80c Tax Rebate Web 30 janv 2022 nbsp 0183 32 Seven ways to get the Section 80C tax rebate Shipra Singh 4 min read 31 Jan 2022 12 00 AM IST Istock Summary Most of the time tax saving instruments are

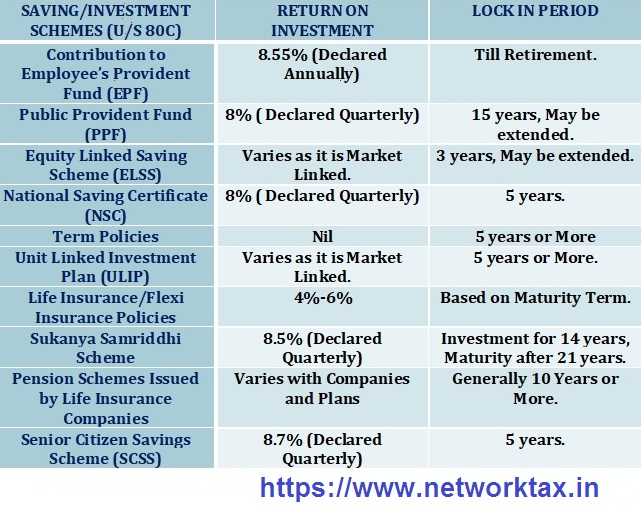

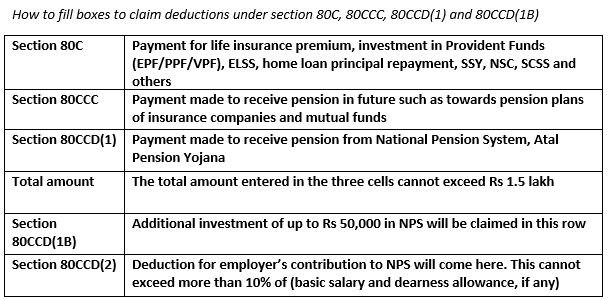

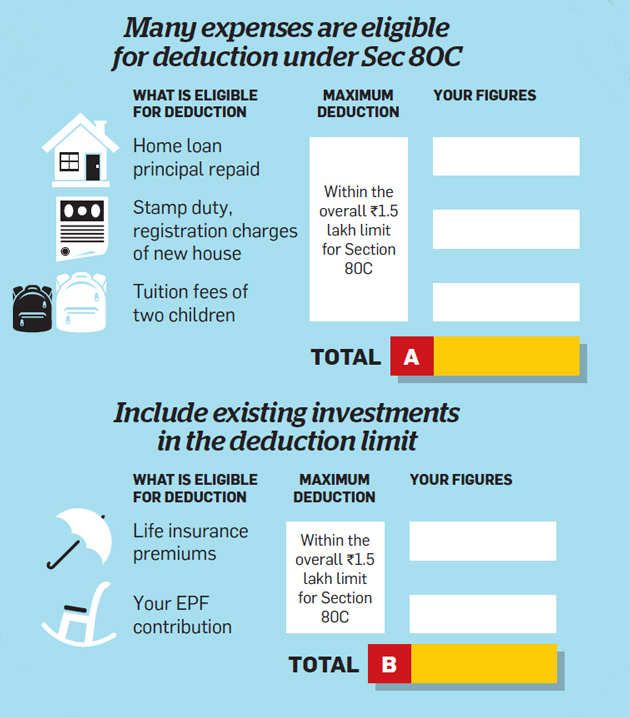

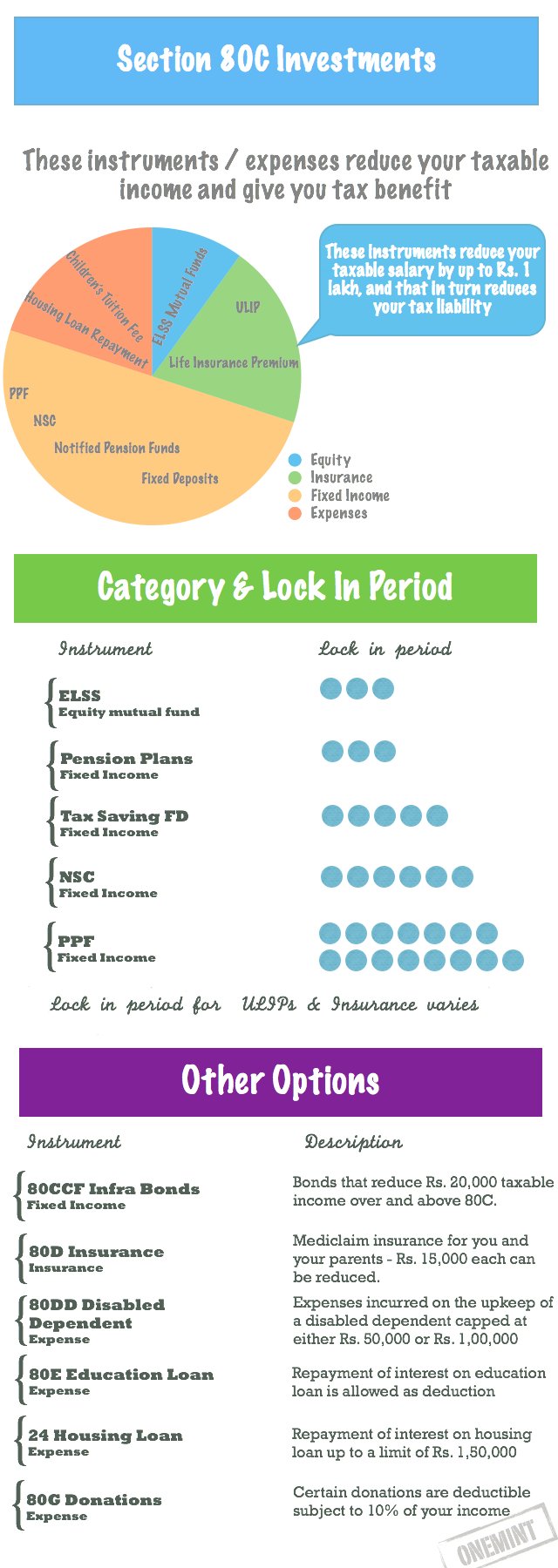

Web 8 juin 2021 nbsp 0183 32 Tax benefit for repayment of the principal amount of home loans is eligible for deduction under Section 80C but the deduction is available only in respect of home Web 28 mars 2019 nbsp 0183 32 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF

80c Tax Rebate

80c Tax Rebate

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

How To Claim Health Insurance Under Section 80D From 2018 19

https://myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

80C TO 80U DEDUCTIONS LIST PDF

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Web 11 janv 2023 nbsp 0183 32 How to maximise tax rebate under Section 80C Deductions allowed on home loan interest Deductions under Section 24 Terms and conditions for home buyers Web 6 sept 2023 nbsp 0183 32 Section 80C An individual can claim a deduction up to INR 1 5 lakh of the total income under Section 80C Rebate under section 80C is only available for HUF and individuals Apart from 80C there are other

Web 1 f 233 vr 2023 nbsp 0183 32 Going by the current income tax slab and rates the deduction under section 80C can help an individual paying tax at 31 2 per cent to save tax of Rs 46 800 This tax saving is inclusive of cess at 4 per cent and Web Section 80C Investment in ELSS Fund or Tax Saving Mutual Fund is considered as the best tax saving option These funds are specially designed to give you dual benefit of saving taxes and getting higher

Download 80c Tax Rebate

More picture related to 80c Tax Rebate

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Income Tax For Under Construction House The Property Files

https://blog.tax2win.in/wp-content/uploads/2019/03/80C-Deduction-in-respect-of-LIP-PF-PPF-NSC-etc-1024x819.jpg

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

https://i.ytimg.com/vi/slgW7PuiQOk/maxresdefault.jpg

