Plug In Hybrid Tax Rebate Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

Plug In Hybrid Tax Rebate

Plug In Hybrid Tax Rebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/california-clean-vehicle-rebate-project-for-plug-in-hybrid-cars-youtube-8.jpg?resize=840%2C473&ssl=1

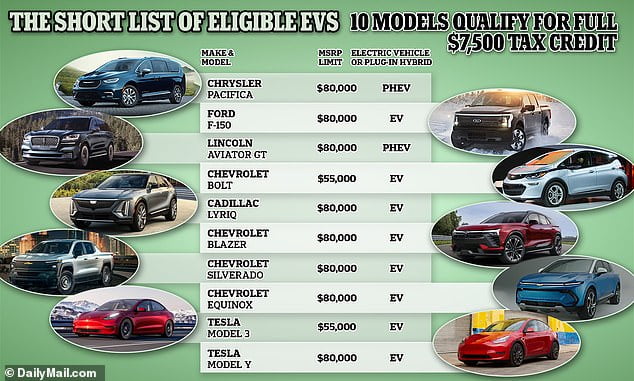

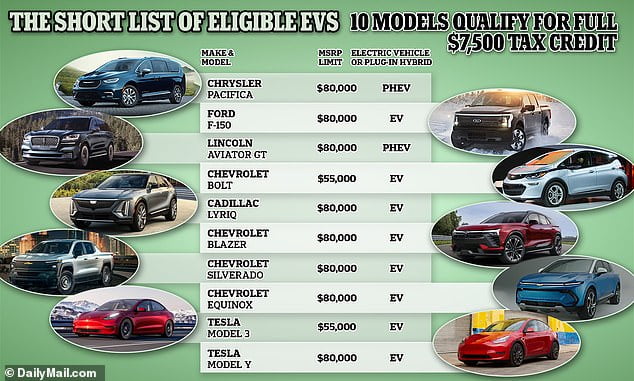

10 Electric And Plug in Hybrid Cars That Qualify For 7 500 Tax Cut

https://en.mogaznews.com/temp/resized/medium_2023-04-21-f759bfcbdd.jpg

2022 Tax Rebate For Hybrid Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/2022-hyundai-santa-fe-plug-in-hybrid-will-cost-less-than-hybrid-after.jpg

