Ga Tax Rebate Eligibility Web The taxpayer filed a timely 2022 return and is eligible to receive a refund of 2021 taxes in the amount of 200 Although the maximum allowable

Web HB 162 allows for a tax refund out of the State s surplus to Georgia filers who meet eligibility requirements You may be eligible for the HB 162 Surplus Tax Refund if you File your Individual Income Tax Return for Web 11 mai 2022 nbsp 0183 32 Head of household filers could receive a maximum refund of 375 Married individuals who file joint returns could receive a maximum refund of 500 The refund amount will be based on an individual s tax liability

Ga Tax Rebate Eligibility

Ga Tax Rebate Eligibility

https://www.pdffiller.com/preview/100/625/100625541/large.png

Piedmont Natural Gas Rebates Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/14/944/14944825/large.png

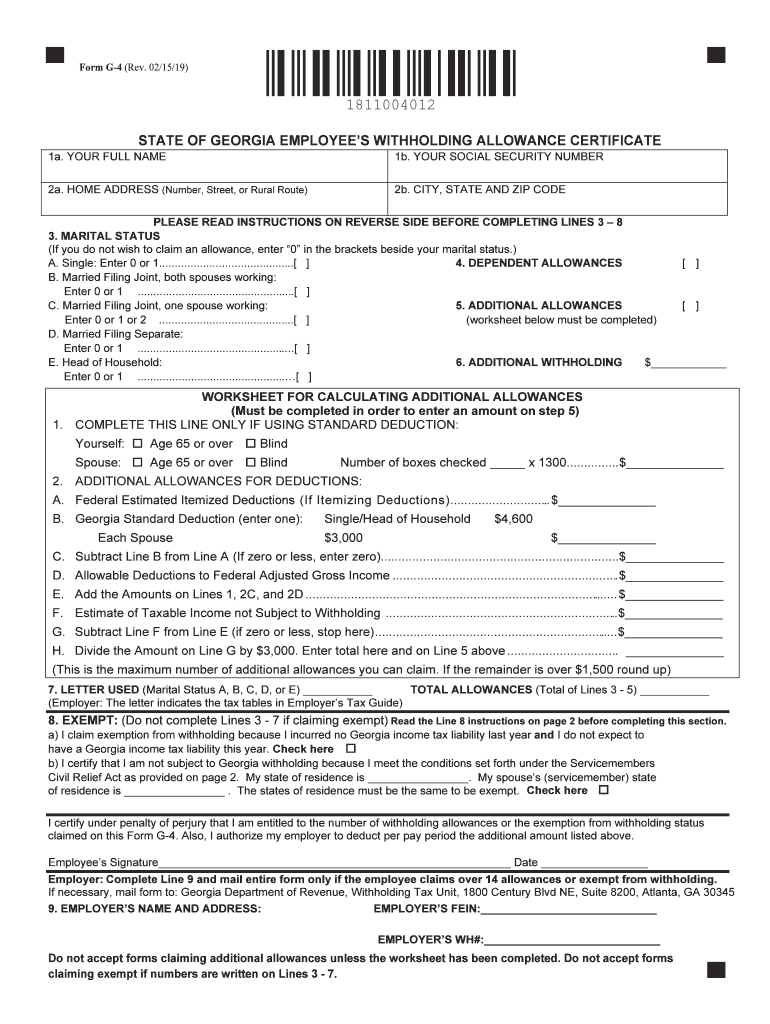

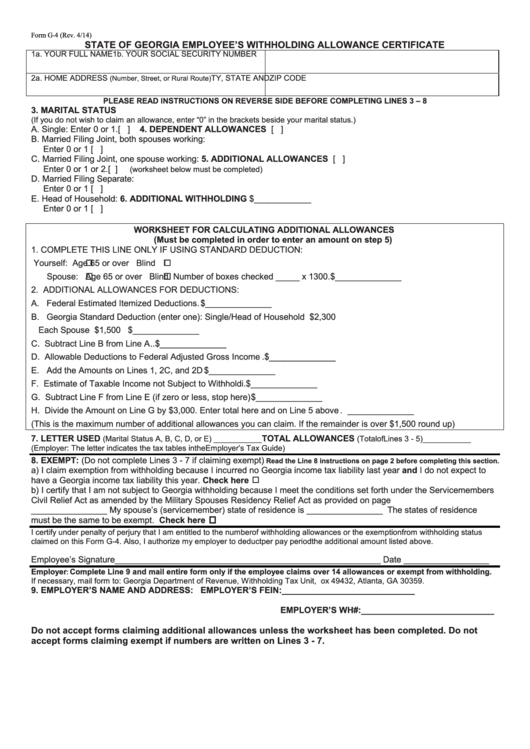

2019 2021 Form GA DoR G 4 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/470/527/470527518/large.png

