Housing Loan Tax Rebate Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax

Web 12 juin 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section Web Income tax rebate on home loan Tax deductions Tax deductions for a mortgage loan FY 2022 23 Repayment of a home loan s principal is tax deductible under Section 80C

Housing Loan Tax Rebate

Housing Loan Tax Rebate

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

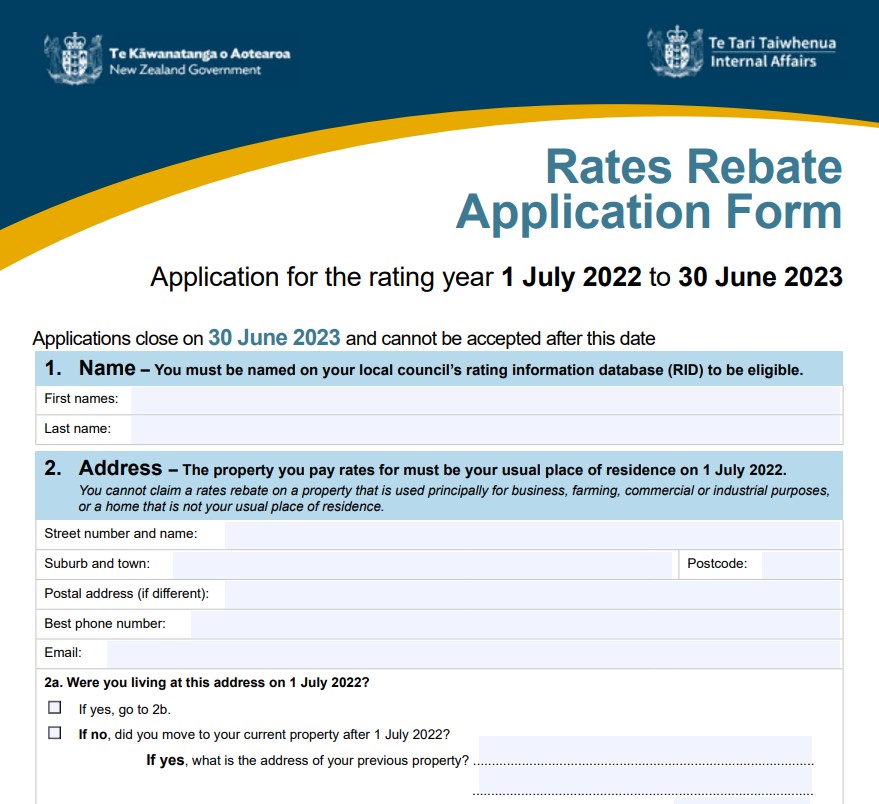

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Web 28 mars 2017 nbsp 0183 32 May 29th 2023 Acquiring a home loan can provide opportunities to save on taxes in accordance with the regulations of the Income Tax Act 1961 The latest Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Web Income Tax Benefits on Home Loans The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to

Download Housing Loan Tax Rebate

More picture related to Housing Loan Tax Rebate

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Web Claim a maximum home loan tax deduction of up to Rs 1 5 lakh from your taxable income on the principal repayment This may include deduction on stamp duty and registration Web 29 ao 251 t 2023 nbsp 0183 32 If you are looking for Housing Loan Tax Rebate you ve come to the right place We have 33 rebates about Housing Loan Tax Rebate including images

Web The total claimed tax rebate is Rs 3 50 000 So the remaining amount is Rs 4 50 000 As we know there is no tax obligation for amount up to Rs 2 50 000 The taxable income will Web 31 mars 2022 nbsp 0183 32 know about home loan Tax benefit Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and tax benefit on

