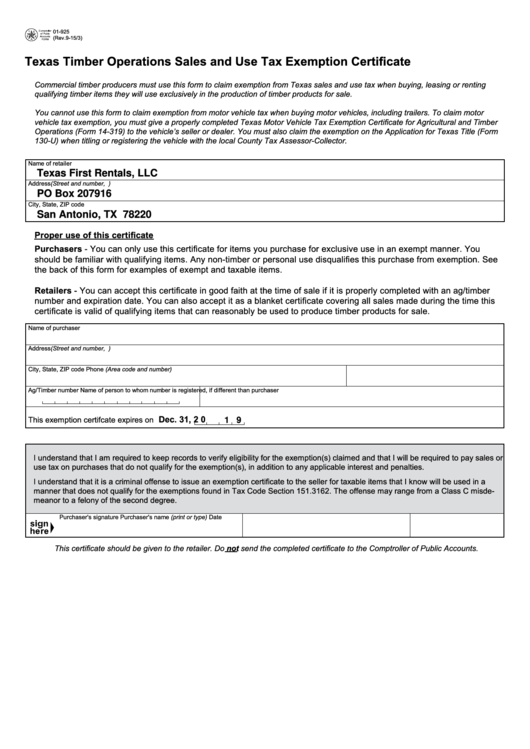

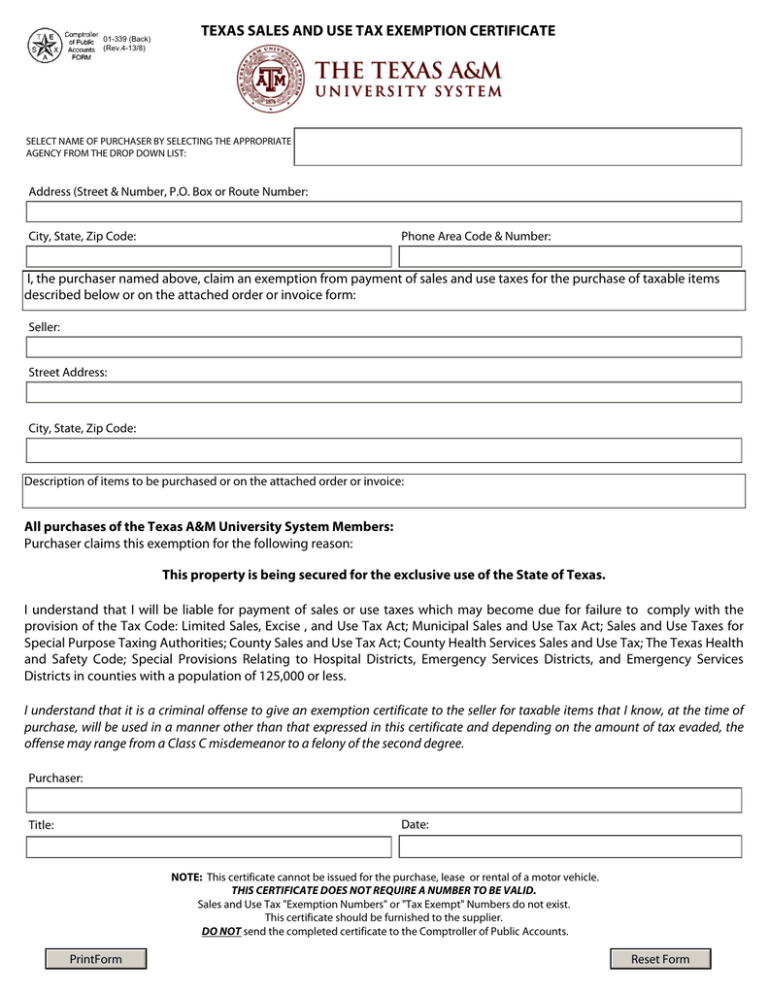

Are 501c3 Exempt From Sales Tax In Texas The Texas Tax Code provides an exemption from franchise tax and sales tax to Nonprofit organizations with an exemption from Internal Revenue Service IRS under IRC Section

