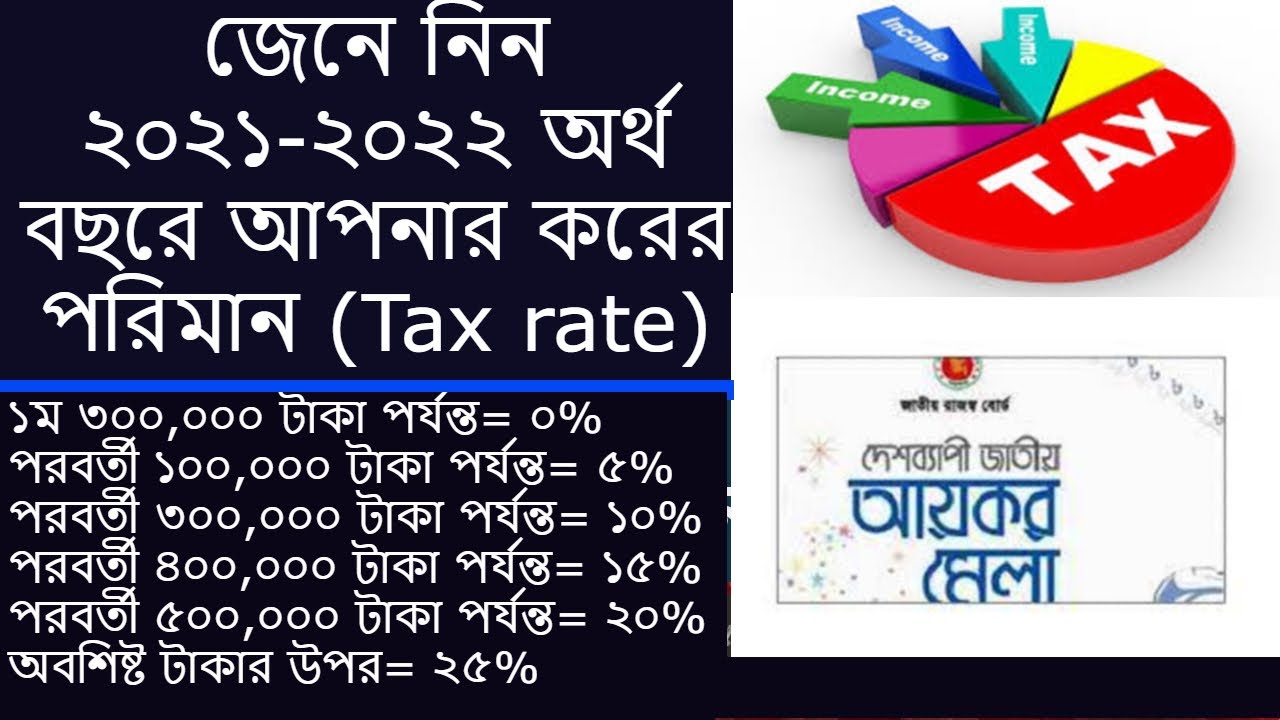

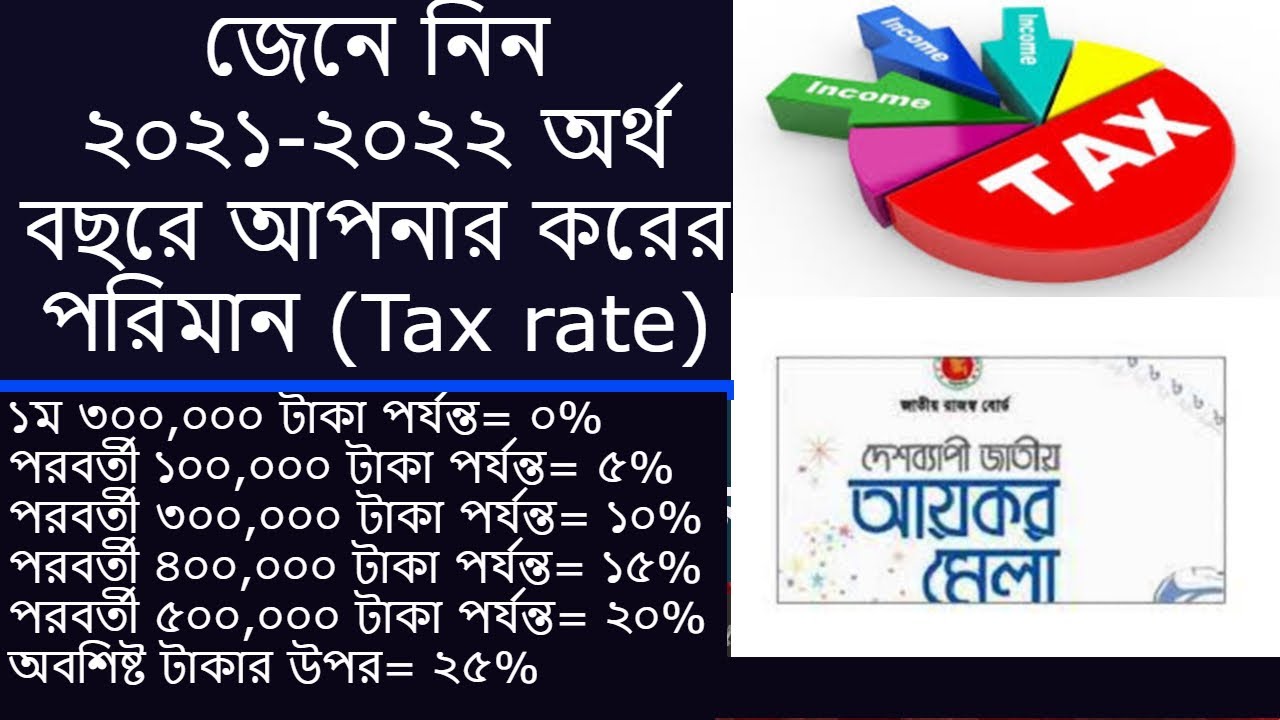

Advance Income Tax Rate In Bangladesh 2020 21 Major sources of income subject to deduction 14 or collection of tax advance payment of tax and presumptive tax Rates applicable for Financial Year 2021 2022

You have to know the updated TDS rates 2020 21 to deduct or collect tax at the time of payment or collection of money to comply with Income Tax Law of Bangladesh TDS Rates Chart FY 2021 22 I have Paripatra Income Tax 2013 2014 Income Tax Circular 1 for 2013 2014 Irregularities of Grameen Bank Income Tax Circular 2013 14 Circular Income Tax 2012 13

Advance Income Tax Rate In Bangladesh 2020 21

Advance Income Tax Rate In Bangladesh 2020 21

https://charteredjournal.com/wp-content/uploads/2021/07/Personal-Income-Tax-Slab-in-Bangladesh-2022-2023.jpg

Personal Income Tax Rate In Bangladesh 2021 2022 YouTube

https://i.ytimg.com/vi/vZv_C0-xW_E/maxresdefault.jpg

Income Tax Rate In Bangladesh Income Tax Rate For Individuals

https://i.ytimg.com/vi/yEFoIIuLDIo/maxresdefault.jpg

PDF 1 4 2 0 obj stream x W o G J D P 6 I r 3 XQ y l n n O Y q 3 Rationalization of tax rates at general sources In case of sale or lease of any commodity property or rights through public auction it is proposed to collect advance tax at source

