529 Tax Rebate Pa Web Treasurer Garrity approved the reduction of the state fee for PA 529 IP account owners from 0 06 to 0 055 effective August 20 2021 IP account owners pay total fees ranging from 21 to 31 annually

Web 27 juin 2022 nbsp 0183 32 Updated Jun 27 2022 06 25 PM EDT HARRISBURG Pa WHTM Pennsylvania State Treasurer Stacy Garrity today announced that qualifying PA 529 Web 3 ao 251 t 2006 nbsp 0183 32 An individual taxpayer could contribute 17 000 per beneficiary per year up to the amount of taxable income reported on the PA 40 return A married couple could

529 Tax Rebate Pa

529 Tax Rebate Pa

https://www.pdffiller.com/preview/47/686/47686220/large.png

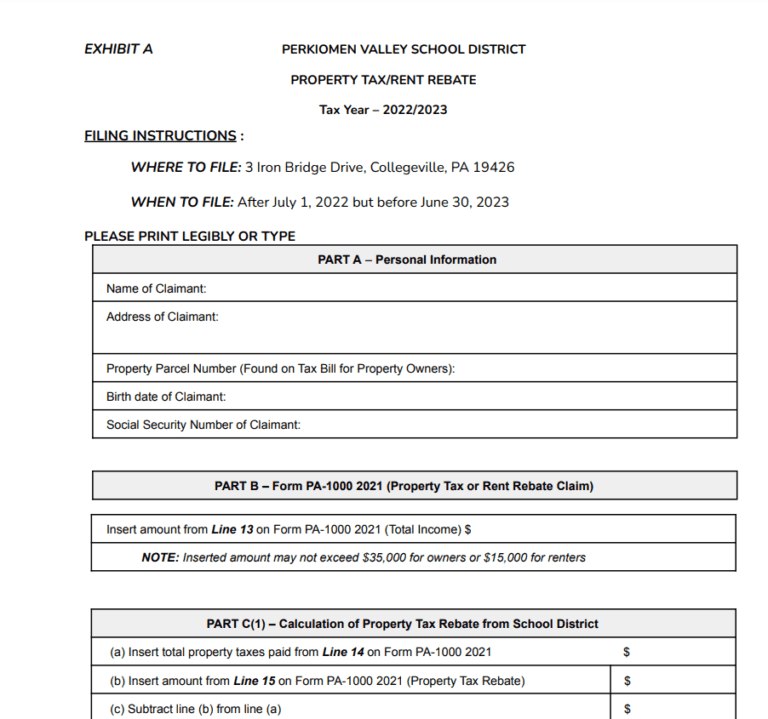

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

529 Plans PA State Tax Benefits On Vimeo

https://i.vimeocdn.com/video/775576175-8aa2b49e51eed39eb0611936ab90b7c106e7fff7a0e47a97e2f0450998b7d61b-d?mw=1920&mh=1080&q=70

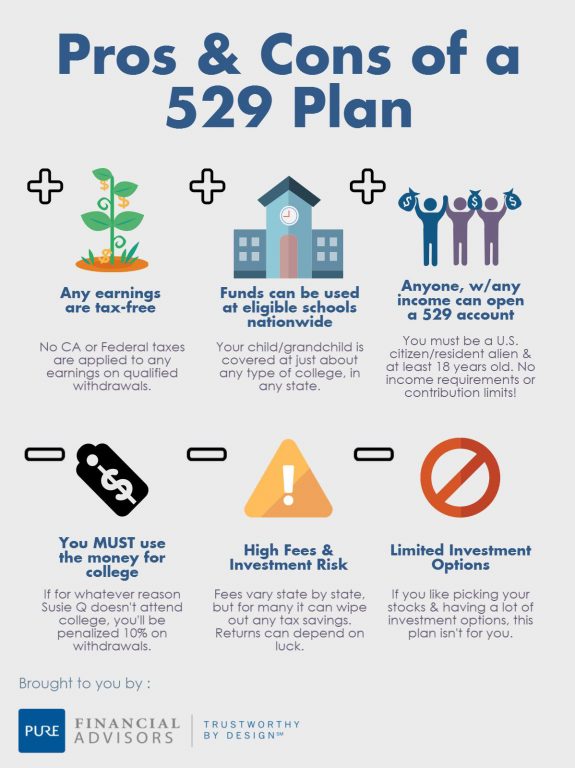

Web Before investing in either PA 529 plan please carefully read that plan s disclosure statement available at www PA529 or by calling 1 800 440 4000 to learn more about that Web PA 529 Accounts Offer Tax Advantages Over Other Types of Savings Accounts Including State tax deduction Deduct contributions from your PA state income taxes Tax

