Are 529 Contributions Tax Deductible In Ca No Tax Deduction While California s 529 plan is a good one California is one of seven states with an income tax system that does not allow tax deductions for contributions There s

Unfortunately the federal government does not allow families to deduct contributions to a 529 plan There is no indication that this rule will change anytime soon Families should note that while the federal government does not reward 529 contributions it does penalize early withdrawals As a 529 Plan ScholarShare 529 provides California families compelling income tax benefits Although contributions are not deductible on your federal tax return any investment earnings can grow tax deferred Tax deferred growth Any earnings can grow 100 tax deferred Tax free withdrawals When used for qualified higher educational

Are 529 Contributions Tax Deductible In Ca

Are 529 Contributions Tax Deductible In Ca

https://file-uploads.teachablecdn.com/ca21a025529949aa88ec354b2bc36ff1/cfea973f79a542cf810a9f5522769ed6

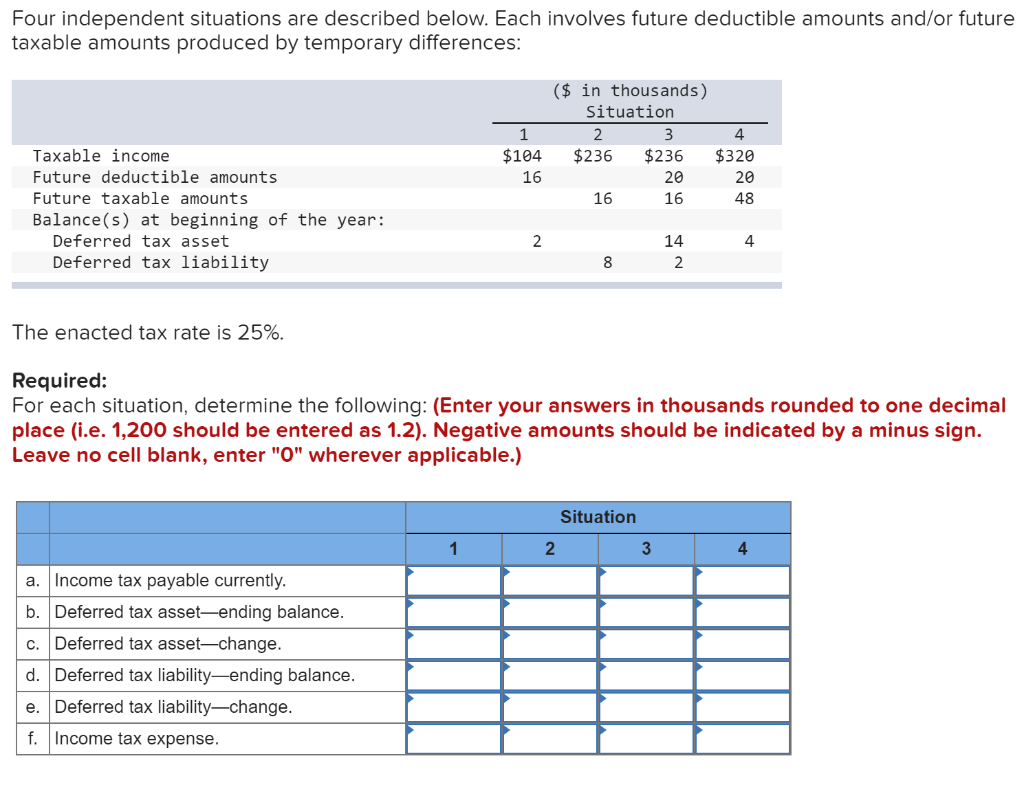

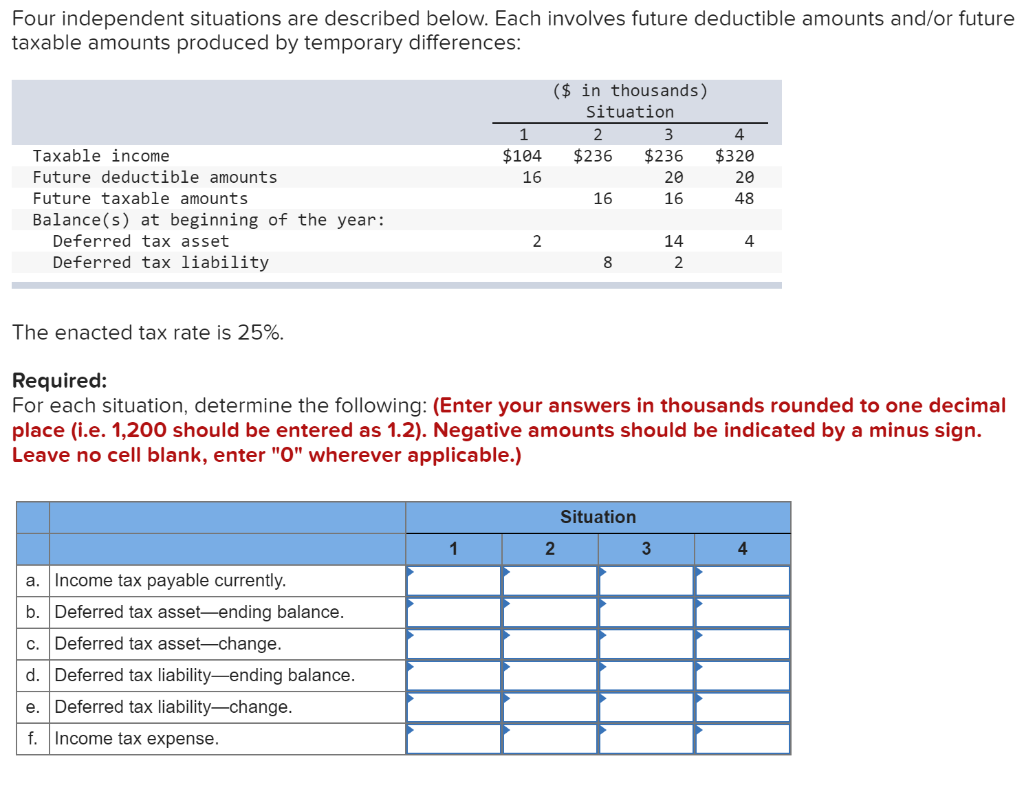

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

Is The NC 529 Plan Tax Deductible CFNC

https://www.cfnc.org/media/sjshnqm0/fafsa-tax-forms.jpg

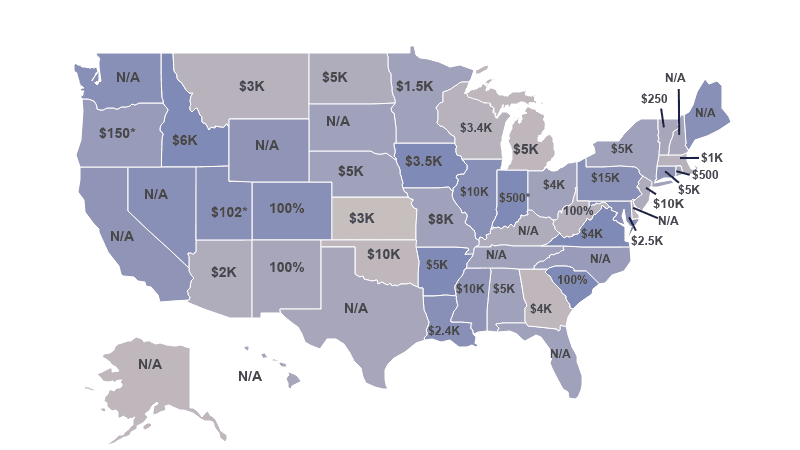

While contributions to California s plan are not deductible at the state or federal level all investment growth is free from state and federal taxes and the earnings portion of withdrawals used for qualified education expenses are Contributions to California 529 plans are not deductible on federal or California state income tax returns California is one of the few states with a state income tax that does not allow state income tax deductions or tax credits on contributions to the state s 529 plans

