Tax Rebate On Mortgage Payments Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use

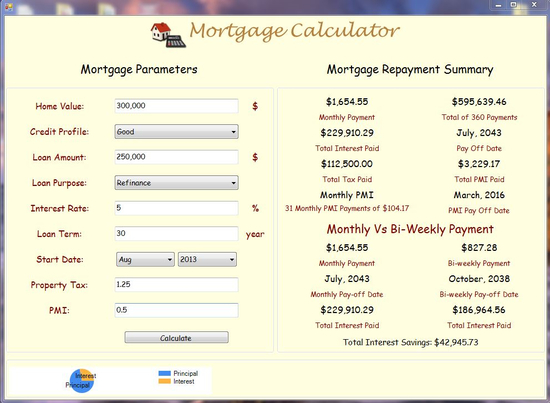

Web Mortgage Tax Benefits Calculator One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes This Web 4 janv 2023 nbsp 0183 32 A mortgage calculator can help you determine how much interest you paid each month last year You can claim a tax deduction for the interest on the first 750 000

Tax Rebate On Mortgage Payments

Tax Rebate On Mortgage Payments

https://www.coursehero.com/qa/attachment/24027424/

Economic Development Lancaster TX Official Website

http://lancaster-tx.com/ImageRepository/Document?documentID=16655

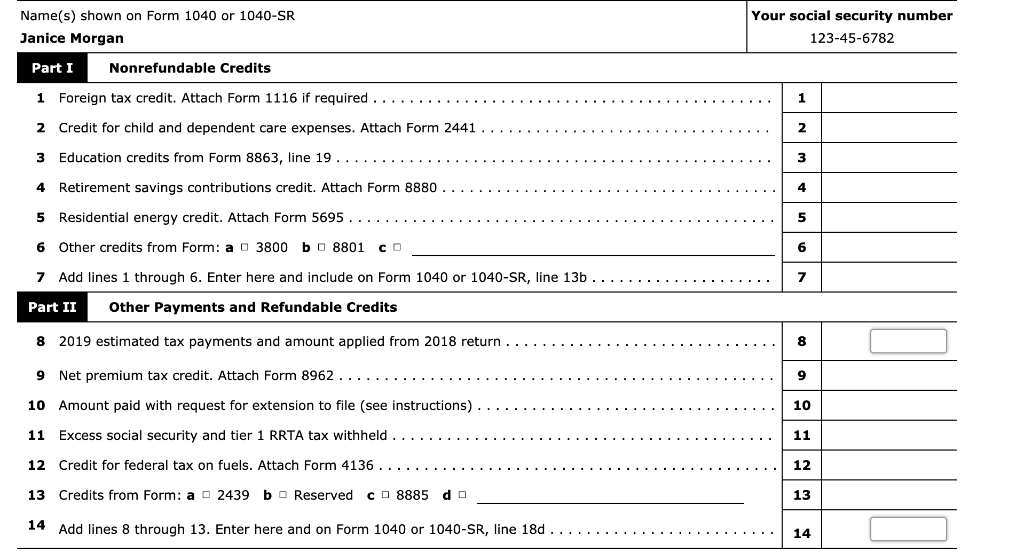

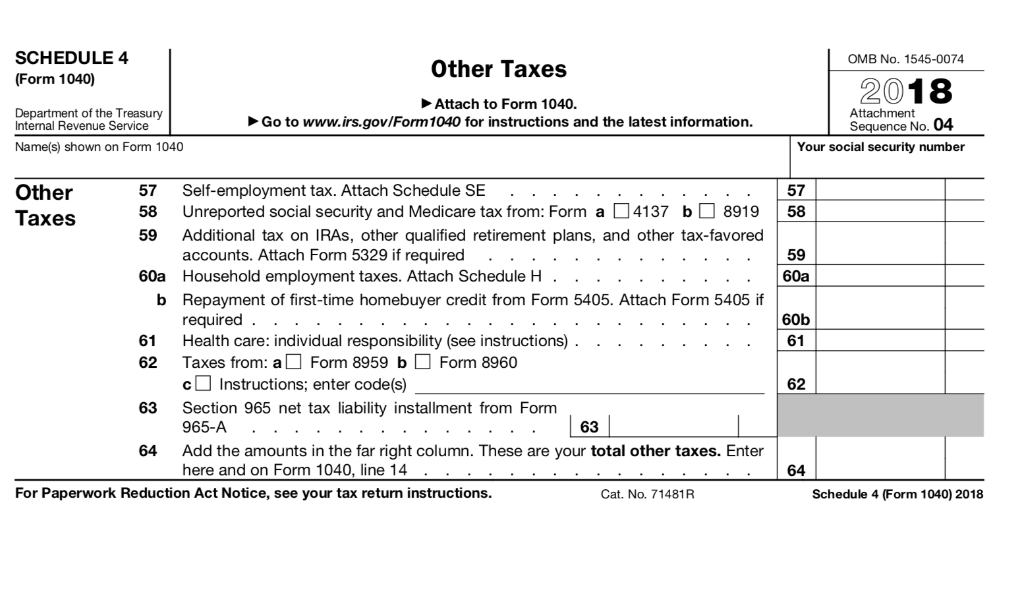

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/3b6/3b6e0b0f-5f0b-4b1a-993f-e6359e2d4ede/phpXXJUd2

Web Interest expense Homeowners can deduct interest expenses on up to 750 000 of mortgage debt from their income taxes though when they itemize these deductions they forgo the standard deduction of 12 550 Web 16 nov 2022 nbsp 0183 32 The Tax Advantage of Making an Extra Mortgage Payment If you have a mortgage loan you are well aware of the tax deduction you get each year for the

Web 21 ao 251 t 2023 nbsp 0183 32 You could suspend your mortgage payments for up to 360 days under federal law if your income was affected by COVID 19 There s still some help available Web 14 juin 2022 nbsp 0183 32 A mortgage rebate is a tradeoff where the borrower agrees to pay a higher interest rate on the loan but pays fewer upfront closing costs Accepting a mortgage

Download Tax Rebate On Mortgage Payments

More picture related to Tax Rebate On Mortgage Payments

Mortgage Calculator Free Home Mortgage Calculator For Excel Calculate

https://i.pinimg.com/originals/1e/bf/2e/1ebf2ead0c37812eaed478655de6de70.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/e40/e40704e5-b559-4cc6-9813-0237a8a5e3d1/phpzsNBgK

