Any Tax Rebate On Car Loan To get a tax rebate on car loan you have to list the car loan interest paid as a business expense For this you can request your lender to issue an interest certificate indicating the amount paid as interest on the car loan to enjoy tax savings

Additionally personal loans usually have a short repayment term and low eligibility criteria making them easy to obtain Many individuals question whether there are any tax benefits associated with personal loans and in this article we ll address that query The government is ensuring that tax that is owed is paid by introducing the most ambitious ever package to close the tax gap raising 6 5 billion in additional tax revenue per year by 2029 30

Any Tax Rebate On Car Loan

Any Tax Rebate On Car Loan

https://www.petrieford.com/media/1124048/1st-time-buyers.jpg

Stimulus Checks How To File For IRS Tax Rebate On February 12

https://www.gannett-cdn.com/-mm-/bdaa868f3fb135fb5b2327024b78c6d1173f6f06/c=0-412-3331-2286/local/-/media/2021/01/04/USATODAY/usatsports/MotleyFool-TMOT-5eff076a-1040-tax-form-2.jpg?width=3200&height=1801&fit=crop&format=pjpg&auto=webp

OCBC Cards 5 Rebate For Taxi Or Car Ride Coupon Giveaway On Fridays

https://cdn.singpromos.com/wp-content/uploads/2016/07/OCBC-Cards-8-Jul-2016.jpg

If you pay 1 000 in interest on your car loan annually this means you can only claim a 500 deduction On the other hand if the car is used entirely for business purposes the full amount of In all Americans have 1 63 trillion in auto loan debt across over 100 million loans according to the New York Fed while making car loan interest tax deductible might sound appealing it

A car rebate is a flat sum taken off how much you pay for the car often totaling thousands of dollars A rebate may only apply to more expensive trims if you finance through a certain 3 ways to get a car with your tax refund There are a few ways you can fund a tax return car purchase Depending on your current financial situation determine which route is best for you

