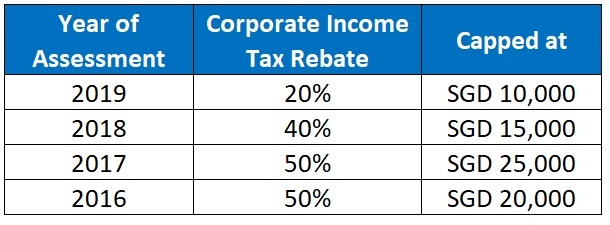

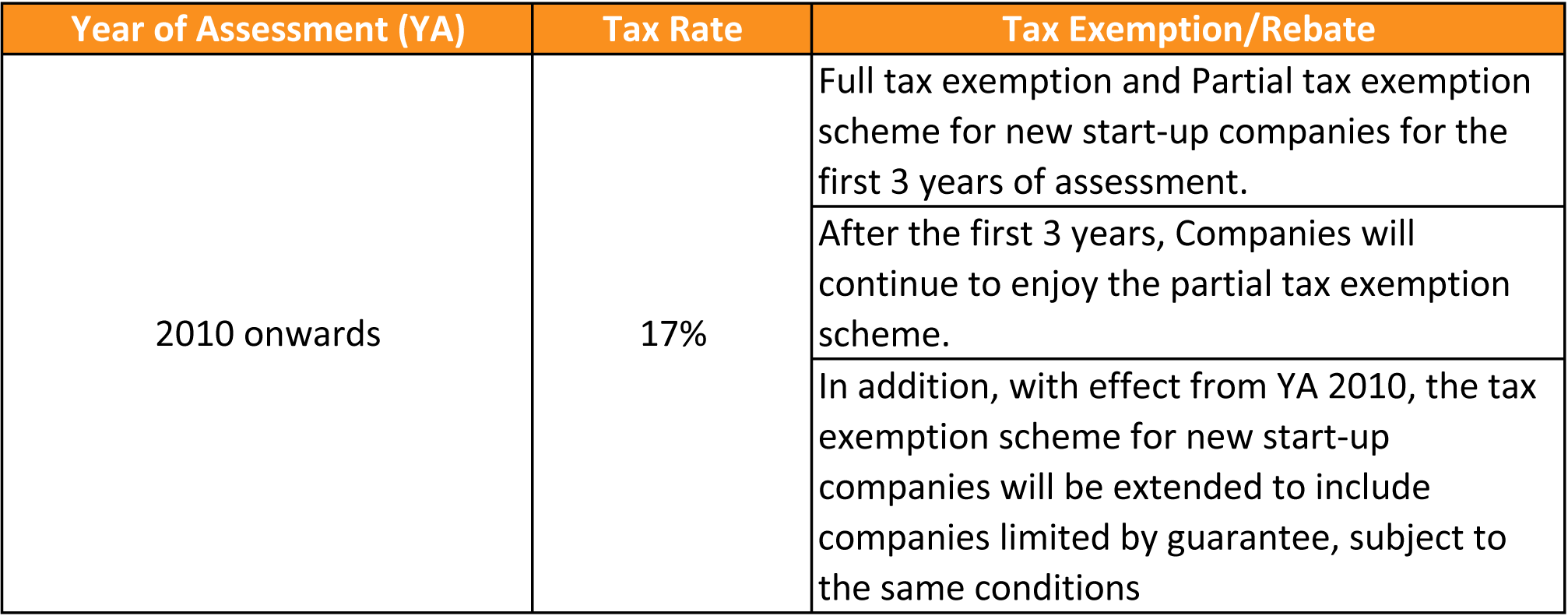

Singapore Corporate Tax Rebate Web 18 f 233 vr 2020 nbsp 0183 32 All Singapore companies are eligible for corporate income tax rebate regardless of profit levels or paid up capital amount The following table lists the

