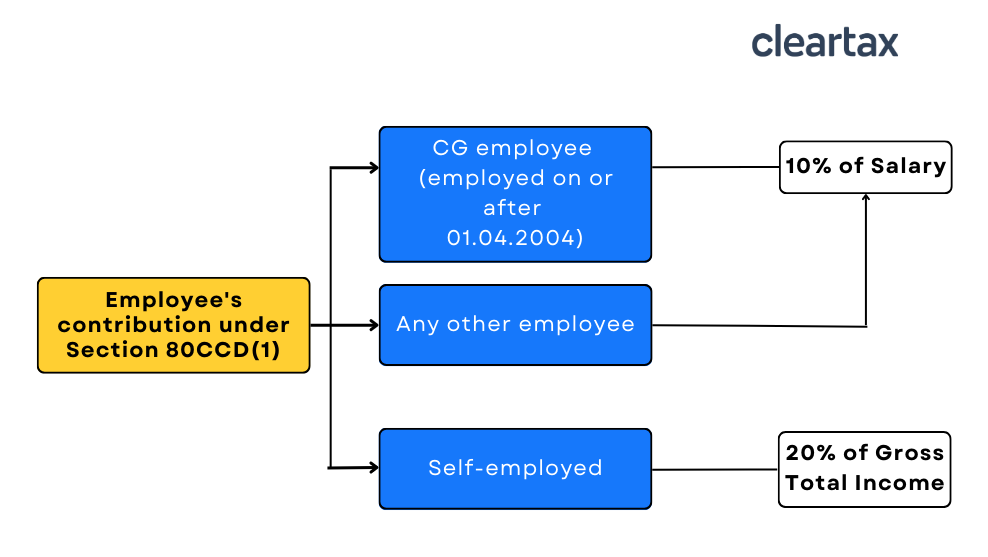

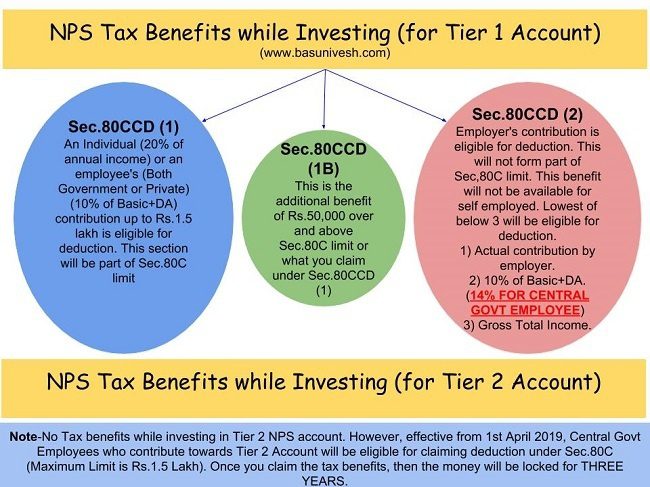

80ccd 1 Vs 80ccd 2 Section 80CCD 2 applies to only salaried individuals and not to self employed individuals The deductions under this section can be availed over and above those of Section 80CCD 1 Section 80CCD 2 allows a salaried individual to claim the following deduction Central Government or State Government Employer Up to 14 of

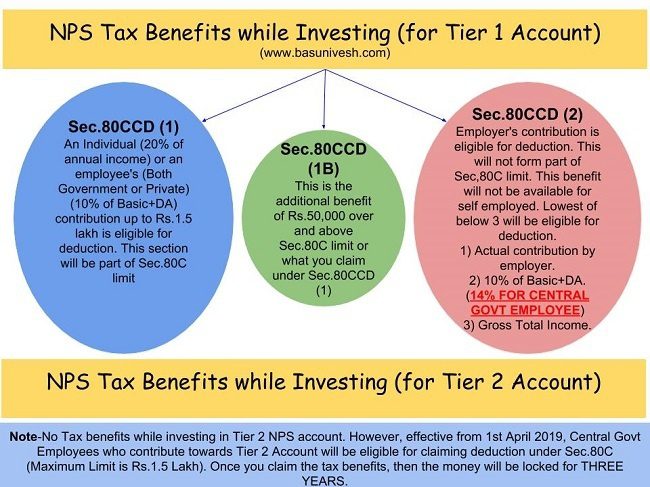

Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn about eligibility limits and benefits Section 80CCD offers income tax deductions on contributions to the National Pension Scheme NPS and the Atal Pension Yojana APY The section covers NPS contributions made by employees and employers and is categorised into two sub sections Sections 80CCD 1 and 80CCD 2

