Tax Rebate Slab For Female The Union Budget 2023 announced tax relief for the new tax regime under Section 87A of the Income Tax Act 1961 for individual taxpayers including women Following is the tax rebate for previous and current financial years applicable for women in

Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 Know how to claim section 87A rebate in ClearTax Software An income tax slab for women is the applicable tax rate for a taxpayer based on her age and income level The tax slab rates are subject to change for every Union Budget Here is a detailed analysis of the income tax slab rate for women in India per the latest Union Budget

Tax Rebate Slab For Female

Tax Rebate Slab For Female

https://www.strathbogie.vic.gov.au/wp-content/uploads/2022/08/20220729ClothNappyRebate2Crop.jpg

Prestige Campaigns Rebate Campaign

https://www.prestigeinvest.finance/assets/campaigns/rebate_campaign-6e71d07bdfe4e53ff9660d7974eee03eecb1c992f32c563c5b4dda098806ec52.jpg

Income Tax Slab For Women Exemption And Rebates

https://www.canarahsbclife.com/content/dam/choice/blog-inner/images/income-tax-slab-for-women-exemption-and-rebates.jpg

Even with standardized tax slabs women can obtain considerable advantages from multiple tax rebates and deductions offered under varying sections of the Income Tax Act Key deductions for women Section 80C deductions Women can claim deductions up to Rs 1 5 lakh annually under Section 80C which includes investments in Individuals with net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A under the old tax regime i e tax liability will be NIL Important Points to note if you select the new tax regime

Discover the 2024 income tax slabs for women in India Learn about the various tax rebates and deductions available to maximise your tax savings and financial security Discover income tax slabs for women in India including exemptions and rebates Explore taxation specifics by age group taxable income sources tailored for women taxpayers

Download Tax Rebate Slab For Female

More picture related to Tax Rebate Slab For Female

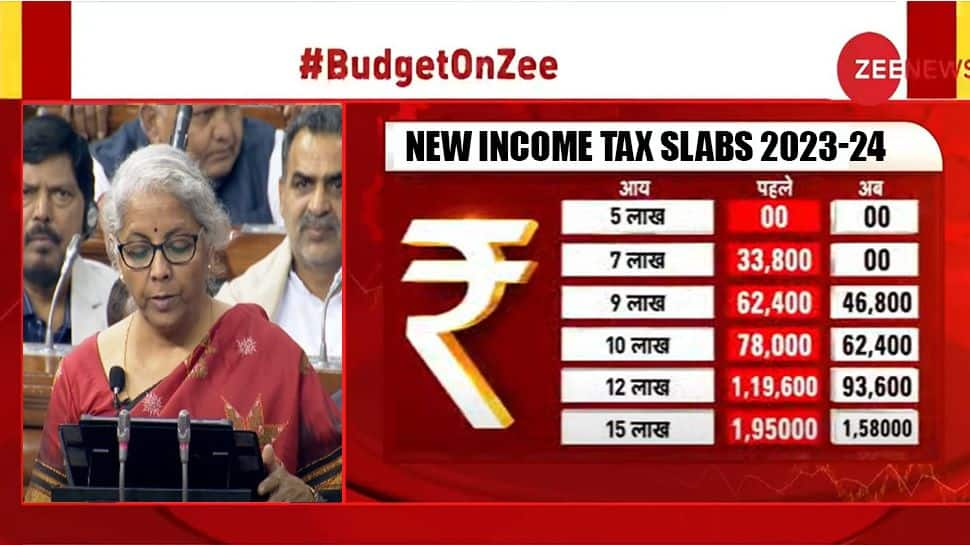

New Income Tax Slabs 2023 24 No Income Tax Till Rs 7 Lakh Check New

https://english.cdn.zeenews.com/sites/default/files/2023/02/01/1148068-income-tax-slab.jpeg

HMRC Paid My Tax Rebate Into Someone Else s Bank Account Consumer

https://i.guim.co.uk/img/media/d6b4235d7c4d4e3715bcf9e3786605d2554b014b/575_1246_4591_2754/master/4591.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=86afad64dcb566da22db6377996e0dcd

SLAB PS Olympic Doors

https://olympicdoors.com/wp-content/uploads/2022/04/SLAB-PS.png

Income Tax Slabs for Women Learn about tax rates based on age and income Gain insights into income brackets and tax exemptions applicable to women Income Tax Slabs FY 2023 24 rebate under new tax regime Under the new tax regime taxpayers with a net taxable income of up to Rs 7 00 000 are eligible for a rebate of up to Rs 25 000

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime S Old Tax Regime AY 2024 25 1 OverviewThe Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessees being Individual HUF AOP not being co operative soc eties BOI or Artificial Juridical Person However the eligible taxpayers have the option to opt

150 Energy Help Via Council Tax Rebate How To Get It Be Clever With

https://becleverwithyourcash.com/wp-content/uploads/2022/04/Energy-rebate.jpeg

Right To A Tax Rebate For Whom Is It Available And How To Use It

https://fbs-tax.com/wp-content/uploads/2023/04/photo.png

https://www.godigit.com/income-tax/income-tax-slab-for-women

The Union Budget 2023 announced tax relief for the new tax regime under Section 87A of the Income Tax Act 1961 for individual taxpayers including women Following is the tax rebate for previous and current financial years applicable for women in

https://cleartax.in/s/income-tax-rebate-us-87a

Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 Know how to claim section 87A rebate in ClearTax Software

View Topic Garden Shed Concrete Slab Rebate Issue Home Renovation

150 Energy Help Via Council Tax Rebate How To Get It Be Clever With

Facts About The 150 Council Tax Rebate

Eight Moves To Make To Give Yourself A Larger Tax Refund Between 2 000

Income Tax New Regime Rebate And Slabs Explained Should You Choose

Council Tax Rebate Struggling Households Face Postcode Lottery To Get

Council Tax Rebate Struggling Households Face Postcode Lottery To Get

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of

Gamut Slab Black Extended Aogonek By Hannes Famira On Dribbble

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct

Tax Rebate Slab For Female - Earlier those falling in Rs 3 6 lakh taxable income bracket paid income tax at the rate of 5 per cent The FM announced a change in this slab to Rs 3 7 lakh Similarly the slab for 10 per cent tax rate has been changed from Rs 6 9 lakh to Rs 7 10 lakh The tax slab for 15 per cent rate has been changed from Rs 9 12 lakh to 10 12 lakh