87a Rebate For Fy 2023 23 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2023 24 under the

Rebate u s 87A of the Income Tax Act provides tax relief to taxpayers whose total income does not exceed a specified limit It allows a reduction in tax liability up to a A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to

87a Rebate For Fy 2023 23

87a Rebate For Fy 2023 23

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-section-87a-tax-rebate-fy-2019-20-how-to-check-rebate-eligibility-from-87a-rebate-ay-2023-20-post.jpg?w=979&ssl=1

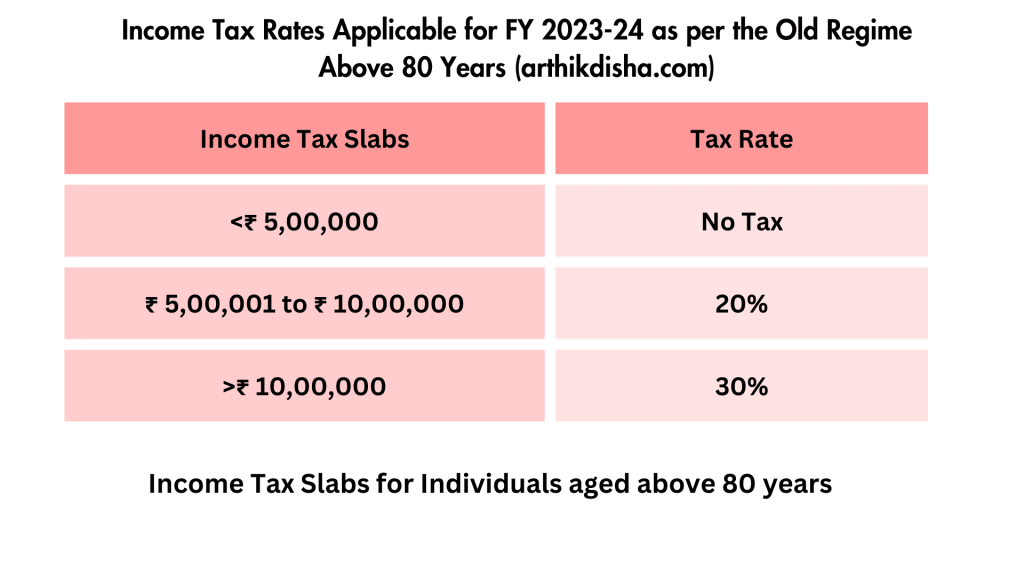

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-Old-Regime-Above-80-Years-arthikdisha.com_-1024x576.png

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an People with taxable incomes under Rs 5 lakhs are eligible for a tax rebate under Section 87A of the Income Tax Act of 1961 in the financial year 2022 23 Both the previous and

Section 87A rebate is an income tax provision that allows taxpayers to lower their tax liability It allows you to claim the refund if your yearly income does not The new tax regime allows tax rebate under Section 87A for taxable incomes up to Rs 7 lakh It s important to note that the tax rules may change from the current

Download 87a Rebate For Fy 2023 23

More picture related to 87a Rebate For Fy 2023 23

Rebate Under Sec 87A On Basic Income Tax PY 2022 23 AY 2023 24

https://i.ytimg.com/vi/iBVPuOeMqvo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGMgYyhjMA8=&rs=AOn4CLAkxwuVfXRiwLFdgZ5yJ77kkzr3_g