80ccd 1 Vs 80ccd 2

80ccd 1 Vs 80ccd 2

https://i.ytimg.com/vi/GT73sBLn6A0/maxresdefault.jpg

Deductions Under Section 80CCD Of Income Tax 2024

https://assets1.cleartax-cdn.com/finfo/wg-utils/retool/3b9315af-adc8-4376-9d95-d7b2a6214509.png

80CCD 1 80CCD 2 80CCD 1B NPS CONTRIBUTION NEW PENSION SCHEME

https://i.ytimg.com/vi/LO7AMxTrhyw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYfyBHKCowDw==&rs=AOn4CLDfRFVXwN4NeqbGesfWDbGy3ZAZbQ

These income tax deductions sections are for investments made in a pension scheme notified by the central government 80CCD 1 deals with the investment or contribution made by an employer to such a pension scheme whereas section 80CCD 2 deals with employer contribution to an employee s pension account Under 80CCD and its subsections you can receive annual tax savings of up to Rs 2 lakh by investments made into retirement plans National Pension Scheme NPS and Atal Pension Yojana APY Read on to know the key features of Section 80CCD of the Income Tax Act and its various subsections

Section 80CCD 2 pertains to the deduction available for employer contributions to an employee s NPS account This applies to salaried and self employed individuals who employ others and contribute to their employees NPS accounts Key Features and Benefits of Section 80CCD 2 So a government employee a private sector employee self employed or an ordinary citizen can claim benefit of Rs 50 000 under Section 80CCD 1B Therefore the total tax benefits that can be claimed for NPS under Section 80CCD 1 Section 80CCD 1B equals to 2 Lakhs for financial year

Download 80ccd 1 Vs 80ccd 2

More picture related to 80ccd 1 Vs 80ccd 2

Section 80 CCD 80CCD 1 80CCD IB 80CCD 2 80CCE 80CCF

https://i.ytimg.com/vi/E_xOfPkGWfs/maxresdefault.jpg

NPS 80CCD Part 3 Tier 1 Vs Tier 2 Income Tax 24

https://i.ytimg.com/vi/-GbgOmEMsM4/maxresdefault.jpg

NPS Tax Benefit U s 80ccd1 80ccd2 And 80ccd 1b NPS Tax Benefits

https://i.ytimg.com/vi/TNPR3oHyhIE/maxresdefault.jpg

Thus the maximum deduction limit is Rs 2 lakhs under Section 80CCD 1 Section 80CCD 1B Deductions would be available to an individual only if he exercises the option of shifting out of the new tax regime u s 115BAC 1A DID YOU KNOW Maximum deductions under section 80C 80CCC 80CCD 1 Rs 1 5 lakh Section 80CCD 1 of the Income Tax Act 1961 provides deductions for contributions made towards the National Pension Scheme and Atal Pension Yojana scheme Here are the key points to understand about Section 80CCD 1

[desc-10] [desc-11]

NPS Tax Benefits 2020 Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2018/12/NPS-Tax-Benefits-2019-Sec.80CCD1-80CCD2-and-80CCD1B.jpg?lossy=1&strip=1&webp=1

NPS 80CCD 1 AND SECTION 80CCD 1B YouTube

https://i.ytimg.com/vi/9zU4iMCWPdM/maxresdefault.jpg

https://cleartax.in/s/section-80ccd

Section 80CCD 2 applies to only salaried individuals and not to self employed individuals The deductions under this section can be availed over and above those of Section 80CCD 1 Section 80CCD 2 allows a salaried individual to claim the following deduction Central Government or State Government Employer Up to 14 of

https://www.taxbuddy.com/blog/section-80ccd1-and-80ccd2

Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn about eligibility limits and benefits

National Pension Scheme NPS Tax Deduction U s 80CCD 1 80CCD 2 80CCD

NPS Tax Benefits 2020 Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

2 Deductions From GTI Section 80CCD 80CCD 1 80CCD 1B 80CCD 2

Deductions 80C 80CCC 80CCD 80D 80DD 80DDB 80E 80G PDF Tax Deduction

Section 80CCD Deduction Under 80CCD 1 80CCD 1B 80CCD 2

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

Deduction U s 80C 80CCC 80CCD 1 80CCD 1B 80CCD 2 II Invest In NPS

Deduction U s 80CCC To 80CCD 1 80CCD 1B 80CCD 2 II Invest In NPS II

80CCD 2 Nps Contribution Deduction In Income Tax

80ccd 1 Vs 80ccd 2 - [desc-12]