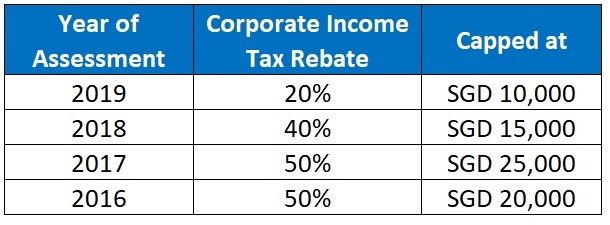

Web 3 lignes nbsp 0183 32 14 mars 2023 nbsp 0183 32 The Singapore corporate income tax rebate is no longer available for YA 2023 This is based Web 15 mars 2020 nbsp 0183 32 The table below summarizes the measures introduced in Budget 2020 with regards to the Corporate Income Tax Rebate its impact on businesses and the action

Singapore Corporate Tax Rebate

Singapore Corporate Tax Rebate

https://www.rebate2022.com/wp-content/uploads/2023/05/singapore-corporate-tax-rate-singapore-taxation-guide-2021.jpg

Tax Services Singapore File Tax Returns On Time Company Taxation

https://www.accountingsolutionssingapore.com/wp-content/uploads/CIT-2018.jpg

Overview Of Singapore Corporate Taxation System JSE Office

https://jseoffices.com/wp-content/uploads/2018/06/no-11-768x211.jpg

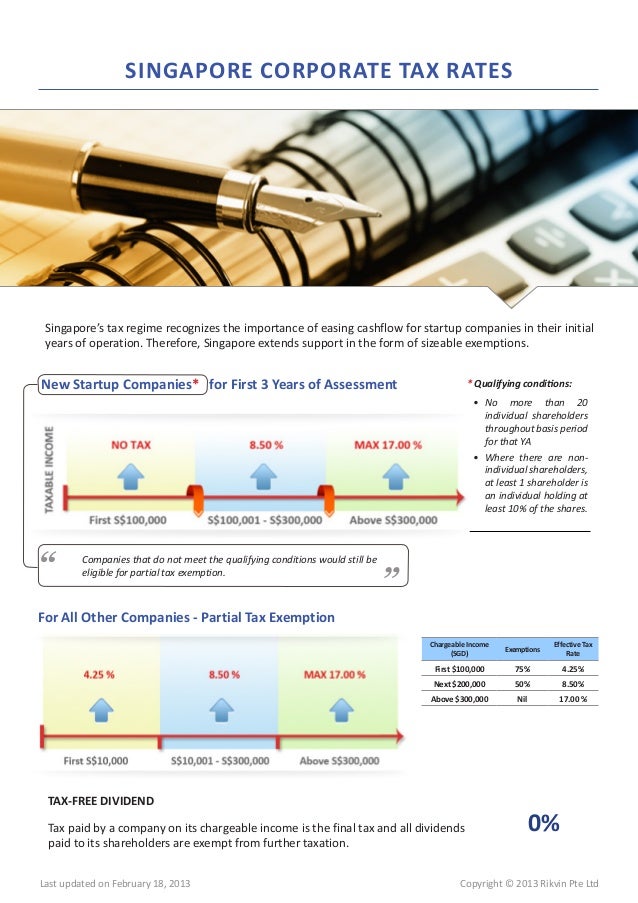

Web Corporate Income Tax Rebate Mazars Singapore Corporate Income Tax rebates were applicable for the Years of Assessment YAs 2013 to 2020 The rebates are no longer Web 16 f 233 vr 2021 nbsp 0183 32 No corporate income tax rebate is proposed for the year of assessment YA 2021 Extension of a number of Budget 2020 measures including

