Ac Tax Rebate 2023 Web 13 avr 2023 nbsp 0183 32 How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation

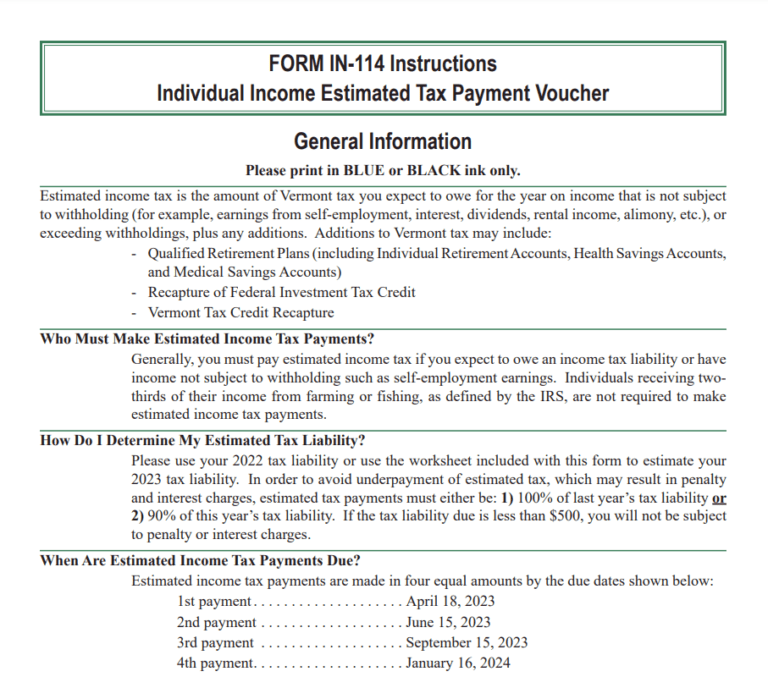

Web 30 d 233 c 2022 nbsp 0183 32 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home See tax credits for 2022 and previous years This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 Web 12 janv 2023 nbsp 0183 32 Up to 2000 in Federal Tax Credits for Heat Pumps and Air Conditioners 2023 Is Your Air Conditioner or Heat Pump Eligible for a Federal Tax Credit under the Inflation Reduction Act On January 1 2023 new federal tax credits came into effect under the provisions set forth in the Inflation Reduction Act

Ac Tax Rebate 2023

Ac Tax Rebate 2023

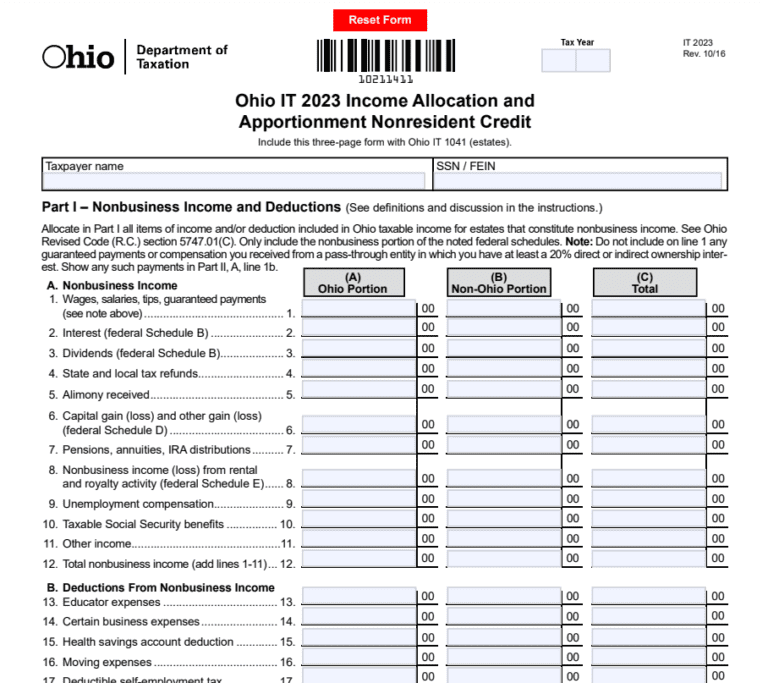

https://printablerebateform.net/wp-content/uploads/2023/04/Ohio-Tax-Rebate-2023-768x683.png