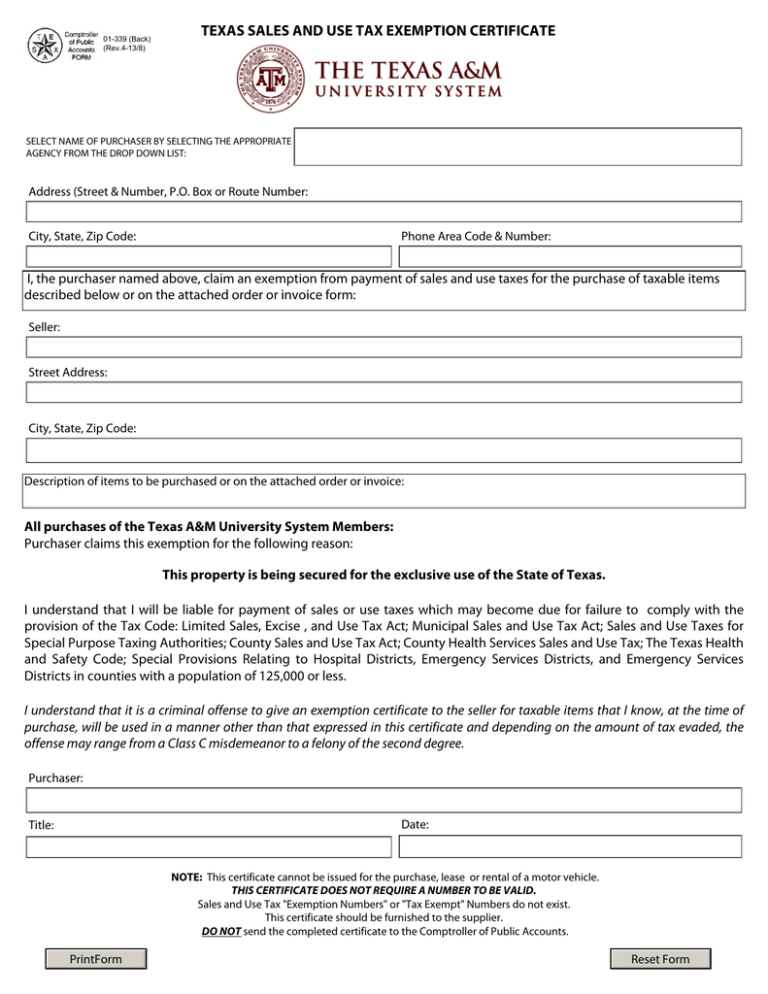

An approved Form AP 207 provides exemption from Texas sales tax hotel tax and state franchise corporate tax A Texas nonprofit organization whether a corporation or an unincorporated association is not automatically exempt from federal or state taxes To become

Are 501c3 Exempt From Sales Tax In Texas

Are 501c3 Exempt From Sales Tax In Texas

https://www.exemptform.com/wp-content/uploads/2022/08/texas-sales-and-use-tax-exemption-certificate.png

501c3 Certificate Certificates Templates Free

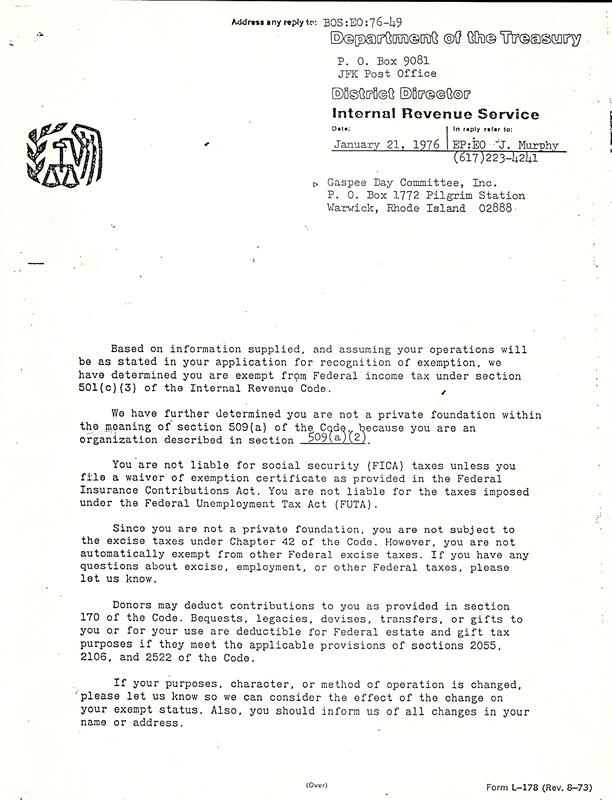

http://www.certificatestemplatesfree.com/wp-content/uploads/2018/01/501c3-certificate-irs501c3-jVFMCR.jpg

Sales Tax Exemption Request Letter Malayagif

https://groupraise.zendesk.com/hc/article_attachments/360002290207/IRS_Tax_Exempt_Letter-Examples.jpg