Web Are you eligible for the 2023 Georgia Surplus Tax Refund Georgia Department of Revenue notice Douglas Savannah Closed Due to Hurricane Idalia Douglas Savannah 1 00pm offices are closed on Wednesday More Information on Closure Are you eligible Web 4 avr 2022 nbsp 0183 32 Who is eligible for the Georgia Tax Rebate Checks As for who is eligible the Georgia state government makes it quite clear on their website quot Any Georgian who was a full year resident in 2020

Web 22 mars 2023 nbsp 0183 32 Georgia workers who paid state income tax in 2021 and 2022 will be eligible with a deadline of April 18 the same deadline as federal Tax Day to have your 2022 taxes filed to ensure you get the Web 12 juil 2022 nbsp 0183 32 But now the Georgia General assembly saw new legislation introduced on that same proposal for a tax refund of 25 500 to tax payers across the state

Download Ga Tax Rebate Eligibility

More picture related to Ga Tax Rebate Eligibility

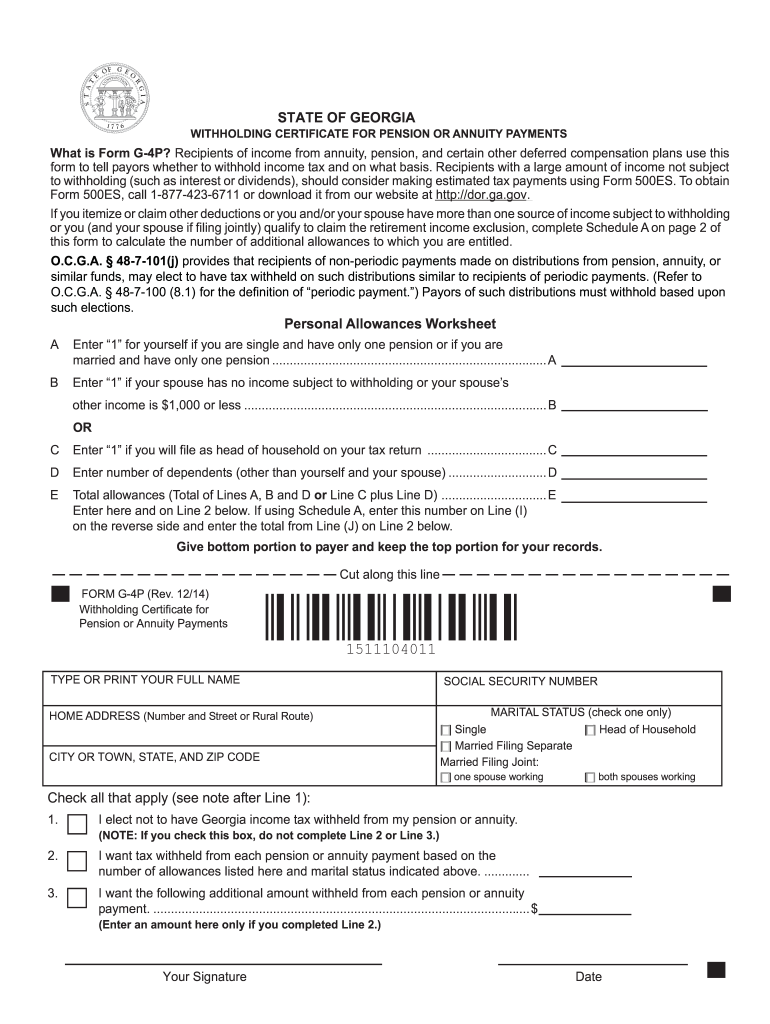

Form G 4P Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/484/100484908/large.png