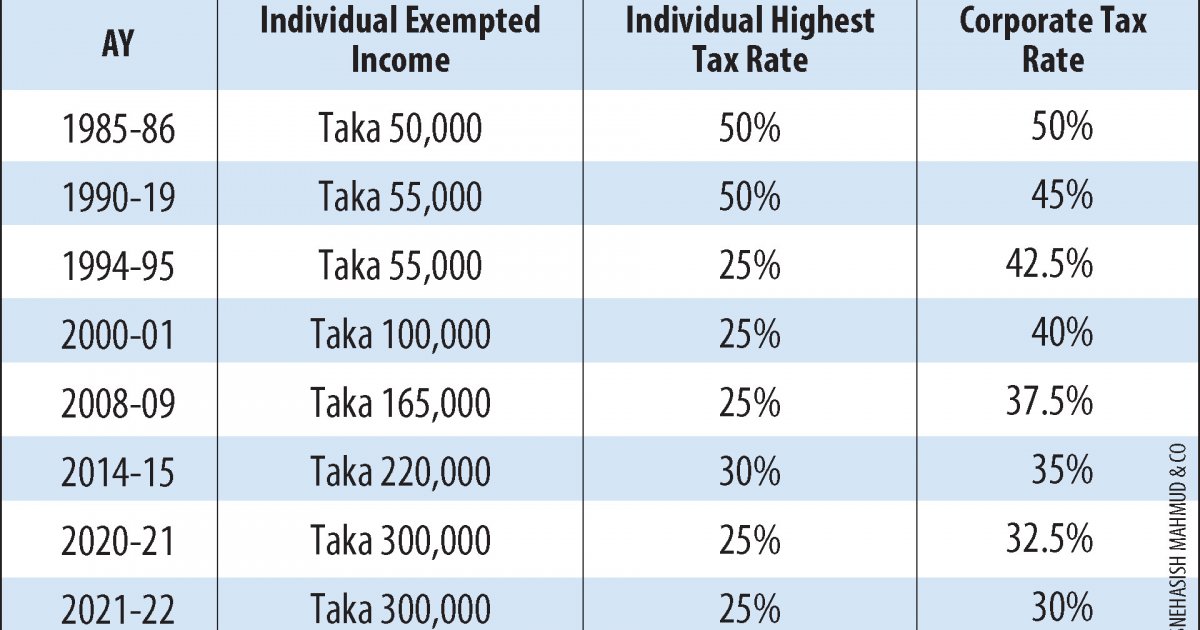

The Income tax rates and personal allowances in Bangladesh are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables Advance income tax on imports to see major overhaul The government is likely to bring about major changes in the Advance Income Tax AIT structure in the

Download Advance Income Tax Rate In Bangladesh 2020 21

More picture related to Advance Income Tax Rate In Bangladesh 2020 21

VAT Rates Chart FY 2021 22 In Bangladesh With H S Code

http://www.jasimrasel.com/wp-content/uploads/2021/08/Corporate-Tax-Book-Bangladesh-1024x512.jpg

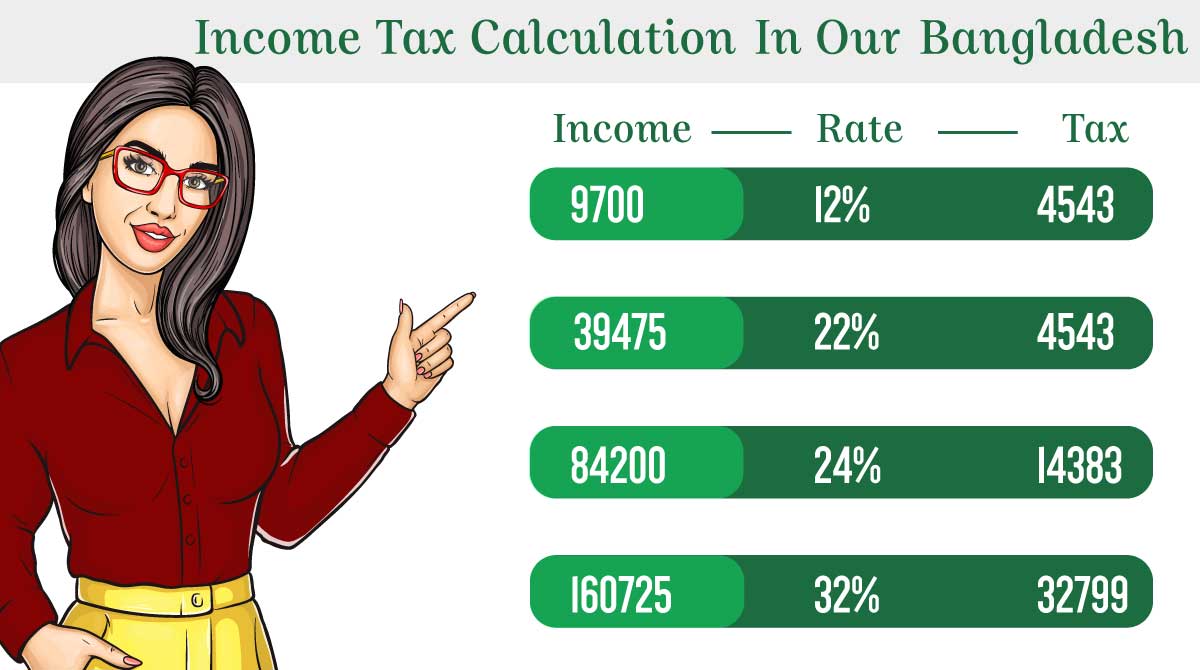

Income Tax Calculate And Submit Returns In Bangladesh

https://www.payroll.com.bd/wp-content/uploads/2022/10/Tax-1.jpg

VAT Rates Chart With H S Code FY 2022 23 In Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2022/09/VAT-Rates-Chart-2022-23-BD.jpg

The calculator is updated with the latest tax rates and brackets as per the 2020 tax year in Bangladesh This tool is designed for simplicity and ease of use focusing solely on Choose a specific income tax year to see the Bangladesh income tax rates and personal allowances used in the associated income tax calculator for the same tax year

