Ma Income Tax Rebate 2024 Getting back to this year s special state payments the eligibility criteria payment amounts and delivery timelines differ from state to state Here s a breakdown of some states issuing rebate

Increases the tax credit for a dependent child disabled adult or senior from 180 to 310 in taxable year 2023 and then to 440 in taxable year 2024 and beyond per dependent while eliminating the child dependent cap Massachusetts Tax Amnesty 2024 is a one time opportunity for eligible individuals and businesses who owe a Massachusetts tax liability to request a waiver of

Ma Income Tax Rebate 2024

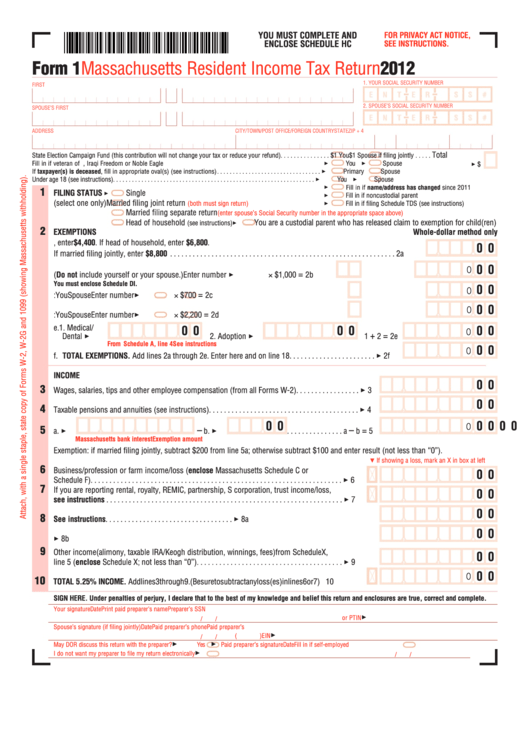

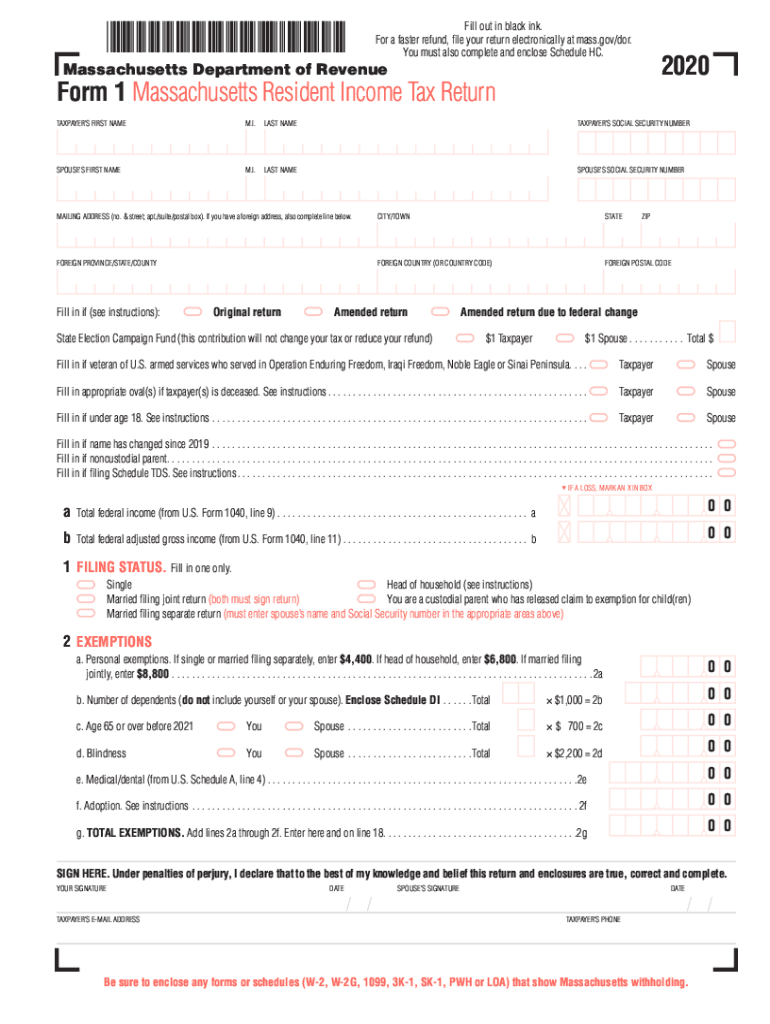

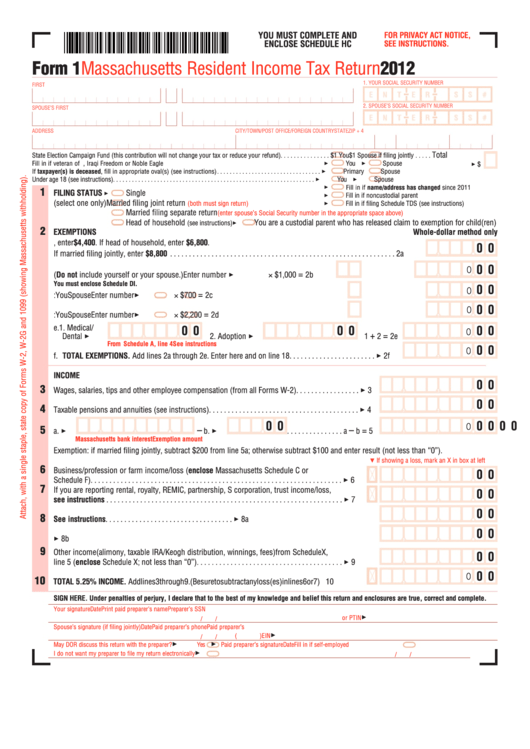

Ma Income Tax Rebate 2024

https://data.formsbank.com/pdf_docs_html/337/3373/337317/page_1_thumb_big.png

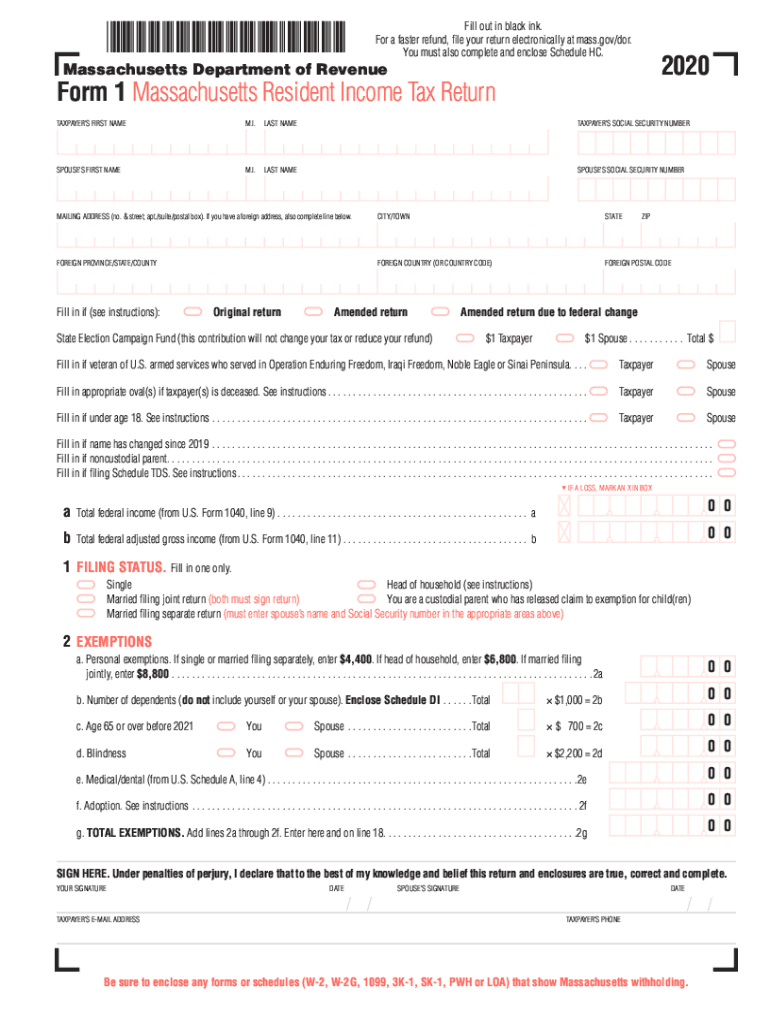

Ma State Tax Form 2 Fillable Printable Forms Free Online

https://www.signnow.com/preview/544/877/544877146/large.png

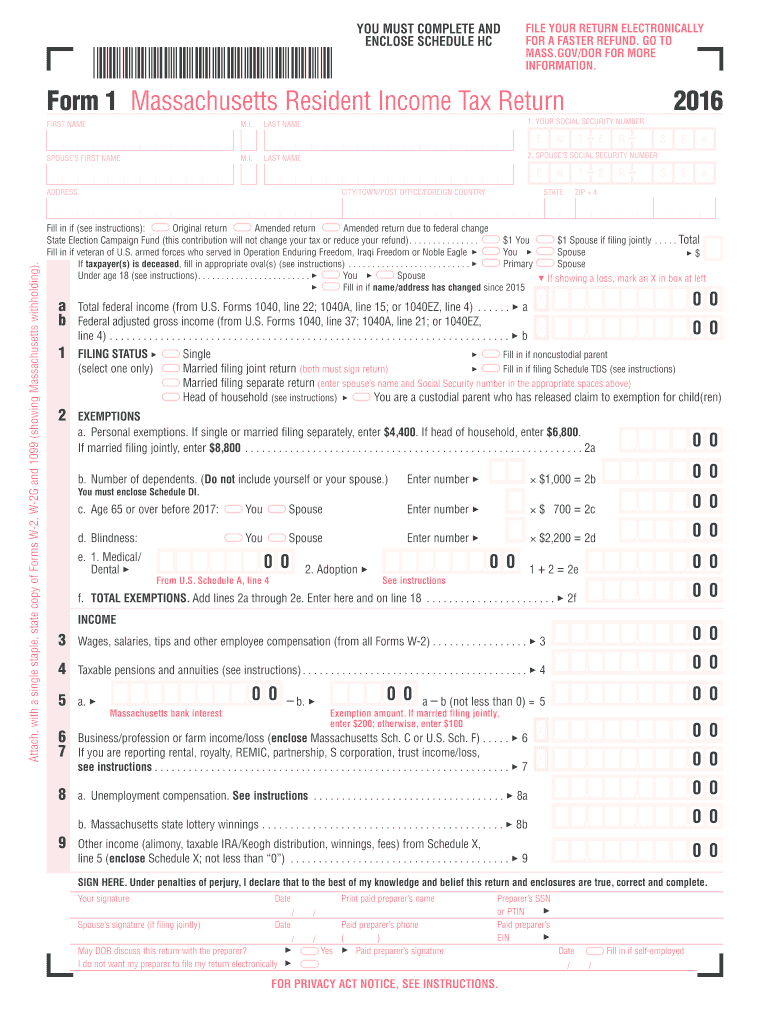

2016 MA Form 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/388/602/388602102/large.png

The individual submits an Amnesty Request and files back Massachusetts personal income tax returns and pays all tax and interest due for tax year 2023 return due The bill more than doubles the state s child and dependent tax credit taking it from 180 to 310 for qualifying dependents this year and then to 440 for every qualifying dependent in 2024