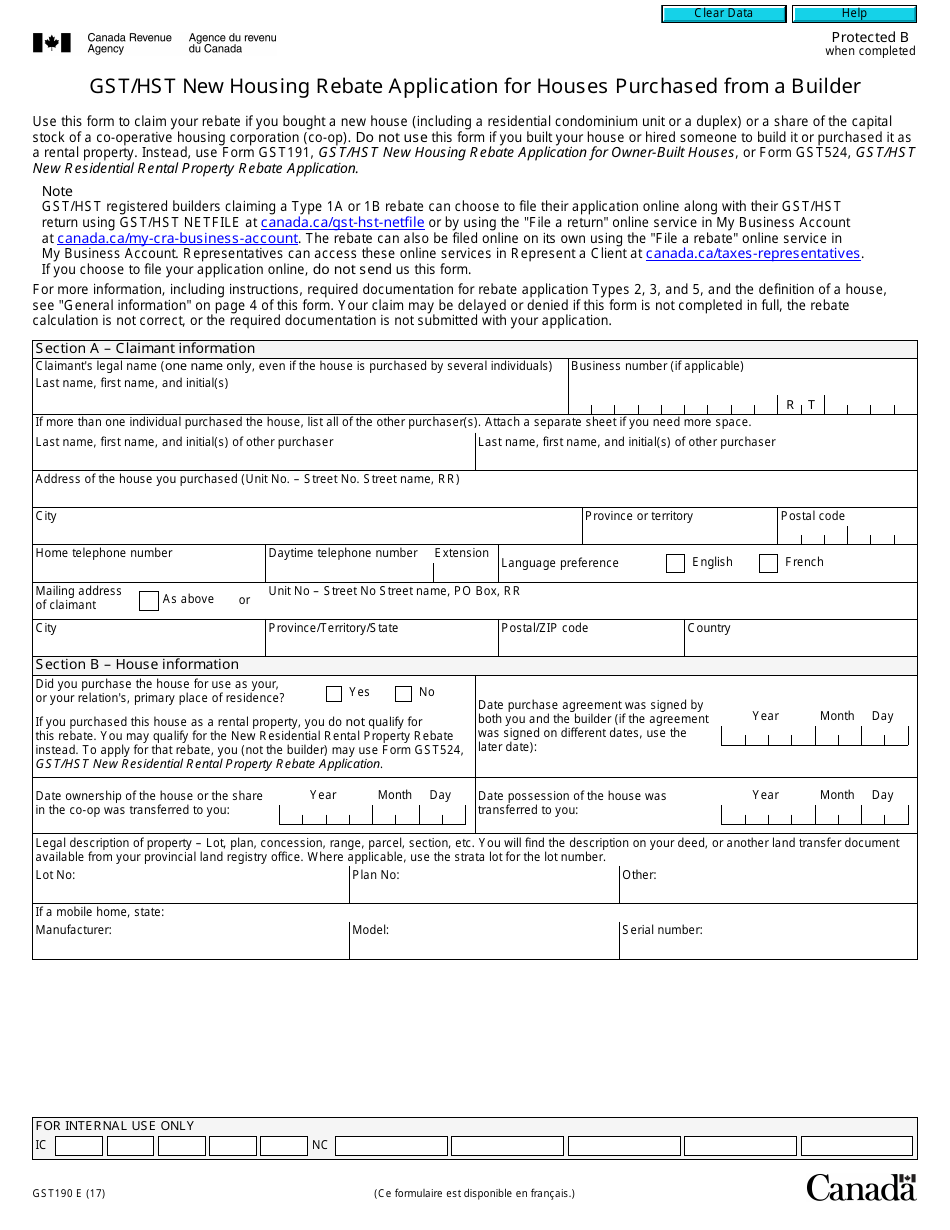

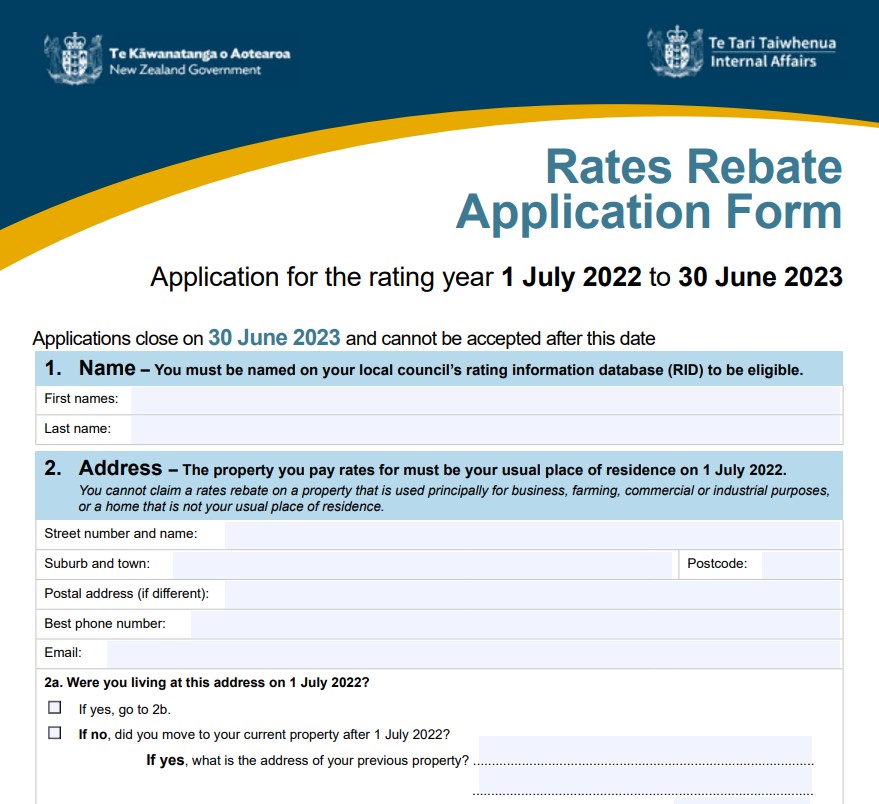

Gst New Housing Rebate Application Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Housing-Rebate-Form-2023.jpg

Ontario New Housing Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-New-Housing-Rebate-Form-768x715.png

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section

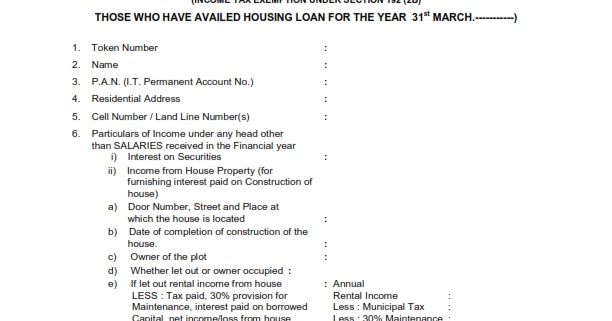

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Gst New Housing Rebate Application Form Printable Rebate Form

Property Tax Rebate Application Printable Pdf Download

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

84 Can You Apply For Housing Benefit Online Page 3 Free To Edit

Evolution Of Tax System Concessions On Home Loans Home Loans Tax

Evolution Of Tax System Concessions On Home Loans Home Loans Tax

Joint Home Loan Declaration Form For Income Tax Savings And Non

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

How Do Banks Determine Home Loan Amounts LOANOLK

Housing Loan Tax Rebate - Web 28 mars 2017 nbsp 0183 32 May 29th 2023 Acquiring a home loan can provide opportunities to save on taxes in accordance with the regulations of the Income Tax Act 1961 The latest