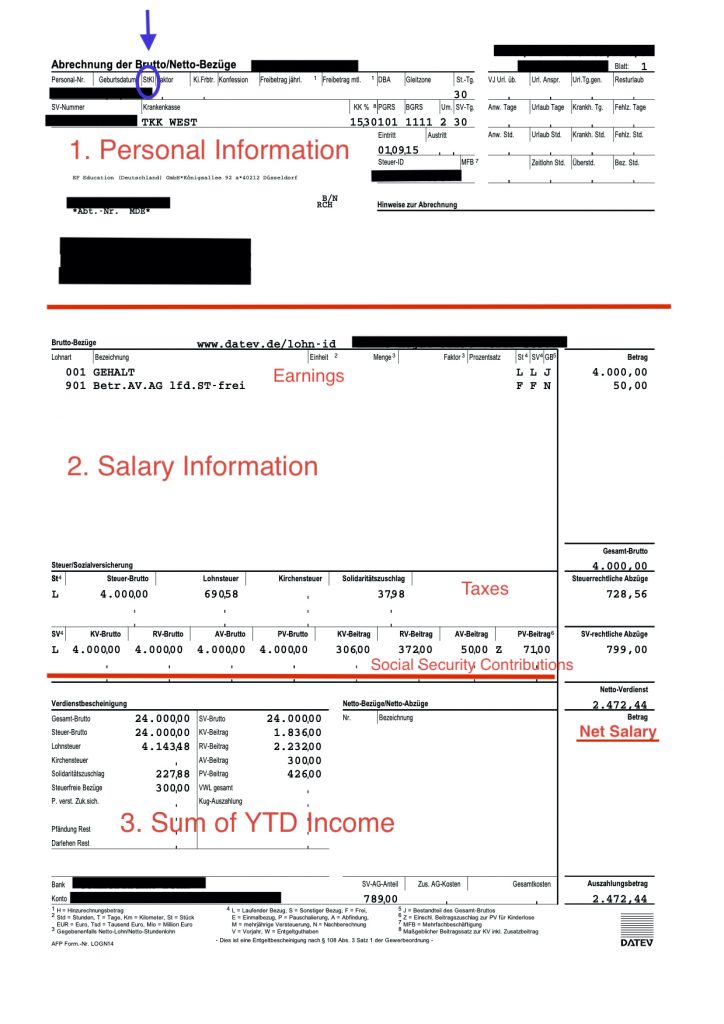

German Tax Rebate Web 30 mars 2022 nbsp 0183 32 In 2017 the average worker received a 1 051 rebate after submitting their tax return according to the Federal Office of Statistics Not only that but 90 percent of

Web 17 mars 2022 nbsp 0183 32 Germany earmarks 15 billion euros for tax relief grants and heating subsidies 17 March 2022 by Abi Carter In a bid to cushion the population from rising Web Foreign artists athletes license grantors and directors remuneration creditors can claim relief from German withholding tax under Section 50a ITA if a double taxation

