebates-distributions-rmd-waivers-student-loan.png

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Recovery Rebate Credit Worksheet Pdf Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-pdf-9.jpg

Web 18 mai 2023 nbsp 0183 32 The Recovery Rebate is available for federal income tax returns through 2021 You can receive up to 1 400 for each tax dependent that is eligible married Web 20 mai 2023 nbsp 0183 32 The Recovery Rebate can be applied to federal income tax returns from now to 2021 You could receive up to 1 400 per tax dependent that is eligible married

Web Thresholds You may have received less than the maximum amount if your 2020 or 2019 AGI was between 75 000 to 80 000 as a single filer 112 500 to 120 000 as a Web 12 oct 2022 nbsp 0183 32 By Rocky Mengle last updated October 12 2022 If you didn t get a third stimulus check or you only got a partial check then you certainly want to check out

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 FAQs about eligibility for claiming the Recovery Rebate Credit These updated FAQs were released to the public in Fact Sheet 2022 27PDF April 13 2022

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Stimulus Checks From The Government Explained Vox Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

How To Answer The Recovery Rebate Credit 2020 Answers Recovery Rebates

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Threshold - Web 1 d 233 c 2022 nbsp 0183 32 This second stimulus payment distributed up to 600 per qualified recipient The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of