Web 11 sept 2023 nbsp 0183 32 Section 80C of the Income Tax Act allows for certain expenditures and investments to be exempt from income tax If you plan your investments across different Web 28 mai 2020 nbsp 0183 32 Deduction on stamp duty and registration charges on property purchase could be claimed under Section 80C of the Income Tax Act 1961 Under Section 80C a homebuyer not only claims rebate on his home

Web 6 f 233 vr 2022 nbsp 0183 32 Section 80C offers taxpayers the widest range of investment options that can help them save up to 1 5 lakh of their income from tax Given so many options it is Web 20 nov 2019 nbsp 0183 32 Under Section 80C of the Income Tax Act 1961 taxpayers can claim deduction benefit on payments contributions or investments in a way specified by the

80C Checklist Tax Checklist Indirect Tax Income Tax

https://i.pinimg.com/originals/c2/6f/d1/c26fd1823e7d39702c2b1314fa37bb4e.jpg

Common Tax Benefits Under Section 80C Of Income Tax Act 1961 With

https://1.bp.blogspot.com/-tTRSJgMDHwI/Xztks0LxITI/AAAAAAAAOK8/PgW2yccVGZAPqu4JgxjY4437sXpdArODgCNcBGAsYHQ/s1600/picture%2Bfor%2Bincome%2Btax%2B80C.jpg

https://www.livemint.com/money/personal-finance/seven-ways-to-get-the...

Web 30 janv 2022 nbsp 0183 32 Seven ways to get the Section 80C tax rebate Shipra Singh 4 min read 31 Jan 2022 12 00 AM IST Istock Summary Most of the time tax saving instruments are

https://www.financialexpress.com/money/income-tax/before-claiming...

Web 8 juin 2021 nbsp 0183 32 Tax benefit for repayment of the principal amount of home loans is eligible for deduction under Section 80C but the deduction is available only in respect of home

Have You Utilised The Sec 80C Tax Saving Limit Fully Find Out The

80C Checklist Tax Checklist Indirect Tax Income Tax

Budget 2014 Impact On Money Taxes And Savings

Tax Benefit Investment Know About Section 80C Deductions

Section 80C Tax Saving Instruments Infographic OneMint

Income Tax 80C TAMNEWS

Income Tax 80C TAMNEWS

Section 80C 80 Investment

How To Calculate Tax Rebate On Home Loan Grizzbye

Exemption In Lieu Of 80C Tax Benefits

80c Tax Rebate - Web 11 janv 2023 nbsp 0183 32 How to maximise tax rebate under Section 80C Deductions allowed on home loan interest Deductions under Section 24 Terms and conditions for home buyers