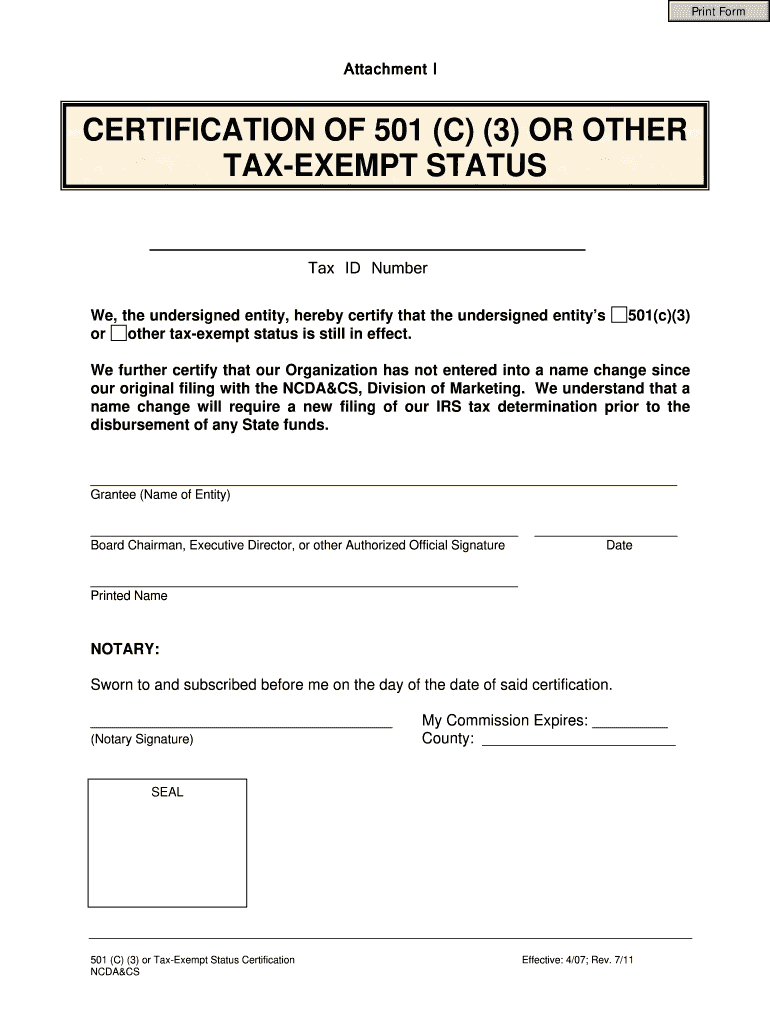

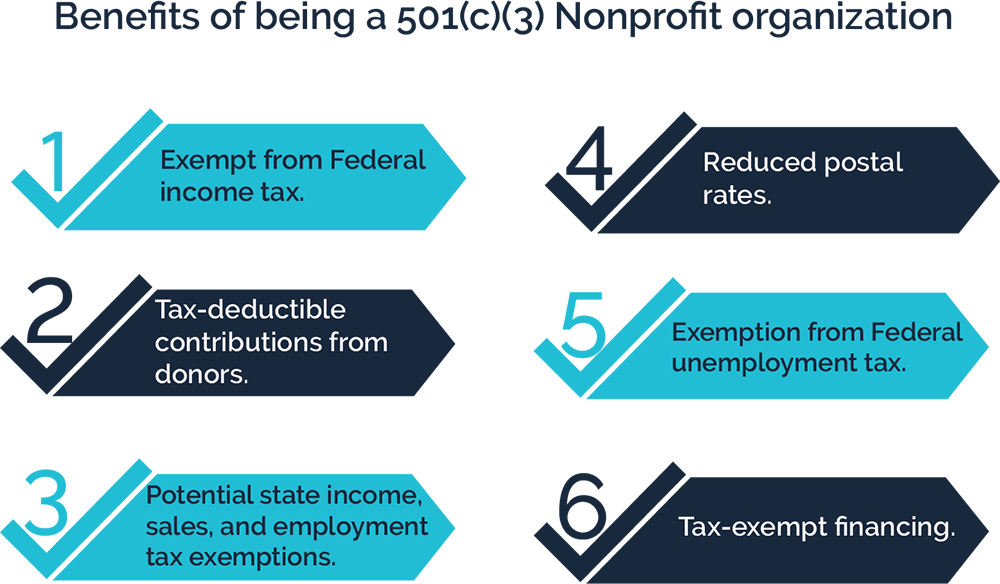

ANSWER Any 501 c organization can potentially be required to pay sales tax QUESTION Which nonprofit organizations are exempt from paying sales tax Tax Federal Taxes IRS Charities Nonprofits page To attain a federal tax exemption as a charitable organization your certificate of formation must contain a required purpose