Advance tax is tax paid by registered on registered and enlisted person on the imported merchandise at the time of import The rate of Advance tax is 3 percent Yes Advance Hence this writing contains an up to date version of the Income Tax of some important sectors of Bangladesh Information relating to the Current Income Tax Rate i Income

Tax Return Submission In Bangladesh Lowest Among South Asian Countries

https://ecdn.dhakatribune.net/contents/cache/images/1200x630x1xxxxx1/uploads/dten/2022/11/26/317136234-505891394916439-3492985655066547137-n.jpeg

Income Tax Rate In Nepal For 2080 81 FY 2023 24 Top Nepali

https://i0.wp.com/topnepali.com/wp-content/uploads/2022/05/Income-tax-rate-in-Nepal-.jpg

https://nbr.gov.bd/uploads/paripatra/2021...

Major sources of income subject to deduction 14 or collection of tax advance payment of tax and presumptive tax Rates applicable for Financial Year 2021 2022

https://www.jasimrasel.com/tds-rates-20…

You have to know the updated TDS rates 2020 21 to deduct or collect tax at the time of payment or collection of money to comply with Income Tax Law of Bangladesh TDS Rates Chart FY 2021 22 I have

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Tax Return Submission In Bangladesh Lowest Among South Asian Countries

Income Tax Rate In Bangladesh 2020 21 Income TAX YouTube

FY24 Minimum Income Tax Rate Reducing

Corporate Income Tax Rate In Bangladesh In 2023 Hire The Most

Tax Rate In Bangladesh In 2023 Choose The Actionable Way Of Dealing

Tax Rate In Bangladesh In 2023 Choose The Actionable Way Of Dealing

Withholding Tax Rate In Bangladesh 2022 24 BDesheba Com

VAT Rates 2020 21 Bangladesh Jasim Uddin Rasel

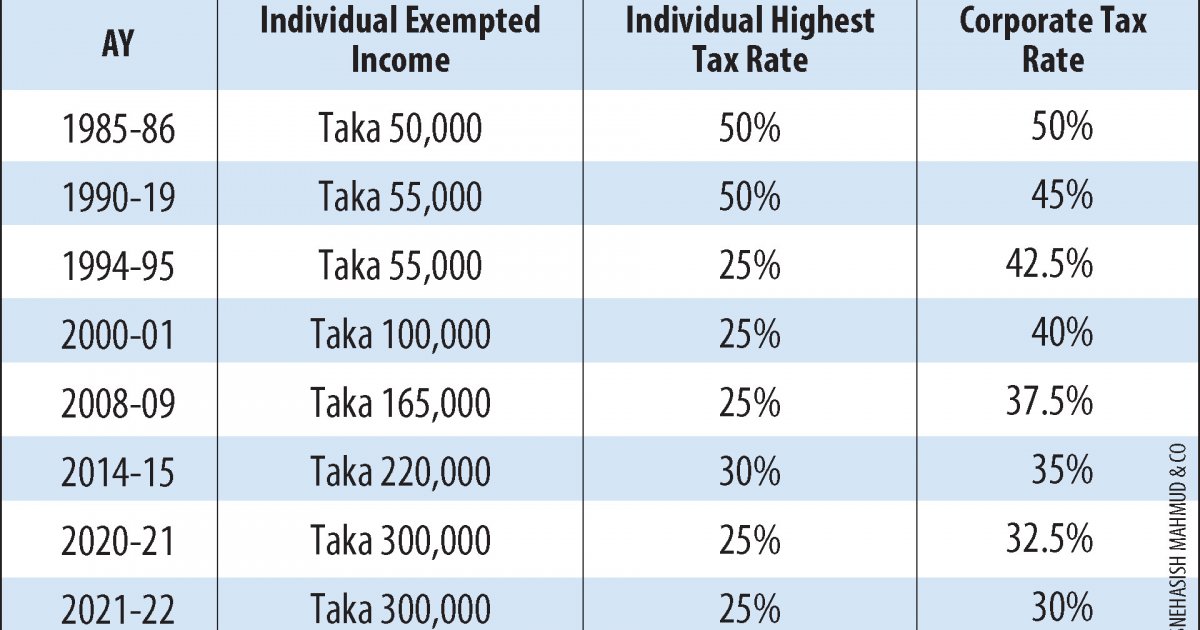

Bangladesh s Corporate Tax Cuts Turn eyewash The Financial Express

Advance Income Tax Rate In Bangladesh 2020 21 - For the assessment year 2020 2021 the Company deposited its advance tax payable up to 3 rd quarter and on the other hand due to Covid 19 the Company is expecting a