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/cd5/cd50fb5b-bf8f-4b45-9d3c-6ca906f26a72/php0YnyaW.png

Web You receive a mortgage credit certificate from State X This year your regular tax liability is 1 100 you owe no alternative minimum tax and your mortgage interest credit is Web 6 mars 2023 nbsp 0183 32 For the 2022 tax year homeowners going green can also shave up to 500 off their tax bill with another credit by installing energy efficient insulation doors roofing heating and air

Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year So if you have a mortgage keep good records Web 30 avr 2023 nbsp 0183 32 A taxpayer spending 12 000 on mortgage interest and paying taxes at an individual income tax rate of 35 would receive only a 4 200 tax deduction That s

Tax Rebate Programs How Many States Have Confirmed Payments Marca

https://phantom-marca.unidadeditorial.es/1492d8e97eb34287b28ab9771345c086/crop/0x0/652x367/resize/1320/f/jpg/assets/multimedia/imagenes/2022/06/15/16552808009696.png

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alproject

https://i1.wp.com/i.pinimg.com/736x/c3/94/0a/c3940a59fd831b4f8791ab4c5f3d2f90.jpg

https://www.bankrate.com/mortgages/mortgage-tax-deduction-calculator

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use

https://www.mortgagecalculator.org/calculato…

Web Mortgage Tax Benefits Calculator One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes This

FREE 26 Payment Receipt Samples In PDF MS Word Excel Apple Pages

Tax Rebate Programs How Many States Have Confirmed Payments Marca

Download Free Mortgage Calculator

30 Child Care Tax Rebate 2022 Carrebate

If You Got Inflation Relief From Your State The IRS Wants You To Wait

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

How To Apply For The Council Tax Rebate What To Do If You Can Claim

Are Mortgage Payments Tax Deductible AZexplained

Is The Recovery Rebate Credit The Same As The Stimulus Leia Aqui Is

Tax Rebate On Mortgage Payments - Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can