Contributions to the California 529 plan are not tax deductible on state income tax returns California is one of eight states that have a state income tax but which do not offer a tax deduction or tax credit based on contributions to the state s 529 plan Seven states have no state income tax Was this article helpful Most states do set 529 max contribution limits somewhere between 235 000 and 529 000 Contributions may trigger gift tax consequences if you earmark more than the gift tax exclusion

Download Are 529 Contributions Tax Deductible In Ca

More picture related to Are 529 Contributions Tax Deductible In Ca

How To Reduce Virginia Income Tax

https://static.wixstatic.com/media/753bc4_54233880b95140b6b722381f7064e880~mv2.jpg/v1/fill/w_1000,h_843,al_c,q_90,usm_0.66_1.00_0.01/753bc4_54233880b95140b6b722381f7064e880~mv2.jpg

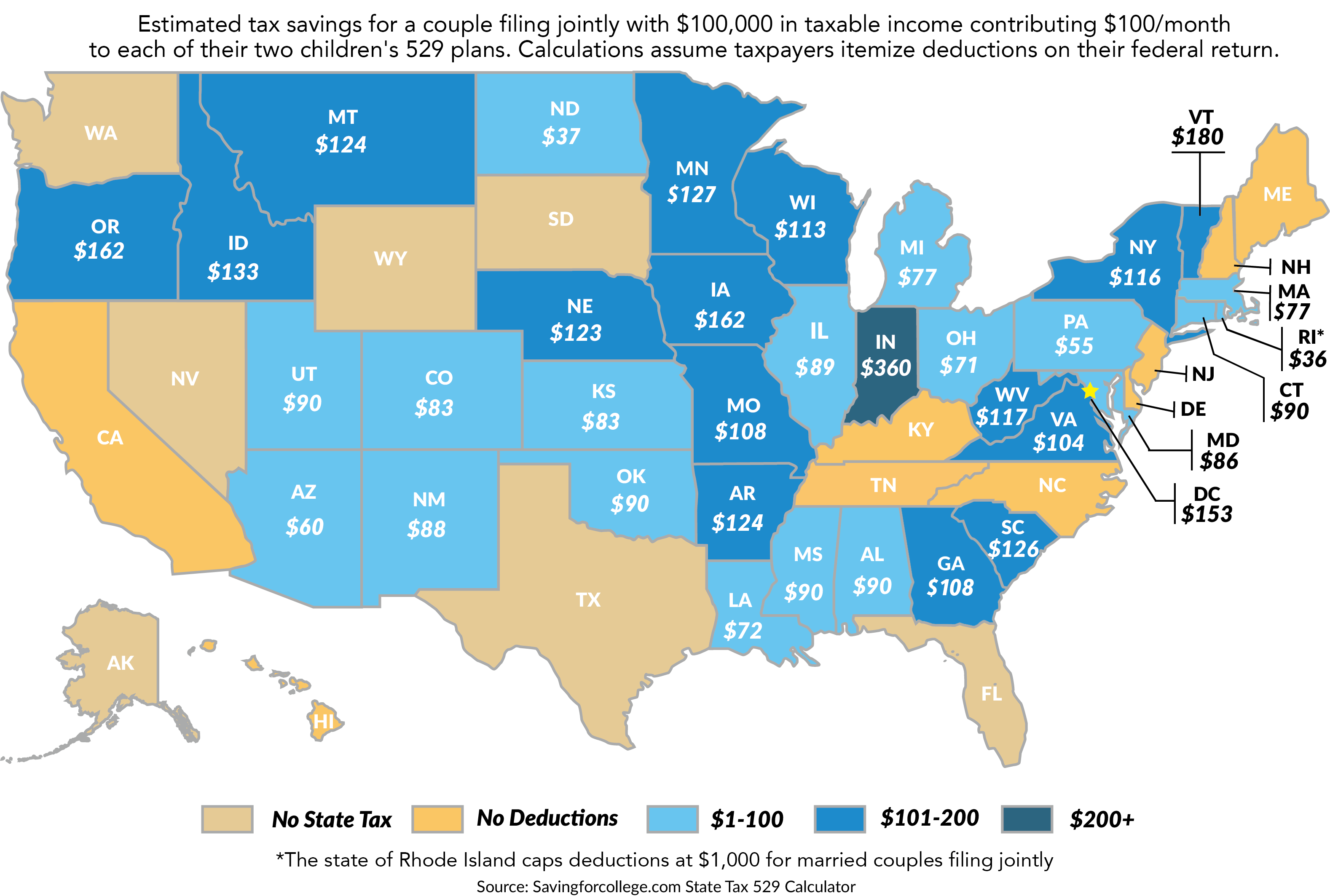

If You Use Your 529 College Savings Plan For This You May Get A Tax

https://sc.cnbcfm.com/applications/cnbc.com/resources/files/2018/04/04/original-state-map-2017-12.png

Are Oklahoma 529 Contributions Tax Deductible Diamond Carranza

https://www.invesco.com/content/dam/invesco/education-savings/en/landing-page/LNDG-HRO-Tax-advantages.jpg

529 plan contributions aren t typically tax deductible but they are exempt from federal and state taxes when used for qualified higher education expenses tuition room and board textbooks or other expenses related to secondary education enrollment California conforms with modifications to Section 529 Plans as of the specified date of January 1 2015 as they relate to tax exempt qualified tuition programs California modifies the additional 10 percent tax on excess distributions to instead be an additional tax of 2 5 percent for state purposes

