Marriage Allowance Tax Rebate Check Progress Web 5 sept 2022 nbsp 0183 32 How to check progress Published on 5 September 2022 You may have made or tried to make contact with HMRC by post or phone recently If so you may

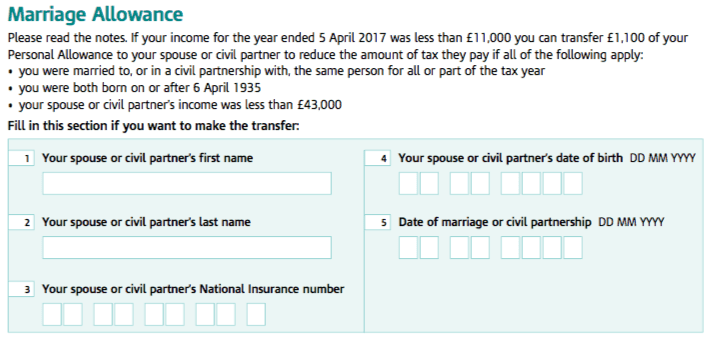

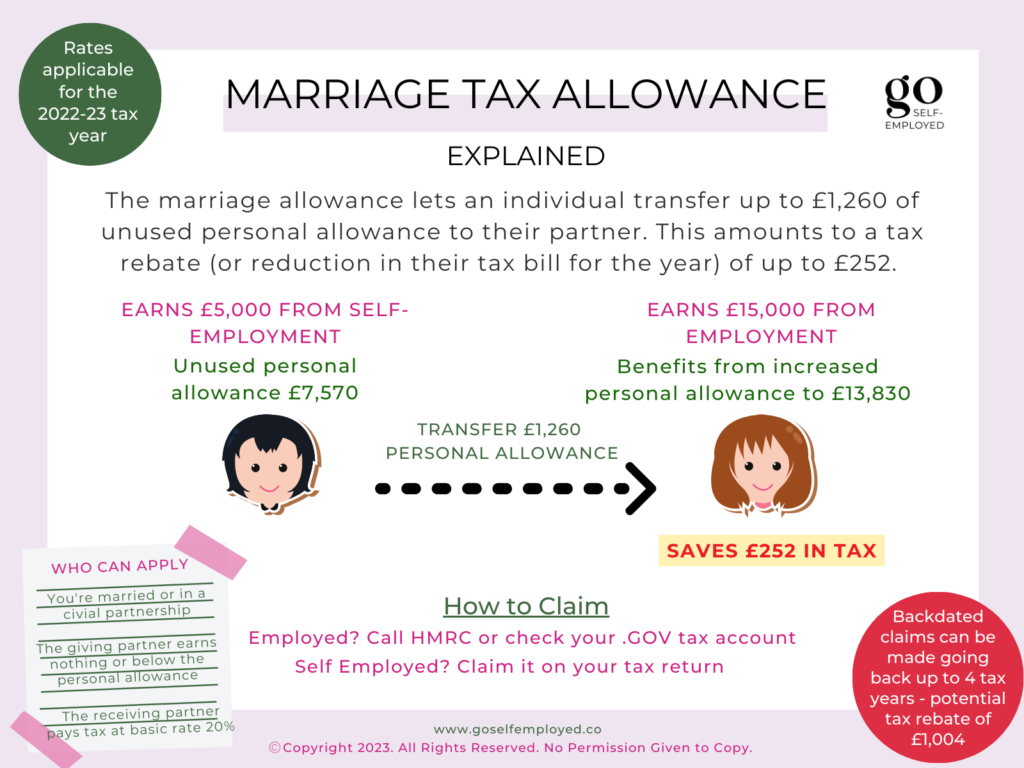

