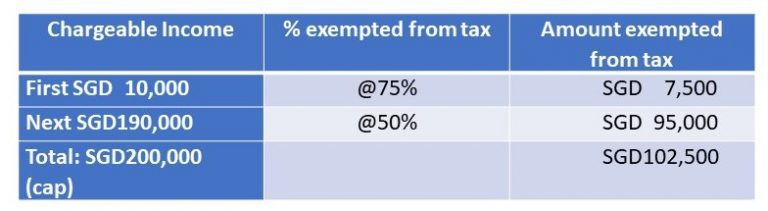

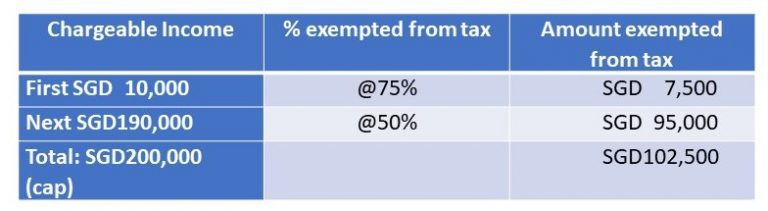

50 Percent Tax Rebate Singapore Web 28 f 233 vr 2023 nbsp 0183 32 Corporate Tax Relief Partial Tax Exemption PTE For All Companies In Singapore All companies in Singapore enjoy a Partial Tax Exemption PTE From

Web 25 juil 2023 nbsp 0183 32 Since 2020 qualified companies can obtain a 75 percent tax exemption on the first S 100 000 US 73 770 of chargeable income during the first consecutive three Web Apart from tax saving schemes businesses can fall back on a Singapore tax rebate to lower business expenses and support restructuring plans Although no tax rebate has

50 Percent Tax Rebate Singapore

50 Percent Tax Rebate Singapore

https://thenewdawnliberia.com/govoampi/2021/11/Margibi-County-story.jpg

Solved If Mexico Decides To Impose A 50 Percent Tax On Chegg

https://media.cheggcdn.com/study/ae0/ae055c47-f642-4fb5-8b3e-3a6e1841a8ad/image

UAE 50 Percent Tax On Sugary Drinks 100 Percent Tax On Tobacco

https://i.pinimg.com/originals/6b/de/52/6bde52125034335adb0ef0046acc32bf.jpg

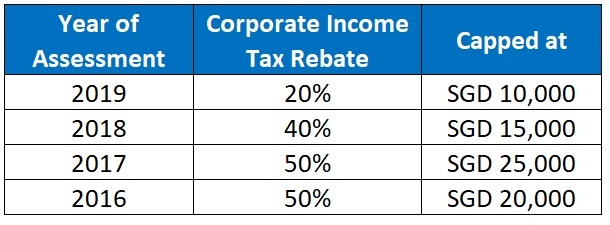

Web 23 f 233 vr 2022 nbsp 0183 32 The carbon tax rate would be progressively increased from SGD 5 per tonne of emissions to SGD 25 per tonne as from 2024 SGD 45 per tonne as from 2026 and Web For the Years of Assessments YA 2016 and 2017 all corporations get a 50 percent rebate on all corporate tax The rebate is capped at S 20 000 per YA In assisting firms

Web 14 mars 2023 nbsp 0183 32 If the chargeable income falls between the range of S 10 000 and S 200 000 or the next S 190 000 you ll be granted a 50 exemption for the next Web Less 50 corporate tax income rebate 50 of tax payable or capped at 20 000 20 000 Tax payable A 49 275 E ective tax rate A B 8 8 Click here to download the

Download 50 Percent Tax Rebate Singapore

More picture related to 50 Percent Tax Rebate Singapore

Bayelsa Government Issues 50 Percent Tax Relief To Business Operators

https://i1.wp.com/bizwatchnigeria.ng/wp-content/uploads/2020/07/tax-relief.png?resize=640%2C448&ssl=1

Taxed

https://i.pinimg.com/originals/86/e2/49/86e2491f8cc26b3c061cf63126262dec.jpg

All Income Earned In Singapore Is Subject To Tax However Singapore

https://i.pinimg.com/originals/02/cc/ee/02cceeb8209cfe3f959b1480f37a5c15.jpg

Web The government s risk share is 50 percent and 70 percent for young companies defined as companies incorporated within the past five years and is more than 50 percent equity Web 24 janv 2020 nbsp 0183 32 For the second child 20 of earned income is eligible for tax relief For the third and subsequent children 25 of earned income is eligible for tax relief The

Web 13 mars 2023 nbsp 0183 32 Income tax rate Gross tax payable First S 20 000 Next S 10 000 0 2 S 0 S 200 First S 30 000 Next S 10 000 3 5 S 200 S 350 First S 40 000 Next Web 23 juin 2021 nbsp 0183 32 The corporate tax rate in Singapore is a single tier territorial based flat rate system The effective tax rate is one of the lowest in the world and contributes to the

Overview Of Singapore Corporate Taxation System JSE Office

https://jseoffices.com/wp-content/uploads/2018/06/no-11-768x211.jpg

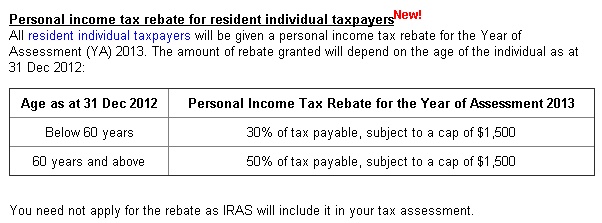

Bulicenas Singapore Tax Rebates

https://2.bp.blogspot.com/-mWIID9_ikkA/UVBehKRVxiI/AAAAAAAABhY/Ld9isw9tW0E/s1600/IRAS+tax+rebate.jpg

https://dollarsandsense.sg/business/complete-guide-to-singapore...

Web 28 f 233 vr 2023 nbsp 0183 32 Corporate Tax Relief Partial Tax Exemption PTE For All Companies In Singapore All companies in Singapore enjoy a Partial Tax Exemption PTE From

https://www.aseanbriefing.com/news/business-and-tax-incentives-for...

Web 25 juil 2023 nbsp 0183 32 Since 2020 qualified companies can obtain a 75 percent tax exemption on the first S 100 000 US 73 770 of chargeable income during the first consecutive three

Tax Deferred Account Distribution Advice

Overview Of Singapore Corporate Taxation System JSE Office

EU Country To Reduce Cryptocurrency Tax By 50 Percent To Attract

Tax Services Singapore File Tax Returns On Time Company Taxation

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Connecticut Dem Introduces 50 Percent Tax On Ammunition Calling It

Singapore Corporate Income Tax Rebates Paul Wan Co

Wealth And Sin Taxes Why Singapore Budget 2023 Raise Taxes For Those

50 Percent Tax Rebate Singapore - Web 14 mars 2023 nbsp 0183 32 If the chargeable income falls between the range of S 10 000 and S 200 000 or the next S 190 000 you ll be granted a 50 exemption for the next