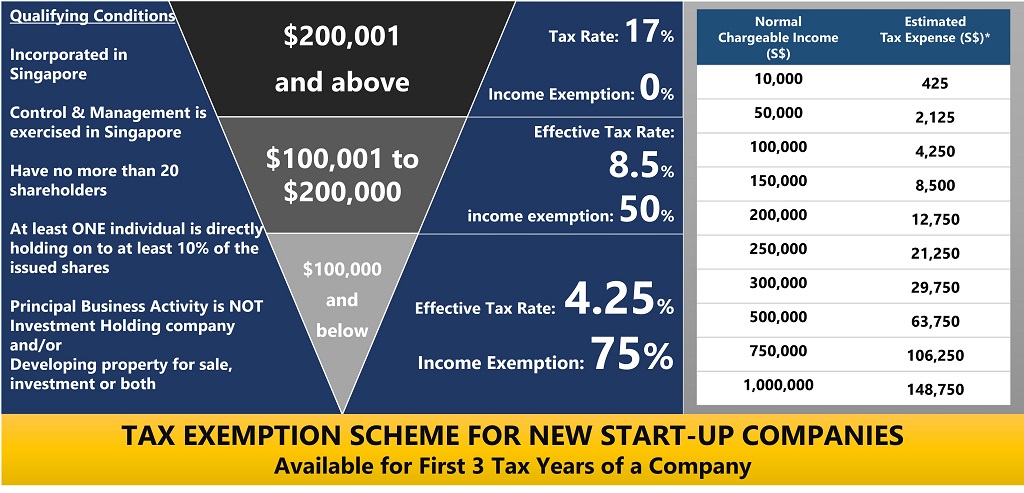

Web Corporate income tax CIT rebate In 2020 the government announced that all companies will be granted a 25 corporate income tax rebate that is subject to an annual cap of S 15 000 Web 30 juil 2021 nbsp 0183 32 Corporate Tax Rates Budget 2021 Update Corporate Income Tax Rebate As announced in Budget 2021 there will no longer be corporate income tax rebate in

Download Singapore Corporate Tax Rebate

More picture related to Singapore Corporate Tax Rebate

All You Need To Know About Taxation In Singapore Taxofindia

https://www.singaporecompanyincorporation.sg/wp-content/uploads/effective-corporate-tax-rate-full-exemption.jpg