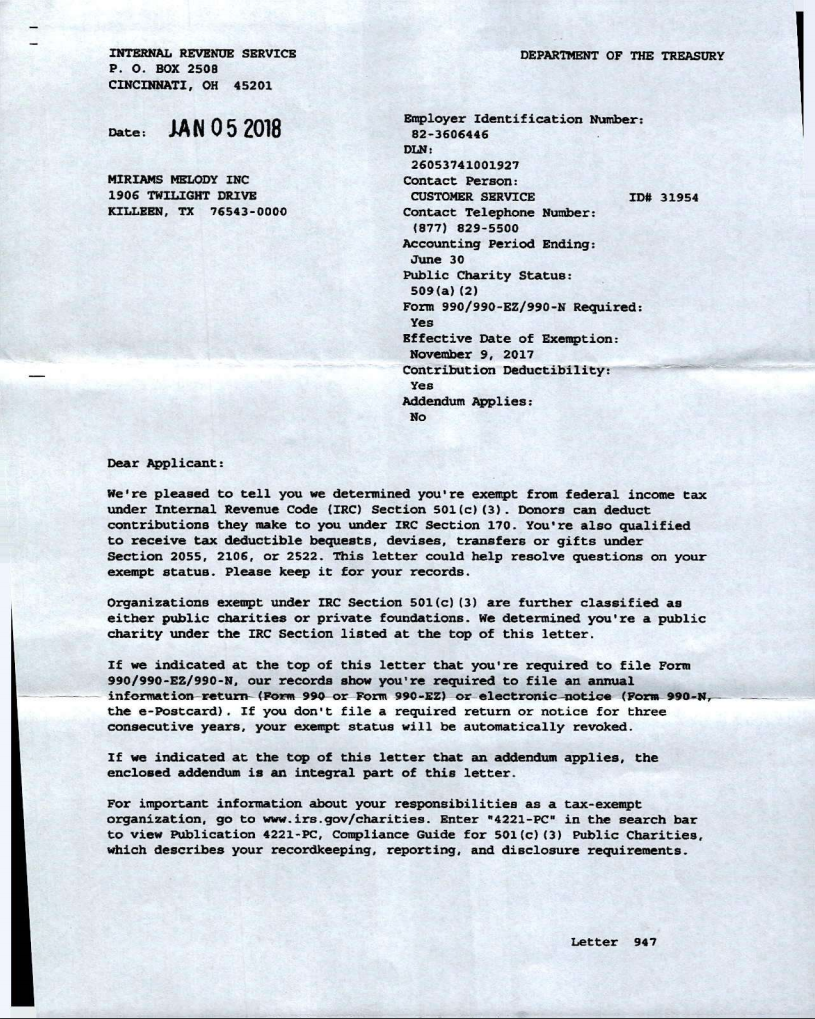

If your organization has been granted IRS 501c status Texas will give you sales tax and franchise tax exemption However you can still apply for your TX tax exemptions Organization for federal tax exempt status and a nonprofit corporation may be subject to certain state taxes depending on its activities This article examines the application of

