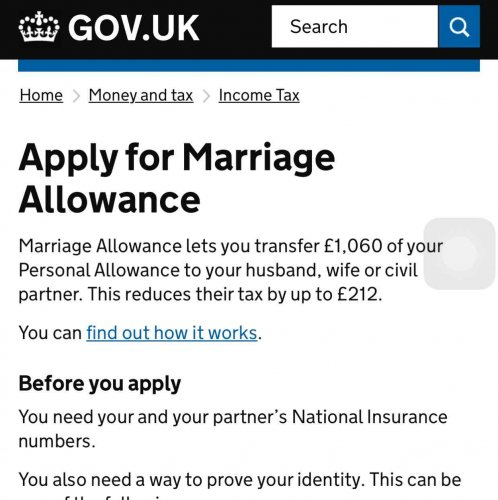

Marriage Tax Rebate Hmrc Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs HMRC Web HM Revenue and Customs HMRC will give your partner the allowance you have transferred to them either by changing their tax code this can take up to 2 months

Marriage Tax Rebate Hmrc

Marriage Tax Rebate Hmrc

https://www.pdffiller.com/preview/22/555/22555713/large.png

Government Transformation Summit 2023 Home

https://summit.govx.digital/hubfs/HMRC Logo-1.png

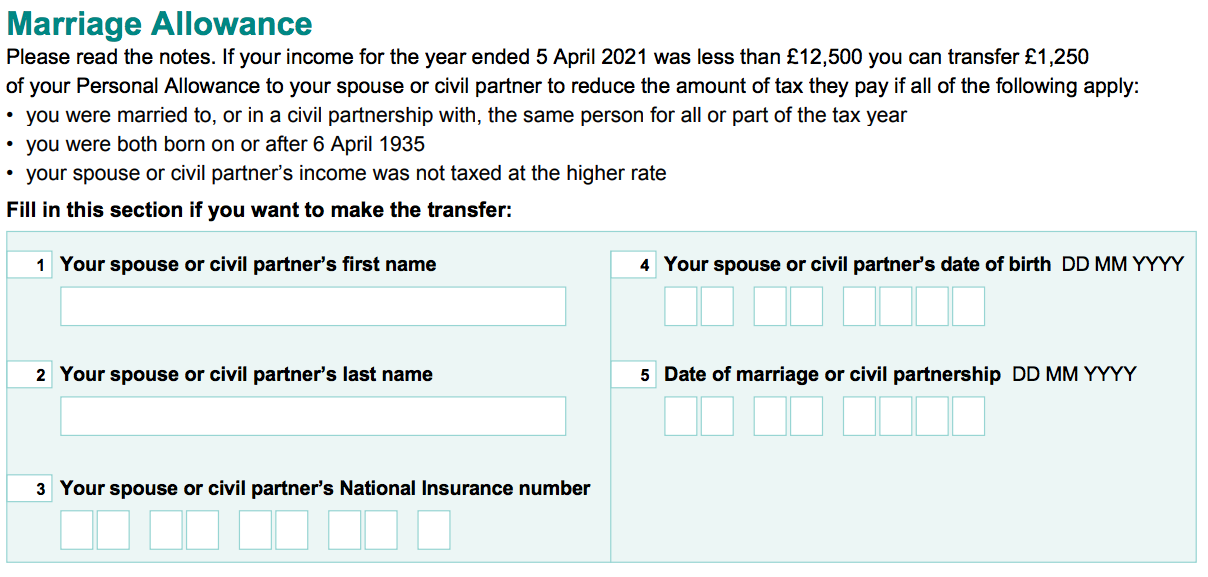

What Is An SA100 Form Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2021/04/sa100-marriage-allowance.png

Web 11 f 233 vr 2022 nbsp 0183 32 HM Revenue amp Customs Published 11 February 2022 Married couples and people in civil partnerships could receive extra cash this Valentine s Day as HM Revenue Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay

Web If your income changes and you re not sure if you should still claim call HMRC Marriage Allowance enquiries How to cancel Either of you can cancel if your relationship has ended Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a

Download Marriage Tax Rebate Hmrc

More picture related to Marriage Tax Rebate Hmrc

We Thought We Were Dealing With HMRC Marriage Allowance Claimants

https://media.product.which.co.uk/prod/images/1328_886/gm-b18cfbc6-c2d0-4a84-9b44-584b3ba9752c-hmrc-2.jpeg

HMRC Tax Return Get The Information You Need

https://pdfimages.wondershare.com/pdf-forms/hmrc.png

PSA HMRC Will Not E mail Or Call You About Tax Rebates CasualUK

https://i.imgur.com/NPT0C0n.png

Web Married Couple s Allowance could reduce your tax bill each year you re married or in a civil partnership if one of you was born before before 6 April 1935 Web Kit Sproson Edited by Martin Lewis Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the marriage tax allowance something

Web 11 sept 2023 nbsp 0183 32 To receive backdated marriage allowance you can apply online or phone the HMRC Income Tax helpline If your partner was the lower earner in the couple the person responsible for managing their tax Web 4 nov 2019 nbsp 0183 32 0 163 0 It is possible to backdate your claim by up to four years This means that eligible couples who have been married or in a civil partnership for the past five years

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

HMRC Are Reminding Married Couples And Civil Partnerships To Sign Up

https://www.northern-times.co.uk/_media/img/JQB4KDWSHN80N59HECXL.jpg

https://www.gov.uk/apply-marriage-allowance

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

https://www.gov.uk/married-couples-allowance/how-to-claim

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs HMRC

Hmrc Customs Contact Number

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

HMRC Give Tax Relief Pre approval Save The Thorold Arms

Hmrc Tax Rebate Form P55 Printable Rebate Form

Cash Declaration HM Revenue Customs Hmrc Gov Fill Out Sign

Tax Shock How Unmarried Couples Are Losing 1150 To The Taxman

Tax Shock How Unmarried Couples Are Losing 1150 To The Taxman

Tax Shock How Unmarried Couples Are Losing 1150 To The Taxman

HMRC Give Tax Relief Pre approval Save The Thorold Arms

Hmrc Archives Huston And Co

Marriage Tax Rebate Hmrc - Web 14 juil 2023 nbsp 0183 32 Updated July 14 2023 If you are married or in a civil partnership where one partner earns less than 163 12 570 a year and the other is a basic rate taxpayer you may