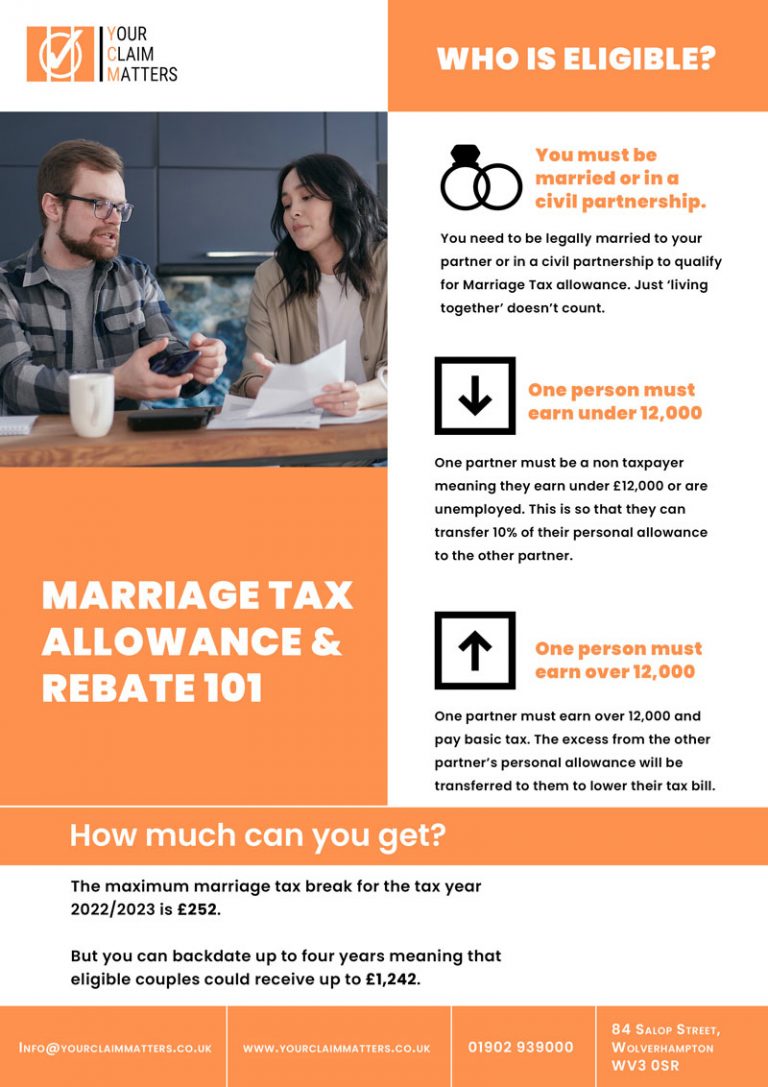

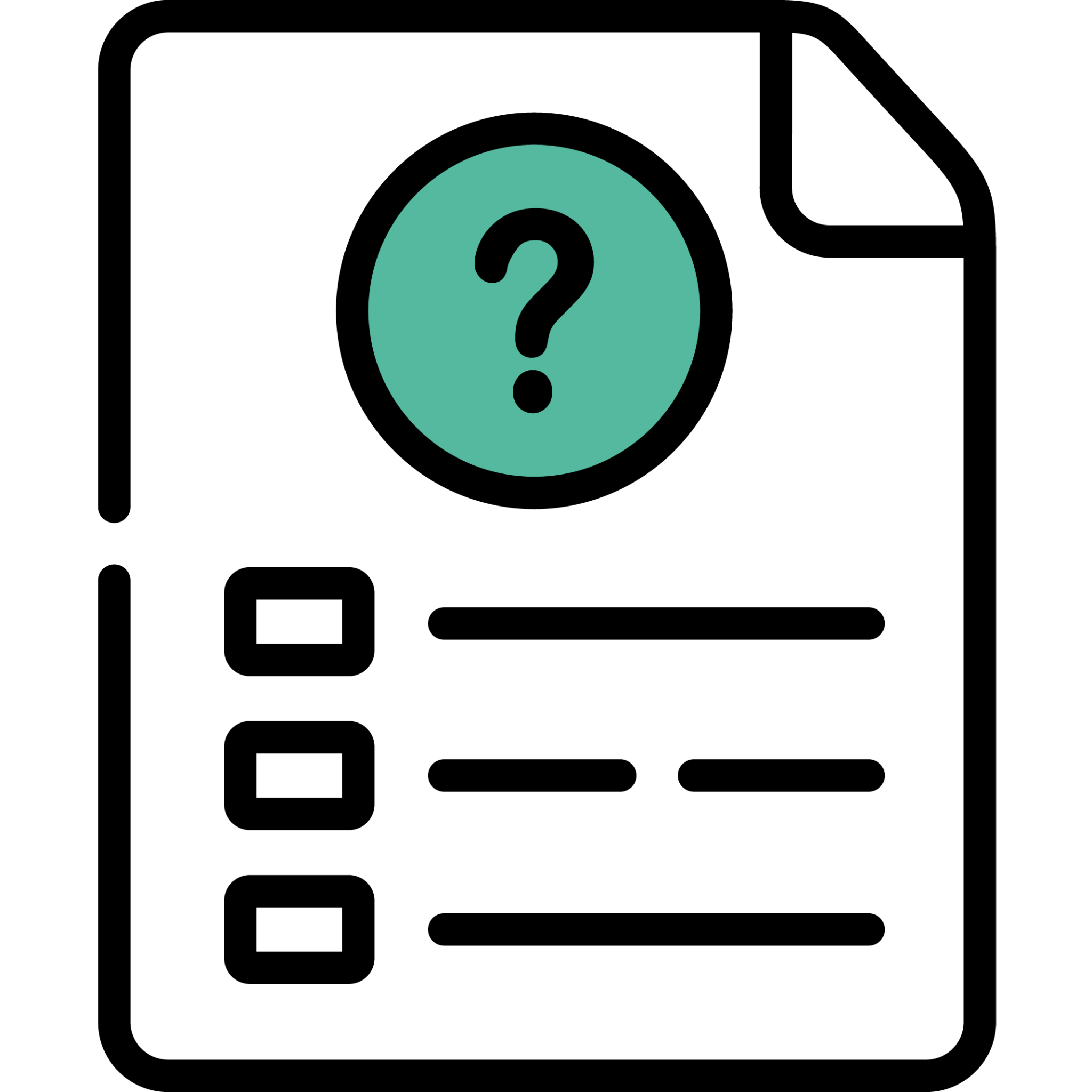

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner Web Your partner s income must be between 163 12 571 and 163 50 270 163 43 662 in Scotland for you to be eligible You can backdate your claim to include any tax year since 5 April 2019