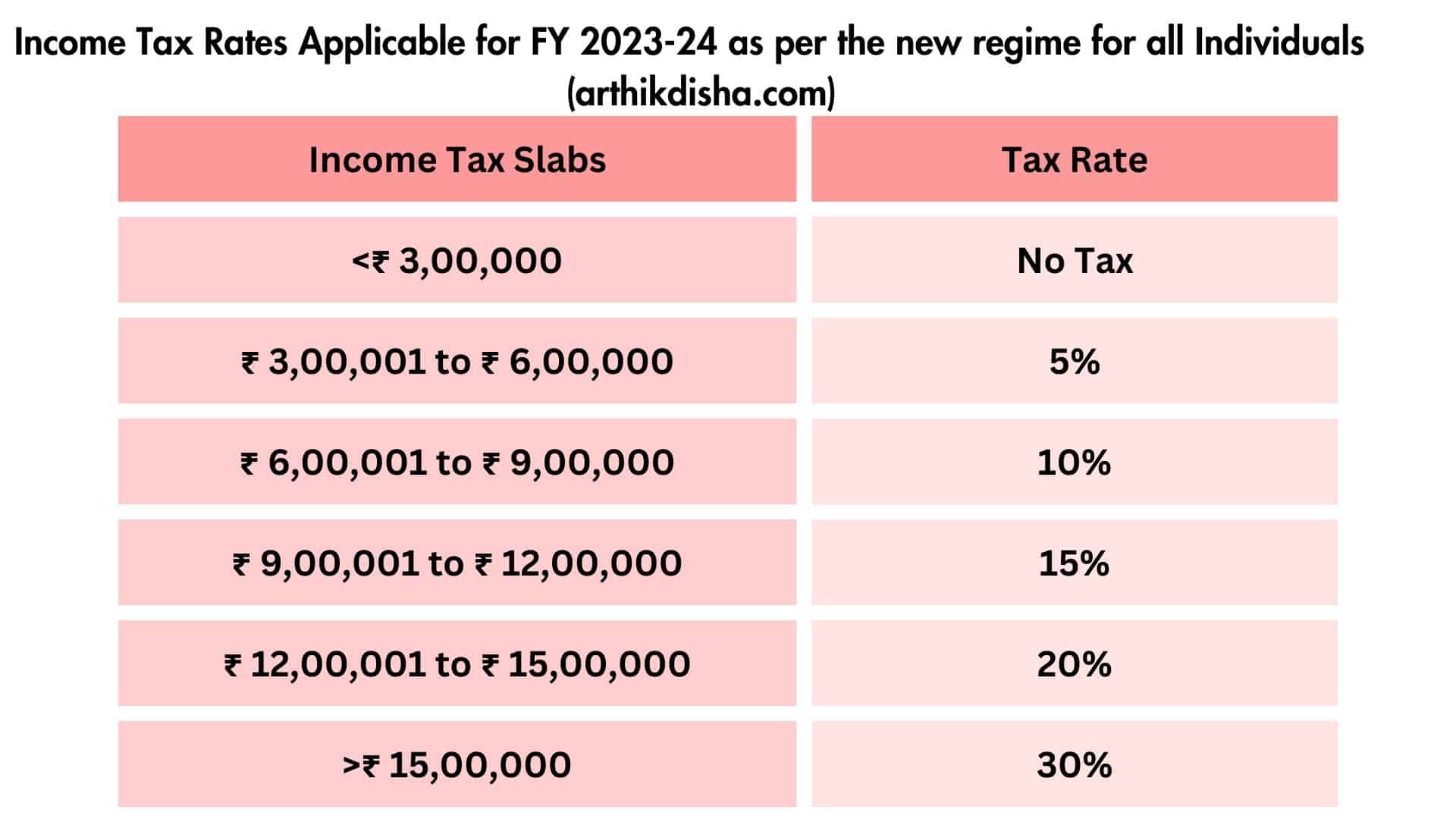

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/SmartSelect_20230524_092144_Microsoft-365-Office-1024x948.jpg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