Singapore Company Registration Guide AsiaBiz Services

http://www.asiabiz.sg/wp-content/uploads/taxation-according-to-structure.jpg

Corporate Tax In Singapore Company Incorporation In Singapore

http://www.paulhypepage.com/wp-content/uploads/2012/06/Corporate-Tax-Table-1.png

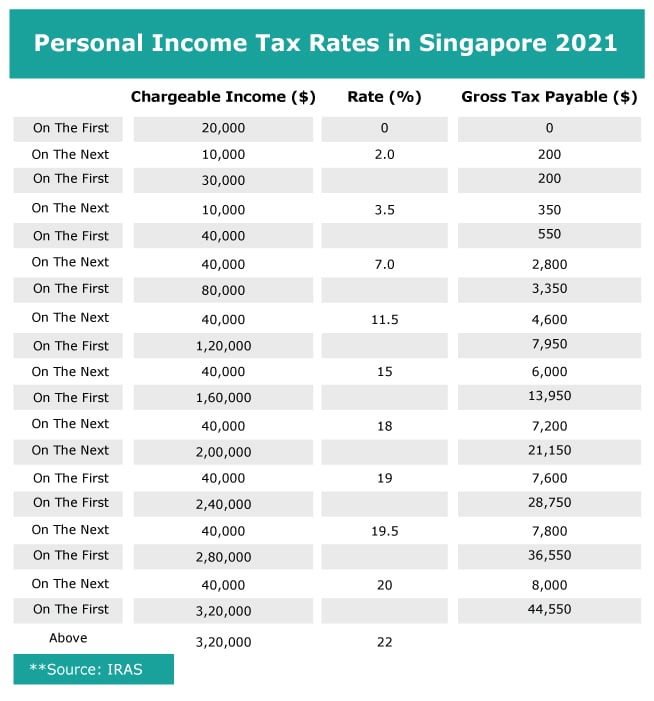

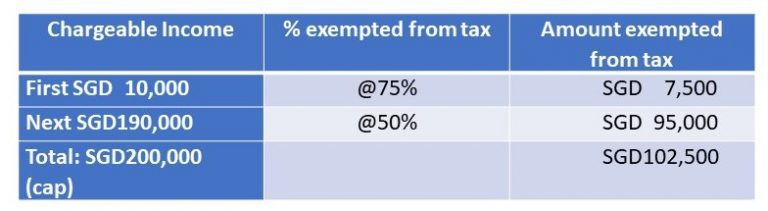

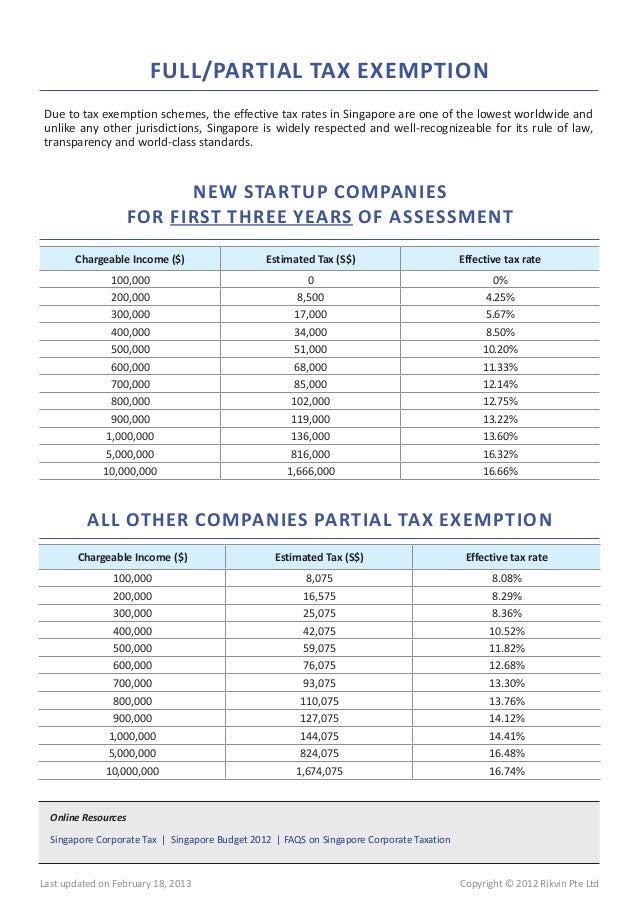

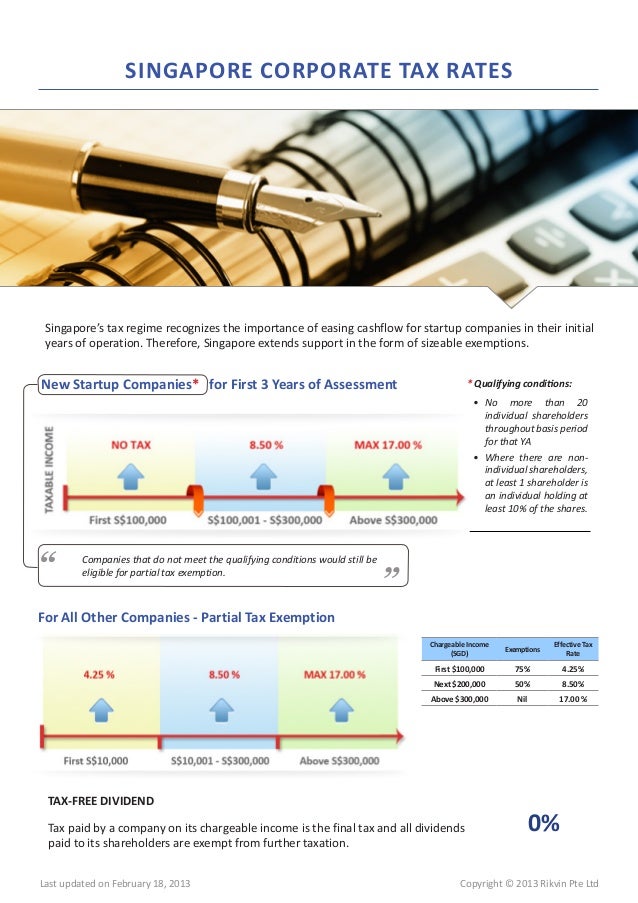

Web 18 f 233 vr 2020 nbsp 0183 32 If a company s chargeable income is SGD250 000 for YA2020 the total income exempted from tax would be SGD125 000 SGD75 000 SGD 50 000 and final chargeable income would be Web Singapore adopts the use of tax incentives as one of the tools to encourage new and high growth activities Tax incentives are granted only for qualifying activities and the