What To Expect With your Upcoming Tax Rebate Last month the Baker Administration announced that eligible Massachusetts taxpayers will receive a tax rebate connected to their 2021 filings Individuals should start seeing funds by The calendar officially flipped to 2024 at midnight on Monday and that meant a new tax law would take effect in Massachusetts In October Gov Maura Healey signed a new bill

Download Ma Income Tax Rebate 2024

More picture related to Ma Income Tax Rebate 2024

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Low and middle income seniors who rent or own a home stand to benefit Individual seniors who make less than 80 000 or couples that make less than 96 000 could get a 2 400 tax credit The final agreement will permanently raise the Earned Income Tax Credit from 30 to 40 of the federal credit and establish an uncapped Child and Family Tax Credit of 310

For the 2024 tax year the amount of the credit will jump to 440 per eligible dependent What does this mean With no cap on the number of eligible dependents and the increase in the credit The 2024 tax package will also double the maximum senior circuit breaker credit from 1 200 to 2 400 slash the tax rate on short term capital gains from 12 to 8 5 and increase the rental

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?w=1280&ssl=1

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

https://www.kiplinger.com/taxes/state-…

Getting back to this year s special state payments the eligibility criteria payment amounts and delivery timelines differ from state to state Here s a breakdown of some states issuing rebate

https://www.boston25news.com/news/lo…

Increases the tax credit for a dependent child disabled adult or senior from 180 to 310 in taxable year 2023 and then to 440 in taxable year 2024 and beyond per dependent while eliminating the child dependent cap

Fortune India Business News Strategy Finance And Corporate Insight

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief Of Tax In Hindi

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check New Tax Rates BetaVersa

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax Calculation Examples FinCalC TV

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax Calculation Examples FinCalC TV

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

Georgia Income Tax Rebate 2023 Printable Rebate Form

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

Ma Income Tax Rebate 2024 - The bill more than doubles the state s child and dependent tax credit taking it from 180 to 310 for qualifying dependents this year and then to 440 for every qualifying dependent in 2024