Annual Income Tax Return Amount If you have previously informed the Tax Administration of your rental income when requesting a tax card or when completing another tax return or if you have paid rental related prepayments there may be a pre filled amount on your tax

Use SmartAsset s Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount This calculator is updated with rates brackets and other information for your 2023 Under the new TRAIN law those who earn less than 250 000 annually are exempt from paying income tax returns So if you fall under this bracket you don t have to pay your annual ITR BUT you still have to file

Annual Income Tax Return Amount

Annual Income Tax Return Amount

https://c.pxhere.com/photos/c2/d6/tax_return_control_tax_office_form_finance_money_income_tax_billing-1038566.jpg!d

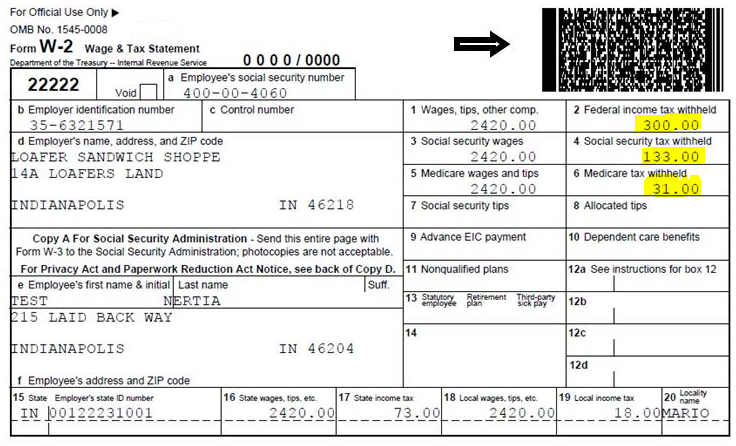

How To Determine Your Total Income Tax Withholding Tax Rates

http://www.tax-rates.org/wp-content/uploads/2013/03/sample-w2.png

Nice Audit Report Of Reliance 2019 International Accounting Standard 10

https://i.pinimg.com/originals/44/17/ae/4417ae287a47614a557a5bcd993701d3.png

An annual statement of income received but excluding dividend tax withheld For example gross dividends interest on bonds the value on 1 January and on 31 December Use the annual Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus allowable

Net income typically means the amount of income left over after you pay your income tax or get a tax refund What is gross income Gross income is the total amount of income you receive from all sources before any There are five filing statuses Find details on tax filing requirements with Publication 501 Dependents Standard Deduction and Filing Information Self employment

Download Annual Income Tax Return Amount

More picture related to Annual Income Tax Return Amount

2022 Tax Refund Calculator Hr Block Very Hot Log Book Photographs

http://www.tax-rates.org/wp-content/uploads/2012/04/1040-total.png

What Is Pre Tax Commuter Benefit

http://www.remotefinancialplanner.com/wp-content/uploads/2017/02/word-image-3.png

Latest ITR Forms Archives Certicom

https://i0.wp.com/certicom.in/wp-content/uploads/2022/06/Understanding-updated-and-revised-income-tax-returns.jpg?fit=1920%2C1080&ssl=1

Knowing where to find the annual net income on tax returns is vital for completing accurate filings This information is used in various tax calculations such as determining the taxable income eligibility for certain See current federal tax brackets and rates based on your income and filing status

Income Tax Calculator How to calculate Income taxes online for FY 2023 24 AY 2024 25 and FY 2024 25 AY 2025 26 with ClearTax Income Tax Calculator Refer examples and tax slabs for easy calculation Annual gross income In this calculator field enter your total household income before taxes Include wages tips commission income earned from interest dividends

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

http://cacult.com/wp-content/uploads/2022/04/Filing-of-the-Income-Tax-Return-is-mandatory.jpg

Find Your WHY 2 Easy Ways To Discover Your Life s Purpose

https://www.freedomtoascend.com/wp-content/uploads/2021/01/Income-tax-return2014-1507x1536.png

https://www.vero.fi/en/individuals/tax-car…

If you have previously informed the Tax Administration of your rental income when requesting a tax card or when completing another tax return or if you have paid rental related prepayments there may be a pre filled amount on your tax

https://smartasset.com/taxes/tax-retur…

Use SmartAsset s Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount This calculator is updated with rates brackets and other information for your 2023

