Are 529 Contributions Tax Deductible In Illinois We pay full in state or in district undergraduate tuition and mandatory fees at any Illinois public university or community college in your plan Plus your benefits can be used toward tuition and fees at most Illinois private colleges and even at colleges and universities throughout the country 01 General

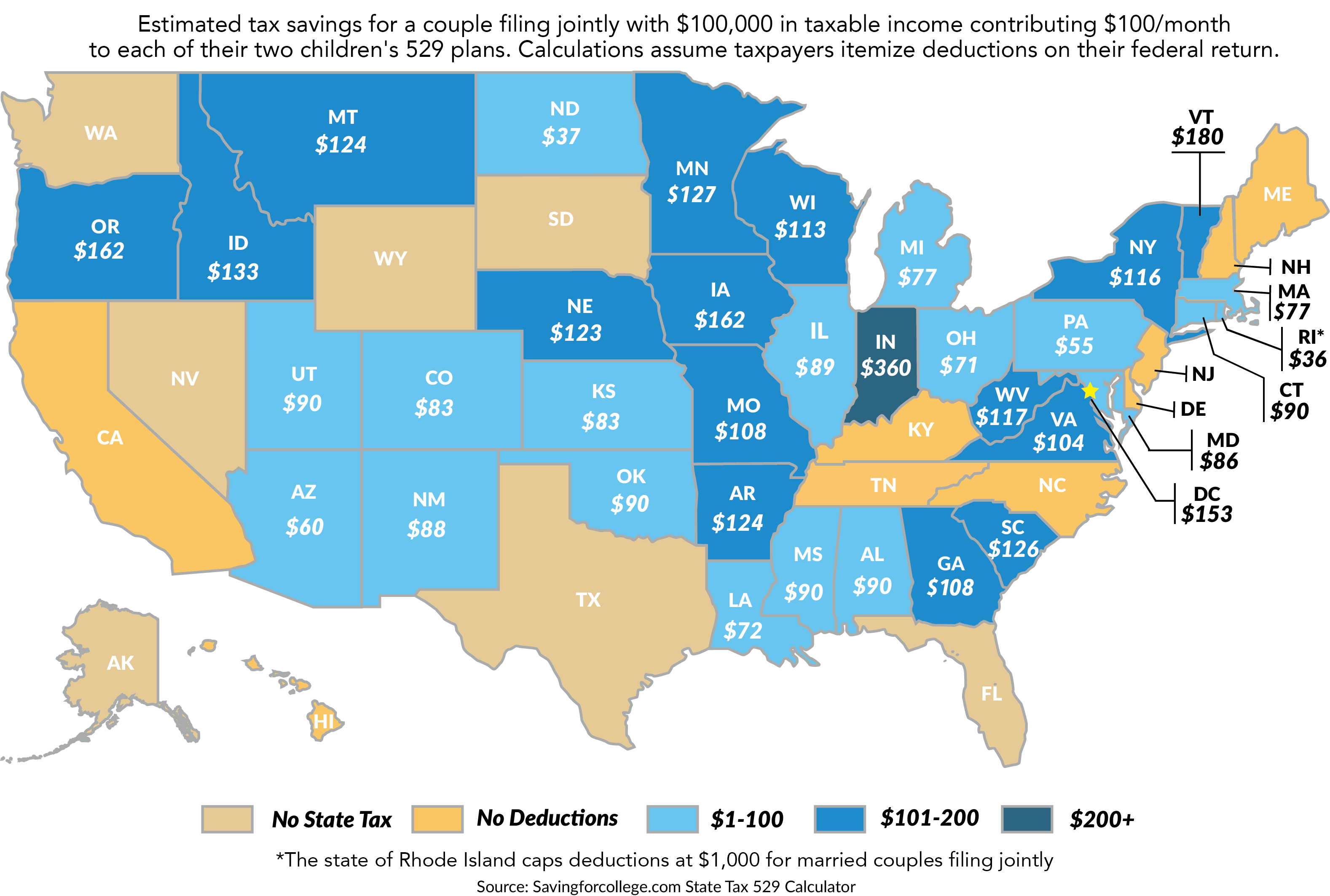

While most states tax deduction rules allow families to subtract 529 contributions from their gross income the rules vary from state to state The chart below provides an overview of the rules in each state Illinois offers a state tax deduction for contributions to a 529 plan of up to 10 000 for single filers and 20 000 for married filing jointly tax filers Bonus Contribution Illinois will automatically deposit 50 into a 529 college savings account for every child born or adopted in

