After Deduction Tax Return Rebates Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 20 d 233 c 2022 nbsp 0183 32 Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund Here s how eligible Web 17 f 233 vr 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit can reduce any taxes owed or be included in the tax refund for the 2021 tax year Filers must ensure to not mix

After Deduction Tax Return Rebates

After Deduction Tax Return Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

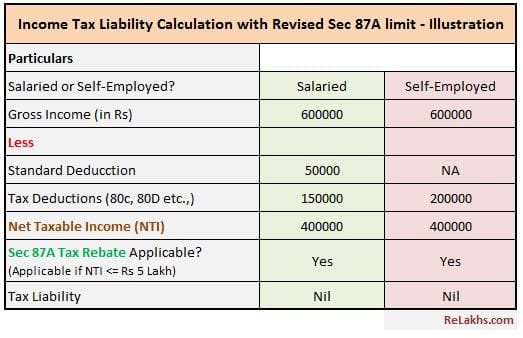

Income Tax Deductions List FY 2019 20

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

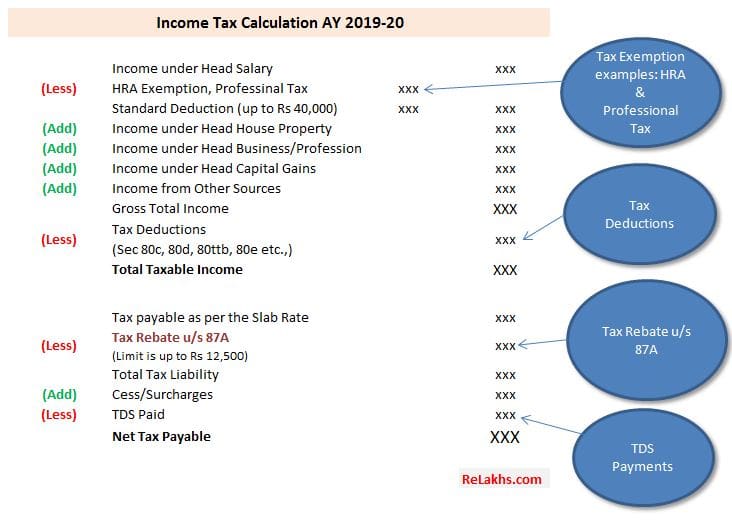

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

https://i1.wp.com/only30sec.com/wp-content/uploads/2020/12/Income-tax-Sections-of-deductions-and-rebates-for-Residents-and-Non-Residents.png?w=1303&ssl=1

Web 13 avr 2022 nbsp 0183 32 You will receive your 2020 Recovery Rebate Credit included in your refund after your 2020 tax return is processed If you requested a trace on your first or second Web 10 d 233 c 2021 nbsp 0183 32 The IRS will not calculate the 2020 Recovery Rebate Credit for you if you did not enter any amount on your original 2020 tax return You can use the Interactive

Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840 Web 14 janv 2022 nbsp 0183 32 DEDUCTIONS Business meal deductions after the TCJA This article discusses the history of the deduction of business meal expenses and the new rules

Download After Deduction Tax Return Rebates

More picture related to After Deduction Tax Return Rebates

Pin On Tigri

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Tax Rebate For Individual To Qualify For The 2001 And 2008 Rebates

https://blog.tax2win.in/wp-content/uploads/2019/03/80C-Deduction-in-respect-of-LIP-PF-PPF-NSC-etc-1024x819.jpg

Web 10 d 233 c 2021 nbsp 0183 32 If you re eligible you must file a 2020 tax return to claim the 2020 Recovery Rebate Credit even if you usually don t file a tax return You will need the amount of all Web 20 mars 2018 nbsp 0183 32 1 Primary rebate under 65 years 2 Secondary rebate between 65 and 75 years 3 Tertiary rebate over 75 years Depending on your age group you ll qualify

Web Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be Web 13 juil 2021 nbsp 0183 32 After Tax Return The return on an investment including all income received and capital gains calculated by taking expected or paid income taxes into account

Income Tax Return E filing With ITR 1 And Description Of Income IT

https://i.ytimg.com/vi/JaMW8F0HFns/maxresdefault.jpg

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912447/story_image/1040.PNG?1612073472

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-h...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 d 233 c 2022 nbsp 0183 32 Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund Here s how eligible

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Income Tax Return E filing With ITR 1 And Description Of Income IT

Major Exemptions Deductions Availed By Taxpayers In India

Tax Deductions Template For Freelancers Google Sheets

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Minnesota Property Tax Refund Fill Out And Sign Printable PDF

After Deduction Tax Return Rebates - Web 14 janv 2022 nbsp 0183 32 DEDUCTIONS Business meal deductions after the TCJA This article discusses the history of the deduction of business meal expenses and the new rules