Marriage Allowance Tax Rebate Check Progress

Marriage Allowance Tax Rebate Check Progress

https://goselfemployed.co/wp-content/uploads/2018/07/marriage-allowance-self-employed.png

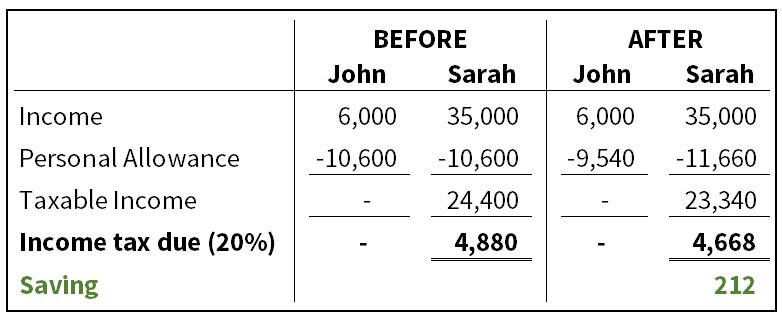

Marriage Allowance Tax Advantages For Married Couples

https://moneystepper.com/wp-content/uploads/2015/11/Marriage-Allowance-Example.jpg

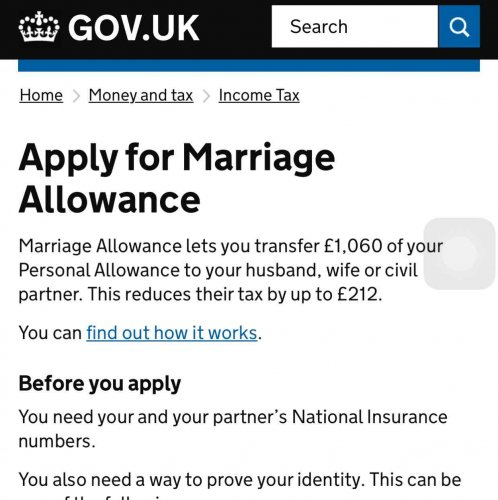

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

Web 11 f 233 vr 2022 nbsp 0183 32 11 February 2022 Married couples and people in civil partnerships could receive extra cash this Valentine s Day as HM Revenue and Customs HMRC Web 14 juil 2023 nbsp 0183 32 If you re married you may be entitled to a tax break called the marriage tax allowance Find out what it is and how to check if you re missing out

Web How to claim If you fill in a Self Assessment tax return each year Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Web Monday to Friday 8am to 6pm Find out about call charges After you cancel If you cancel because of a change of income the allowance will run until the end of the tax year 5

Download Marriage Allowance Tax Rebate Check Progress

More picture related to Marriage Allowance Tax Rebate Check Progress

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

Draw Your Signature Marriage Tax Allowance Rebate

https://phillipsonhardwickadvisory.co.uk/wp-content/uploads/2022/08/Captured.png

Marriage Allowances You Can Claim

https://theoliversmadhouse.co.uk/wp-content/uploads/2017/07/Screenshot-2017-07-13-20.30.36.png

Web through Self Assessment if you re already registered and send tax returns by filling in Marriage Allowance form MATCF and sending it to the address on the form How your Web You can use this calculator to work out if you qualify for Married Couple s Allowance and how much you might get You need to be married or in a civil partnership to claim

Web 11 sept 2023 nbsp 0183 32 Updated 13 Apr 2023 Marriage allowance explained Find out about marriage tax allowance what it is how it works and whether you might be eligible to Web 8 juin 2020 nbsp 0183 32 For the 2020 21 tax year it could save you a modest 163 250 but you can backdate the claim by up to four years meaning you could end up with a payout of more

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance-768x1087.jpg

Marriage Tax Allowance Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/09/Marriage-Allowance.png

https://www.litrg.org.uk/latest-news/news/220905-waiting-hear-back...

Web 5 sept 2022 nbsp 0183 32 How to check progress Published on 5 September 2022 You may have made or tried to make contact with HMRC by post or phone recently If so you may

https://www.litrg.org.uk/.../how-do-i-claim-marriage-allowance-refund

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

The 101 Marriage Tax Allowance Rebate And Claim Guide

Marriage Allowance Transfers Bradley Accounting

Marriage Tax Allowance Claims What Do You Need To Know Gowing Law

Marriage Allowance Tax Rebate YouTube

Marriage Allowance Should I Claim Alpha Business Services

Marriage Allowance Should I Claim Alpha Business Services

Marriage Allowance Tax Rebate In UK EmployeeTax

Marriage Tax Allowance Tax Rebate Online

How To Take Advantage Of The Marriage Allowance Tax Rebates

Marriage Allowance Tax Rebate Check Progress - Web 11 f 233 vr 2022 nbsp 0183 32 11 February 2022 Married couples and people in civil partnerships could receive extra cash this Valentine s Day as HM Revenue and Customs HMRC