Ri Child Tax Rebate Check Web 2 ao 251 t 2022 nbsp 0183 32 Rebate checks will be automatically issued to all eligible tax filers beginning in October 2022 Any Rhode Island resident who claimed at least one dependent child under the age of 18 as of December 31 2021 on their 2021 federal state personal income tax return within certain income thresholds may be eligible For details and

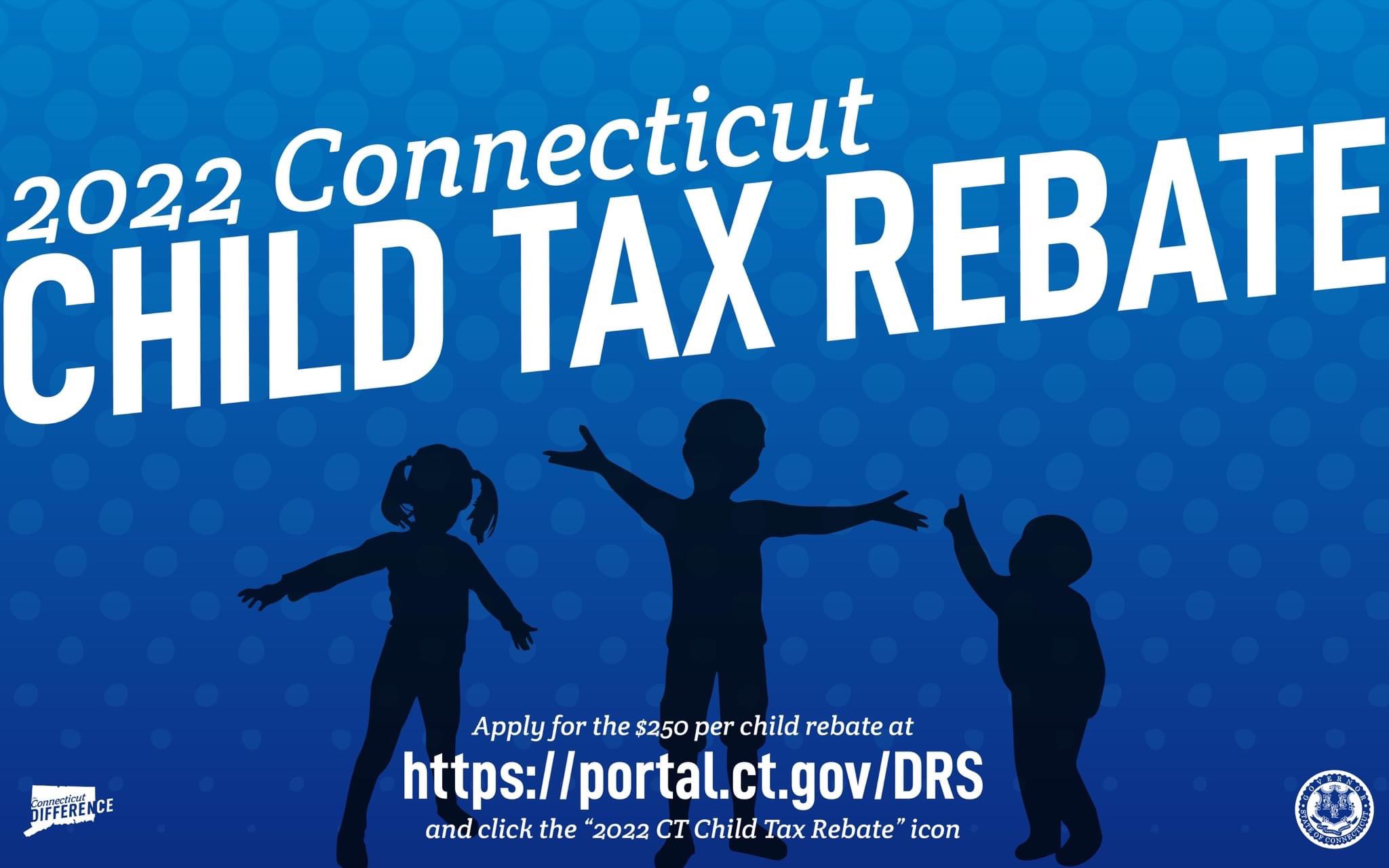

Web 3 oct 2022 nbsp 0183 32 The Child Tax Rebate is a rebate payment of 250 per qualifying child up to a maximum of three children maximum 750 that will be issued to eligible taxpayers Click here to visit the Division of Taxation s webpage for Web You can check your payment status on the Division of Taxation s Child Tax Rebate webpage www tax ri gov ChildTaxRebate2022 using the Where s my Rebate tracking tool If your mailing address or other information has changed since the filing of your return please update your information with the Division by completing and submitting the

Ri Child Tax Rebate Check

/do0bihdskp9dy.cloudfront.net/07-07-2022/t_4b2a4f654eea40f384b59c1c647973cc_name_file_1280x720_2000_v3_1_.jpg)

Ri Child Tax Rebate Check

https://gray-wfsb-prod.cdn.arcpublishing.com/resizer/mNe-jQVunP4HFxzZ-KqYUAzdpXc=/1200x600/smart/filters:quality(85)/do0bihdskp9dy.cloudfront.net/07-07-2022/t_4b2a4f654eea40f384b59c1c647973cc_name_file_1280x720_2000_v3_1_.jpg

