529 Tax Rebate Web 23 ao 251 t 2023 nbsp 0183 32 A 529 plan is a tax advantaged savings plan designed to help pay for education Originally limited to post secondary education

Web 23 ao 251 t 2023 nbsp 0183 32 Federal Gift Tax Implications There s no limit on how much you can contribute to a 529 plan each year but any contributions over 17 000 16 000 in 2022 can trigger federal gift taxes For Web 28 mars 2023 nbsp 0183 32 If you can maximize all of the different ways a 529 plan can give you tax benefits including tax free earnings and potential tax

529 Tax Rebate

529 Tax Rebate

http://www.mymoneyblog.com/wordpress/wp-content/uploads/2015/02/vg529tool.gif

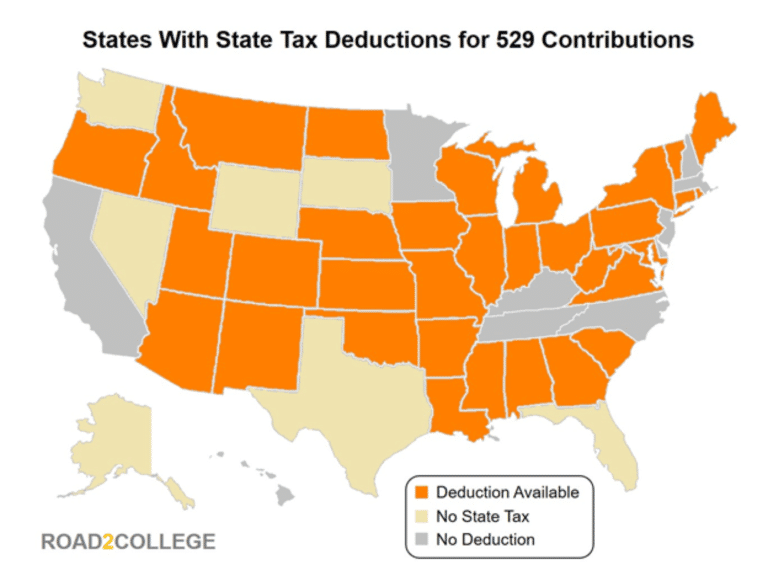

Map Of 529 State Tax Deductions Road2College

https://www.road2college.com/wp-content/uploads/2017/12/Map-of-529-State-Tax-Deductions.png