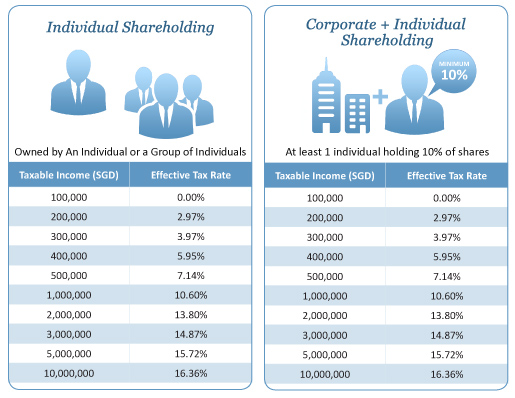

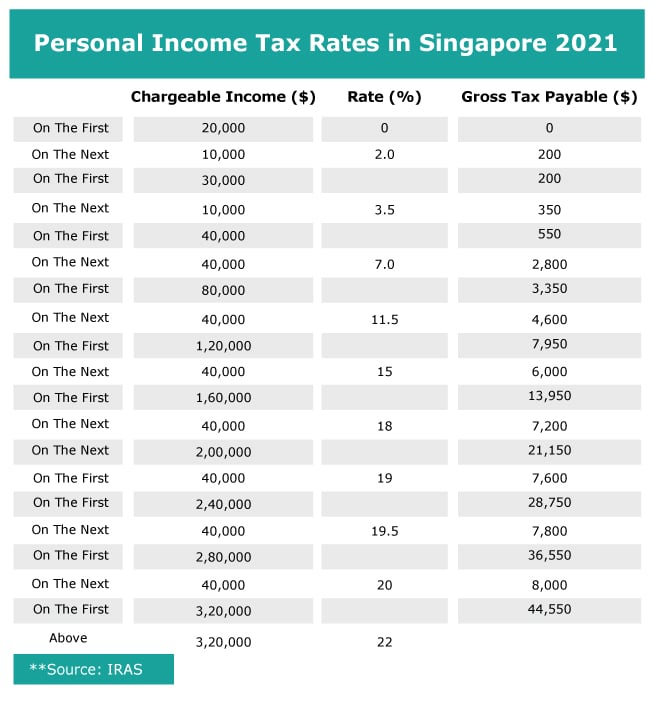

Web 23 juin 2021 nbsp 0183 32 The tax paid by a corporation on its taxable income is the final amount owed and any dividends issued by the company to its existing shareholders will not be Web General Corporate Income Tax Rules Corporate Income Tax is assessed on a preceding year basis in Singapore Singapore s Corporate Income Tax rate is 17

Why Invest In India Through A Singapore Company Rikvin Pte Ltd

https://www.rikvin.com/wp-content/uploads/singapore-corporate-tax-rate-infographic.jpg

Singapore Corporate Tax Rates

https://image.slidesharecdn.com/singapore-corporate-tax1-130326034432-phpapp02/95/singapore-corporate-tax-rates-3-638.jpg?cb=1364269774

https://pwco.com.sg/guides/corporate-tax-rebate

Web 18 f 233 vr 2020 nbsp 0183 32 All Singapore companies are eligible for corporate income tax rebate regardless of profit levels or paid up capital amount The following table lists the

https://premiatnc.com/sg/blog/singapore-cor…

Web 3 lignes nbsp 0183 32 14 mars 2023 nbsp 0183 32 The Singapore corporate income tax rebate is no longer available for YA 2023 This is based

2020 Singapore Corporate Tax Update Singapore Taxation

Why Invest In India Through A Singapore Company Rikvin Pte Ltd

Singapore Corporate Tax Rate 1997 2021 Data 2022 2023 Forecast

Singapore Corporate Tax Rates 2013

All Income Earned In Singapore Is Subject To Tax However Singapore

Singapore Corporate Tax Rates 2013

Singapore Corporate Tax Rates 2013

Understanding Corporate Tax In Singapore ContactOne

Singapore Tax Rates

Singapore Corporate Tax Rates

Singapore Corporate Tax Rebate - Web 30 juil 2021 nbsp 0183 32 Corporate Tax Rates Budget 2021 Update Corporate Income Tax Rebate As announced in Budget 2021 there will no longer be corporate income tax rebate in