Tax Rebate Under Section 16 Web 27 juil 2023 nbsp 0183 32 Standard deduction is allowed under section 16ia of Income Tax Act The standard deduction replaced transport allowance of Rs 19200 and medical

Web 11 ao 251 t 2023 nbsp 0183 32 Presently the standard deduction under 16 ia allows a tax deduction of 50 000 replacing the medical and transport allowance This deduction does not Web 3 janv 2022 nbsp 0183 32 From YA 2021 a tax rebate section 6D 4 will be provided to resident Companies or Limited Liability Partnerships LLPs hereinafter referred to as Qualifying

Tax Rebate Under Section 16

Tax Rebate Under Section 16

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgg1mtcMN8lDsQjsVVJhm5PJKw1_svbV8AaOBI3NlvXDj1TxJZWirv3xwav1R0NPo_YZwRENM6YzrXDdKkPmd2PyMaMkcAtEgEb5f3AxjVdoVXfwWSiJQSYLmXFNrRTmo5oO4jQTcPbPbGmCKcdP2SRNgUsXjSwCMYylMNOPLh-VKCwLjzC5Q6BoPlZ/s687/FORM 16 PART B.jpg

Tax Rebate Section 87a Of Income Tax In Marathi

https://i.timesnowmarathi.com/stories/IMG_PO23_Rupee_2_1_LS9DTKHI1.jpg?tr=w-600,h-450,fo-auto

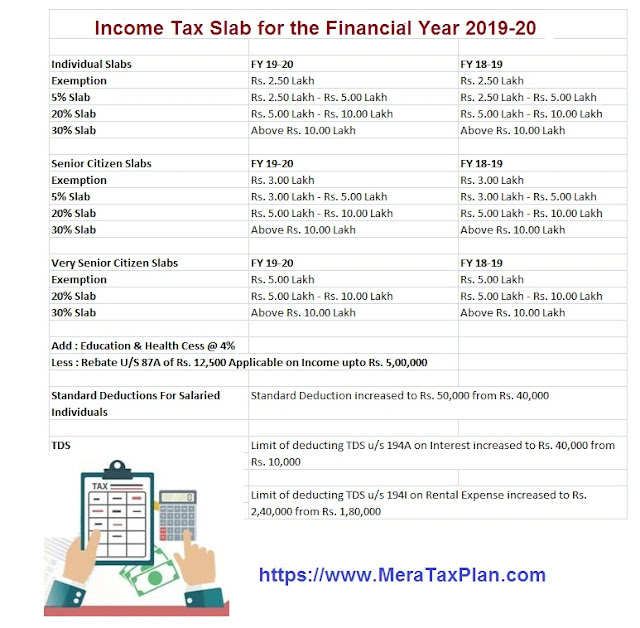

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s640/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

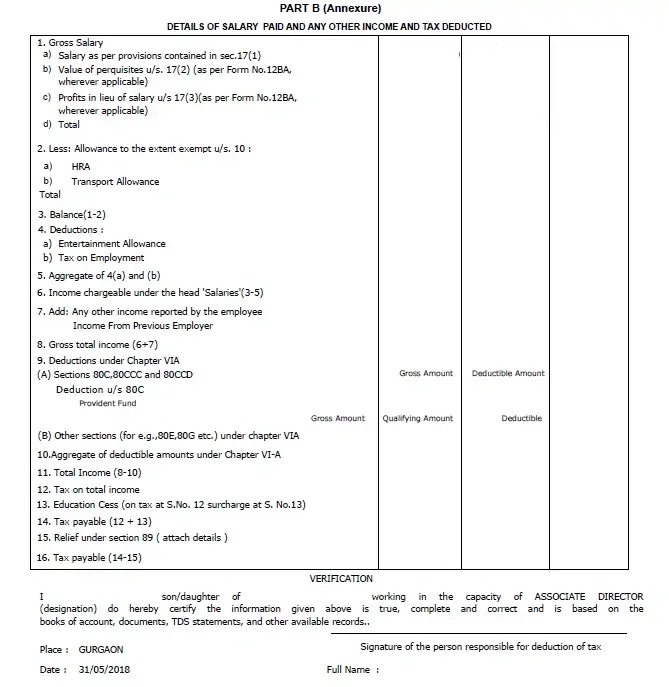

Web 29 mai 2023 nbsp 0183 32 Deduction under section 16 ia states that a taxpayer having income chargeable under the head Salaries shall be allowed a deduction of Rs 50 000 or the Web 2 janv 2023 nbsp 0183 32 Standard Deduction of Section 16 ia Income Tax Act is straight line deductions that individuals can claim against their income to reduce their tax liability Salaried individuals and pensioners can claim a