Download Are 501c3 Exempt From Sales Tax In Texas

More picture related to Are 501c3 Exempt From Sales Tax In Texas

California Sales Tax Exemption Certificate Video Bokep Ngentot

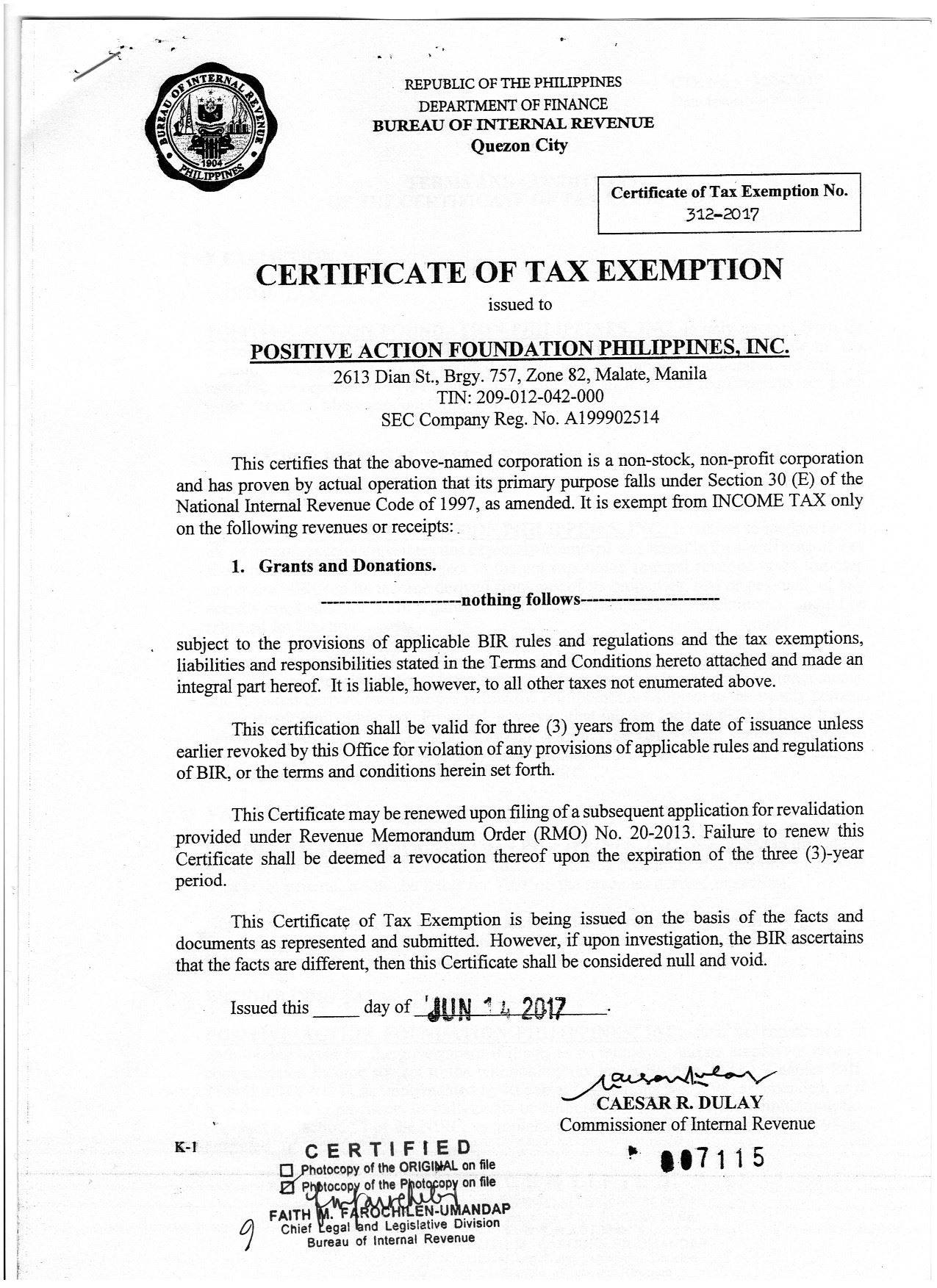

http://pafpi.org/wp-content/uploads/2017/07/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

