Tax Rebate Slab In Bangladesh Web

Web 21 juil 2023 nbsp 0183 32 Provided that the rate of deduction for supply of tobacco leaves in any form and tobacco products including cigarettes bidi zarda gul shall be 10 ten percent b Web IPO Initial Public Offering it would get 10 rebate on total tax in the year of transfer 5 Tax Rebate for investment Section 44 2 only allowable for Resident Non Resident

Tax Rebate Slab In Bangladesh

Tax Rebate Slab In Bangladesh

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

BD NBR Income Tax Itp Apps On Google Play

https://lh3.googleusercontent.com/Aed9OTDsCE3Ar9zEHYR_icKWboX50qxF-WvjuXzUr3Jk0JlyMUTIO5IIihZHNwudHjM

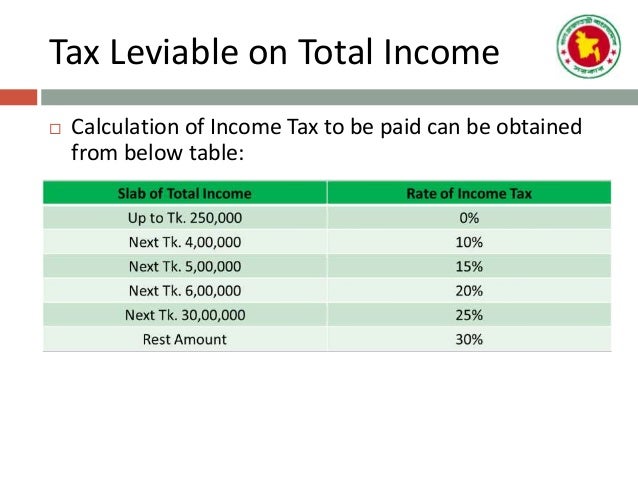

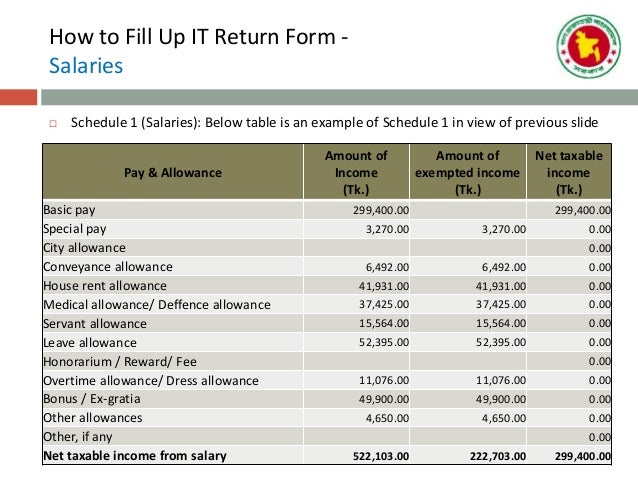

Calculation Of Income Tax On Salary In Bangladesh Tax Walls

https://image.slidesharecdn.com/generalpresentationonincometax1-170901141150/95/general-presentation-on-income-tax-in-bangladesh-27-638.jpg?cb=1504275189

Web Bond under Bangladesh Infrastructure Finance Fund Section 19C 26 xxxi Special tax treatment in respect of investment in Economic Zones or Hi Tech Parks 26 xxxii Web Collection of Tax from motor vehicles plying commercially under section 53Q 166 Collection of tax from inland ships under section 53R 169

Web 30 juin 2021 nbsp 0183 32 The Finance Act 2021 was published by the Government of Bangladesh on 30 June 2021 it came into effect from 1 July 2021 This publication summarises the Web Technical Highlights of Finance Bill 2023 Summary of key changes proposed by the Finance Bill 2023 as discussed in KPMG Bangladesh s Technical Seminar on Sunday 4