Web Overview Use this screen to allocate contributions to a 529 Plan to Pennsylvania part year or nonresident returns and to complete Schedule O Other Deductions Part 1 Note This Web Pennsylvania s 529 Investment Plan is available to residents of any state and offers 26 Vanguard investment options including a socially responsible equity portfolio Pennsylvania residents may enjoy a state tax deduction

Download 529 Tax Rebate Pa

More picture related to 529 Tax Rebate Pa

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Tax

https://i.pinimg.com/originals/d4/78/45/d47845faf5184403355da1ccdf76c329.png

Are There Tax Benefits To 529 Plan BenefitsTalk

https://www.benefitstalk.net/wp-content/uploads/are-the-more-expensive-529-plan-funds-worth-their-tax-benefits.jpeg

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

https://i0.wp.com/gantnews.com/wp-content/uploads/2023/05/vqdbs7zn0dm9fp9tpw6972kypg.jpeg?fit=1920%2C1440&ssl=1

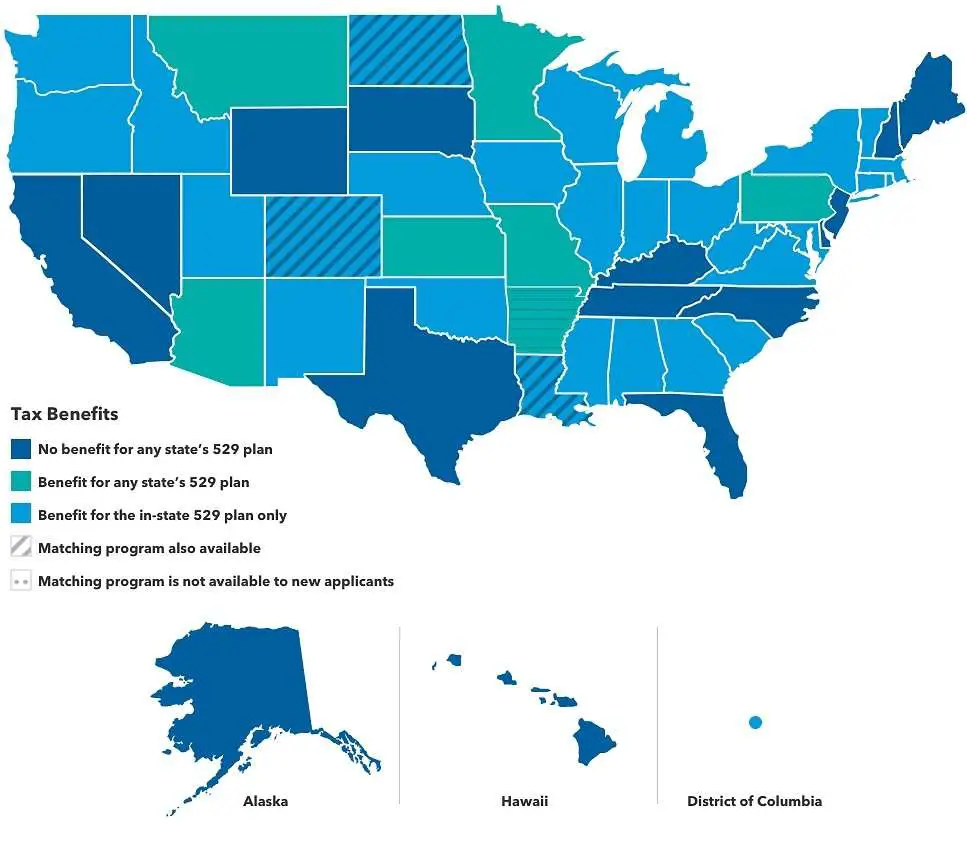

Web 29 nov 2022 nbsp 0183 32 The Best 529 Tax Advantages Offered Over 30 states offer a tax deduction that allows taxpayers to receive a state tax break on contributions to 529 plans Three Web The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older The income

