Do You Put Nj Homestead Rebate On Federal Tax Return Web 22 mars 2020 nbsp 0183 32 In most cases you get the NJ Homestead Benefit as a credit on your property tax bill It s usually credited twice a year for the May and November payments

Web 4 mars 2019 nbsp 0183 32 The rebate is not taxable Wolfe said the IRS issued guidance back in 2006 specifically to New Jersey residents IRS News Release No NJ 2006 03 The guidance Web 15 d 233 c 2022 nbsp 0183 32 Affordable New Jersey Communities for Homeowners and Renters ANCHOR Homestead Benefit and Senior Freeze Property Tax Reimbursement

Do You Put Nj Homestead Rebate On Federal Tax Return

Do You Put Nj Homestead Rebate On Federal Tax Return

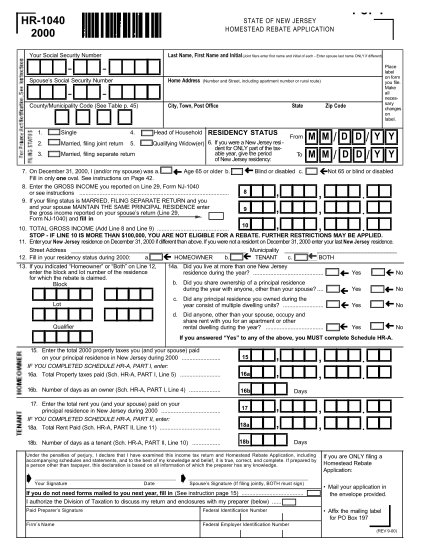

https://cdn.cocodoc.com/cocodoc-form/png/64456293--HR-1040-Homestead-Rebate-Application-State-of-New-Jersey-nj--x-01.png

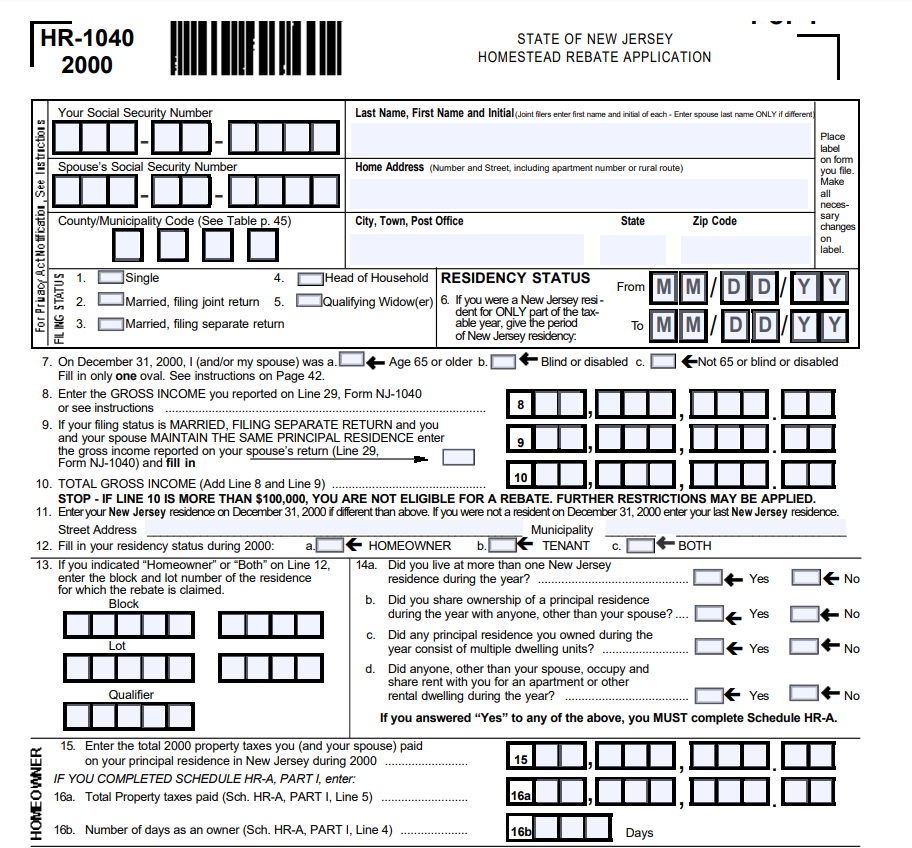

2018 New Jersey Homestead Rebate Application Fill Out Sign Online

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/2018-new-jersey-homestead-rebate-application-fill-out-sign-online-1.png?w=770&ssl=1