Download Tax Rebate Slab In Bangladesh

More picture related to Tax Rebate Slab In Bangladesh

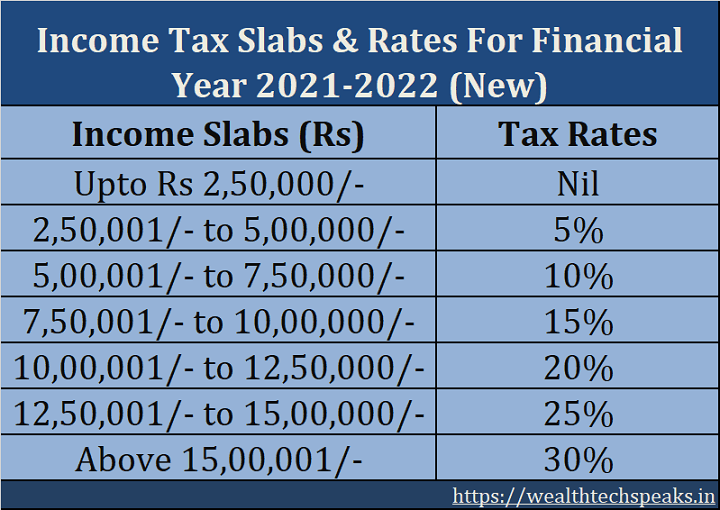

New Income Tax Slab Rate For AY 2021 22 FY 2020 21 IDeal ConsulTax

https://static.wixstatic.com/media/c43a2f_283e48c0fd7f4efeab99b0b9ab6d7aee~mv2.jpg/v1/fit/w_1000%2Ch_572%2Cal_c%2Cq_80/file.jpg

New Income Tax Slab 2023 24

https://moneyexcel.com/wp-content/uploads/2023/02/incometax-slab-2023-24.jpg

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20 Gambaran

https://moneyexcel.com/wp-content/uploads/2020/02/incometax-slabs-2020-21.png

Web We have prepared this booklet for the guidance of our clients and contacts This booklet incorporates many of the important provisions of the Income Tax Ordinance 1984 as Web The key features of the tax proposals that deserve a special mention are amendment of surcharge slab for higher net worth compiled group Besides the tax free benefit has