Web 3 juil 2023 nbsp 0183 32 283 468 rebates on property taxes and rent paid in 2022 will be made starting today Harrisburg PA Starting today 283 468 older homeowners renters and people Web The income cap for homeowners will increase from 35 000 to 45 000 The income cap for renters will increase from 15 000 to 45 000 Third the income caps will be tied to the

529

https://www.varaklaw.com/wp-content/uploads/529-plan.jpg

How Does A 529 Savings Plan Work Save For College The Smart Way

https://www.safesmartliving.com/wp-content/uploads/529-savings-benefits-graphic-png.png

https://www.patreasury.gov/newsroom/archive…

Web Treasurer Garrity approved the reduction of the state fee for PA 529 IP account owners from 0 06 to 0 055 effective August 20 2021 IP account owners pay total fees ranging from 21 to 31 annually

https://www.abc27.com/pennsylvania/pennsylvania-treasurer-announces...

Web 27 juin 2022 nbsp 0183 32 Updated Jun 27 2022 06 25 PM EDT HARRISBURG Pa WHTM Pennsylvania State Treasurer Stacy Garrity today announced that qualifying PA 529

Fillable Pa 40 Fill Out Sign Online DocHub

529

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

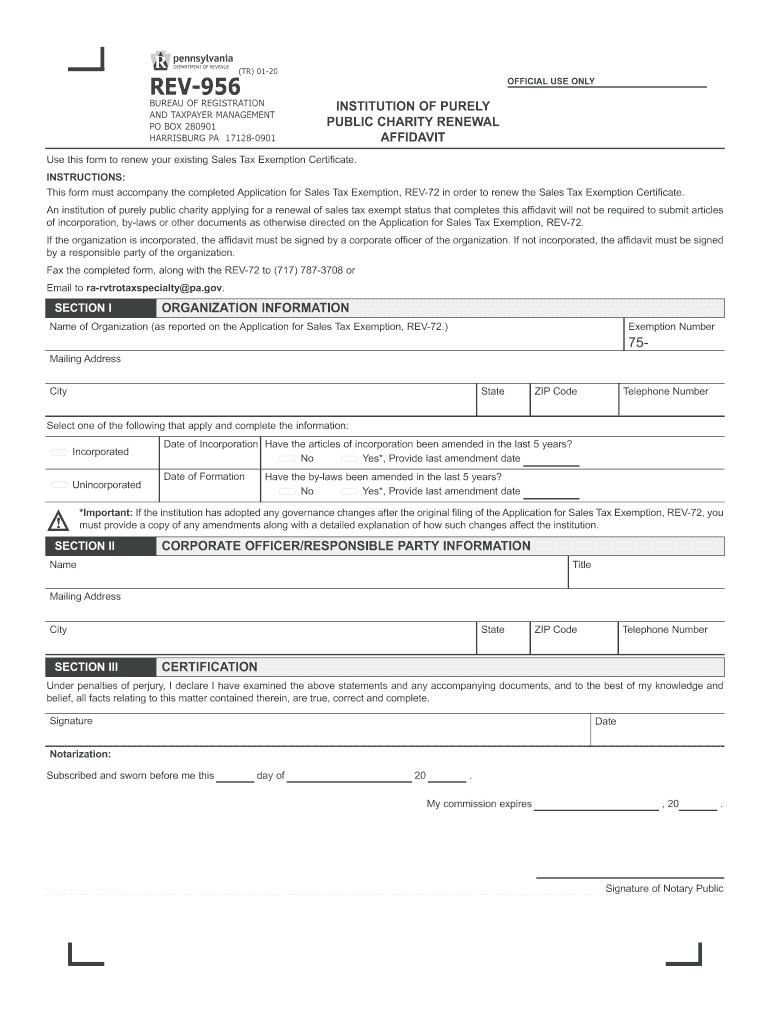

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

What States Allow Tax Deductions For 529 Contributions TaxesTalk

Microfinance Loan Application Form

Microfinance Loan Application Form

529 College Savings Plan Vs Roth IRA

Fill Free Fillable Forms For The State Of Pennsylvania

PA Rent Rebate Form Printable Rebate Form

529 Tax Rebate Pa - Web PA 529 Accounts Offer Tax Advantages Over Other Types of Savings Accounts Including State tax deduction Deduct contributions from your PA state income taxes Tax