State Child Tax Rebate Checks To Begin Arriving This Week NBC Connecticut

https://media.nbcconnecticut.com/2022/08/18161876213-1080pnbcstations.jpg?quality=85&strip=all&resize=1200%2C675

RI Child Tax Rebates Will Start Being Issued This Week McKee

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA12yM4P.img?h=315&w=600&m=6&q=60&o=t&l=f&f=jpg

Web 1 ao 251 t 2022 nbsp 0183 32 Q When will I receive the Child Tax Rebate A For those filing an original or amended filing by August 31 2022 your rebate will be issued starting in October 2022 For those filing on extension by the October 17 2022extended filing deadline your rebate will be issued starting in December 2022 Web The Division of Taxation has created a webpage specifically for the Child Tax Rebate Visit it here www tax ri gov ChildTaxRebate2022 The Division will post all updated information on this page including an upcoming rebate payment tracking tool that will allow you to check the status of your rebate To

Web 3 oct 2022 nbsp 0183 32 Information about the Child Tax Rebate program including a rebate payment tracker can be found on the Division s website here https tax ri gov guidance special programs 2022 child tax rebates This page will be updated frequently and most questions can be answered by using the resources available on that page Web 2 ao 251 t 2022 nbsp 0183 32 Posted Aug 2 2022 10 29 AM EDT Updated Aug 2 2022 05 16 PM EDT NEWPORT R I WPRI Gov Dan McKee announced eligible Rhode Island taxpayers will receive a one time child tax

Download Ri Child Tax Rebate Check

More picture related to Ri Child Tax Rebate Check

Gov s Office Announces Final Tally Of Applications For Child Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAZZRwK.img?w=1280&h=720&m=4&q=79

Child Tax Credit 2022 Update Surprise 175 Payments Sent NOW As IRS

https://www.the-sun.com/wp-content/uploads/sites/6/2022/02/JF-US-CHILD-TAX-CREDIT-LIVE.jpg?w=620

One time Tax Rebate Checks For Idaho Residents KLEW

https://klewtv.com/resources/media/bcd0e069-efe3-406d-b87f-b52ab4b43fd3-medium16x9_IdahoTaxRebateCheckpic.jpg?1630508473534

Web Child Tax Rebate The following circumstances apply to tax year 2022 filings Already filed included the rebate on your federal return and completed the RI Schedule M If you already filed your federal personal income tax return for 2022 please refer to federal guidance on how to address your prior filing If you filed Web 31 ao 251 t 2022 nbsp 0183 32 Eligible residents will get a rebate of 250 per child for a maximum of up to three children per household Moreover the rebate will be available for dependents who were 18 years or younger as of Dec 31 2021

Web 3 oct 2022 nbsp 0183 32 Posted Oct 3 2022 07 50 AM EDT Updated Oct 3 2022 06 22 PM EDT PROVIDENCE R I WPRI Rhode Island will start issuing child tax rebates to around 115 000 households this Web Child Tax Rebate FAQ Rebate Tracker Tool available 2022 Filing Season 709K returns filed 488 6K Refunds issued 46 004 calls 1 084 walk ins 11 730 emails 2023 Filing Season Inflationary changes Personal Exemptions 4 350 Standard Deduction Single Married Separate 9 300

New Mexico Tax Rebate Checks To Be Sent In June

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA19S9Gk.img?w=1280&h=720&m=4&q=79

Families Should See Child Tax Rebate Checks Beginning Thursday NBC

https://media.nbcconnecticut.com/2022/08/BOST_100000054900929.jpg?quality=85&strip=all&resize=1200%2C675

/do0bihdskp9dy.cloudfront.net/07-07-2022/t_4b2a4f654eea40f384b59c1c647973cc_name_file_1280x720_2000_v3_1_.jpg?w=186)

https://governor.ri.gov/press-releases/governor-mckee-announces-new...

Web 2 ao 251 t 2022 nbsp 0183 32 Rebate checks will be automatically issued to all eligible tax filers beginning in October 2022 Any Rhode Island resident who claimed at least one dependent child under the age of 18 as of December 31 2021 on their 2021 federal state personal income tax return within certain income thresholds may be eligible For details and

https://eohhs.ri.gov/2022-child-tax-rebate

Web 3 oct 2022 nbsp 0183 32 The Child Tax Rebate is a rebate payment of 250 per qualifying child up to a maximum of three children maximum 750 that will be issued to eligible taxpayers Click here to visit the Division of Taxation s webpage for

Jimmy Tickey On Twitter Starting Today 250 Per Child Tax Rebates

New Mexico Tax Rebate Checks To Be Sent In June

Child Tax Rebates Are In The Mail For Eligible Rhode Island Families

RI Child Tax Rebate Available McKee Kicks Off Program In Newport

2022 Child Tax Rebate Information Rebate2022

Details Come For New RI Child Tax Rebate

Details Come For New RI Child Tax Rebate

State s Child Tax Rebate Checks In The Mail Republican American

Saving Money The Strategic Way REBATES

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

Ri Child Tax Rebate Check - Web The Division of Taxation has created a webpage specifically for the Child Tax Rebate Visit it here www tax ri gov ChildTaxRebate2022 The Division will post all updated information on this page including an upcoming rebate payment tracking tool that will allow you to check the status of your rebate To