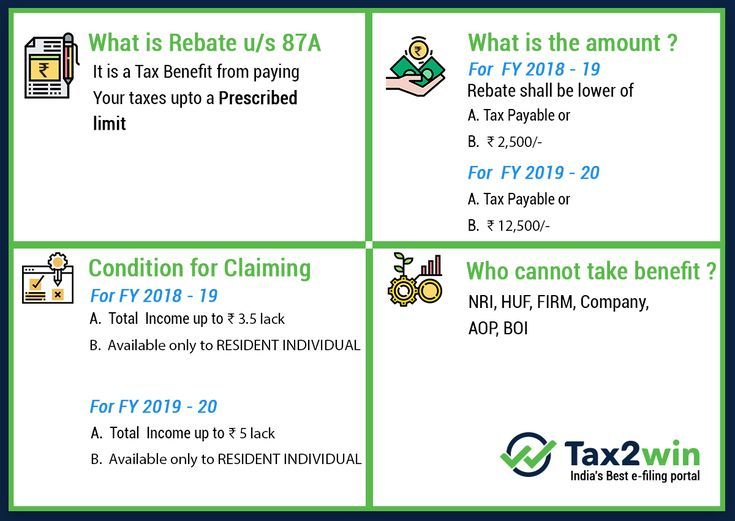

Web 20 juin 2021 nbsp 0183 32 Note 2 A tax rebate under section 87A is allowed to individual taxpayers for a maximum amount of Rs 12 500 if the total income is up to Rs 5 00 000 for AY 2021 22 The amount of rebate Web Now you can apply deductions under section 16 of the Income Tax Act 1961 The maximum deduction allowed is 50000 After computing your income you can also claim

Download Tax Rebate Under Section 16

More picture related to Tax Rebate Under Section 16

Section 87A Tax Rebate Under Section 87A Rebates Financial

https://www.propertyrebate.net/wp-content/uploads/2023/05/section-87a-tax-rebate-under-section-87a-rebates-financial.jpg

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-2KyY6PJRWm4/XePapLA_nLI/AAAAAAAALKQ/0yvvTtxP3XQs24Vse8CqqW6jNqSJBaT8QCNcBGAsYHQ/s1600/Picture%2Bfor%2BTax%2BRebate%2B87A.jpg

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

Web Income tax rebate for new SMEs or Limited Liability Partnerships LLPs Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income Web Currently for the financial year 2021 22 and other years in future the standard deduction from salary income stands at INR 50 000 till it is changed in the future budgets Standard