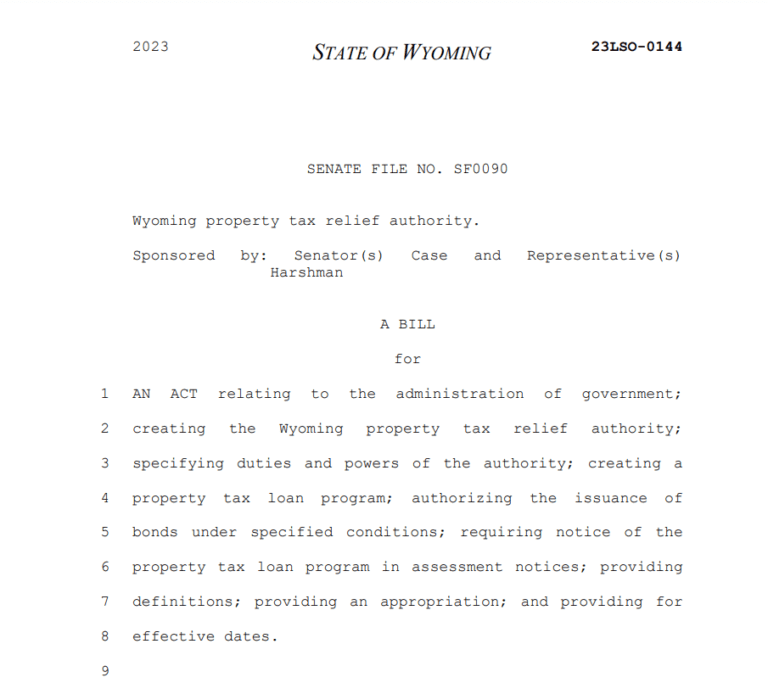

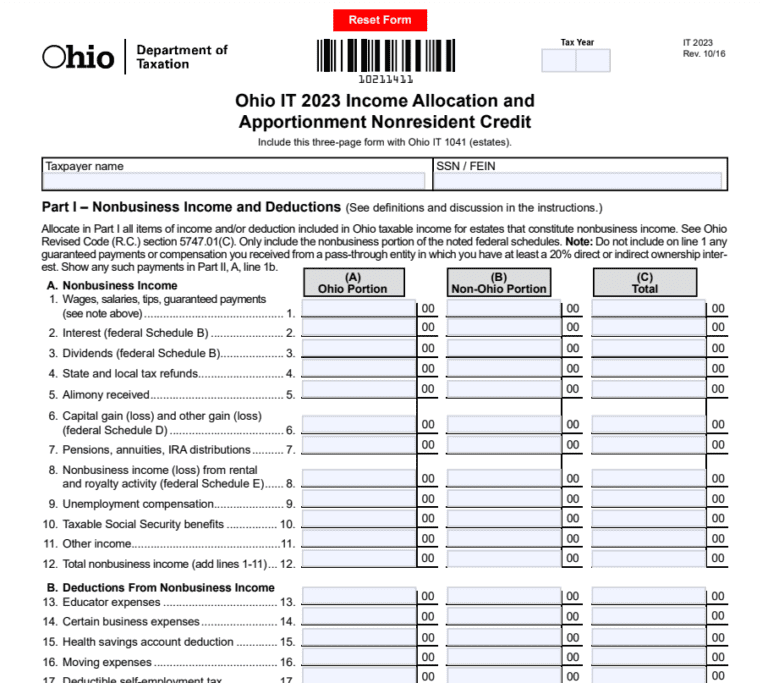

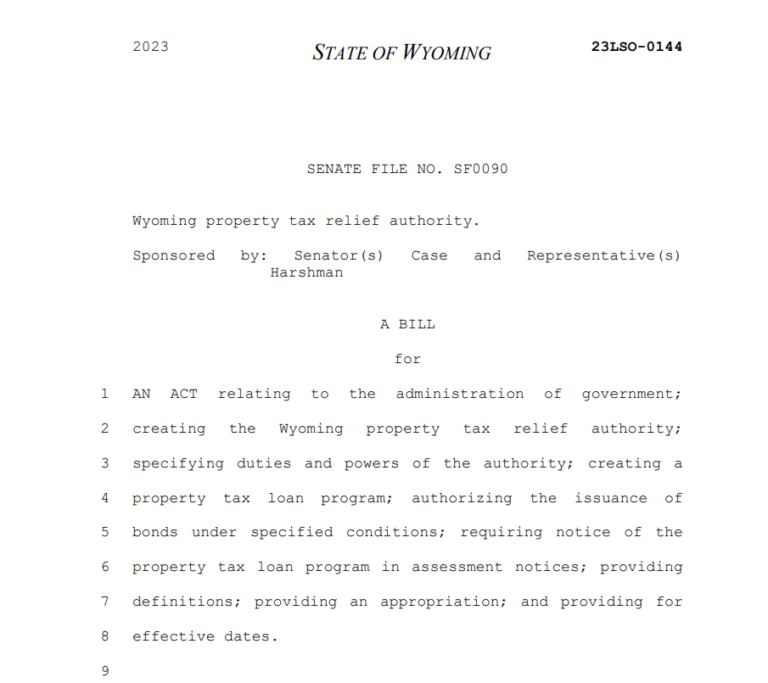

Wyoming Tax Rebate 2023 Complete Guide Tax Rebate Wyoming

https://printablerebateform.net/wp