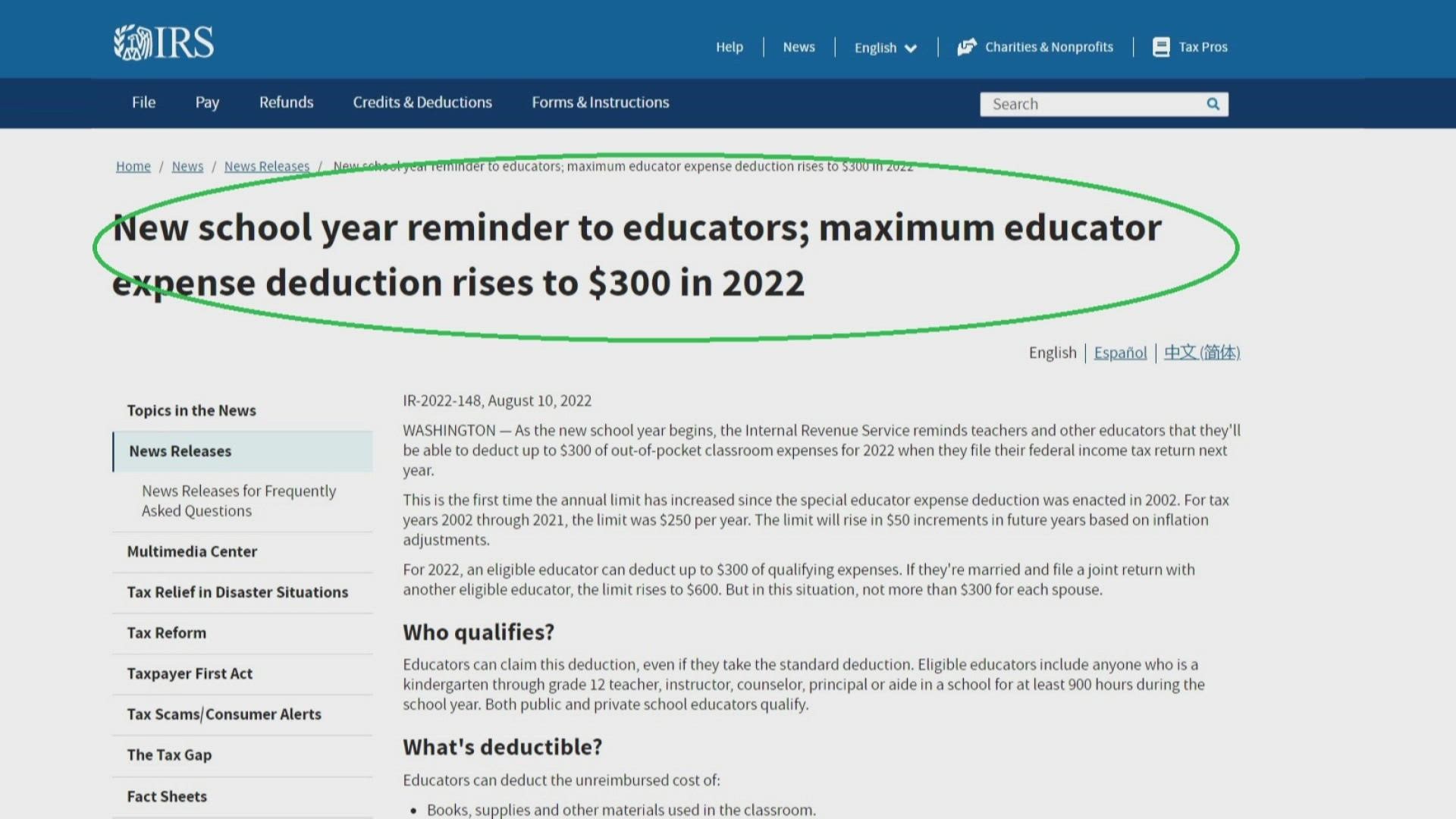

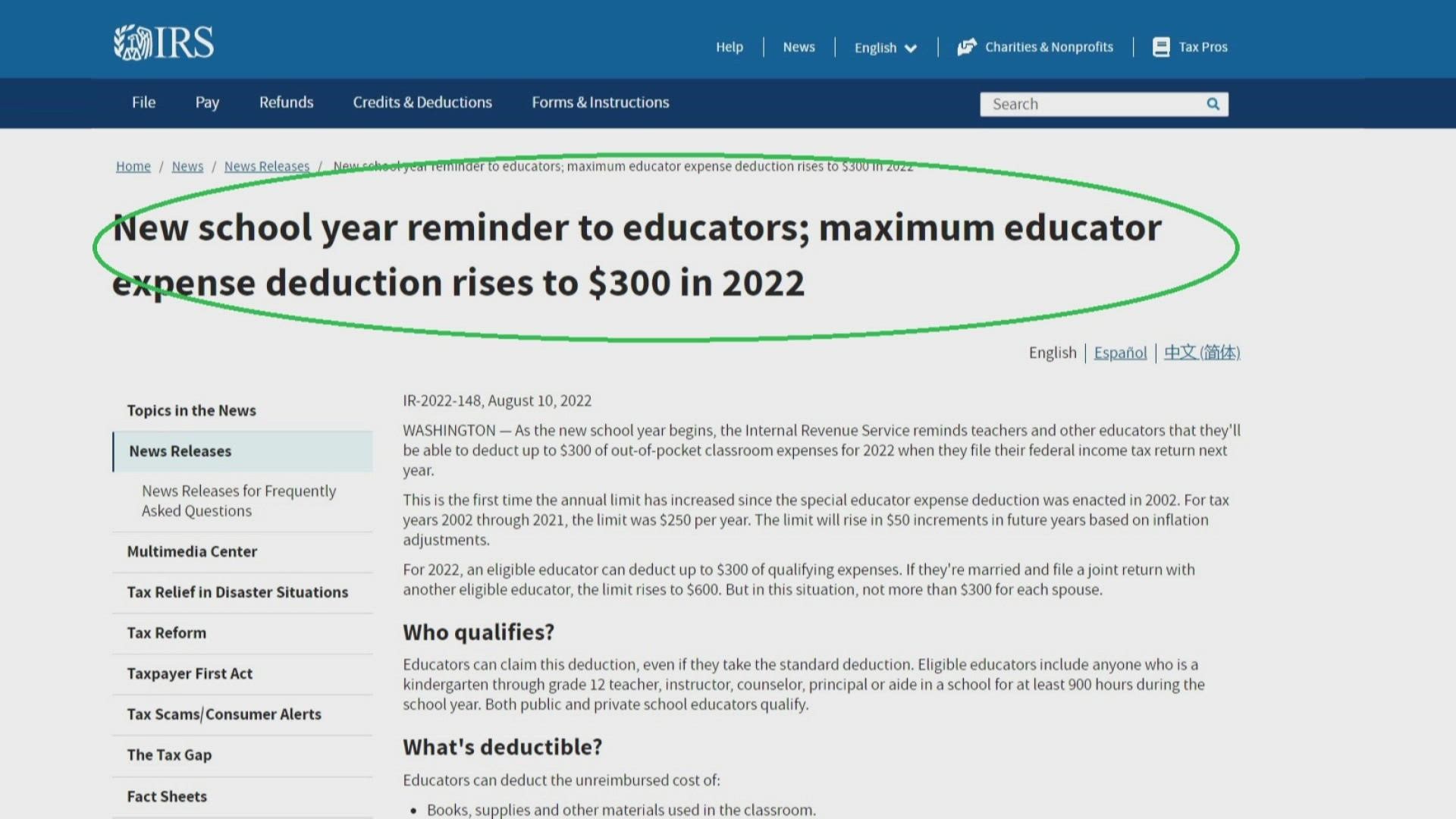

Contributions are not tax deductible for federal income tax purposes but amounts earned in the account i e interest accumulate on a tax free as described in IRC section 529 Also known as California s college savings plan and California s 529 plan 5 On or before July 31 of each calendar year after the year beginning January 1 2019 But currently there is no federal 529 tax deduction available There are however some other tax breaks associated with education expenses that you may be eligible for For instance the student loan interest deduction allows you to deduct interest paid toward eligible student loans

Tax Education Edelman Financial Engines

https://s7d9.scene7.com/is/image/financialengines/WEB_ED-tax-filing-after-death?ts=1695673118997&dpr=off

