Agriculture Rebate Percentage However agricultural income is considered for rate purposes for determining income tax liability if the following two conditions are met The previous year s net agricultural revenue was more than Rs 5 000

How much agricultural income is exempt from income tax There is a complete tax rebate on agriculture income in these cases Where you have both agricultural income and Farmers generally receive income support based on their farm s size in hectares All EU countries have to offer a basic payment a payment for the climate environment and animal welfare to promote sustainable farming practices eco

Agriculture Rebate Percentage

Agriculture Rebate Percentage

https://pioneerunderground.net/wp-content/uploads/2022/02/Landscape-Irrigation-Rebate-Program-in-Omaha.jpeg

Govt Job After Bsc Agriculture CollegeLearners

https://leverageedublog.s3.ap-south-1.amazonaws.com/blog/wp-content/uploads/2020/06/24205939/Jobs-after-BSc-Agriculture.jpg

CSA Network UK Community Supported Agriculture

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100064641583637

Evaluate the tax on the sum of your agricultural and non agricultural income and the tax on the sum of your agricultural income and basic minimum exemption limit Agriculture income is exempt under section 10 1 of the Income tax Act Compute Income tax liability on total income including agricultural income Compute tax rebate on agricultural

HOW TO CALCULATE AGRICULTURAL INCOME AY 2019 20 EXAMPLE 1 AGRICULTURAL INCOME 300000 BUSINESS INCOME 500000 WORKINGS STEP 1 Agriculture income is exempt under section 10 1 of Income Tax Act 1961 if received in India Agriculture income from any other country will be taxable BUT for the computation of tax one has to consider agriculture