Gas Tax Rebate Texas Gas Rebates

https://i0.wp.com/www.gasrebates.net/wp-content/uploads/2023/08/missouri-gas-tax-refund-form-veche-info-16-15.png

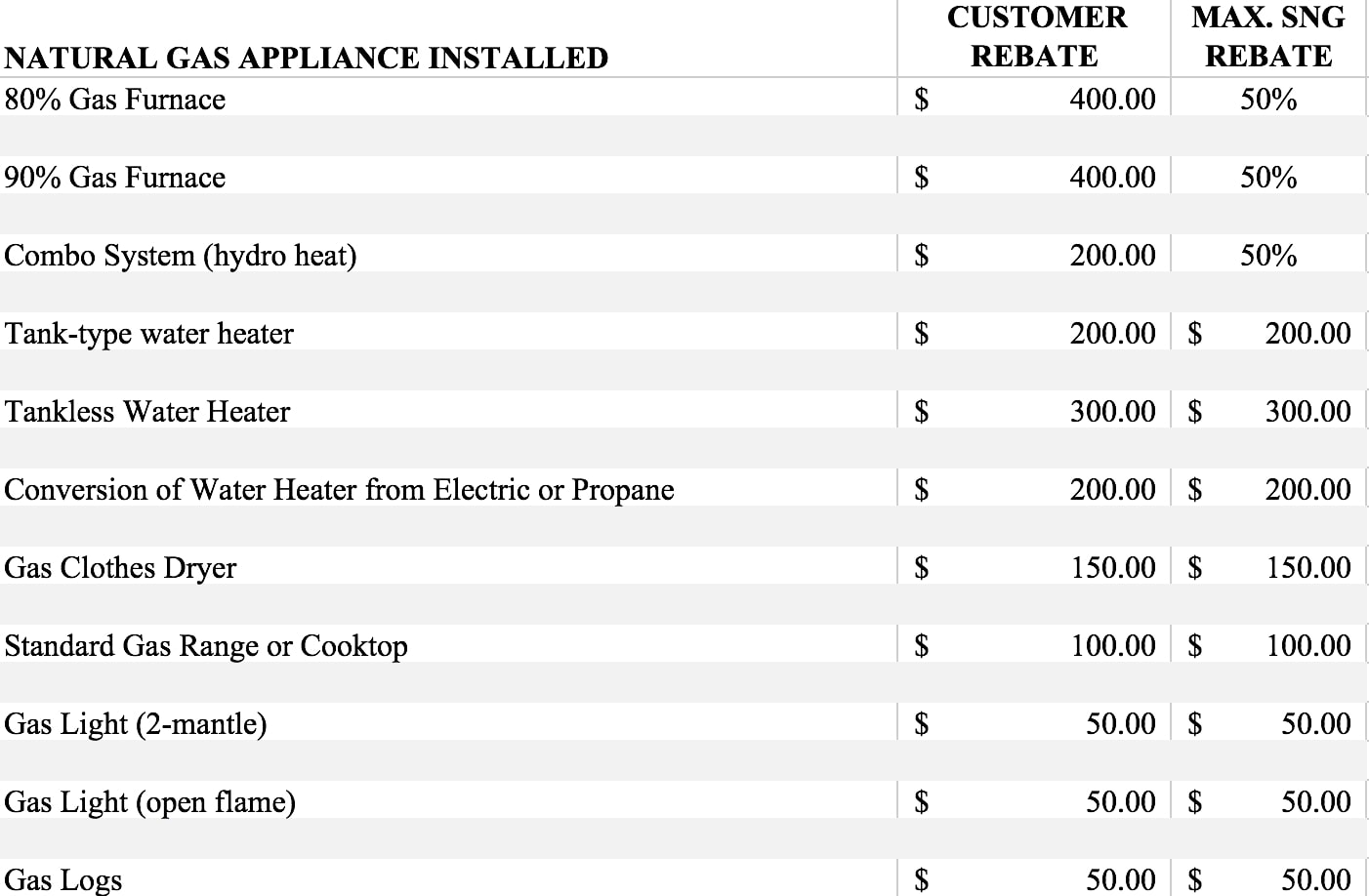

Summerville Natural Gas Rebate Schedule AM 1180 Radio

http://chattooga1180.com/wp-content/uploads/2017/08/Gas-Rebate.jpg

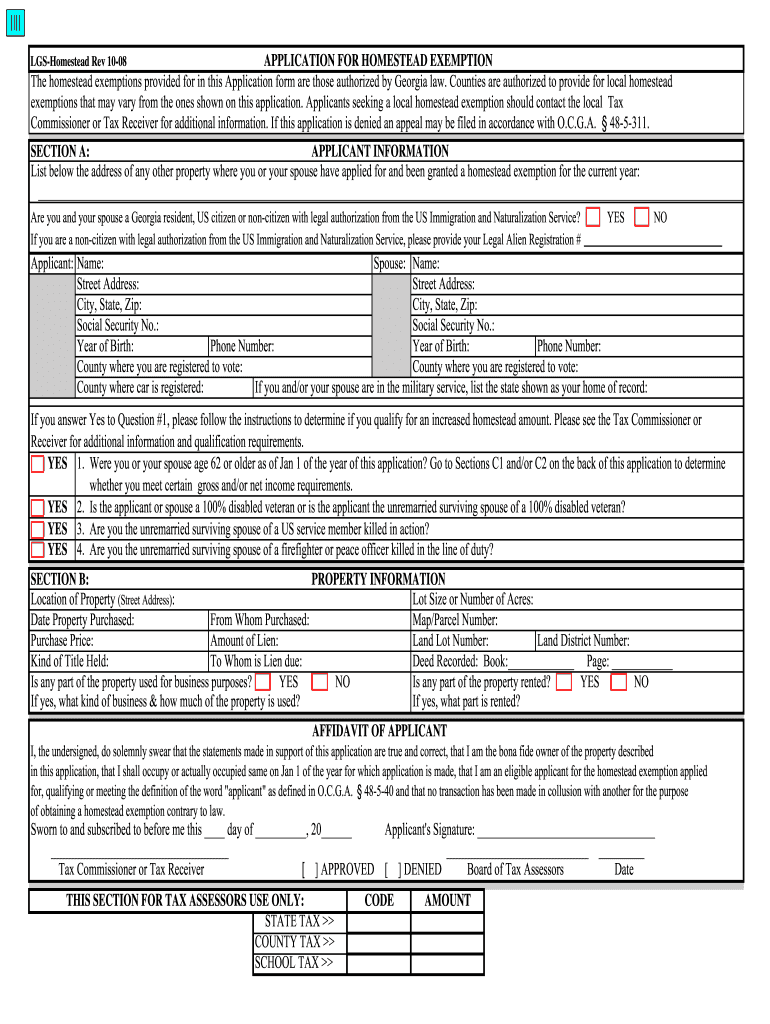

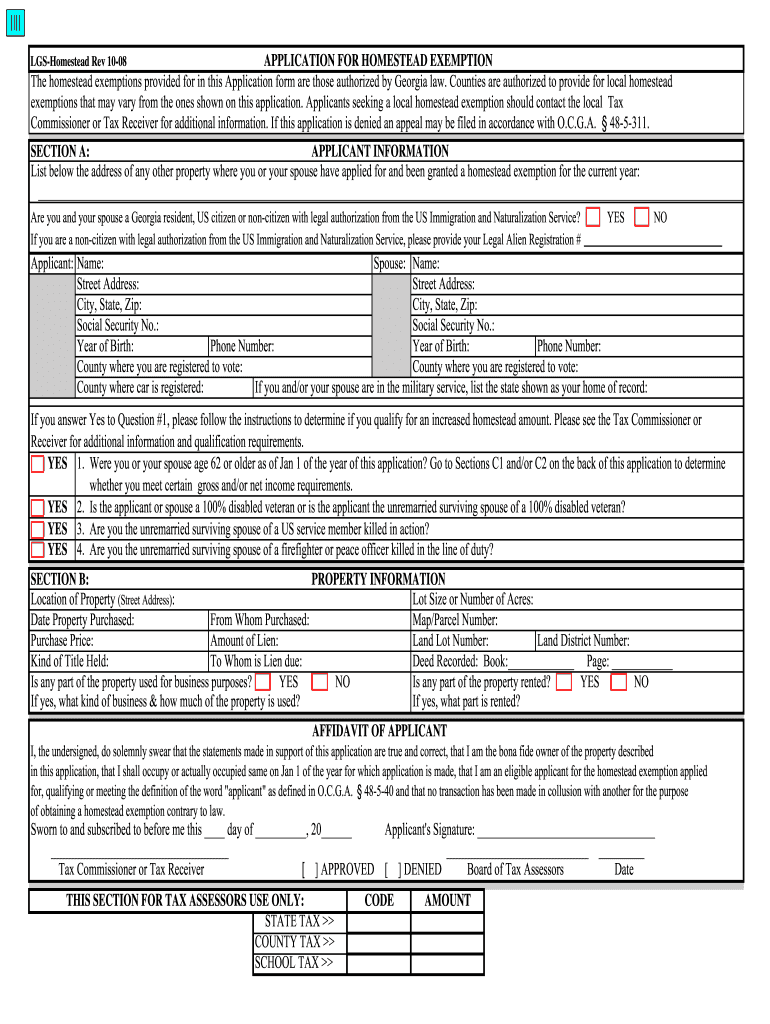

Web The Property Tax Relief Grant may also be known as the Homestead Tax Relief Grant With 950 million appropriated to the Department of Revenue in the Amended Fiscal Year 2023 budget the Department of Revenue will be able to reduce the assessed value of Web 15 avr 2023 nbsp 0183 32 Eligibility for GA Tax Rebate 2023 To be eligible for the GA Tax Rebate in 2023 taxpayers must meet certain criteria These may include Being a resident of Georgia during the 2023 tax year Having a certain income level Filing taxes on time and in

Web 10 mai 2023 nbsp 0183 32 To determine their eligibility for the refunds Georgia taxpayers will need to enter the Tax Year their Social Security Number or alternate Tax Identification Number and their Federal Web 1 mai 2023 nbsp 0183 32 Head of household filers could receive a maximum refund of 375 Married individuals who file joint returns could receive a maximum refund of 500 The refund amount will be based on an individual s tax liability for Tax Year 2021 Additionally

Dekalb County Exemption Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/0/211/211555/large.png