Nj Homestead Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/homestead-rebate-not-received-this-year-hackettstown-nj.png

Web No You must have owned and occupied a home in New Jersey as your principal residence on October 1 2020 However applicants who moved after October 1 2020 are eligible if Web 28 mars 2022 nbsp 0183 32 If you are eligible to get the New Jersey Homestead Rebate you will receive the New Jersey property tax credit via the Homestead Rebate process Maye

Web 10 juin 2020 nbsp 0183 32 The New Jersey homestead rebate is a property tax credit that the state pays to municipalities on behalf of eligible homeowners to help reduce their property tax bills Most people who qualify for the rebate will Web 11 nov 2022 nbsp 0183 32 We re glad you re asking The new ANCHOR property tax benefit is bringing up a lot of questions The ANCHOR funds are a reduction of your real estate taxes said Michael Karu a certified

Download Do You Put Nj Homestead Rebate On Federal Tax Return

More picture related to Do You Put Nj Homestead Rebate On Federal Tax Return

NJ Homestead Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/File-NJ-Homestead-Rebate-Form-Online.png

Is There A Nj Homestead Rebate For 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/what-happens-to-the-homestead-rebate-and-my-tax-return-njmoneyhelp.jpg?w=689&h=458&ssl=1

Maximize Your Savings New Jersey Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/New-Jersey-Tax-Rebate-2023.jpg?ssl=1

Web 18 juil 2022 nbsp 0183 32 In late June with the June 30 budget adoption deadline approaching the governor announced an expansion of the ANCHOR program proposal with tax rebates of Web If you did not itemize deductions in the year that the rebate pertains to instead taking the standard deduction then this does not apply to you The rebate is not taxable Wolfe

Web 27 mars 2017 nbsp 0183 32 A You re correct The IRS requires that a taxpayer report the Homestead Rebate and Senior Freeze benefits as quot Other Income quot and this can result in a higher tax liability Here s why Web It s simple and easy to follow the instructions complete your NJ tax return and file it online Any resident or part year resident can use it to file their 2022 NJ 1040 for free NJ E

Fortune Salaire Mensuel De Nj Budget 2022 Homestead Rebate Combien

https://www.salaire-mensuel.com/salaire-fortune-nj-budget-2022-homestead-rebate.jpeg

Tax Credits Could Replace Senior Freeze Rebates New Jersey Monitor

https://newjerseymonitor.com/wp-content/uploads/2022/09/seniorfreeze-scaled.jpeg

https://ttlc.intuit.com/community/state-taxes/discussion/do-i-need-to...

Web 22 mars 2020 nbsp 0183 32 In most cases you get the NJ Homestead Benefit as a credit on your property tax bill It s usually credited twice a year for the May and November payments

https://www.nj.com/entertainment/2019/03/how-does-my-homestead-rebate...

Web 4 mars 2019 nbsp 0183 32 The rebate is not taxable Wolfe said the IRS issued guidance back in 2006 specifically to New Jersey residents IRS News Release No NJ 2006 03 The guidance

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp

Fortune Salaire Mensuel De Nj Budget 2022 Homestead Rebate Combien

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp

Nj Homestead Rebate 2022 Renters RentersRebate

South Jersey Seniors Stressed About Homestead Property Tax Rebate Delay

If I Sell My Home Do I Get The Homestead Rebate Biz Brain Nj

If I Sell My Home Do I Get The Homestead Rebate Biz Brain Nj

NJ s New 2B Tax Rebate Program Underway How To Get Your Cut Across

Business Report Lingering Financial Challenges Homestead Rebate

Might As Well Put Homestead Rebate Check On Side Of Milk Carton Letter

Do You Put Nj Homestead Rebate On Federal Tax Return - Web 22 sept 2021 nbsp 0183 32 Homeowners making up to 75 000 annually are eligible for Homestead benefits as are seniors and disabled homeowners who make up to 150 000 annually