Recovery Rebate Form Pdf Web Recovery Rebate Credit on a 2021 Tax Return Publication 5486 B 1 2022 Catalog Number 75469X Department of the Treasury Internal Revenue Service www irs gov

Web 10 d 233 c 2021 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040 SR instructions PDF can help determine if you are eligible for the credit See the Web 13 avr 2022 nbsp 0183 32 2021 Recovery Rebate Credit Questions and Answers These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If you didn t get

Recovery Rebate Form Pdf

Recovery Rebate Form Pdf

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/free-7-sample-rent-rebate-forms-in-pdf.jpg

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

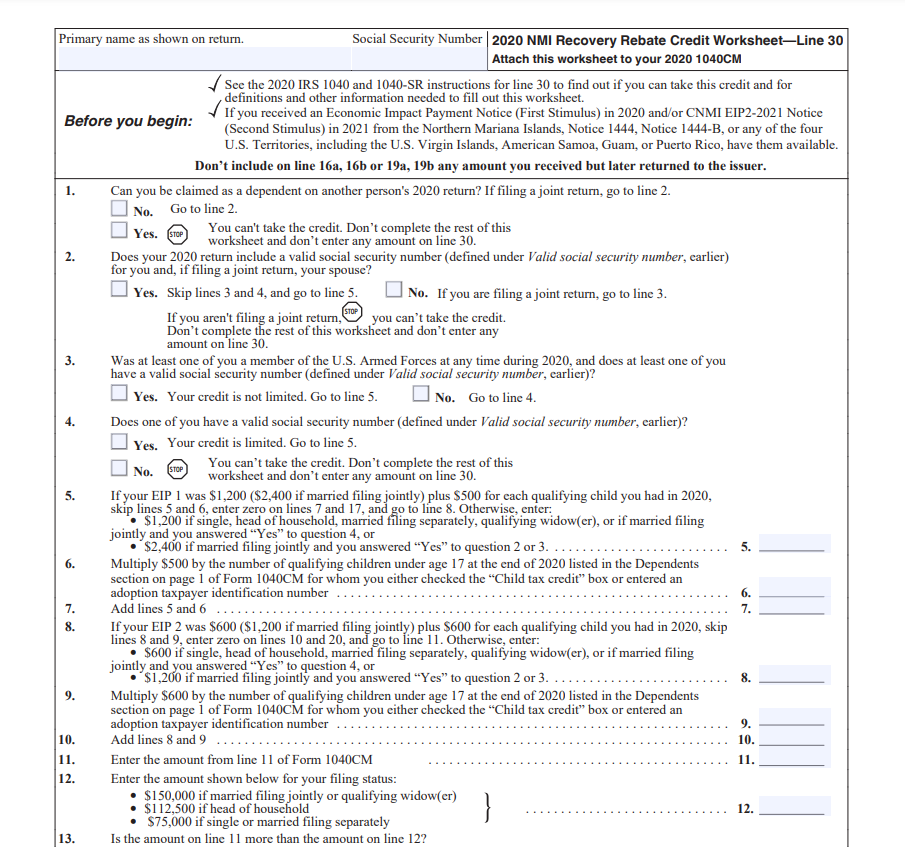

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form Web 9 mars 2021 nbsp 0183 32 If you re eligible for the Recovery Rebate Credit you will need the amount of any Economic Impact Payments you received to calculate your Recovery Rebate Credit

Web 11 Enter the amount from line 11 of Form 1040 or 1040 SR 12 Enter the amount shown below for your filing status 150 000 if married filing jointly or qualifying Web The Recovery Rebate Credit was added to 2020 individual tax returns in order to reconcile the Economic Impact stimulus Payments issued in 2020 You will record the amount

Download Recovery Rebate Form Pdf

More picture related to Recovery Rebate Form Pdf

Supplier Rebate Agreement Template

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

Web 4 f 233 vr 2022 nbsp 0183 32 How to Claim Your Rebate Credit To get your money you ll need to claim the 2021 Recovery Rebate Credit on your 2021 return Filing electronically can guide you Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Web 26 f 233 vr 2021 nbsp 0183 32 The IRS included a Recovery Rebate Credit Worksheet in the instructions for Form 1040 If you are owed money look for the Recovery Rebate Credit that is Web Any eligible individual who did not receive any and or the full amount of the recovery rebate aka stimulus or economic impact payment as an advance payment can claim the

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

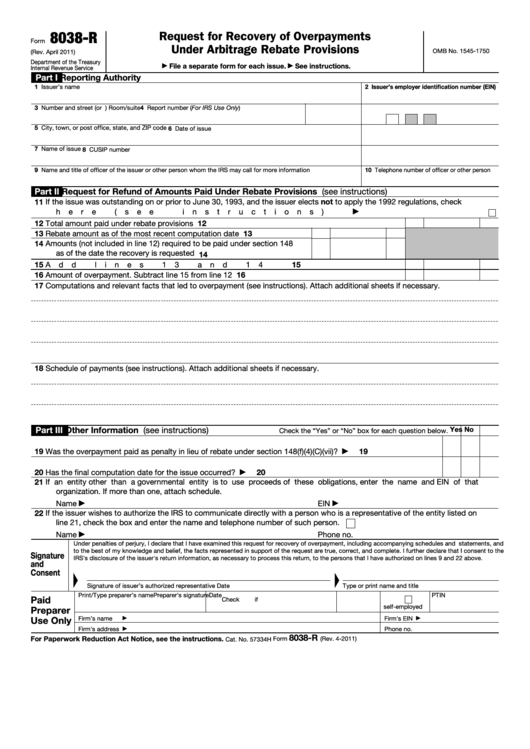

Fillable Form 8038 R Request For Recovery Of Overpayments Under

https://data.formsbank.com/pdf_docs_html/322/3226/322609/page_1_thumb_big.png

https://www.irs.gov/pub/irs-pdf/p5486b.pdf

Web Recovery Rebate Credit on a 2021 Tax Return Publication 5486 B 1 2022 Catalog Number 75469X Department of the Treasury Internal Revenue Service www irs gov

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-d...