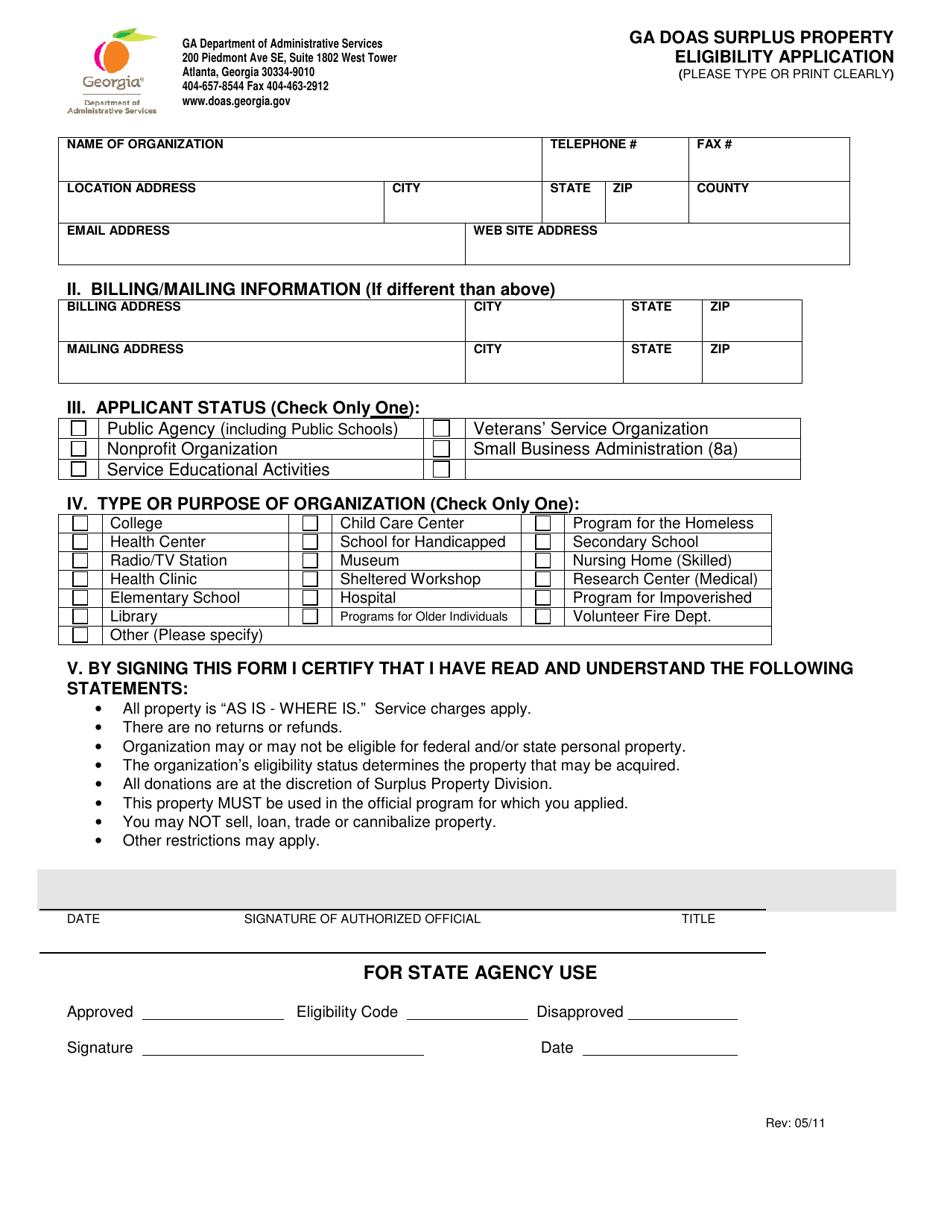

Georgia United States Ga Doas Surplus Property Eligibility

https://data.templateroller.com/pdf_docs_html/2072/20729/2072987/ga-doas-surplus-property-eligibility-application-georgia-united-states_print_big.png

https://dor.georgia.gov/2022-hb-162-surplus-t…

Web The taxpayer filed a timely 2022 return and is eligible to receive a refund of 2021 taxes in the amount of 200 Although the maximum allowable

https://dor.georgia.gov/georgia-surplus-tax-ref…

Web HB 162 allows for a tax refund out of the State s surplus to Georgia filers who meet eligibility requirements You may be eligible for the HB 162 Surplus Tax Refund if you File your Individual Income Tax Return for