German Tax Rebate

German Tax Rebate

https://pbs.twimg.com/media/FppgnKXWAAEIdA4.png

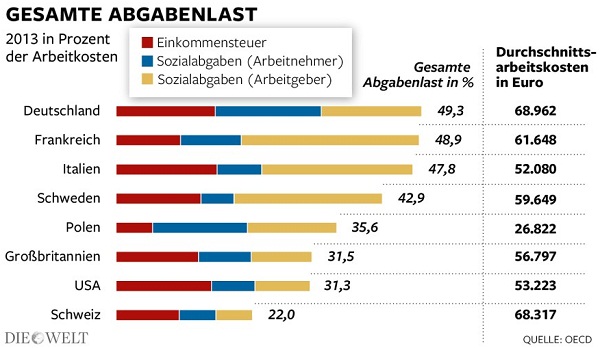

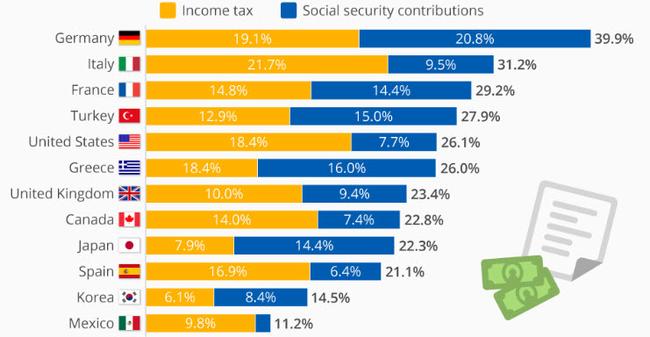

Taxes And Social Security Contributions In Germany Too High Mkenya

https://mkenyaujerumani.de/wp-content/uploads/2014/05/Total-Taxes-in-Germany.jpg

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

https://i0.wp.com/activpayroll-assets.s3.amazonaws.com/sites/56086926e138238d1d000002/assets/56bb6029ec264f834c0000a8/Screenshot_6.png?w=1140&ssl=1

Web 15 sept 2022 nbsp 0183 32 Now ministers have agreed that taxpayers can continue to deduct 5 euros per day worked exclusively at home on their annual tax returns On top of this the maximum deduction is being increased from Web 1 d 233 c 2022 nbsp 0183 32 Starting in 2023 people working from home will be able to deduct 1 000 per year for working from home up from the previous annual amount of 600 Here s what

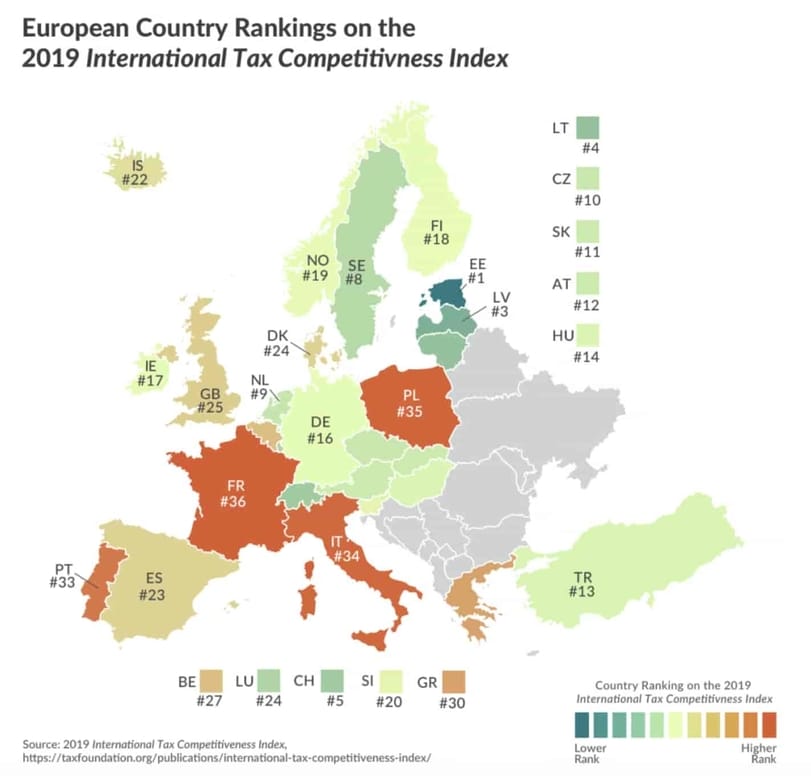

Web 30 juin 2023 nbsp 0183 32 Corporate Tax credits and incentives Germany does not offer tax incentives except in very limited circumstances not usually of direct business relevance Web 30 nov 2020 nbsp 0183 32 Merkel s left right coalition said it had agreed a proposal that would allow employees working from home to reduce their annual tax bill by per 5 working day up

