80ccd1b Additional Nps Employee Contribution Salary Deduction According to the Income Tax Act all individuals who are eligible for claiming tax deduction under section 80CCD 1 can claim an additional deduction of Rs 50 000 for their contribution to

As per Section 80CCD 1B individuals who are employees or self employed can claim an additional deduction of 50 000 when they contribute to the NPS or the Atal Pension Yojana This deduction is over and above the An additional deduction of Rs 50 000 on NPS contributions is offered by Section 80 CCD 1B Furthermore Section 80 CCD 2 allows employees to claim a deduction on the NPS contribution equivalent to 10 of

80ccd1b Additional Nps Employee Contribution Salary Deduction

80ccd1b Additional Nps Employee Contribution Salary Deduction

https://help.tallysolutions.com/docs/te9rel53/Payroll/Images/1_NPS_Employee_Deduction1.gif

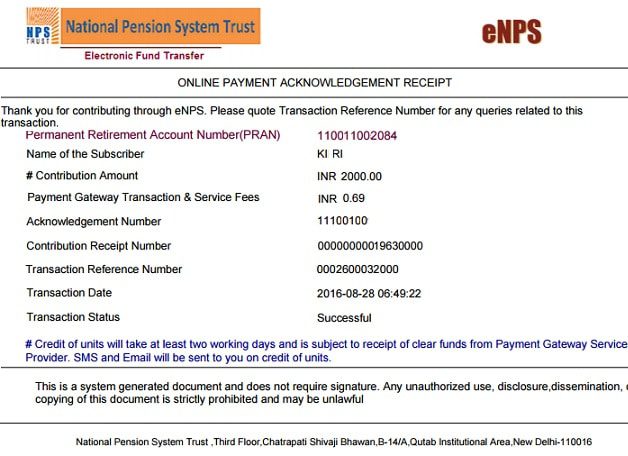

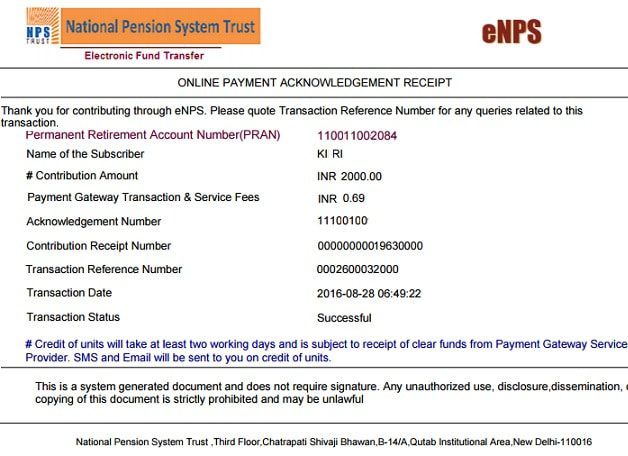

Nps contribution payment receipt

https://bemoneyaware.com/wp-content/uploads/2016/10/nps-contribution-payment-receipt.jpg

Nps Contribution By Employee Werohmedia

https://www.jagoinvestor.com/wp-content/uploads/files/Tax-Benefits-of-contributing-in-NPS.png

For the contributions made by you i e employee contribution you can claim a deduction under section 80CCD 1 or 80CCD 1B Section 80CCD 1B provides additional deduction of Rs 50 000 over and above Rs 1 5 Contribution to NPS One have to contribute a minimum of Rs 6 000 every year in his Tier I account in a financial year One can contribute any amount over and above Rs 6 000 according to his preference Minimum

Introduced to provide additional tax benefits this subsection encourages higher contributions to NPS Eligibility Open to all NPS subscribers Maximum Deduction 50 000 per financial Employee contribution up to 10 of basic salary and dearness allowance DA up to 1 5 lakh is eligible for tax deduction This contribution along with Sec 80C has 1 5 Lakh investment limit for tax deduction Self employed

Download 80ccd1b Additional Nps Employee Contribution Salary Deduction

More picture related to 80ccd1b Additional Nps Employee Contribution Salary Deduction

Inform Employees Of Salary Deduction Letter 4 Templates Writolay

https://writolay.com/wp-content/uploads/2021/08/46-letter-to-inform-about-salary-deduction-to-employee.png

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

Creating Employees NPS Deduction Pay Head

https://help.tallysolutions.com/docs/te9rel50/Payroll/Images_1/1_NPS_Employee_Deduction.gif

This deduction basically availed by the individuals being as a salaried employee or as self employed against the contribution made towards Pension Funds notified by Central Government such as National Pension Learn how to claim tax deductions under Section 80CCD for NPS contributions Explore limits for employees self employed and employers plus additional benefits

Section 80CCD 1B was introduced in the 2015 Budget to supplement the deductions available under Section 80CCD 1 It allows taxpayers to claim an additional deduction of up to 50 000 With Section 80CCD 1B you can claim an extra deduction of up to 50 000 for contributions made to the National Pension System NPS and move closer to a secure

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

https://i.ytimg.com/vi/lBO3PaW69Mc/maxresdefault.jpg

NPS TAX Benefit U s 80C 80CCD1 80CCD1B 80CCD2 Tax Benefit

https://i.ytimg.com/vi/nviDuHSBa5c/maxresdefault.jpg

https://groww.in › tax

According to the Income Tax Act all individuals who are eligible for claiming tax deduction under section 80CCD 1 can claim an additional deduction of Rs 50 000 for their contribution to

https://www.etmoney.com › learn › income-tax

As per Section 80CCD 1B individuals who are employees or self employed can claim an additional deduction of 50 000 when they contribute to the NPS or the Atal Pension Yojana This deduction is over and above the

What Is Dcps In Salary Deduction Login Pages Info

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

Creating Employer s NPS Contribution Pay Head

2023 Updated SSS Contribution Rate Escape Manila

Deduction Under Section 80CCD 2 For Employer s Contribution To

How To Make Online Contributions To NPS Tier I And Tier II Accounts

How To Make Online Contributions To NPS Tier I And Tier II Accounts

Salary Reduction Letter 2024 Company Salaries

Payroll Deduction Form Template

SSS Newly Updated Contribution Table For 2019

80ccd1b Additional Nps Employee Contribution Salary Deduction - Contribution to NPS One have to contribute a minimum of Rs 6 000 every year in his Tier I account in a financial year One can contribute any amount over and above Rs 6 000 according to his preference Minimum