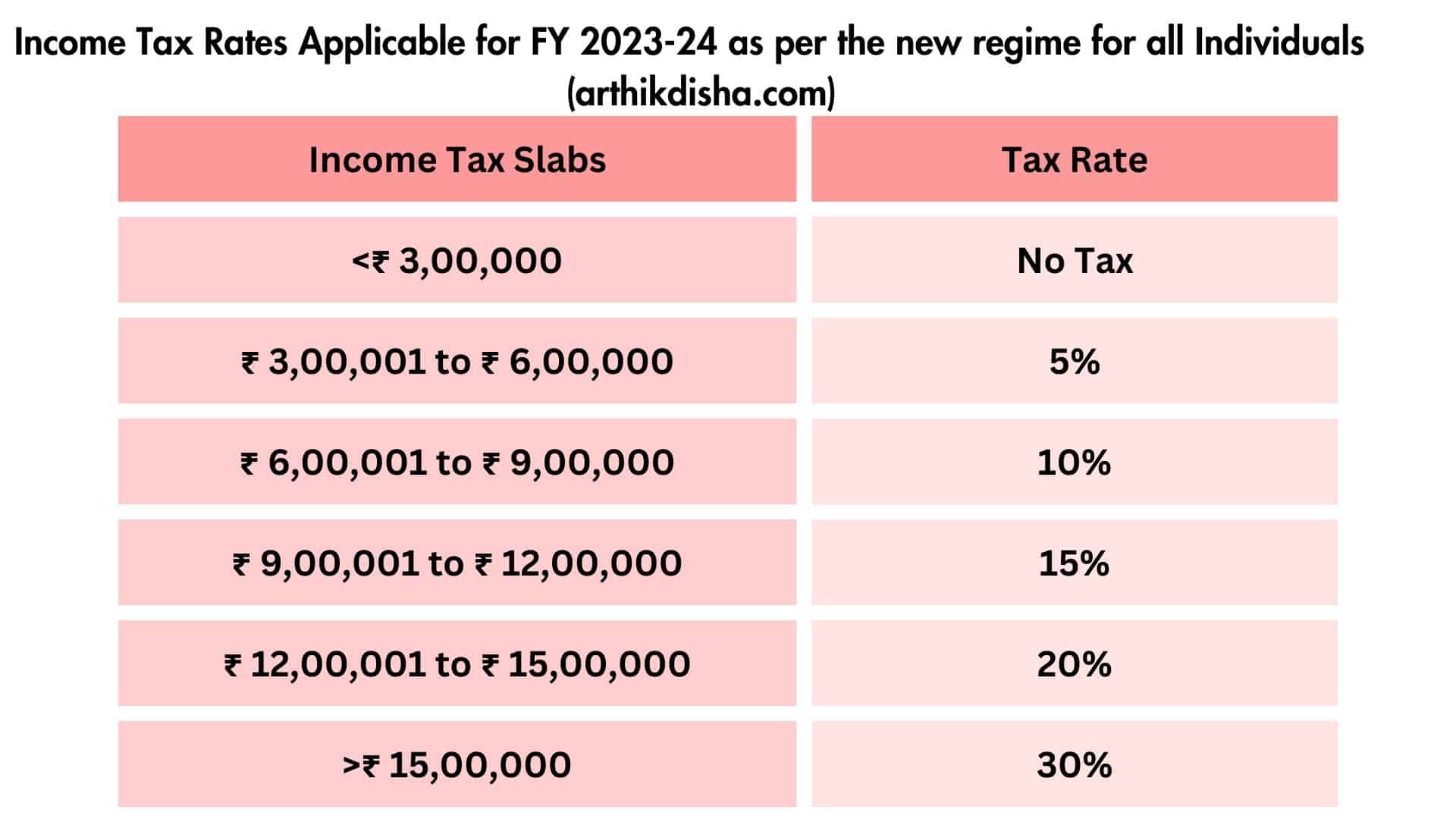

Claim tax rebate under Section 87A only when the income does not exceed 5 lakhs The maximum rebate under section 87A for AY 2024 25 FY 2023 24 is 25 000 under the In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for The new income tax regime which will be effective from FY 2023 24 AY 2024 25 has changed the rebate amount under Section 87A Under this regime if you are a resident

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-new-regime-for-HUF-and-all-Individuals-1.jpg

Section 87A Of The Income Tax Act In 2023 Budgeting Rebates Tax

https://i.pinimg.com/originals/ef/6b/e8/ef6be89602342584b5f4f5401b0229f0.jpg

https://tax2win.in/guide/section-87a

The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2023 24 under the

https://www.caclubindia.com/guide/rebate-u-s-87a

Rebate u s 87A of the Income Tax Act provides tax relief to taxpayers whose total income does not exceed a specified limit It allows a reduction in tax liability up to a

Rebate Under 87a Of Income Tax For 2023 24 With Budget 2023 Changes

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi

Know New Rebate Under Section 87A Budget 2023

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

Rebate U s 87A

Income Tax Calculation FY 2022 23 Salary 9 Lakh

87a Rebate For Fy 2023 23 - Under Section 87A taxpayers are entitled to a rebate of up to Rs 12 500 effectively reducing their income tax liability This rebate is applicable to individuals