Download Any Tax Rebate On Car Loan

More picture related to Any Tax Rebate On Car Loan

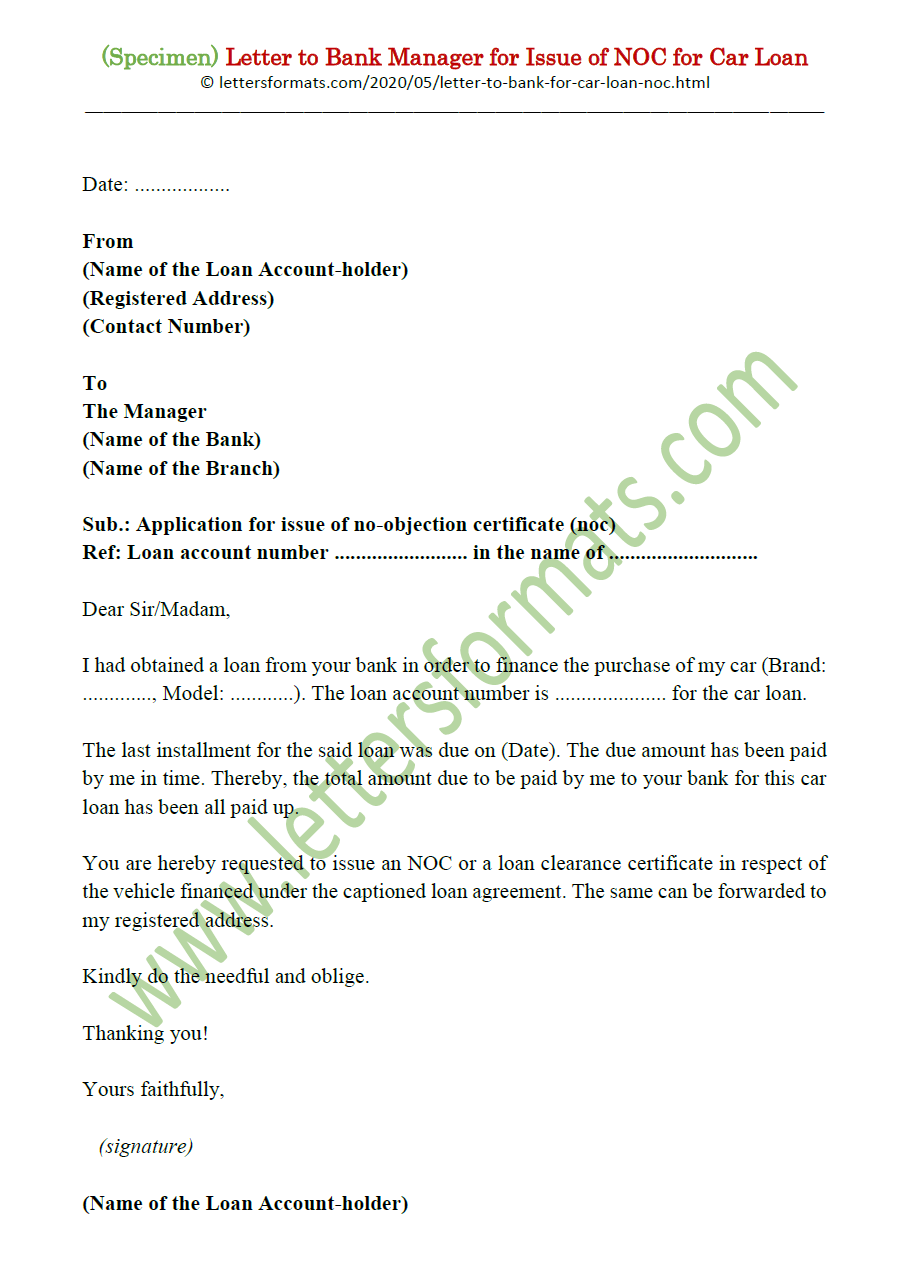

Request Letter To Bank Manager For Car Loan NOC Sample

https://1.bp.blogspot.com/-S5BOSP92Z8w/XsTViRc2y0I/AAAAAAAAask/i1svBMbIxX00Ujt7K2D8aAv8d9VGK-40QCLcBGAsYHQ/s1600/Request%2BLetter%2Bto%2BBank%2BManager%2Bfor%2BCar%2BLoan%2BNOC.png

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

https://cdn.vertex42.com/Calculators/Images/auto-loan-payment-calculator_large.gif