Fillable G4 Form Printable Forms Free Online

Dekalb County Exemption Form Fill Out And Sign Printable PDF Template

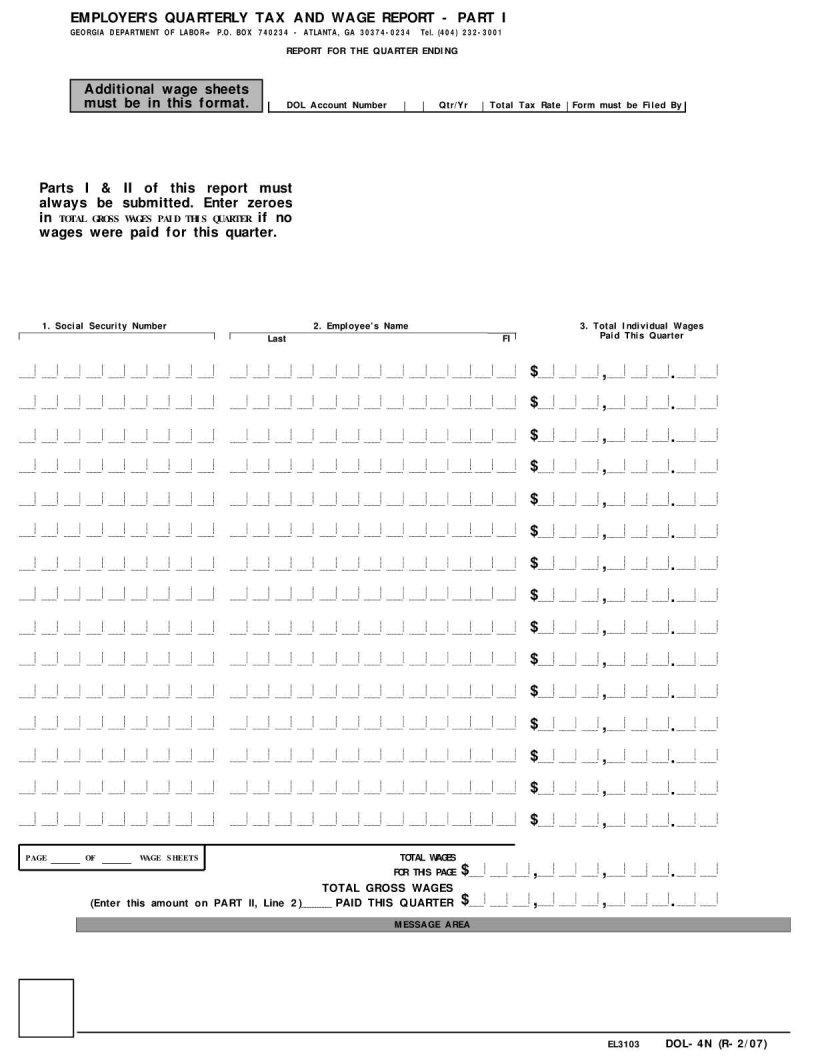

Ga Tax Wage Report Fill Out Printable PDF Forms Online

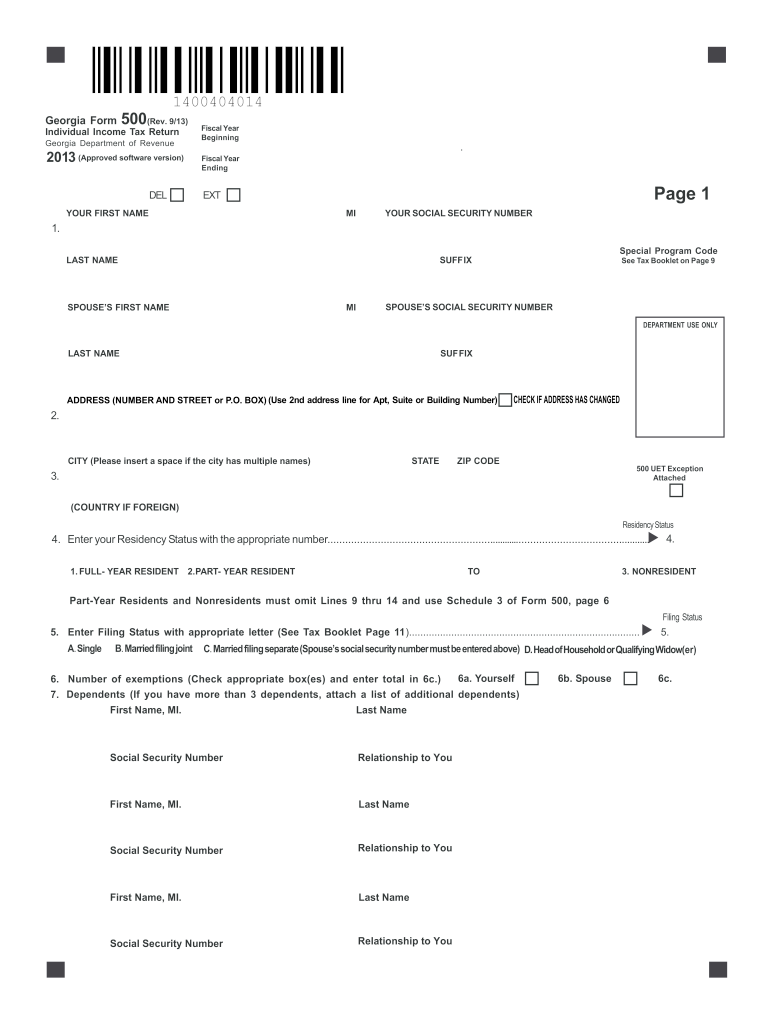

2013 GA Form 500 Fill Online Printable Fillable Blank PDFfiller

More CtC Educated Victories For The Rule Of Law Page 58

Compass Ga Renewal Form Fill Out Sign Online DocHub

Compass Ga Renewal Form Fill Out Sign Online DocHub