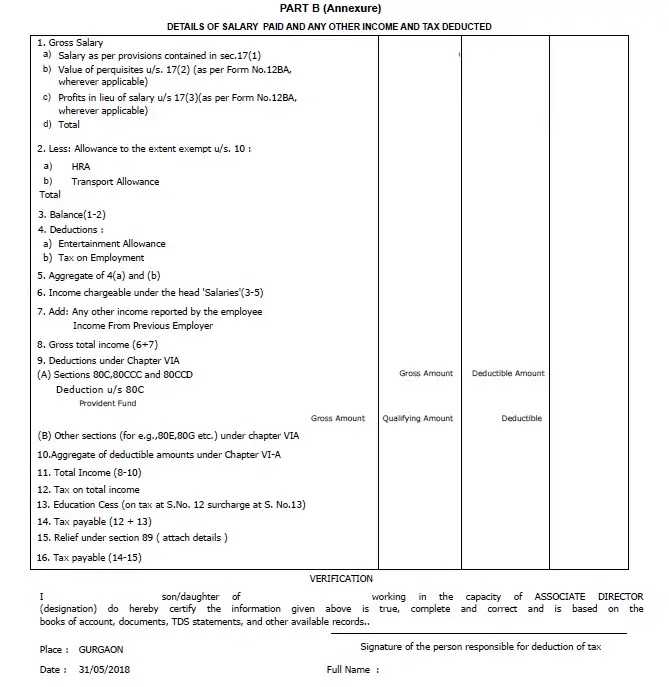

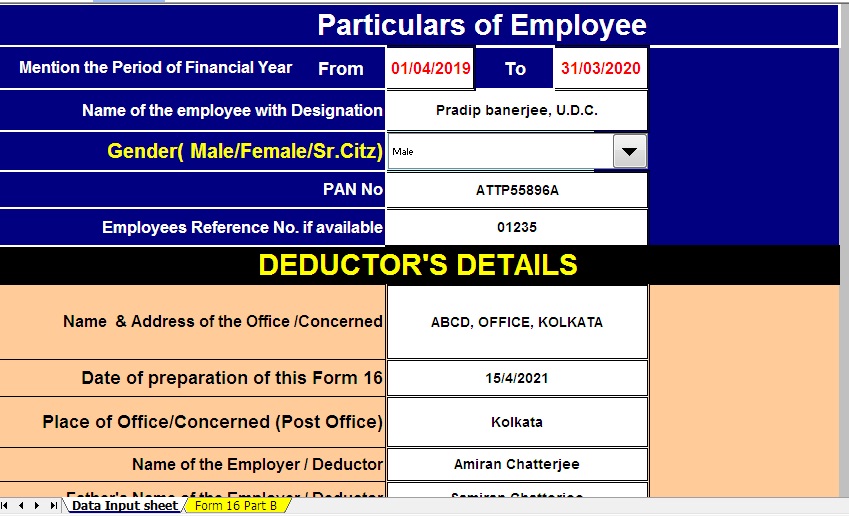

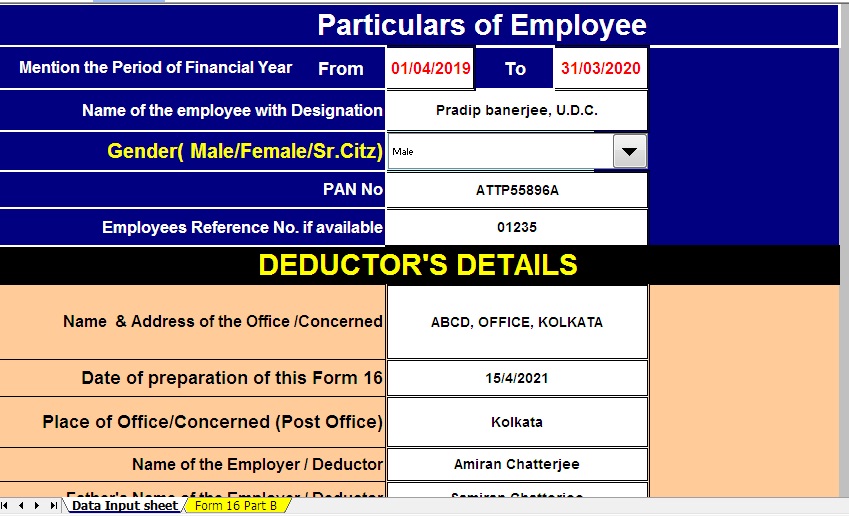

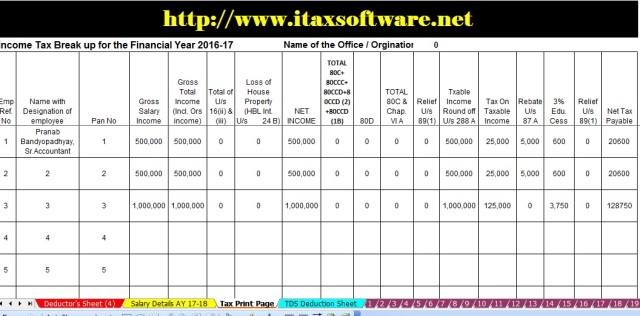

Web 30 juil 2020 nbsp 0183 32 Standard Deduction under section 16 ia has been included this is new provision applicable from FY 18 19 onwards New section 16 ia has been inserted where the standard deduction is allowed while Web This Form validates that the employer has deducted TDS and has deposited the amount to the government on the behalf of employees Form 16 consists of a detailed summary of

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-b2GG3UK8bxk/XePcOJ3sHpI/AAAAAAAALKc/NSDDuJm1F7wv7LveWu-jlbCH8KEKlVC5QCNcBGAsYHQ/s1600/Form%2B16%2BOne%2Bby%2BOne.jpg

Income Below Rs 5 Lakh You May Still Have To Tax Depsite Rebate Under

https://imgk.timesnownews.com/story/1564199754-income_tax_data.jpg?tr=w-600,h-450,fo-auto

https://scripbox.com/tax/section-16

Web 27 juil 2023 nbsp 0183 32 Standard deduction is allowed under section 16ia of Income Tax Act The standard deduction replaced transport allowance of Rs 19200 and medical

https://vakilsearch.com/blog/section-16-of-income-tax-act

Web 11 ao 251 t 2023 nbsp 0183 32 Presently the standard deduction under 16 ia allows a tax deduction of 50 000 replacing the medical and transport allowance This deduction does not

Elevate Your Life

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Education Rebate Income Tested

Income Tax Deductions List FY 2018 19 List Of Important Income Tax

New Tax Regime 2023 24 New Tax Regime 2023 Vs Old Tax Regime How To

New Tax Regime 2023 24 New Tax Regime 2023 Vs Old Tax Regime How To

Theme Presentation1

Income Tax Rebate Hike Rs 5000 Under Section 87A With Automated

What s The Distinction Between PMI And Home Loan Defense Insurance

Tax Rebate Under Section 16 - Web 20 juin 2021 nbsp 0183 32 Note 2 A tax rebate under section 87A is allowed to individual taxpayers for a maximum amount of Rs 12 500 if the total income is up to Rs 5 00 000 for AY 2021 22 The amount of rebate