Download German Tax Rebate

More picture related to German Tax Rebate

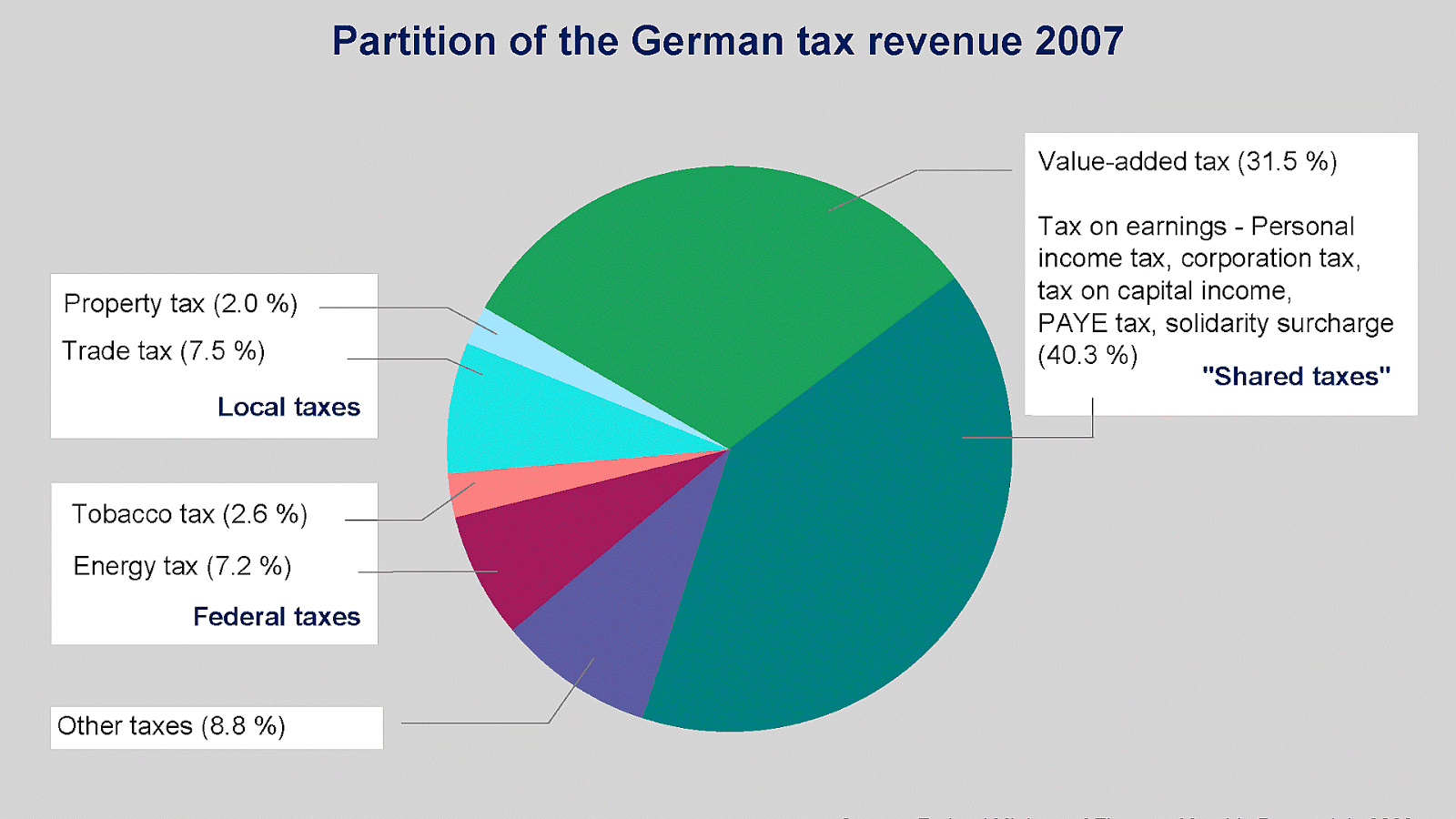

Taxation In Germany German Choices

https://2.bp.blogspot.com/-3tcc90a1ugU/WI9bzyD9teI/AAAAAAAACww/FshUATSVqO0y9qO5ogFdAHuNmSN9IJSugCK4B/s1600/File%253ABZSt%2BLogo.svg%2B-%2BWikimedia%2BCommons-758290.jpg