-content/uploads/2023/05/Wyoming-Tax-Rebate-2023-768x683.png

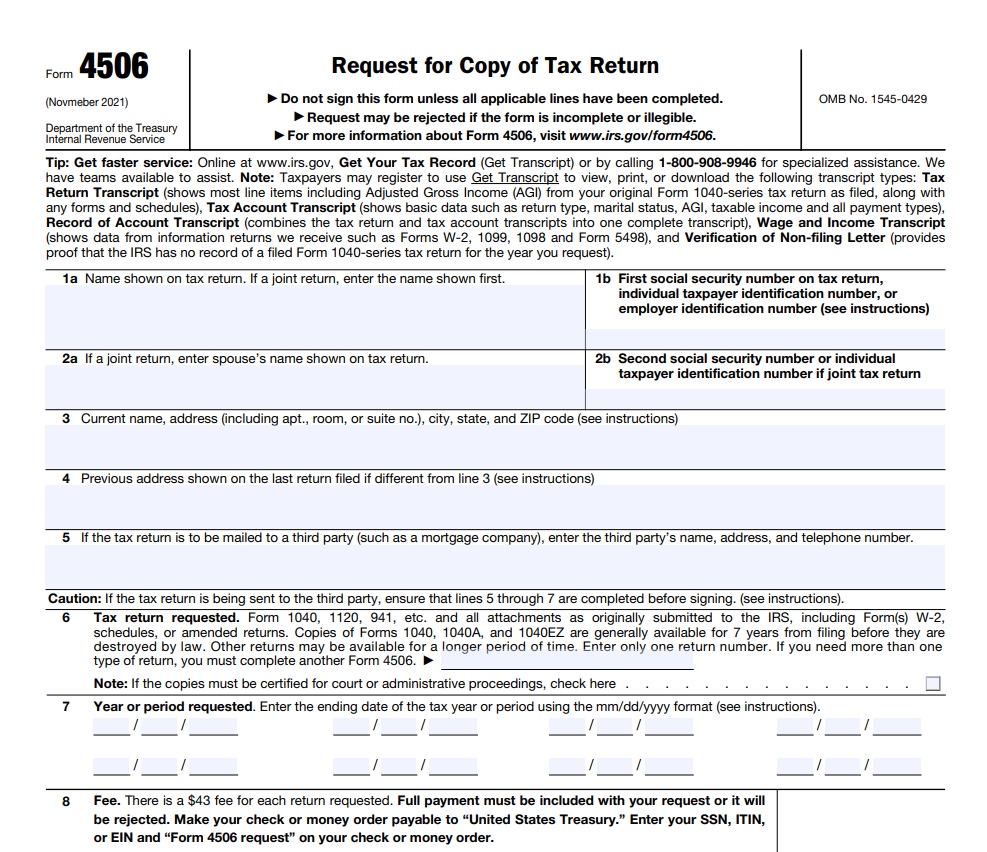

Tax Rebate 2023 California Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/05/Tax-Rebate-2023-California.jpg

