Alabama Tax Rebate 2024 Status 2024 Alabama Tax Season Kicks Off Alabama Department of Revenue NOTICE Mandatory Electronic Filing MONTGOMERY Tax Season 2024 is set to begin on January 29 with a filing deadline for individual income tax returns of April 15 ALDOR offers these tips to

The amount of the rebate is based on your 2021 tax year filing status 150 for single head of family or married filing separate 300 for married filing joint Married couples who filed joint 2021 Individual Income Tax returns will receive one rebate for 300 How will I receive my rebate Published Dec 5 2023 at 5 22 AM PST BIRMINGHAM Ala WBRC The Alabama Department of Revenue has commenced the distribution of rebates offering 150 for individuals and 300 for joint filers The distribution process began on December 1 2023 providing a financial boost to eligible residents just in time for the holiday season

Alabama Tax Rebate 2024 Status

Alabama Tax Rebate 2024 Status

https://www.lamansiondelasideas.com/wp-content/uploads/2023/08/Alabama-Tax-Rebate-Checks.jpg

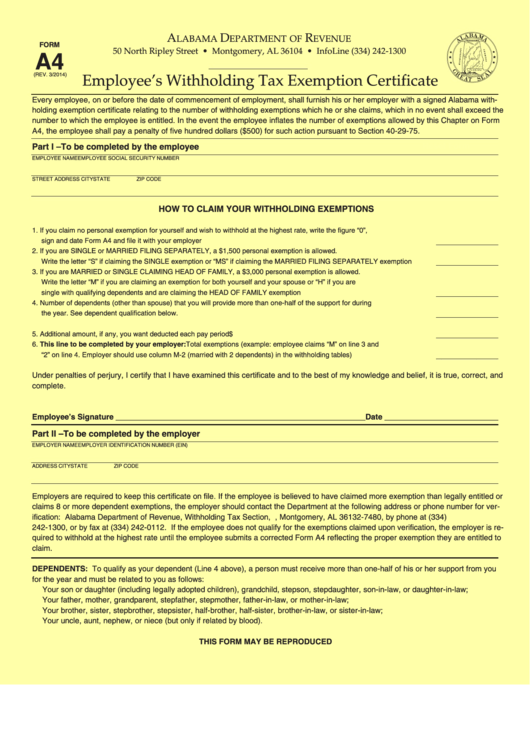

Alabama Form A 4 Employee s Withholding Tax Exemption Certificate 2023 Employeeform

https://i0.wp.com/www.employeeform.net/wp-content/uploads/2022/06/form-a-4-employee-s-withholding-exemption-certificate-alabama-4.png?fit=790%2C1024&ssl=1

/do0bihdskp9dy.cloudfront.net/05-04-2023/t_3d33d21d73fc48eb8f0113091cc09c11_name_file_1280x720_2000_v3_1_.jpg)

Alabama Senate Passes One Time Tax Rebate Of 100 Per Filer

https://gray-wsfa-prod.cdn.arcpublishing.com/resizer/0hyZYK6Ed8k2DOup7Kk8IN7_Rww=/1200x600/smart/filters:quality(85)/do0bihdskp9dy.cloudfront.net/05-04-2023/t_3d33d21d73fc48eb8f0113091cc09c11_name_file_1280x720_2000_v3_1_.jpg

Find out if you will receive one here Published 11 29 am Tuesday November 28 2023 By alabamanow Starting on Friday Alabama taxpayers will start receiving a one time tax rebate To qualify for the one time tax rebate taxpayers must have filed a 2021 Individual Income Tax return on or before October 17 2022 ALABAMA TAX REBATE In accordance with Act 2023 377 that was signed into law on June 1 2023 qualified taxpayers will receive a one time refundable income tax credit to partially offset the amount of sales taxes paid on groceries throughout the tax year

December 6 2023 Press Releases MONTGOMERY Governor Kay Ivey on Wednesday announced that one time tax rebates authorized in her 2023 budget are now on their way to 1 9 million Alabama tax filers Since December 1 which was the start date authorized by law officials have worked around the clock to process the one time tax rebates NOTICE Important Changes to the 2024 Business Privilege Tax Filing Requirements Business Essentials for State Taxpayers B E S T The Alabama Department of Revenue has developed B E S T resources and learning modules to help business owners gain and understand the tax information they need to open and operate a business in Alabama See Resources