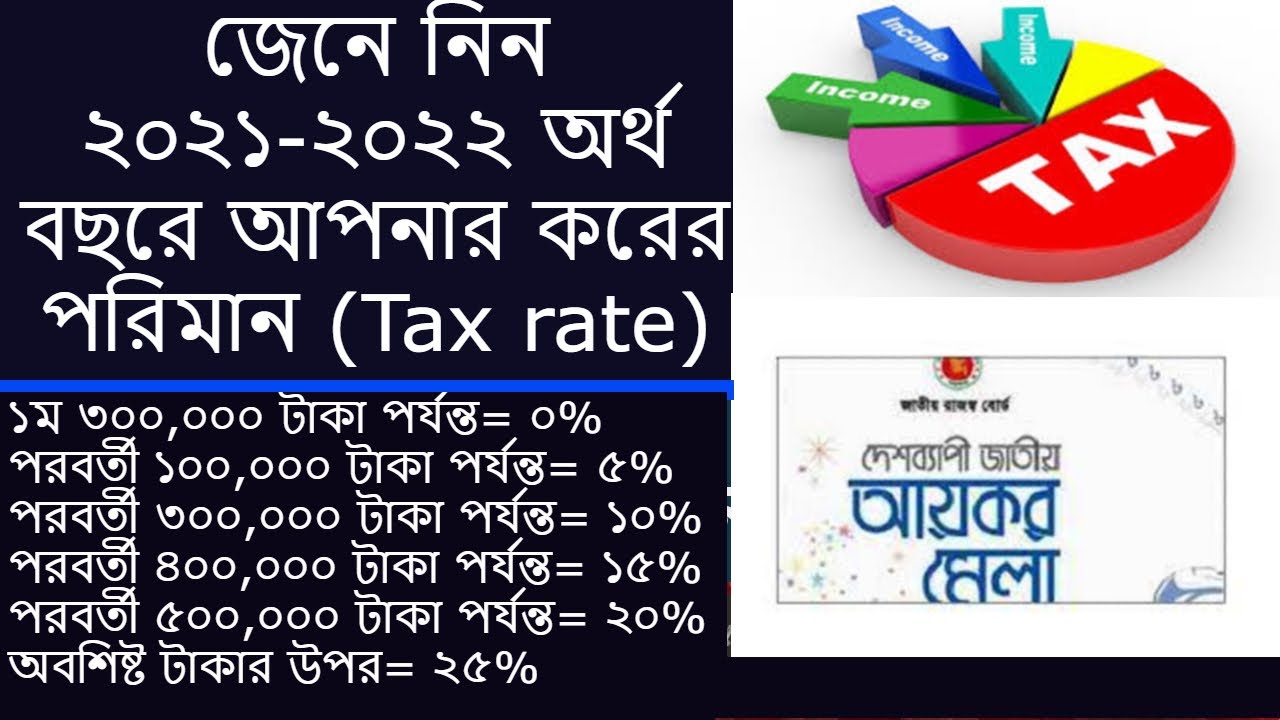

Web 1 juin 2023 nbsp 0183 32 The proposed tax rates and tax slabs for all categories of individual taxpayers except companies and local authorities are no tax on first Tk 3 5 lakh 5 per cent tax on Web 18 ao 251 t 2017 nbsp 0183 32 What is the tax rebate As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 on investment allowance Now

Investment For Tax Rebate In Bangladesh

https://i.pinimg.com/originals/68/7d/bd/687dbda37bcc4fbd9be62bc1dbbfd6d9.jpg

Dissecting The Annual Budget 2017 2018 Of Bangladesh Aggressive

https://i0.wp.com/futrlaw.org/wp-content/uploads/2017/06/Tax-Slabs-Daily-Star.jpg?resize=768%2C990&ssl=1

https://nbr.gov.bd/taxtypes/income-tax/income-tax-paripatra/eng

Web

http://www.jasimrasel.com/tds-rates-chart-fy-2023-24

Web 21 juil 2023 nbsp 0183 32 Provided that the rate of deduction for supply of tobacco leaves in any form and tobacco products including cigarettes bidi zarda gul shall be 10 ten percent b

Lululemon Customer Support Salary Slip

Investment For Tax Rebate In Bangladesh

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Personal Income Tax Rate In Bangladesh 2021 2022 YouTube

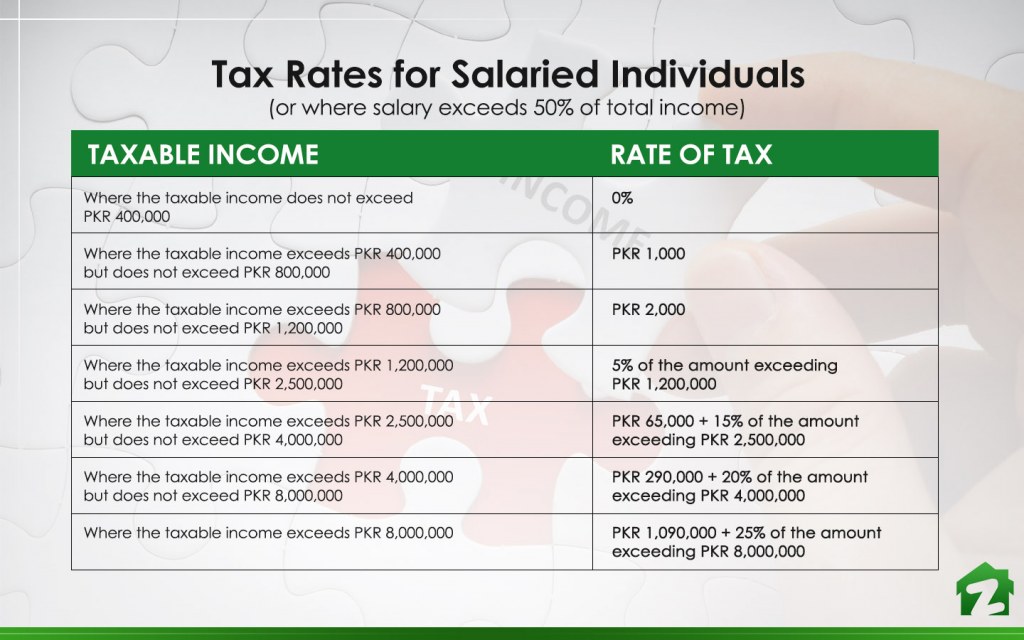

Fbr Income Tax Rates 2019 2020 Pakistan Justgoing 2020

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Salary Slab Rate For Fy 2021 22 Pay Period Calendars 2023

Know New Rebate Under Section 87A Budget 2023

PDF Incidence Of Income Taxation In Bangladesh

Tax Rebate Slab In Bangladesh - Web 30 juin 2021 nbsp 0183 32 The Finance Act 2021 was published by the Government of Bangladesh on 30 June 2021 it came into effect from 1 July 2021 This publication summarises the