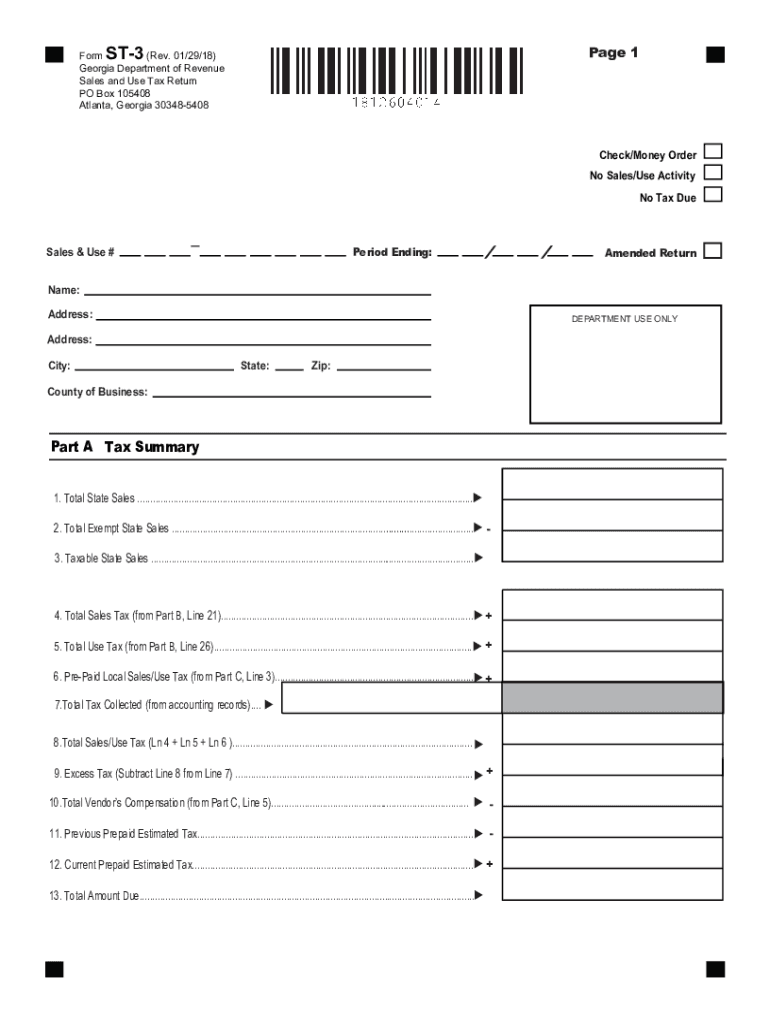

2018 2022 Form GA DoR ST 3 Fill Online Printable Fillable Blank

2016 2021 Form GA DoR ST 5 Fill Online Printable Fillable Blank

Usda Eligibility Map Ga Map Resume Examples

Ga Tax Rebate Eligibility - Web Are you eligible for the 2023 Georgia Surplus Tax Refund Georgia Department of Revenue notice Douglas Savannah Closed Due to Hurricane Idalia Douglas Savannah 1 00pm offices are closed on Wednesday More Information on Closure Are you eligible