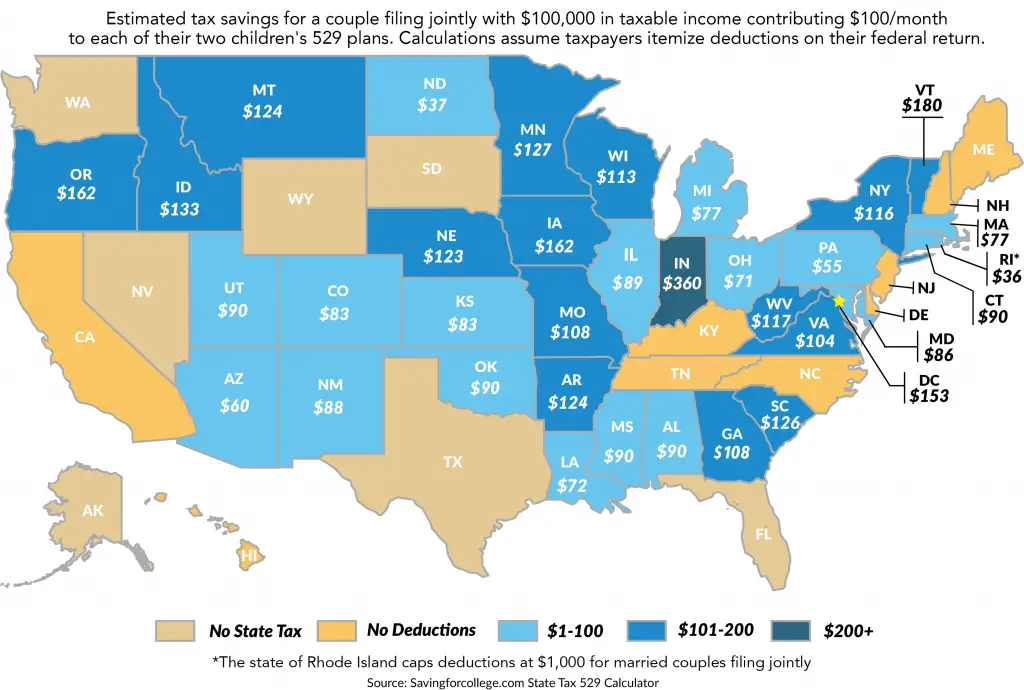

Comparing Your 529 In State Tax Deduction Vs Better Out of State Plans

http://www.mymoneyblog.com/wordpress/wp-content/uploads/2015/02/cs529tool.gif

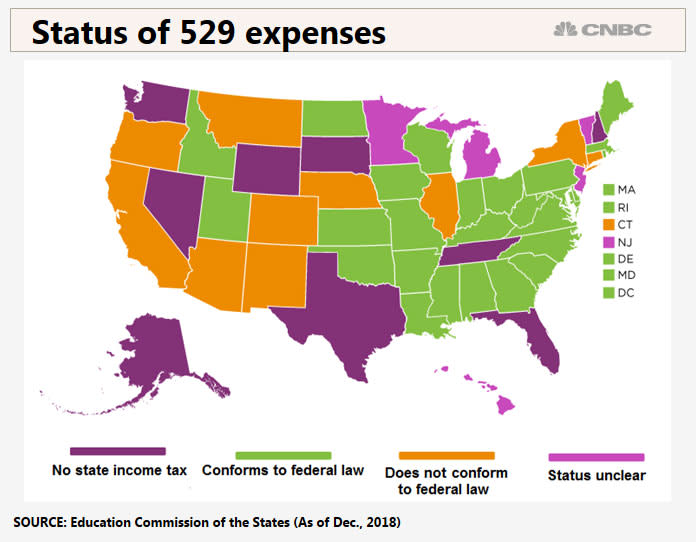

Web 4 juin 2020 nbsp 0183 32 State by State Tax Deduction Rules for 529 Plans While most states tax deduction rules allow families to subtract 529 contributions Web 13 f 233 vr 2023 nbsp 0183 32 Starting in 2024 families saving for education in 529 plans will be allowed to roll over unused funds from those accounts into Roth IRAs without tax penalties The 529 plan beneficiary must own

Web 27 juil 2023 nbsp 0183 32 July 27 2023 Many states offer state income tax deductions or credits for contributions to a 529 plan The amount of your 529 state tax deduction will depend on where you live and how much Web 29 nov 2022 nbsp 0183 32 The Best 529 Tax Advantages Offered Over 30 states offer a tax

Download 529 Tax Rebate

More picture related to 529 Tax Rebate

529 College Savings Plans State by State Tax Benefit Comparison 2015

http://www.mymoneyblog.com/wordpress/wp-content/uploads/2014/10/529tax_720.jpg

The New Tax Code Has Extra Perks For 529 Savers Your State May Not

https://image.cnbcfm.com/api/v1/image/105750190-Unknown.jpg?v=1550675678

Nj 529 Plan Tax Benefits Tiffaney Bernal

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/06/529-Plan-Infographic-How-529-Plan-Works-Infographic-Upromise-Rewards-Upromise-makes-saving-for-college-easy-2-scaled.jpg

Web 1 mai 2020 nbsp 0183 32 Redeposit the refunded amount by July 15 2020 or 60 days after the refund was issued whichever date is later Apply the funds to other qualified expenses later this year Be sure to spend it on expenses for Web 23 ao 251 t 2021 nbsp 0183 32 In the state of Indiana for example you can get a tax credit worth 20 on

Web Learn more about 529 Plan tax benefits how to invest a tax refund into a plan and how Web 28 juin 2017 nbsp 0183 32 You can withdraw money tax free for tuition required books and fees and

Tax Benefits Of 529 Contributions BenefitsTalk

https://www.benefitstalk.net/wp-content/uploads/the-tax-benefits-of-529-plans-the-accountants-for-creatives.png

Is Ny 529 Tax Deductible TaxesTalk

https://www.taxestalk.net/wp-content/uploads/if-you-use-your-529-college-savings-plan-for-this-you-may-1024x690.png

https://www.investopedia.com/terms/1/529pla…

Web 23 ao 251 t 2023 nbsp 0183 32 A 529 plan is a tax advantaged savings plan designed to help pay for education Originally limited to post secondary education

https://www.investopedia.com/personal-financ…

Web 23 ao 251 t 2023 nbsp 0183 32 Federal Gift Tax Implications There s no limit on how much you can contribute to a 529 plan each year but any contributions over 17 000 16 000 in 2022 can trigger federal gift taxes For