Are 529 Contributions Tax Deductible In Illinois

Are 529 Contributions Tax Deductible In Illinois

https://webresources-savingforcollege.s3.amazonaws.com/images/original-state-map-2017-12.png

529 Plan Advantages College Savings Guide Fiscal Fitness Zone

https://www.fiscalfitnesszone.com/wp-content/uploads/2023/05/1920-save-money-coins-in-grass-jar-with-piggy-bank-and-graduation-cap-business-finance-education-concept-1.jpg

Is Maintenance Tax Deductible After An Illinois Divorce

https://rdklegal.com/wp-content/uploads/2022/07/bigstock-Bag-Of-Money-And-The-Word-Tax-275040682.jpg

Bright Start is among the lowest cost 529 plans in the country and Bright Directions is among the lowest cost advisor sold plans Tax savings Contributions are tax deductible for Illinois taxpayers up to 10 000 for individuals and 20 000 for joint filers and investments grow tax free while in the plan Illinois residents get tax advantages for participating According to the College Savings Plan Network 2 single state residents can deduct their annual contributions to an Illinois 529 plan up to 10 000 Married state residents who

Illinois residents who use an in state 529 plan may deduct up to 10 000 20 000 if married filing jointly of annual contributions from Illinois taxable income Eligible contributions include the principal portion of a rollover contribution As an Illinois taxpayer you ll realize benefits now from starting a Bright Start 529 college savings account Each year you can deduct your contributions to your Bright Start account up to 10 000 per individual taxpayer 20 000 for a married couple filing jointly

Download Are 529 Contributions Tax Deductible In Illinois

More picture related to Are 529 Contributions Tax Deductible In Illinois

Is The NC 529 Plan Tax Deductible CFNC

https://www.cfnc.org/media/sjshnqm0/fafsa-tax-forms.jpg

Are Contributions To A 529 Plan Tax Deductible Sootchy

https://global-uploads.webflow.com/5e7af514190cb858e85adbbe/5f9c2480d8e12e5446ae4d45_shutterstock_1109910923-min.jpg

Hey SLPs Do YOU Know What Is Tax Deductible In Your Private Practice

https://file-uploads.teachablecdn.com/ca21a025529949aa88ec354b2bc36ff1/cfea973f79a542cf810a9f5522769ed6

In short 529 contributions are not tax deductible on the federal level However some states consider contributions tax deductible Defer to your state treasurer for more info Plus 529 plans offer other tax benefits Unlike an IRA contributions to a 529 plan are not deductible and do not have to be reported on federal income tax returns What s more the investment earnings in your account are not reportable until the year they are withdrawn 529 plans save taxpayers billions of dollars on their income taxes

[desc-10] [desc-11]

Are Oklahoma 529 Contributions Tax Deductible Diamond Carranza

https://www.invesco.com/content/dam/invesco/education-savings/en/landing-page/LNDG-HRO-Tax-advantages.jpg

Tax Education Edelman Financial Engines

https://s7d9.scene7.com/is/image/financialengines/WEB_ED-tax-filing-after-death?ts=1695673118997&dpr=off

https://www.collegeillinois.org/HowDoesItWork/FAQs.html

We pay full in state or in district undergraduate tuition and mandatory fees at any Illinois public university or community college in your plan Plus your benefits can be used toward tuition and fees at most Illinois private colleges and even at colleges and universities throughout the country 01 General

https://collegefinance.com/saving-for-college/tax-deduction-rules...

While most states tax deduction rules allow families to subtract 529 contributions from their gross income the rules vary from state to state The chart below provides an overview of the rules in each state

Are 529 Contributions Tax Deductible In Virginia Tax Walls

Are Oklahoma 529 Contributions Tax Deductible Diamond Carranza

529 Tax Deduction

Are Oklahoma 529 Contributions Tax Deductible Diamond Carranza

Are 529 Contributions Tax Deductible Avidian Wealth Solutions

School Supplies Are Tax Deductible Wfmynews2

School Supplies Are Tax Deductible Wfmynews2

Letter Of Donation To Charity Collection Letter Template Collection

Tax Education Edelman Financial Engines

Are 529 Contributions Tax Deductible Student Loan Planner

Are 529 Contributions Tax Deductible In Illinois - [desc-13]