Web 4 avr 2023 nbsp 0183 32 Central air conditioners 17 SEER2 Electric heat pumps 18 SEER2 and 10 HSPF2 Gas furnaces 97 AFUE The new program also established retroactive tax credits for anyone who had a qualifying air conditioner furnace or heat pump installed in 2022 Web 3 janv 2023 nbsp 0183 32 Starting in 2023 the tax credit provides homeowners up to 30 of the installation costs for qualified expenditures This tax credit program lasts until December 31 2032 The 25C credit has an annual cap of 30 of the installed costs with a maximum of 1 200 Qualified air conditioners or furnaces may receive up to 600 each There is also

Web 13 f 233 vr 2023 nbsp 0183 32 To verify tax credit eligibility ask your HVAC contractor to provide the Manufacturer s Certification Statement for the purchased equipment For qualifying central air conditioners installed in your primary residence between January 1 2023 and December 31 2032 you can claim a tax credit of 30 of the total project with a max benefit of 600 Web 1 ao 251 t 2023 nbsp 0183 32 For qualifying central air conditioners installed in your primary residence between January 1 2023 and December 31 2032 you can claim a tax credit of 30 of the total project with a max benefit of 600 New

Download Ac Tax Rebate 2023

More picture related to Ac Tax Rebate 2023

Missouri Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

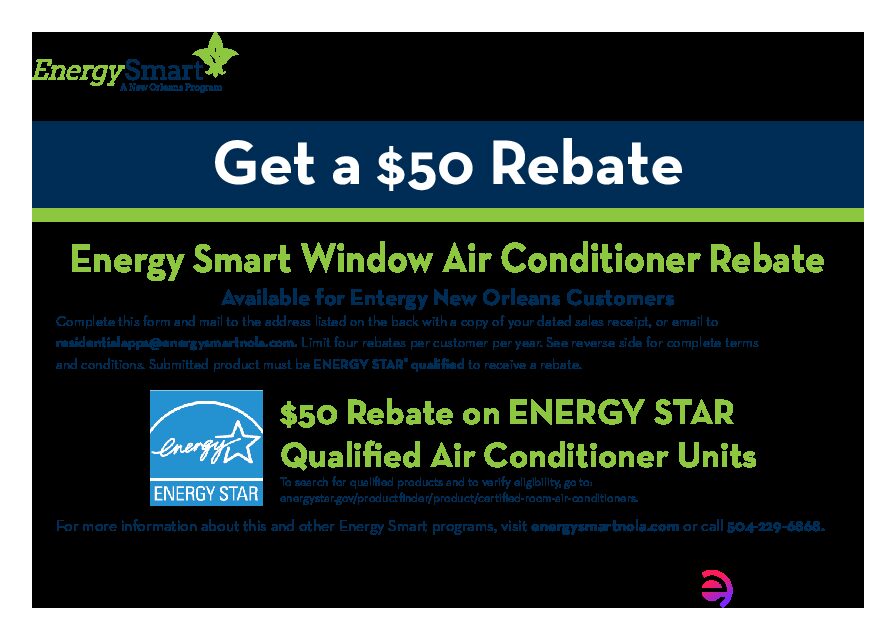

Window AC Rebate Form 2023 Energy Smart NOLA

https://www.energysmartnola.info/wp-content/uploads/2023/02/Window-AC-Rebate-Form-2023-pdf.jpg

All Rebate Forms Available 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/05/Vermont-Tax-Rebate-2023-768x677.png

Web 3 f 233 vr 2023 nbsp 0183 32 1 Go Renewable One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30 percent of the cost of installing clean energy systems in your home including solar panels wind turbines battery storage and more 2 Web 9 sept 2023 nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have received special rebates and

Web 17 oct 2022 nbsp 0183 32 Regulation Compliance Dates As of January 1st 2023 all regions will see a minimum increase of 1 SEER for AC units and heat pumps This means the minimum efficiency needed to pass will increase Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Maine Tax Relief 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Maine-Tax-Rebate-2023-768x690.png

https://todayshomeowner.com/hvac/guides/hvac-tax-credit

Web 13 avr 2023 nbsp 0183 32 How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation

https://www.energystar.gov/about/federal_tax_credits/central_air...