Part 5 501c3 Tax Exempt Status YouTube

https://i.ytimg.com/vi/FH51KEVmqJA/maxresdefault.jpg

Fillable Texas Timber Operations Sales And Use Tax Exemption

https://data.formsbank.com/pdf_docs_html/135/1359/135919/page_1_thumb_big.png

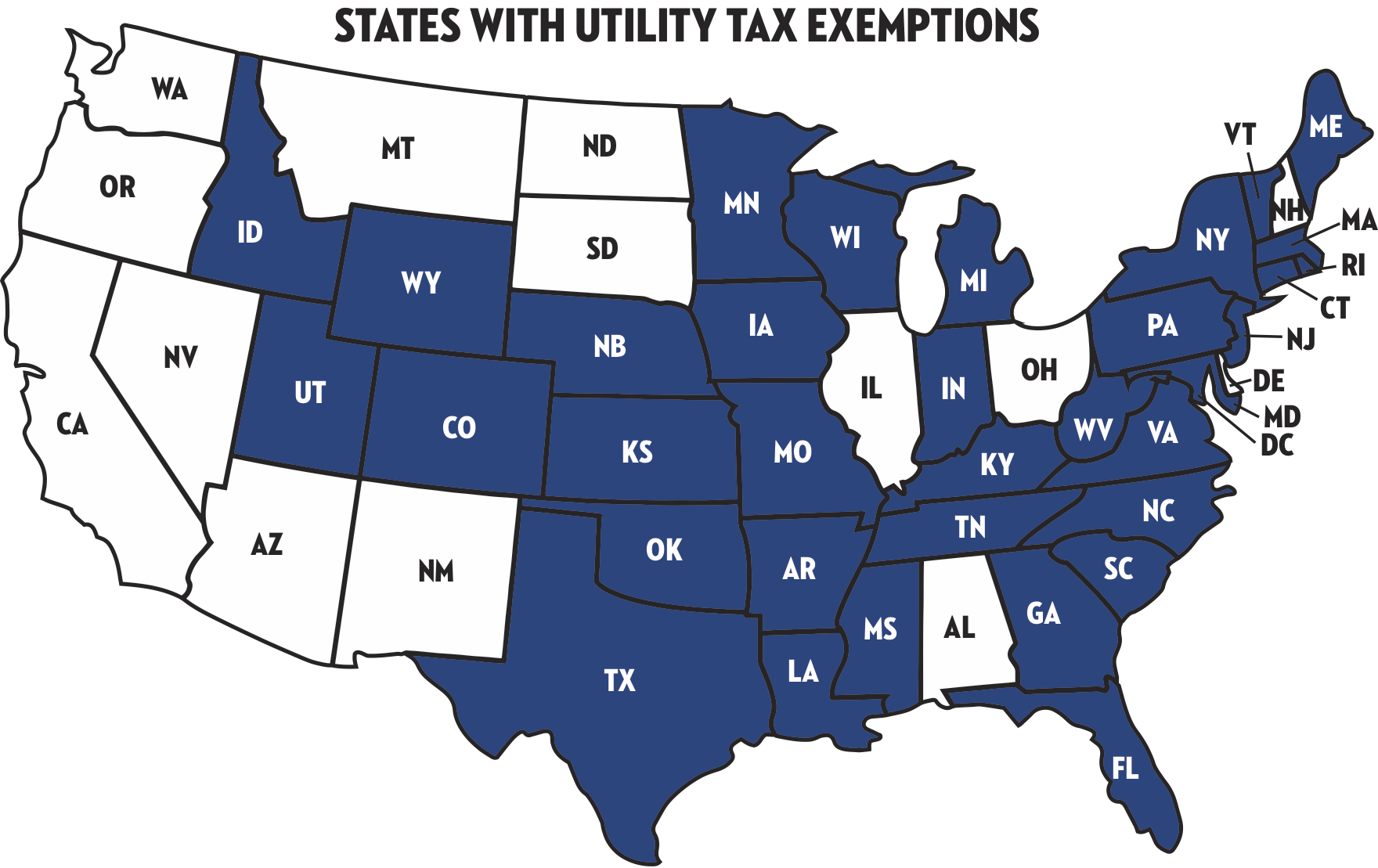

The Texas Tax Code provides tax exemptions for certain qualifying organizations for sales tax hotel occupancy tax and franchise tax The exemptions for which an organization Are 501 c entities exempt from state taxes Certain 501 c organizations can apply for exemption based on their federal exempt status If your entity is exempt under

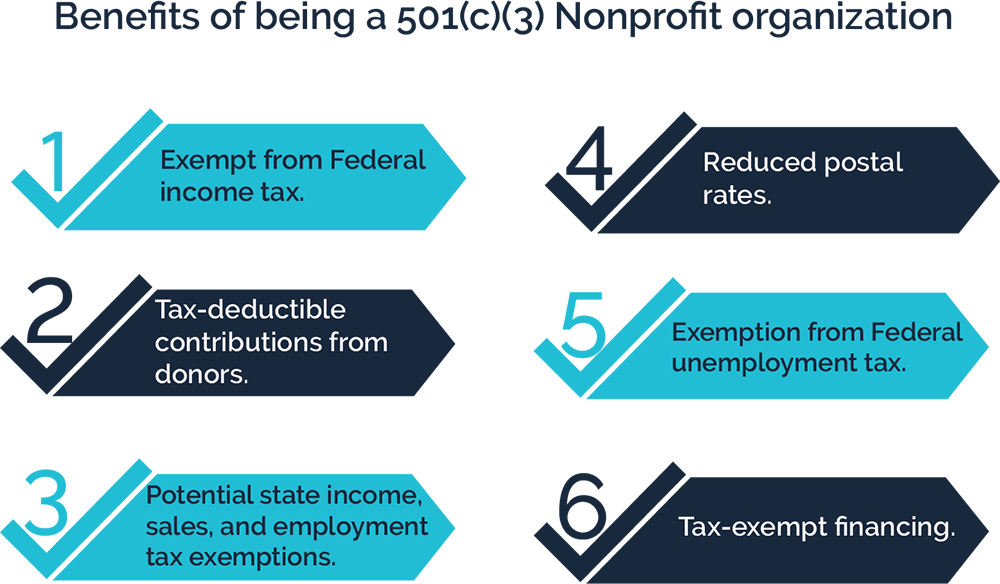

To be tax exempt under section 501 c 3 of the Internal Revenue Code an organization must be organized and operated exclusively for exempt purposes set Not all 501 c 3 entities are automatically exempt from sales and use tax In most states 501 c 3 entities must pay sales tax on their purchases and charge

