5 Lakh Rebate In Income Tax Verkko 1 p 228 iv 228 sitten nbsp 0183 32 20 on Rs 12 15 lakh 30 on Rs 15 lakh gt Income Tax Rebate Before the Union Budget 2023 individuals with an annual income up to Rs 5 lakh were not required to pay any tax

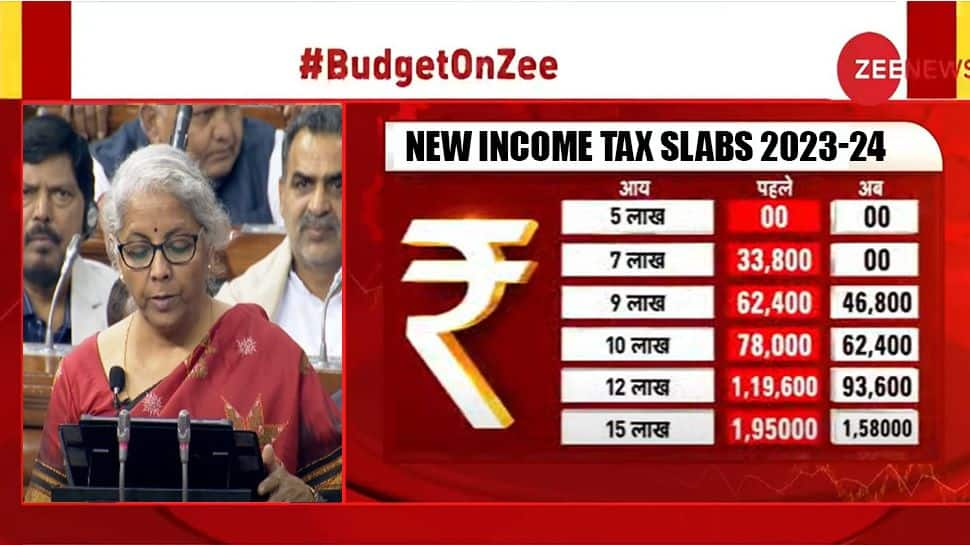

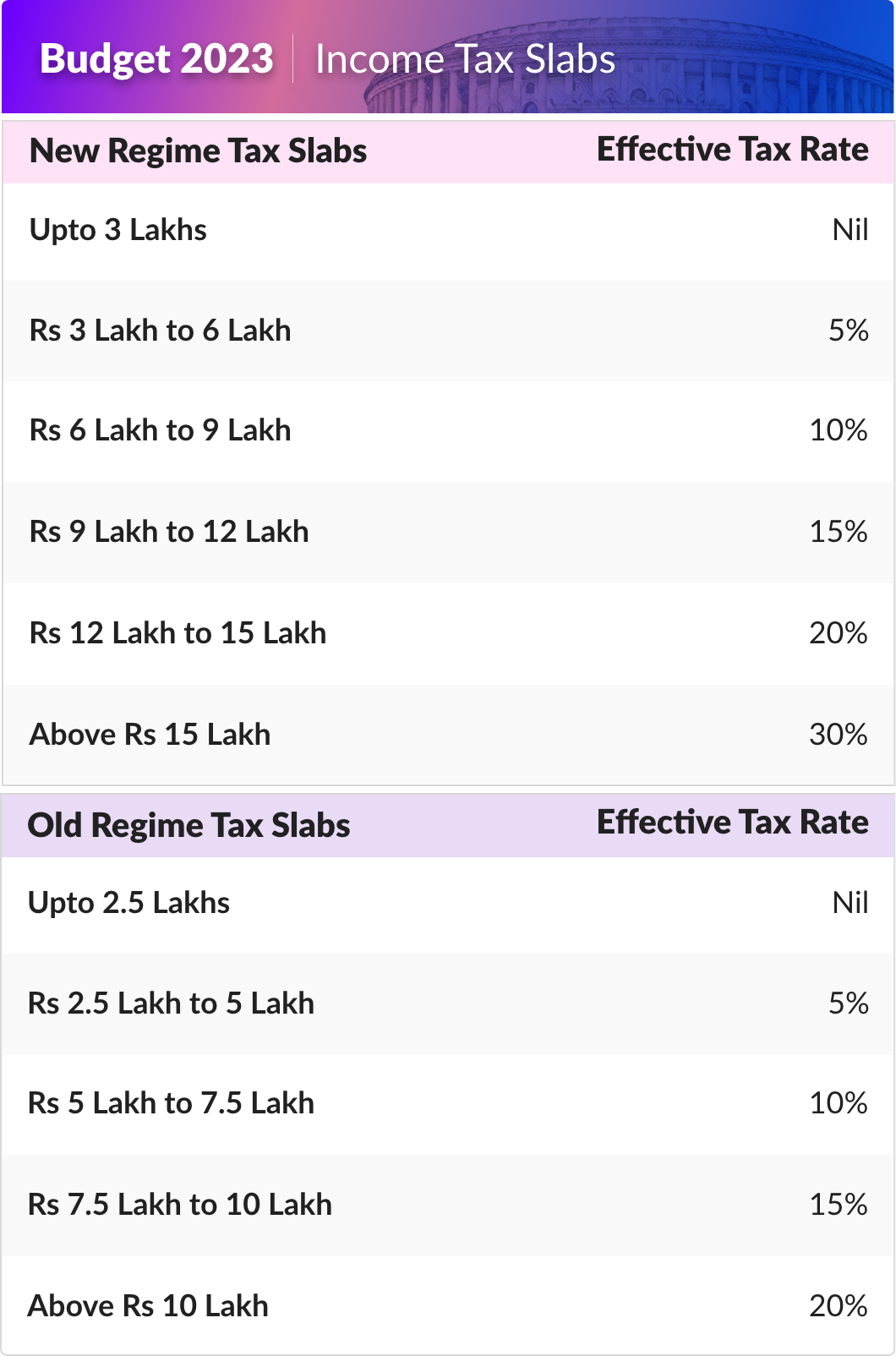

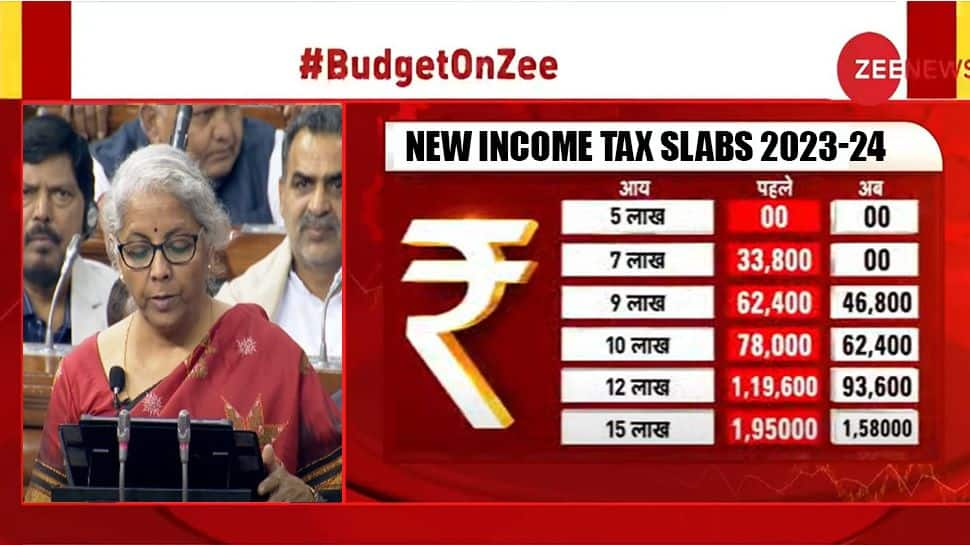

Verkko 1 helmik 2023 nbsp 0183 32 Budget 2023 Income Tax rebate limit raised to 7 lakh from 5 lakh Finance Minister Nirmala Sitharaman announces that there will not be any new tax for income up to 3 lakh reduces the number of I T slabs to 5 Verkko gt Income Tax Rebate Before the Union Budget 2023 individuals with an annual income up to Rs 5 lakh were not required to pay any tax This limit was hiked to Rs 7 lakh

5 Lakh Rebate In Income Tax

5 Lakh Rebate In Income Tax

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Union Budget 2023 Centre Raises Tax Rebate Limit Reduces Slabs In Key

https://images.hindustantimes.com/img/2023/02/01/1600x900/The-Union-government-made-the-new-income-tax-regim_1675278142042.jpg

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202302/new_tax_slab_amounts-sixteen_nine.jpg?VersionId=fwHXK2_vWXcpm_arzu9kYnCvtYzgEmii