Web 30 d 233 c 2022 nbsp 0183 32 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home See tax credits for 2022 and previous years This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032

P G Rebate 2023 Get The Best Deals On Eligible Products Save Big

Georgia Income Tax Rebate 2023 Printable Rebate Form

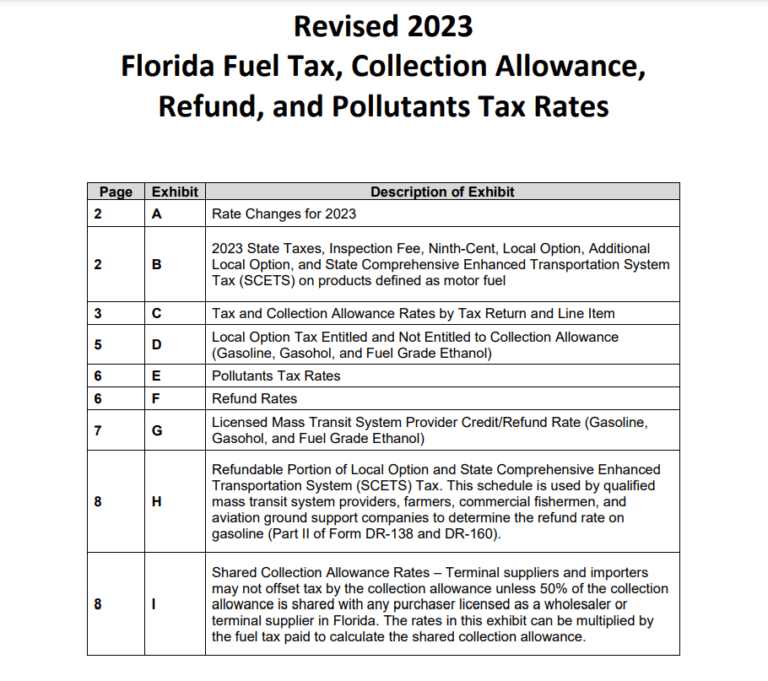

Florida Tax Rebate Printable Rebate Form

This Is An Attachment Of 2023 LG Rebates Printable Rebate Form From

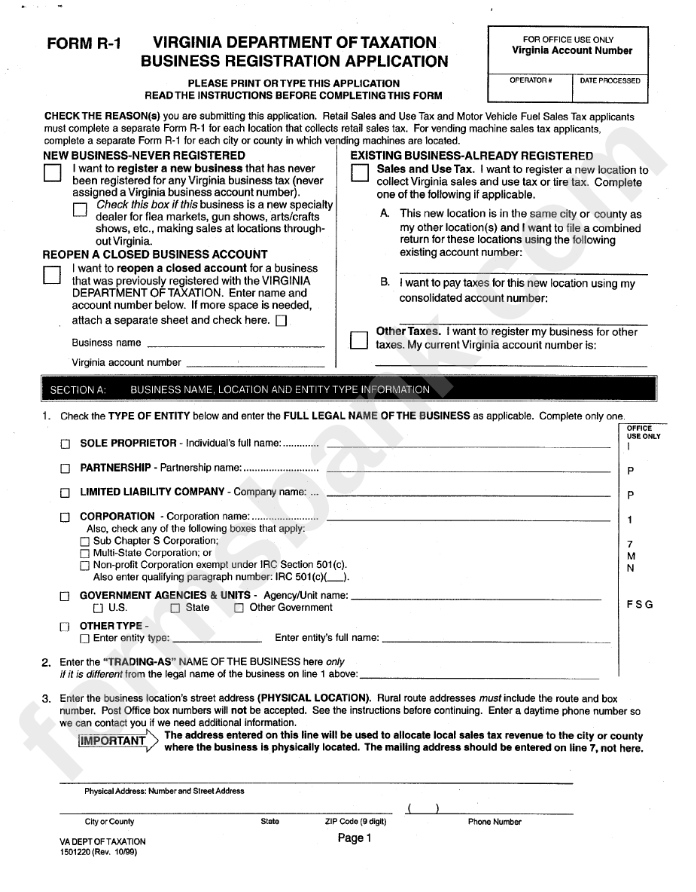

Virginia State Tax Rebate 2023 Eligibility Application And Deadline

Washington State Tax Rebate Printable Rebate Form

Washington State Tax Rebate Printable Rebate Form

Council Tax Rebate Form 2023 Printable Rebate Form

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

Delaware Tax Rebate 2023 Printable Rebate Form

Ac Tax Rebate 2023 - Web 30 d 233 c 2022 nbsp 0183 32 Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help reduce energy costs while reducing demand as we transition to cleaner energy sources Savings for Homeowners