Download Alabama Tax Rebate 2024 Status

More picture related to Alabama Tax Rebate 2024 Status

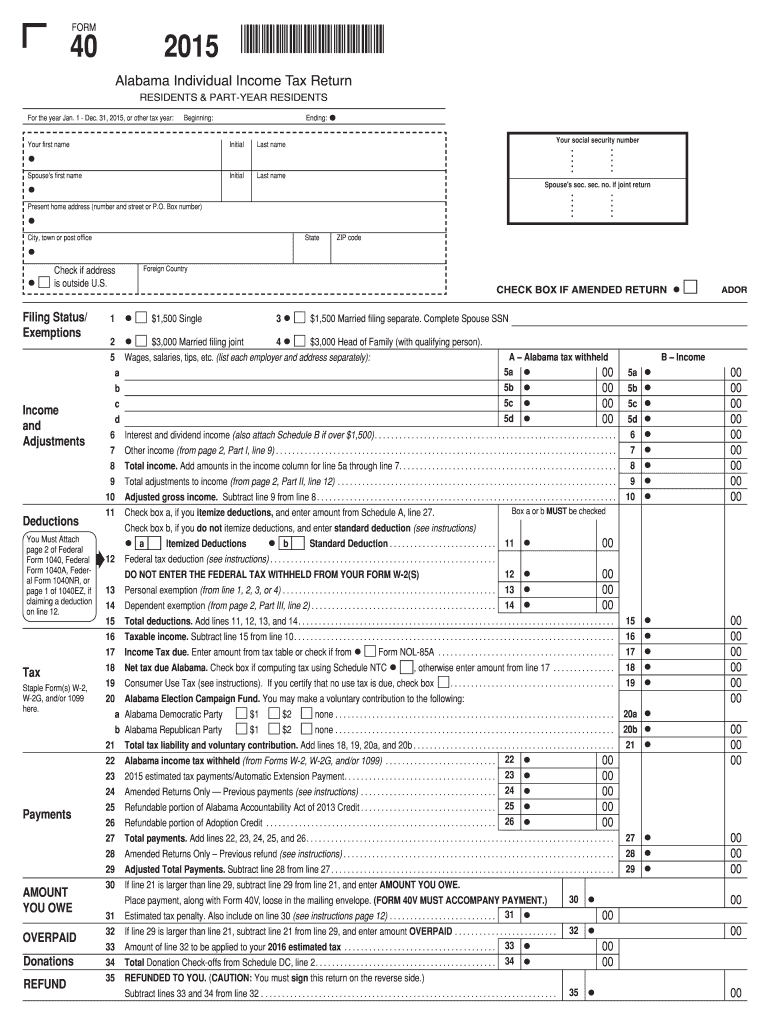

Alabama State Income Tax Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/964/6964211/large.png

Alabama Form A 4 Employee S Withholding Tax Exemption Certificate 2023 Www vrogue co

https://www.employeeform.net/wp-content/uploads/2022/06/fillable-form-a4-alabama-employee-s-withholding-tax-exemption-4.png

Rebuild Alabama Tax Hike Revenue Earns 24 Million Above Initial Estimates

https://optimise2.assets-servd.host/al-news/production/images/Rebuild.jpg?w=1200&h=630&q=82&auto=format&fit=crop&crop=focalpoint&fp-x=0.6193&fp-y=0.4728&dm=1666273312&s=8a826e6bc415edd8e5958782e6983153

The tax rebate will provide 150 to individuals and 300 for couples filing jointly Who will receive the tax rebates The rebates will go to taxpayers who filed a state income tax The Alabama Department of Revenue will start issuing the checks on Nov 30 For those who use direct deposit for their tax refunds the rebates will go to their checking account If there s no

November 1 2023 Press Releases MONTGOMERY Governor Kay Ivey on Wednesday reminded Alabama taxpayers that the one time tax rebates included in her 2023 budget will be on the way beginning December 1 st That s because payment amounts are based on the state filing status of Alabama residents for the 2021 tax year If your filing status was married filing jointly you will receive a 300 tax rebate

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

https://www.revenue.alabama.gov/2024-alabama-tax-season-kicks-off/

2024 Alabama Tax Season Kicks Off Alabama Department of Revenue NOTICE Mandatory Electronic Filing MONTGOMERY Tax Season 2024 is set to begin on January 29 with a filing deadline for individual income tax returns of April 15 ALDOR offers these tips to

https://www.revenue.alabama.gov/individuals/2023-rebate/

The amount of the rebate is based on your 2021 tax year filing status 150 for single head of family or married filing separate 300 for married filing joint Married couples who filed joint 2021 Individual Income Tax returns will receive one rebate for 300 How will I receive my rebate

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Virginia Tax Rebate 2024

You Can Still Apply For 150 Tax Rebate From North Carolina

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Property Tax Rebate Pennsylvania LatestRebate

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Happy Tax Day Forbes Says Alabama Is The 10th Best State For Taxes Yellowhammer News

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Alabama Tax Rebate 2024 Status - Tuscaloosa News 0 00 1 19 Alabama residents soon will begin receiving one time tax rebates of up to 300 The Alabama Department of Revenue will start issuing the payments on Friday by direct