529 Plans Which States Reward College Savers Adviser Investments

Tax Benefits Of 529 Contributions BenefitsTalk

529 Plan Ohio Tax Benefits BenefitsTalk

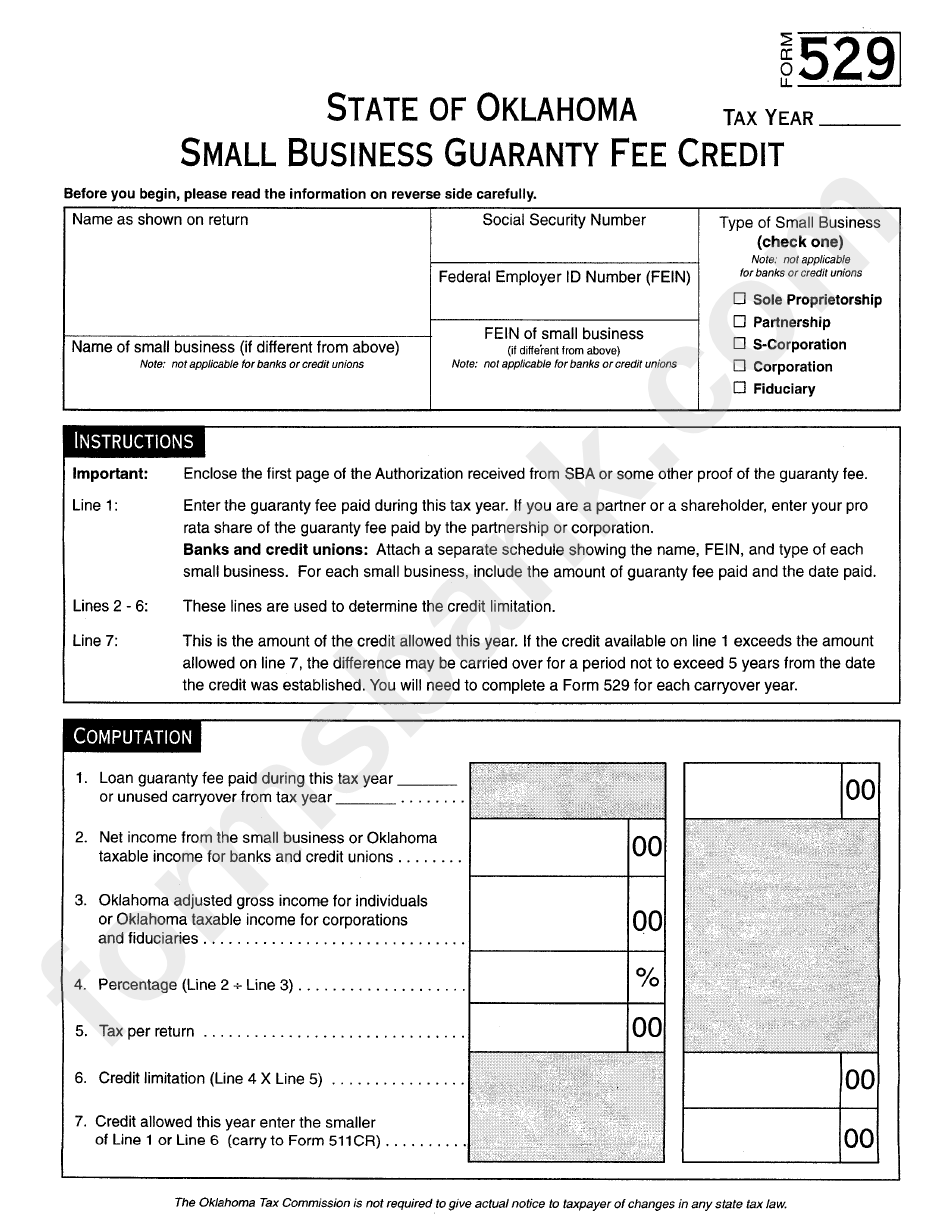

Form 529 Small Business Guaranty Fee Credit Oklahoma Tax Comission

How Does A 529 Savings Plan Work Save For College The Smart Way

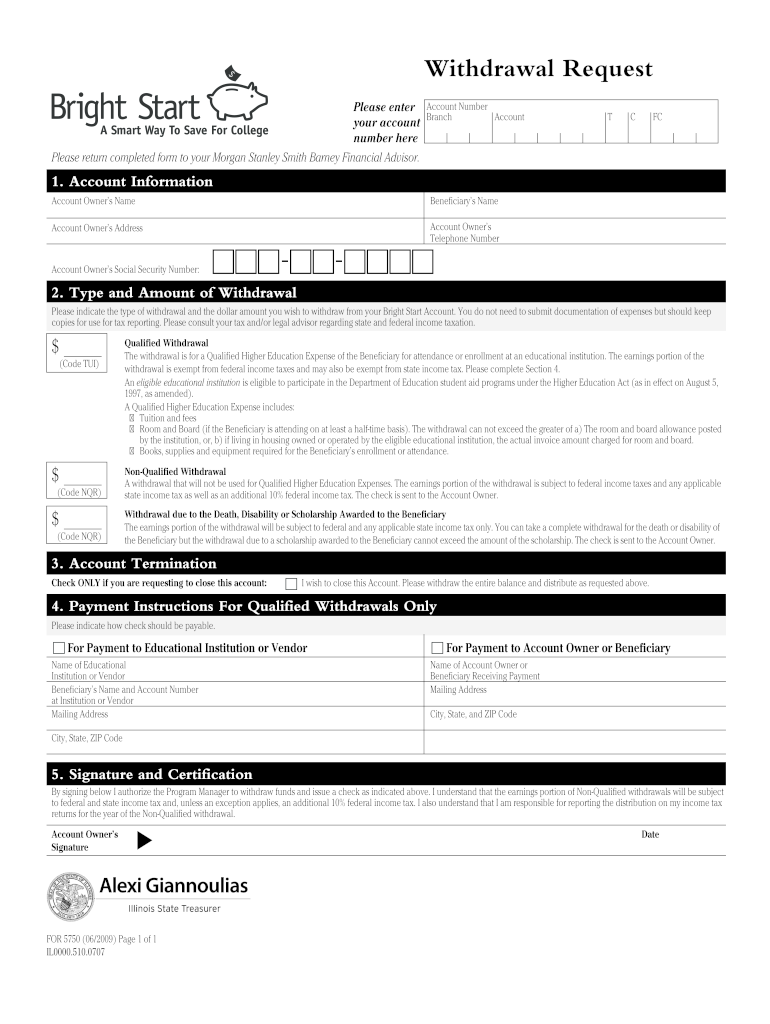

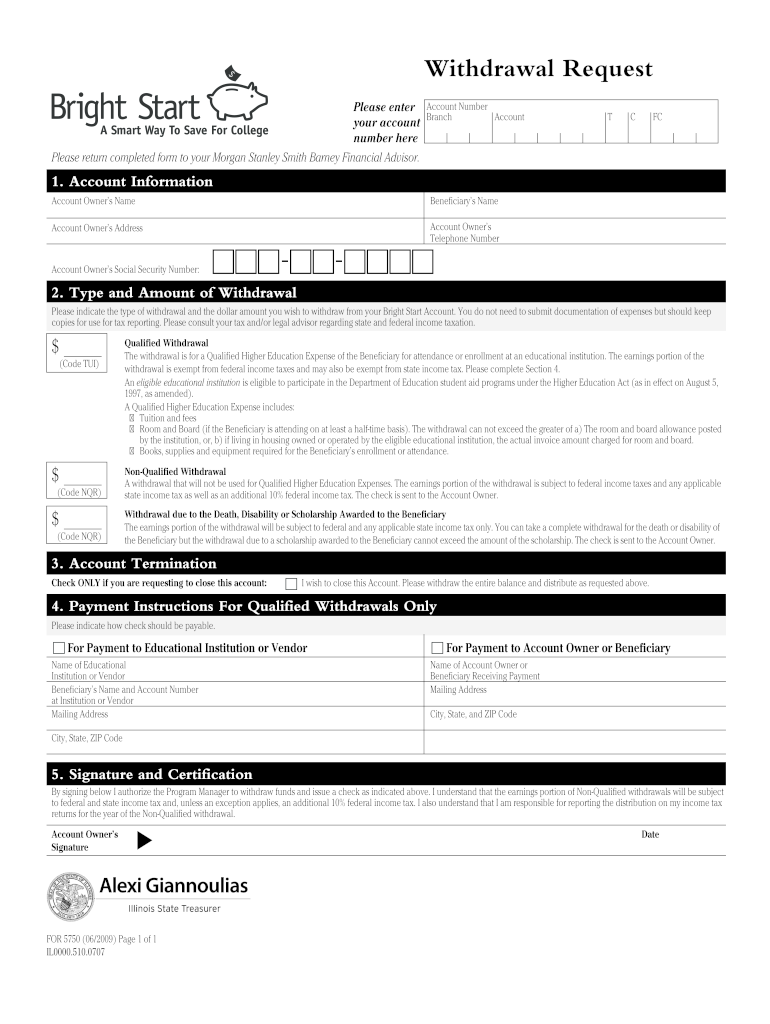

Morgan Stanley 529 Withdrawal Form Fill Out And Sign Printable PDF

Morgan Stanley 529 Withdrawal Form Fill Out And Sign Printable PDF

529 College Savings Plans All 50 States Tax Benefit Comparison

529 College Savings Plans All 50 States Tax Benefit Comparison

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Tax

529 Tax Rebate - Web 13 f 233 vr 2023 nbsp 0183 32 Starting in 2024 families saving for education in 529 plans will be allowed to roll over unused funds from those accounts into Roth IRAs without tax penalties The 529 plan beneficiary must own