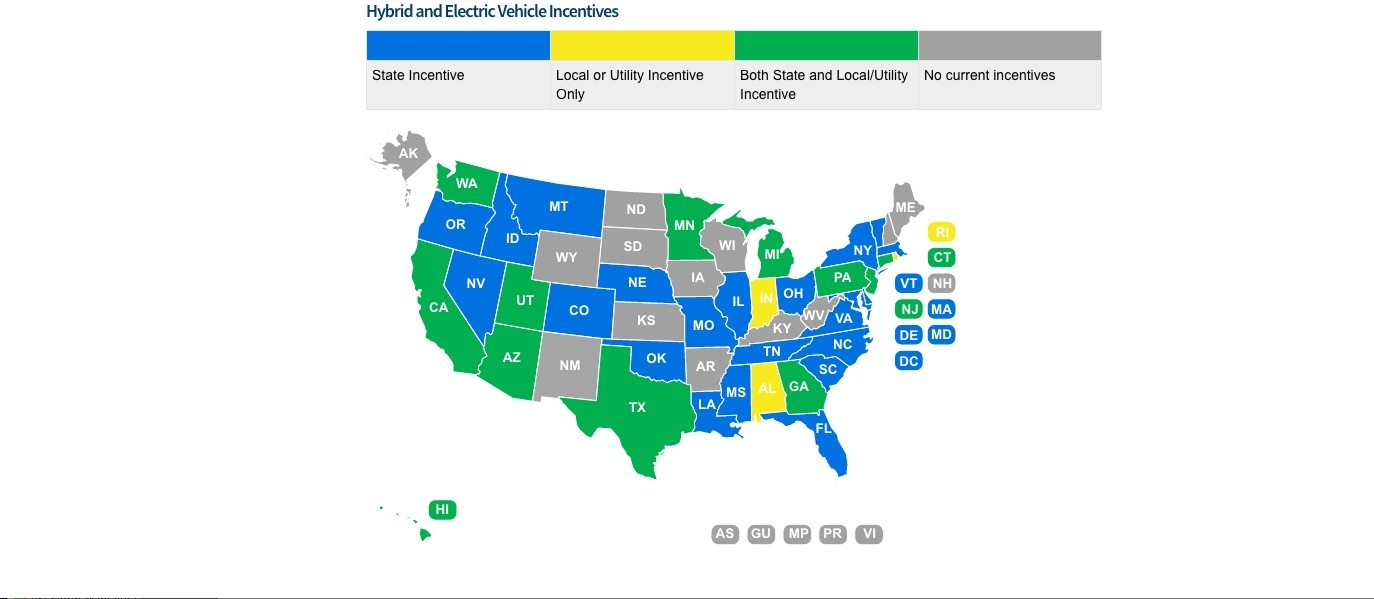

Web 25 janv 2022 nbsp 0183 32 Several states and even some eco minded cities offer their own incentives for EV and plug in hybrid buyers that typically take the form of either a tax credit or a Web 18 ao 251 t 2022 nbsp 0183 32 Electric and plug in hybrid vehicles previously eligible for up to 7 500 in tax credits through 2022 are no longer eligible because of the Inflation Reduction

Web All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 Web 17 avr 2023 nbsp 0183 32 Release Date 4 19 2023 Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Placed into Service on or after April 18 2023 Vehicle Model Year

Download Plug In Hybrid Tax Rebate

More picture related to Plug In Hybrid Tax Rebate

Electric Car Rebates By State ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/electric-car-and-plug-in-hybrid-incentives-in-the-usa-a-quick-guide.jpg

Hybrid EV Tax Incentives In CA Community Chevrolet BURBANK

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/hybrid-ev-tax-incentives-in-ca-community-chevrolet-burbank.jpg?w=1759&ssl=1

Table 1 From Characterizing Plug In Hybrid Electric Vehicle Consumers

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/df7ed74b4fa0f1b23b4eca4d9c9e319a6e4a4324/3-Table1-1.png

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web 5 mai 2023 nbsp 0183 32 The Inflation Reduction Act passed in August 2022 changed the eligibility criteria for plug in hybrid electric vehicles PHEVs to qualify for the clean vehicle tax credit As of August 16 th 2022 only PHEVs

Web New Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Web 6 juin 2023 nbsp 0183 32 The US Treasury has updated the list of electric vehicles and plug in hybrid EVs that qualify for some or all of the 7 500 federal tax credit and there are now just a

Fillable Online PLUG IN HYBRID VEHICLE CHARGING STATION REBATE

https://www.pdffiller.com/preview/568/706/568706519/large.png

California Rebates For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/california-drops-ev-rebates-for-cars-over-60k-plug-ins-below-35-miles-1.jpg?resize=840%2C416&ssl=1

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

https://fueleconomy.gov/feg/tax2022.shtml

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

Ford Rebates 2022 Fusion FordRebates

Fillable Online PLUG IN HYBRID VEHICLE CHARGING STATION REBATE

Massachusetts Rebates For Hybrid Cars 2023 Carrebate

EV And Hybrid Tax Rebates Credits Westbury Jeep Chrysler Dodge Ram

Florida Offering 5 000 Rebates For Plug in Hybrid Prius Conversions

10 Electric And Plug in Hybrid Cars That Qualify For 7 500 Tax Cut

10 Electric And Plug in Hybrid Cars That Qualify For 7 500 Tax Cut

Hybrid Car Government Rebate 2023 Carrebate

Electric Vehicle Rebates Lessons Learning EVs Plug in Hybrid EVs

Boulder Hybrids Bouldering Prius Repair

Plug In Hybrid Tax Rebate - Web 17 avr 2023 nbsp 0183 32 Release Date 4 19 2023 Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Placed into Service on or after April 18 2023 Vehicle Model Year