Germans Pay The Highest Income Tax Zero Hedge

https://zh-prod-1cc738ca-7d3b-4a72-b792-20bd8d8fa069.storage.googleapis.com/s3fs-public/styles/max_650x650/public/2018-05/2018-05-02_20-00-32.jpg?itok=TwjsRk3A

Germany Taxes On Income Profits And Capital Gains current LCU

https://tradingeconomics.com/charts/germany-taxes-on-income-profits-and-capital-gains-current-lcu-wb-data-.png?s=deu.gc.tax.ypkg.cn:worldbank&lbl=0

Web 20 oct 2021 nbsp 0183 32 The German federal government introduced this in 2020 to help compensate employees for the higher electricity heating and internet bills they may have encountered due to working from home If eligible Web Shop in Germany in three easy steps Check the country rules for Tax Free shopping and get your refund Go Shopping Get Customs Validation Receive Your Refund 01 Go Shopping Go shopping and while paying

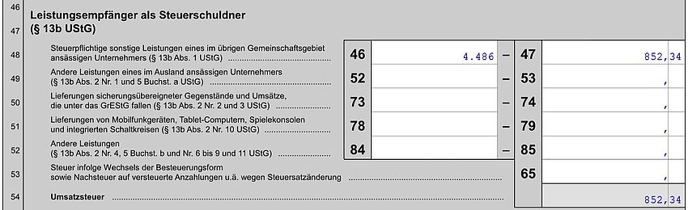

Web German VAT Refund In Germany the amount paid for merchandise includes 19 value added tax VAT The VAT can be refunded if the merchandise is purchased and Web 18 juin 2021 nbsp 0183 32 The German parliament has now adopted new legislation on withholding tax relief anti treaty shopping and transfer pricing Lars H Haverkamp of Flick Gocke

How To Get A Tax Rebate For Moving In Germany SMOOVER

https://smoover-moving.de/wp-content/uploads/2020/06/pexels-pixabay-53621_orig.jpg