501c3 Tax Exemption BryteBridge

https://brytebridge.com/wp-content/uploads/2022/03/benefits-of-501c3-1.png

State Tax Exemption Map National Utility Solutions

https://nationalutilitysolutions.com/wp-content/uploads/2019/01/State-Tax-Exemption-Map.png

https://comptroller.texas.gov/taxes/publications/96-1045.php

The Texas Tax Code provides an exemption from franchise tax and sales tax to Nonprofit organizations with an exemption from Internal Revenue Service IRS under IRC Section

https://www.501c3.org/understanding-texas-t…

An approved Form AP 207 provides exemption from Texas sales tax hotel tax and state franchise corporate tax

501c3 Form PDF Fill Out And Sign Printable PDF Template SignNow

501c3 Tax Exemption BryteBridge

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

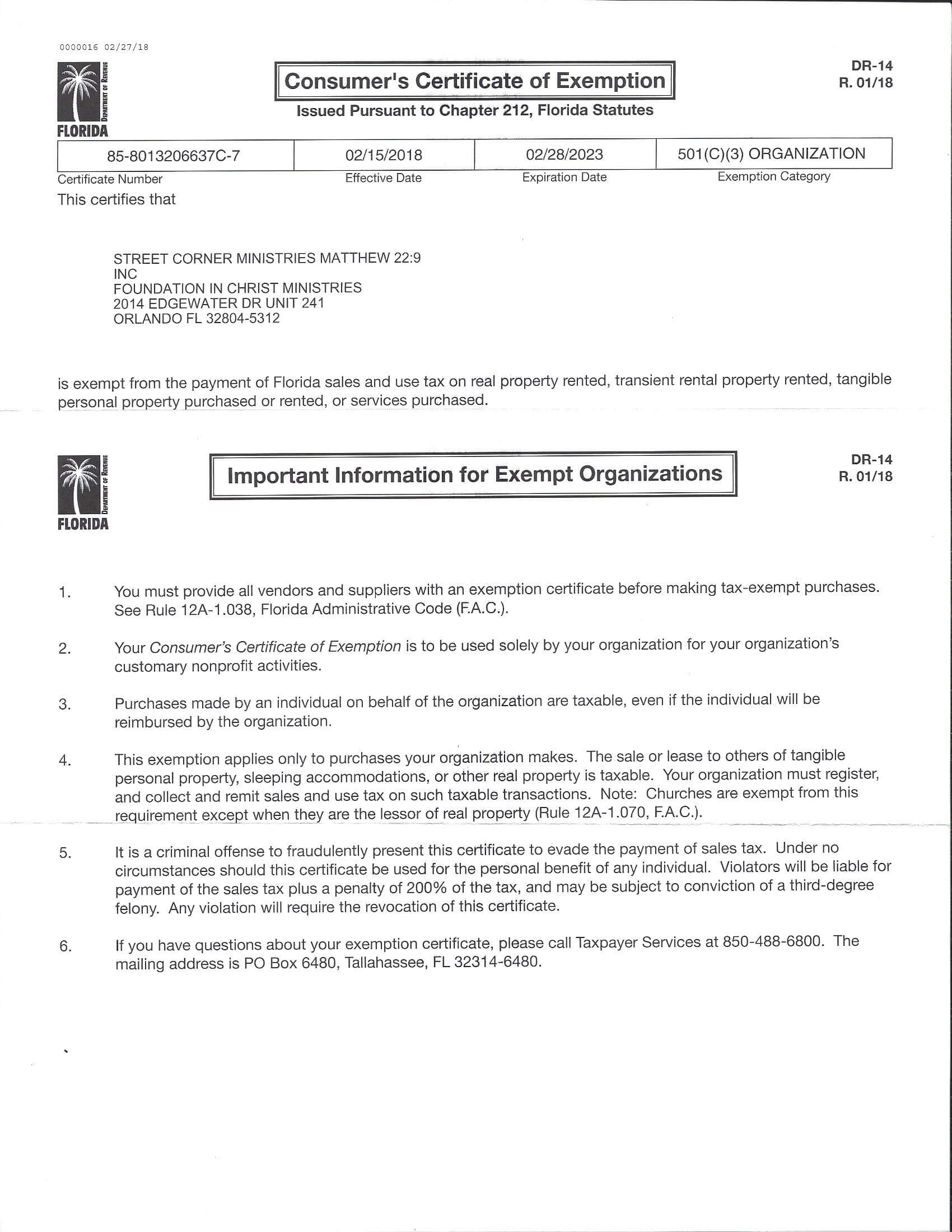

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

Nonprofit Tax Exemptions Harbor Compliance

501 c 3 Tax exempt Charitable Organization Miriams Song

501 c 3 Tax exempt Charitable Organization Miriams Song

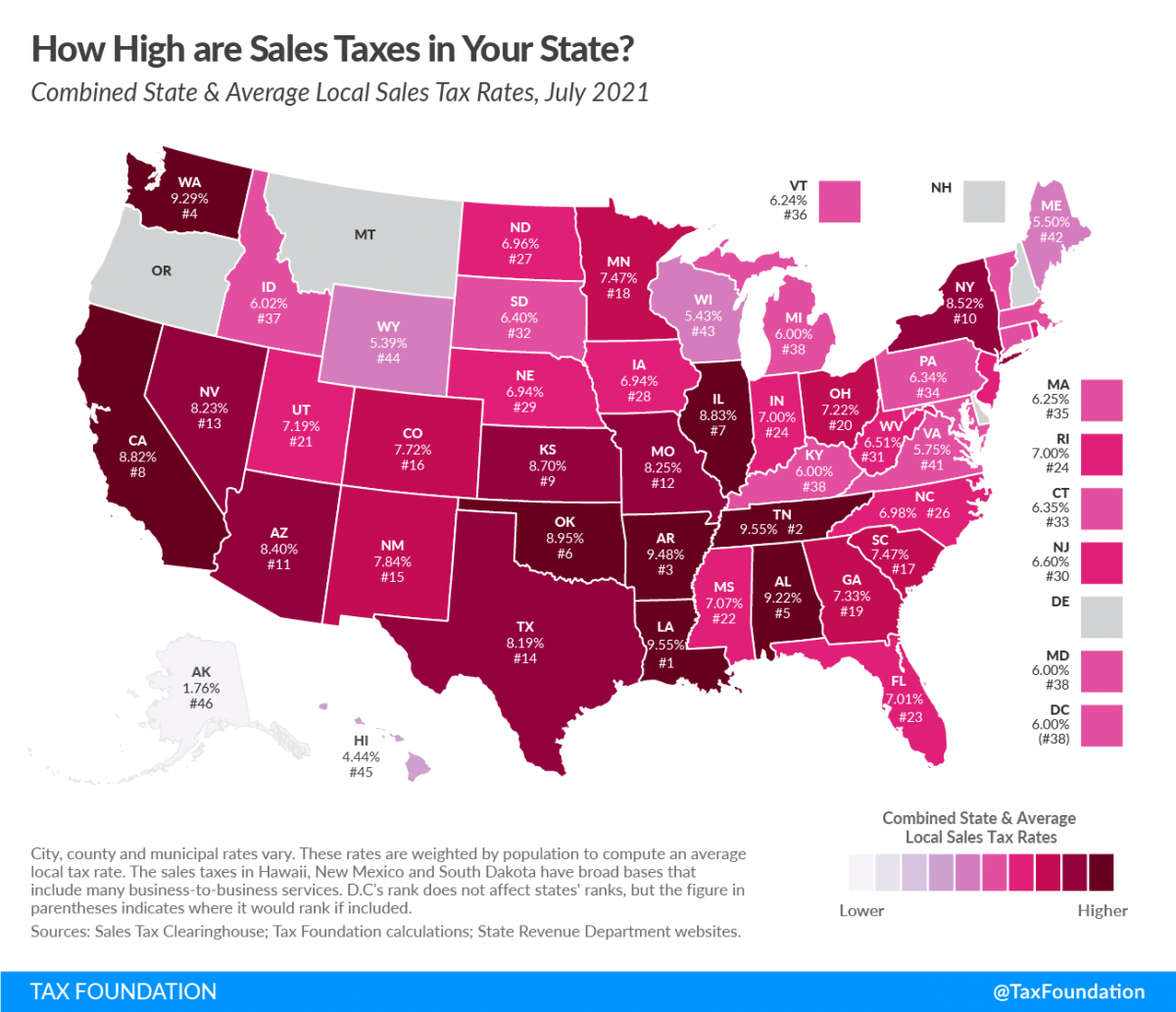

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

Texas Sales Tax Exemption Certificate From The Texas Human Rights

A 501c3 Donation Receipt Template Is Mostly Used By A Non profit

Are 501c3 Exempt From Sales Tax In Texas - Organization for federal tax exempt status and a nonprofit corporation may be subject to certain state taxes depending on its activities This article examines the application of