US Individual Income Tax Form With Pen Hand With Pen Fills Tax Form

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

The CAP Blog New Income tax Return Forms Huge Data Mining Exercise

6 Benefits Of Tax Return Services Melbourne Registered Tax Agent

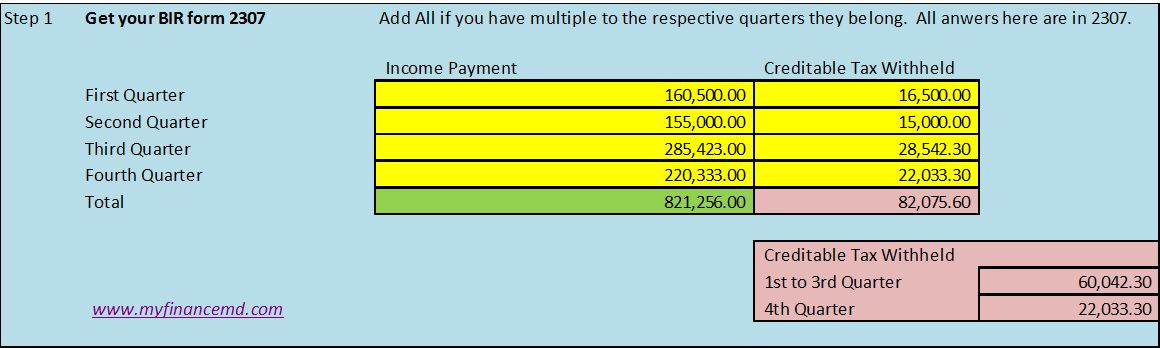

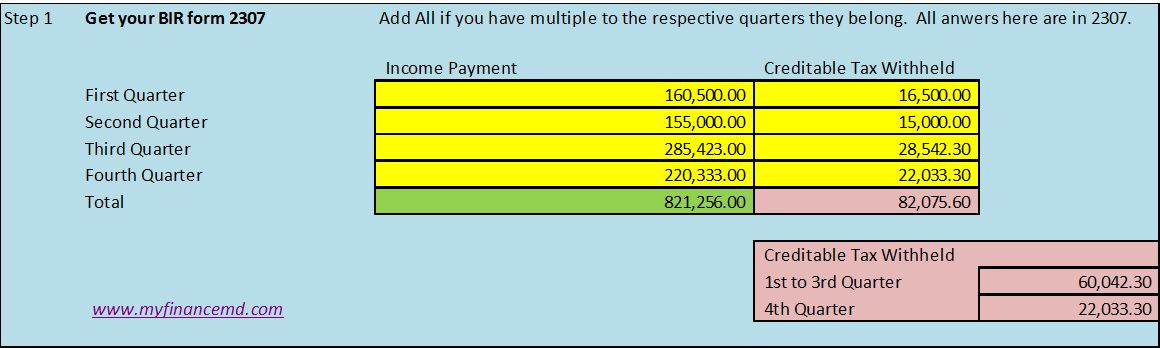

Doctor s Taxation How To Compute Your Income Tax Return Part 5 My

Doctor s Taxation How To Compute Your Income Tax Return Part 5 My

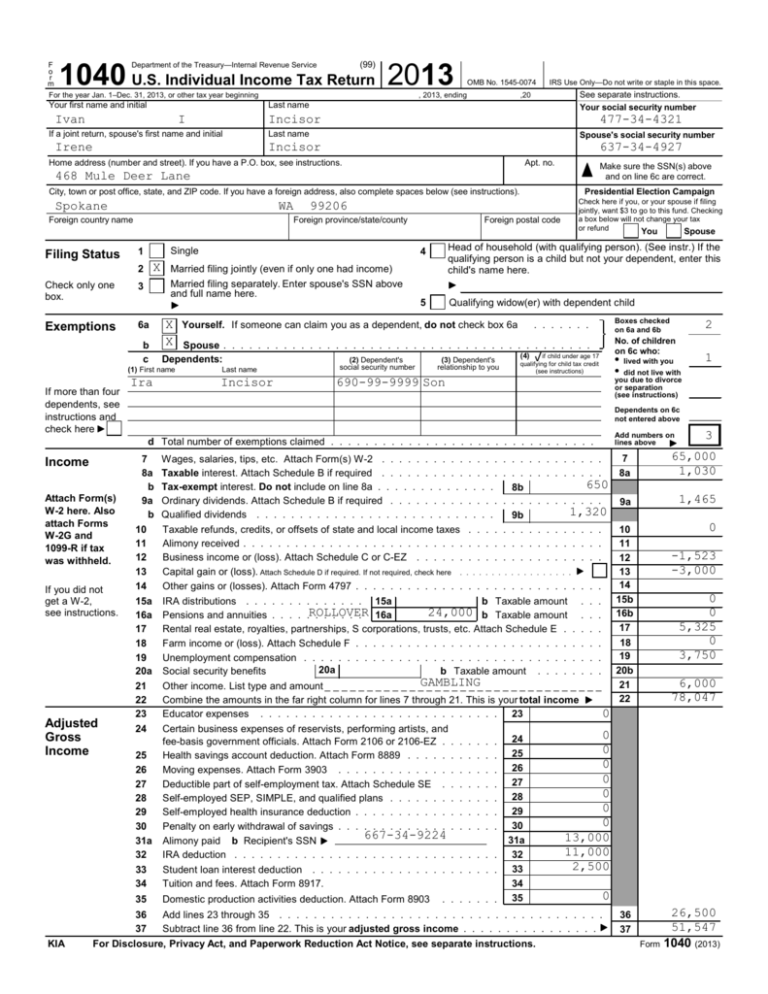

U S Individual Income Tax Return

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

How Federal Income Tax Rates Work Full Report Tax Policy Center

Annual Income Tax Return Amount - Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus allowable