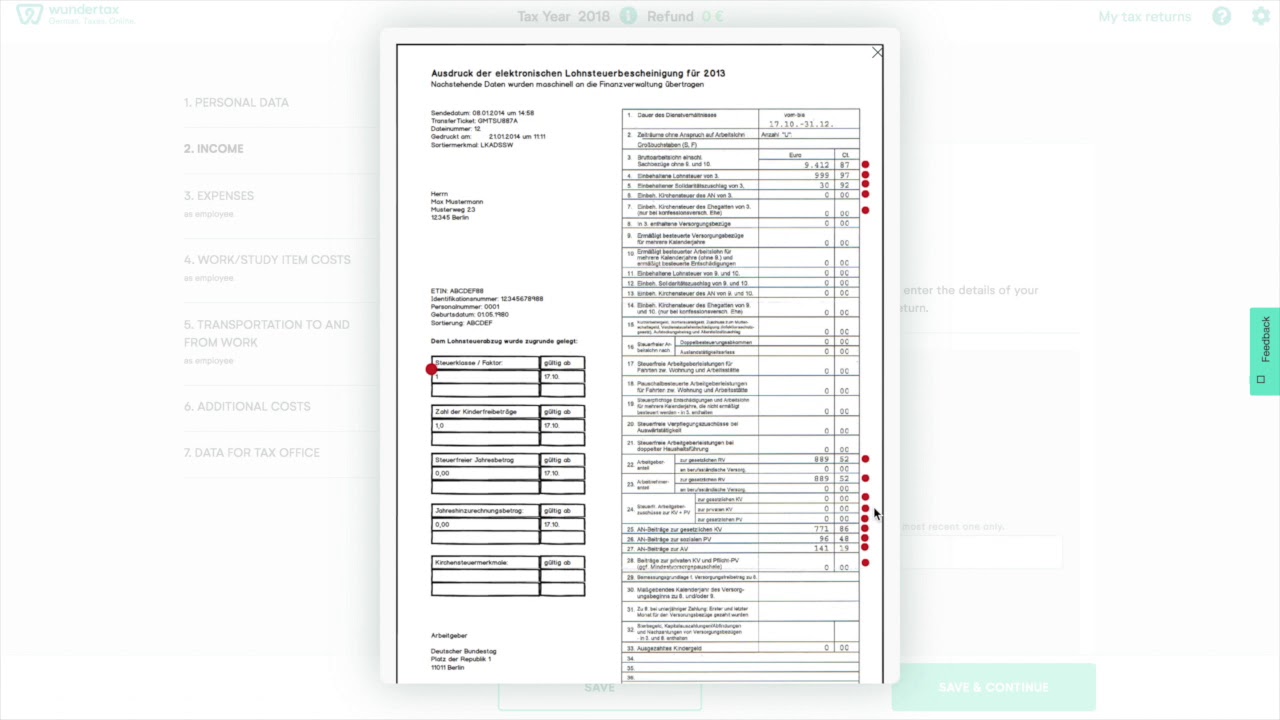

How To Submit A German Tax Return

https://service.consultinghouse.eu/hs-fs/hubfs/Service/German Tax Forms/The-German-Tax-Return-Declartion.png?width=688&name=The-German-Tax-Return-Declartion.png

https://www.thelocal.de/20220330/everything-you-need-to-know-about...

Web 30 mars 2022 nbsp 0183 32 In 2017 the average worker received a 1 051 rebate after submitting their tax return according to the Federal Office of Statistics Not only that but 90 percent of

https://www.iamexpat.de/expat-info/german-expat-news/germany-earmar…

Web 17 mars 2022 nbsp 0183 32 Germany earmarks 15 billion euros for tax relief grants and heating subsidies 17 March 2022 by Abi Carter In a bid to cushion the population from rising

Tax Class In Germany Explained Easy 2022 English Guide 2023

How To Get A Tax Rebate For Moving In Germany SMOOVER

Taxes In Germany A Competitive Tax System Universal Hires

The Ultimate German Tax Return Guide For Expats Johnny Africa

Income Taxes In Germany Who Pays How Much Econoblog101

Almanya Gelir Vergi Oran 1995 2022 Veri 2023 2025 Tahmin

Almanya Gelir Vergi Oran 1995 2022 Veri 2023 2025 Tahmin

How To Do Your Tax Return In Germany Income YouTube

German Tax Calculator Munich Cortney Ernst

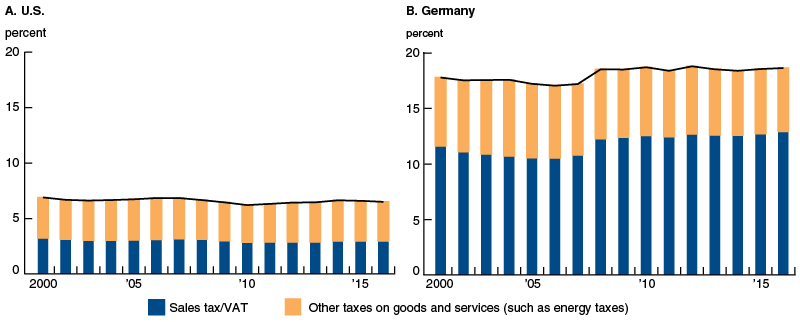

The Burden Of Taxation In The United States And Germany

German Tax Rebate - Web 1 d 233 c 2022 nbsp 0183 32 Starting in 2023 people working from home will be able to deduct 1 000 per year for working from home up from the previous annual amount of 600 Here s what