Web 10 d 233 c 2021 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040 SR instructions PDF can help determine if you are eligible for the credit See the

Recovery Rebate Credit Form Printable Rebate Form

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Top Mass Save Rebate Form Templates Free To Download In PDF Format

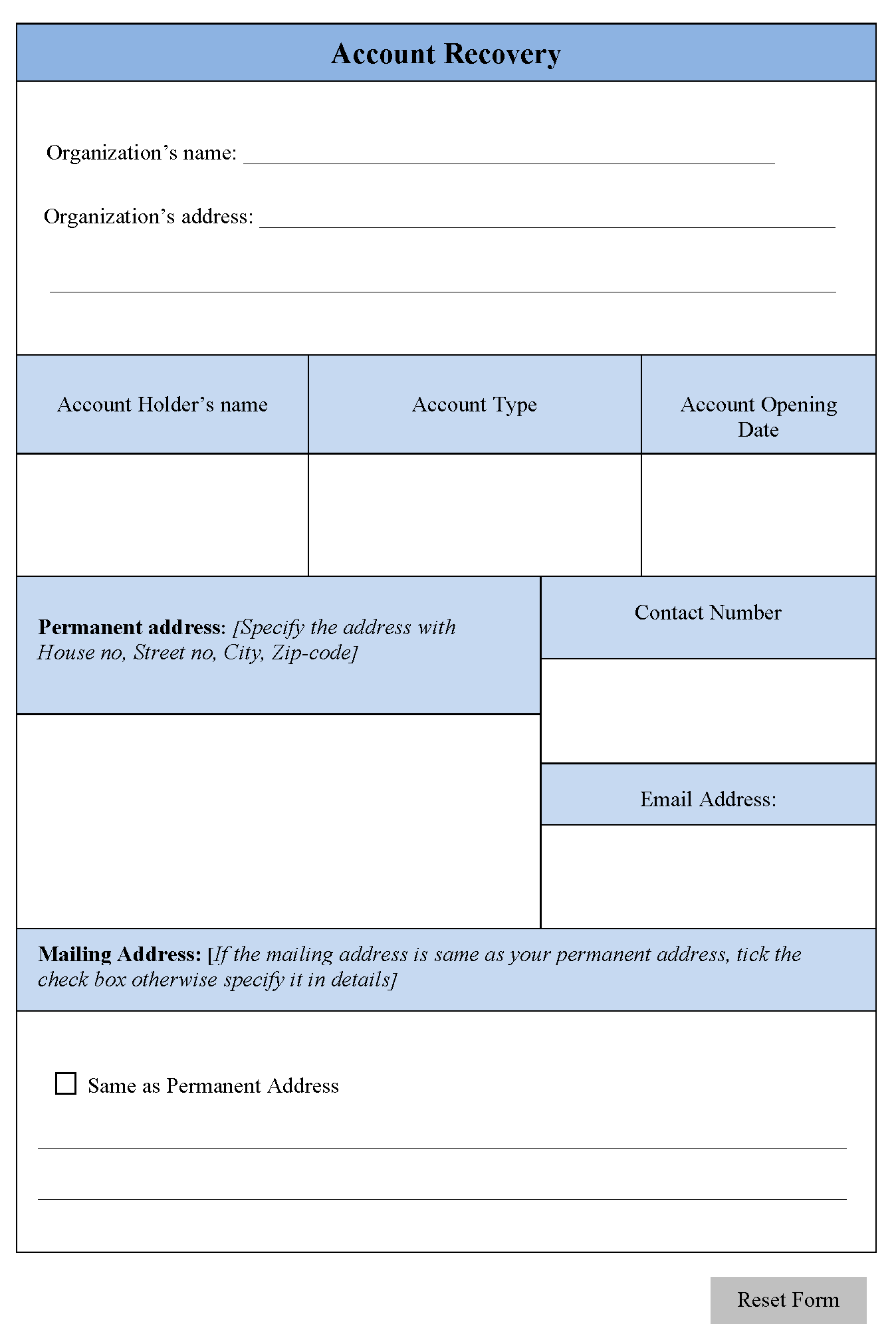

Account Recovery Form Editable Forms

What Does It Mean To Claim The Recovery Rebate Credit Leia Aqui Who

Printable Old Style Rebate Form Printable Forms Free Online

Printable Old Style Rebate Form Printable Forms Free Online

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

How To Calculate Recovery Rebate Credit 2022 Rebate2022 Recovery Rebate

Form 8038 R Request For Recovery Of Overpayments Under Arbitrage

Recovery Rebate Form Pdf - Web 17 f 233 vr 2021 nbsp 0183 32 Fill Online Printable Fillable Blank Recovery Rebate Credit Worksheet TheTaxBook Form Use Fill to complete blank online THETAXBOOK pdf forms for