529 Tax Deduction

https://uploads-ssl.webflow.com/5f9e3058e3ecc6040724fa97/62b42763a1415814fdde9d3e_image4.png

https://finance.zacks.com/california-allow-deduct...

No Tax Deduction While California s 529 plan is a good one California is one of seven states with an income tax system that does not allow tax deductions for contributions There s

https://collegefinance.com/saving-for-college/tax...

Unfortunately the federal government does not allow families to deduct contributions to a 529 plan There is no indication that this rule will change anytime soon Families should note that while the federal government does not reward 529 contributions it does penalize early withdrawals

Are Oklahoma 529 Contributions Tax Deductible Diamond Carranza

Tax Education Edelman Financial Engines

California 529 Plans Tax Benefit Good Paying Jobs Self Made

Are 529 Contributions Tax Deductible Avidian Wealth Solutions

Which Charitable Contributions Are Tax Deductible Buy Side From WSJ

School Supplies Are Tax Deductible Wfmynews2

School Supplies Are Tax Deductible Wfmynews2

Letter Of Donation To Charity Collection Letter Template Collection

2023 Dcfsa Limits 2023 Calendar

Nj 529 Plan Tax Benefits Tiffaney Bernal

Are 529 Contributions Tax Deductible In Ca - Contributions to the California 529 plan are not tax deductible on state income tax returns California is one of eight states that have a state income tax but which do not offer a tax deduction or tax credit based on contributions to the state s 529 plan Seven states have no state income tax Was this article helpful