Download Agriculture Rebate Percentage

More picture related to Agriculture Rebate Percentage

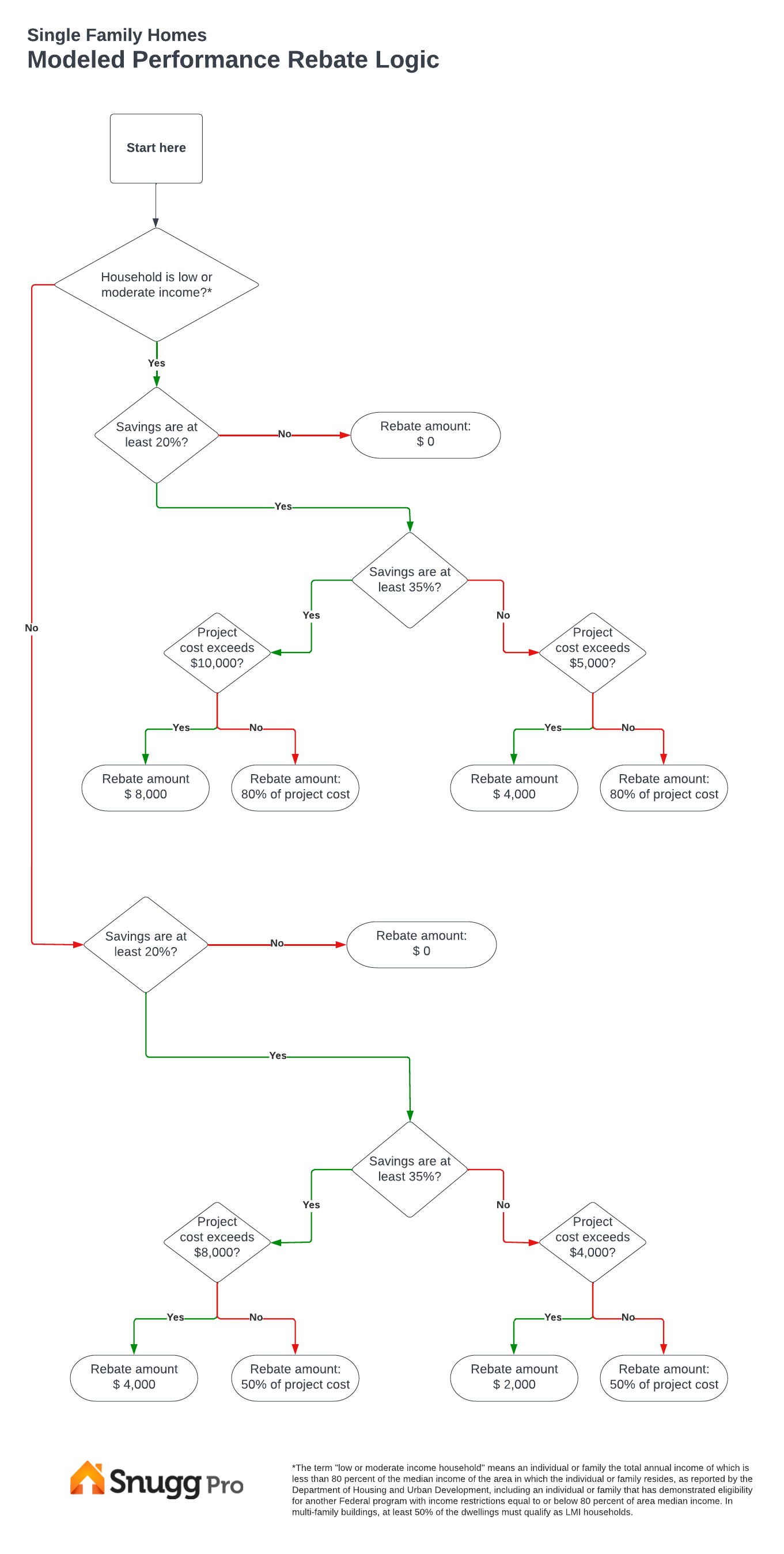

What The Climate Bill s HOMES Rebates Program Means For States Energy

https://snuggpro.com/images/uploads/HOMES_Rebate_Program_Modeled_Savings.png

AGRICULTURE IS THE BACK BONE OF UGANDA

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=10152989285533127

Sustainable Agricultural Rebate Guidelines

https://s3.studylib.net/store/data/007155201_1-df64c3e5d3307cf3cac4c14604b2d96b-768x994.png

In the financial year 2021 direct payments amounted to EUR 37 9 billion 68 of the whole CAP expenditure and benefited 6 million farms throughout the European Union Since 2006 The Secretary of Agriculture certified that the payment was primarily made for conserving soil and water resources protecting or restoring the environment improving forests or providing a

An agricultural subsidy also called an agricultural incentive is a government incentive paid to agribusinesses agricultural organizations and farms to supplement their income manage the Is there a minimum rate of tax that Member States must levy on fuels used in agriculture and forestry and if there is what is it and what is the legal basis for it

Nebraska Commercial Rebates Black Hills Energy

https://www.blackhillsenergy.com/sites/blackhillsenergy.com/files/2022-01/agriculture-rebate-891x608.jpg

Mizoram Agriculture About Us

https://loneitu.nic.in/images/logo.png

https://saral.pro › blogs › agricultural-income

However agricultural income is considered for rate purposes for determining income tax liability if the following two conditions are met The previous year s net agricultural revenue was more than Rs 5 000

https://tax2win.in › guide › income-tax-agricultural-income

How much agricultural income is exempt from income tax There is a complete tax rebate on agriculture income in these cases Where you have both agricultural income and

Egaon Wheat

Nebraska Commercial Rebates Black Hills Energy

Agriculture Eufic

Agriculture Publication Unit Peradeniya

Agriculture Skill Development Nepal

Contact Coleman Agriculture

Contact Coleman Agriculture

Mzansi Agriculture Talk Pretoria

File Agriculture In Vietnam With Farmers jpg Wikipedia

Agriculture EU Climate Policy Meets With Resistance Breaking Latest News

Agriculture Rebate Percentage - The Regenerative Agriculture Finance Operating Line program includes a 0 5 interest rate rebate for farmers who achieve climate and water quality benchmarks established