Automobile Dealer Financing Vs Car Manufacturer Rebate Offers

https://www.calculators.org/graphics/auto-loan.jpg

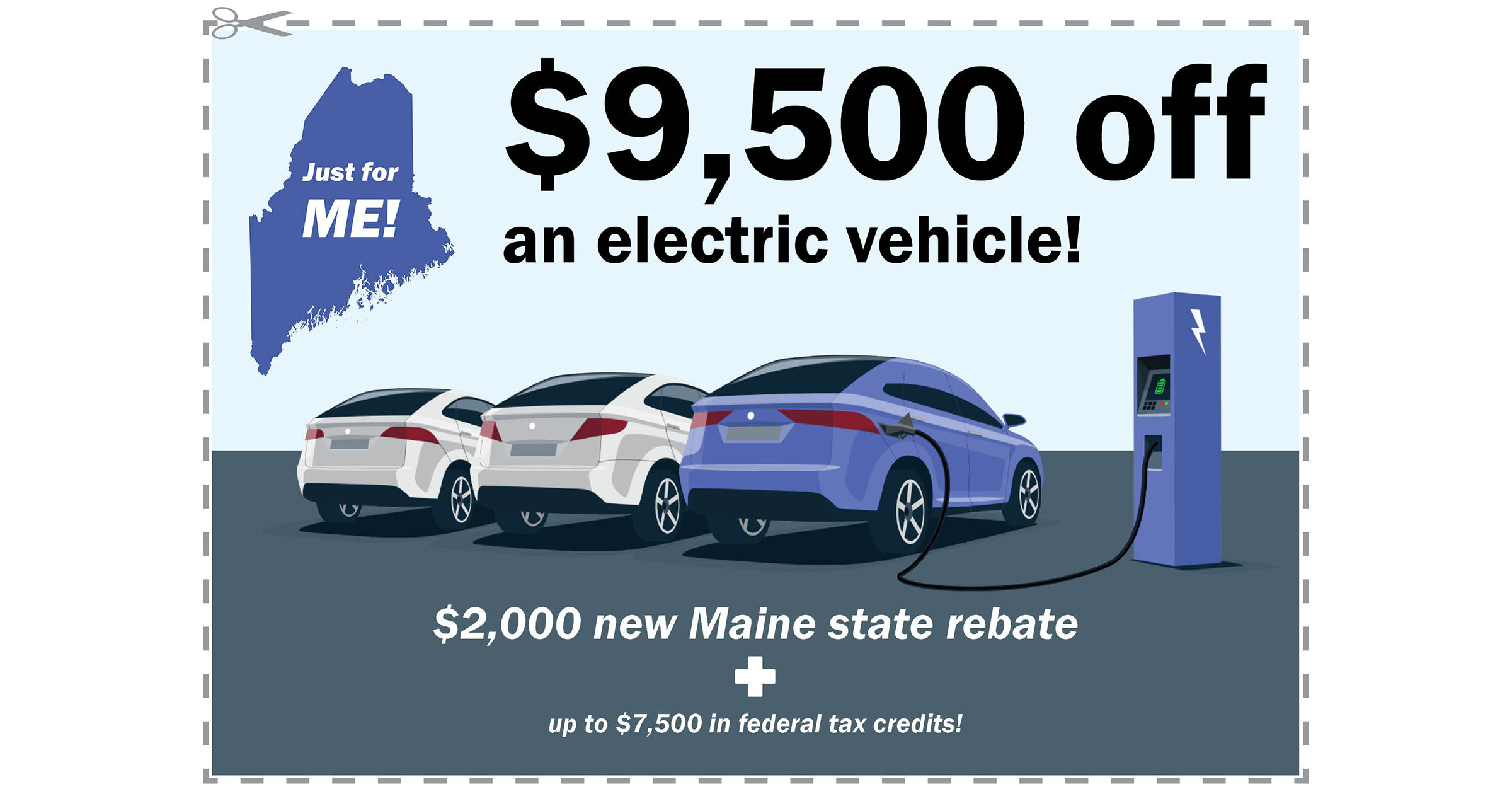

Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit The credit equals 30 of the sale price up to a maximum credit of 4 000 How to claim Car Loan tax benefit Claiming Car Loan tax benefits is easy as long as you are actually using the car for legitimate business purposes For claiming the benefit at the time of filing tax returns include the loan interest paid in a year in the business expenses column

A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an A deduction of up to Rs 1 50 000 for interest payments is available under Section 80EEB Whether an individual taxpayer possesses an electric vehicle for personal or business use this deduction allows for the claiming of interest paid on the vehicle loan

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

How To Claim A Tool Tax Rebate Claim Tax Back On Tools Brian Alfred

https://brianalfred.co.uk/wp-content/uploads/2017/03/Tool-tax-rebate.jpg

https://www.tatacapital.com › blog › loan-for-vehicle › ...

To get a tax rebate on car loan you have to list the car loan interest paid as a business expense For this you can request your lender to issue an interest certificate indicating the amount paid as interest on the car loan to enjoy tax savings

https://cleartax.in › tax-benefits-on-personal-loan

Additionally personal loans usually have a short repayment term and low eligibility criteria making them easy to obtain Many individuals question whether there are any tax benefits associated with personal loans and in this article we ll address that query

Tips To Finding Tax Rebates Without The Hassle

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Tax Rebate Service No Rebate No Fee MBL Accounting

How To Fill Form 10 E For Income Tax Rebate On Arrears Paid

Section 87A Tax Rebate Under Section 87A

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

Electric Vehicle Rebates Now Available In Maine NRCM

Income Upto Rs 5 Lakh To Get Full Tax Rebate FactsToday

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Any Tax Rebate On Car Loan - 3 ways to get a car with your tax refund There are a few ways you can fund a tax return car purchase Depending on your current financial situation determine which route is best for you