Verkko 28 jouluk 2023 nbsp 0183 32 gt Under this regime a full tax rebate on an income up to Rs 7 lakh was introduced under Section 87A Whereas this threshold is Rs 5 lakh under the old tax regime Verkko 9 marrask 2022 nbsp 0183 32 Tax rebate if your income falls under Rs 5 lakh Resident individual assessees whose total net income does not exceed Rs 5 lakh can claim a tax rebate under section 87A The amount of rebate shall be the amount of income tax computed on total income subject to a maximum of Rs 12 500 This means that your tax liability

Verkko 17 huhtik 2021 nbsp 0183 32 Section 87A was introduced in Finance Act 2003 which was changed from time to time Presently the rebate of tax is available for those whose income does not exceed 5 lakh Verkko 1 maalisk 2019 nbsp 0183 32 Since your taxable income is Rs 5 lakh this means you have Rs 2 5 lakh extra over the zero tax slab At 5 income tax rate the tax liability comes to Rs 12 500 However the full tax rebate of up to Rs 12 500 given in the latest budget means you will also pay no tax

Download 5 Lakh Rebate In Income Tax

More picture related to 5 Lakh Rebate In Income Tax

Income Tax Return Forget Rs 5 Lakh Rs 6 5 Lakh Tax Rebate First Know

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2019/02/05/72552-who-moved-my-taxes-pixabay.png?itok=bWLfBJAC&c=9d91abc4150fe6afe4b239ee31c14c63

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Budget 2023 New Tax Regime Will Now Be The Default Tax Regime

https://static.india.com/wp-content/uploads/2023/02/2023_2img01_Feb_2023_PTI02_01_2023_000066B-1.jpg

Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Income tax rebate hiked in new tax regime With the advantage of the standard deduction an individual having taxable income of up to Rs 7 5 lakh will not owe any tax Verkko This tax will be nullified by Tax Rebate under Section 87A which has limit of Rs 12 500 and hence you don t have to pay any tax Please note that in case your income is above Rs 5 lakh in financial year you have to pay this 5 slab Rs 12 500 tax along with the tax on income above Rs 5 lakh and include cess of 4 as well

Verkko 3 helmik 2023 nbsp 0183 32 Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their taxable income does not exceed Rs 5 lakh in a financial year Verkko 4 kes 228 k 2019 nbsp 0183 32 In the Interim Budget 2019 Section 87A of the Income Tax Act 1961 is amended to the extent that where total income of an individual does not exceed Rs 5 lakh he shall be entitled to claim a rebate from total income tax payable of an amount equal to 100 of such tax or Rs 12 500 whichever is less

New Income Tax Slabs 2023 24 No Income Tax Till Rs 7 Lakh Check New

https://english.cdn.zeenews.com/sites/default/files/2023/02/01/1148068-income-tax-slab.jpeg

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

https://www.businesstoday.in/personal-finance/tax/story/it-returns...

Verkko 1 p 228 iv 228 sitten nbsp 0183 32 20 on Rs 12 15 lakh 30 on Rs 15 lakh gt Income Tax Rebate Before the Union Budget 2023 individuals with an annual income up to Rs 5 lakh were not required to pay any tax

https://www.fortuneindia.com/budget-2023/budget-2023-income-tax-rebat…

Verkko 1 helmik 2023 nbsp 0183 32 Budget 2023 Income Tax rebate limit raised to 7 lakh from 5 lakh Finance Minister Nirmala Sitharaman announces that there will not be any new tax for income up to 3 lakh reduces the number of I T slabs to 5

Budget 2023 5 Major Announcements On Personal Income Tax Hindustan Times

New Income Tax Slabs 2023 24 No Income Tax Till Rs 7 Lakh Check New

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

Can You Get Tax Rebate Mint

How To Get Tax Rebate In Income Tax

How To Get Tax Rebate In Income Tax

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

Province Of Manitoba School Tax Rebate

5 Lakh Rebate In Income Tax - Verkko 9 marrask 2022 nbsp 0183 32 Tax rebate if your income falls under Rs 5 lakh Resident individual assessees whose total net income does not exceed Rs 5 lakh can claim a tax rebate under section 87A The amount of rebate shall be the amount of income tax computed on total income subject to a maximum of Rs 12 500 This means that your tax liability