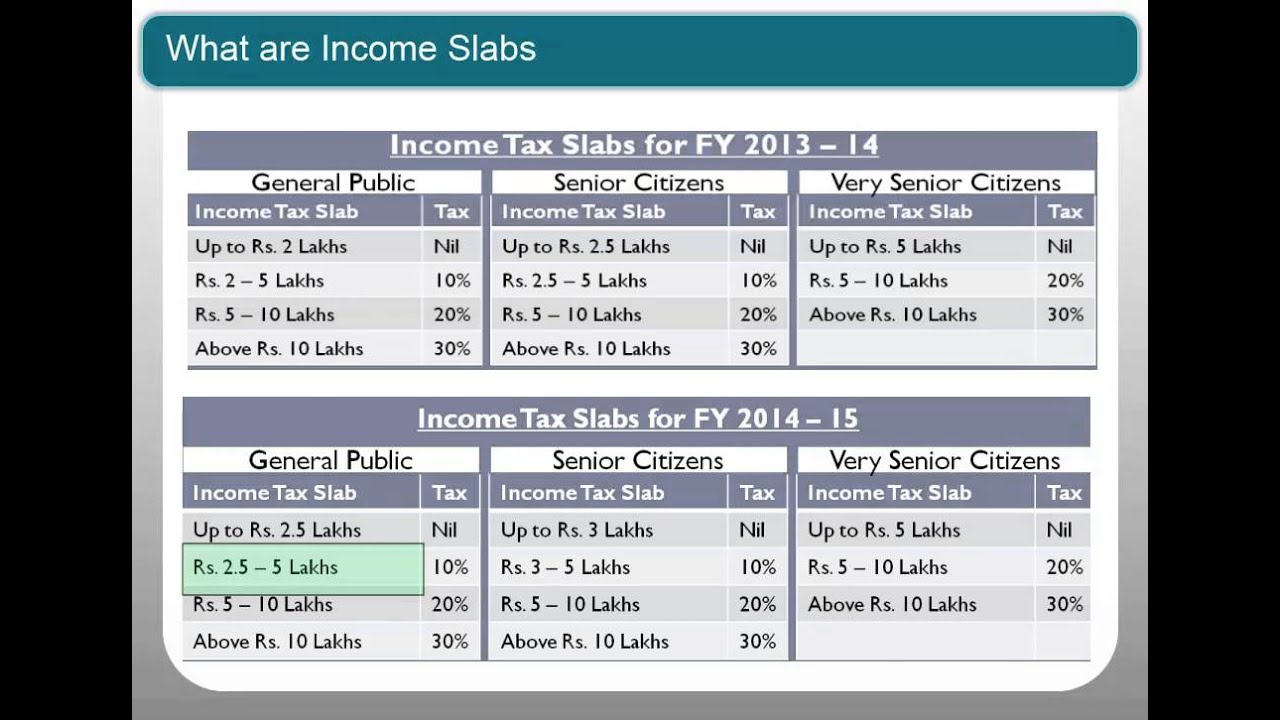

Fixed Deposit Interest Rebate In Income Tax Web 18 janv 2022 nbsp 0183 32 The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable To calculate income tax on interest

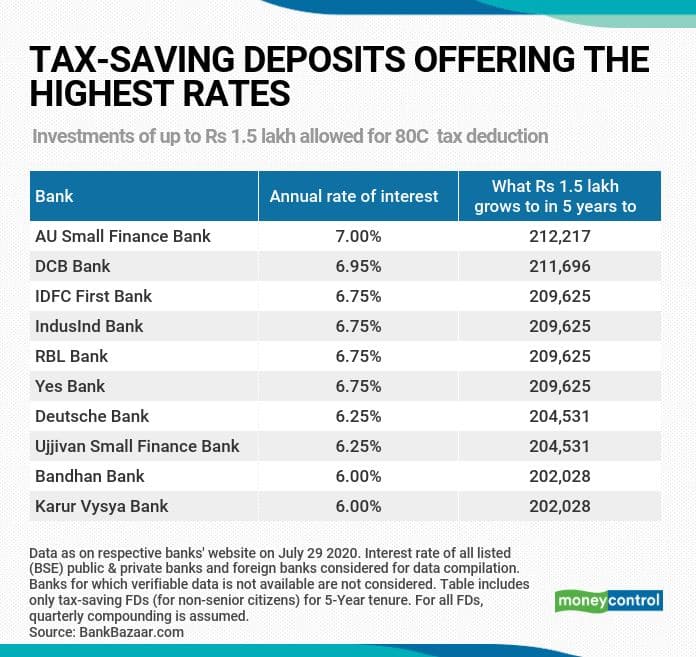

Web 6 avr 2022 nbsp 0183 32 To be eligible for a deduction from taxable income a fixed deposit must have a lock in period of five years In other words only specific five year tax saving fixed Web 8 sept 2023 nbsp 0183 32 Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving

Fixed Deposit Interest Rebate In Income Tax

Fixed Deposit Interest Rebate In Income Tax

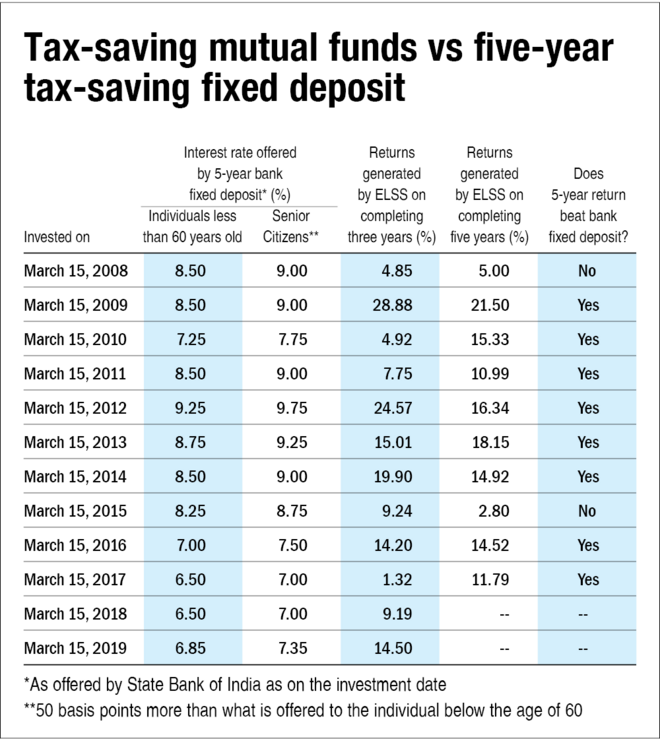

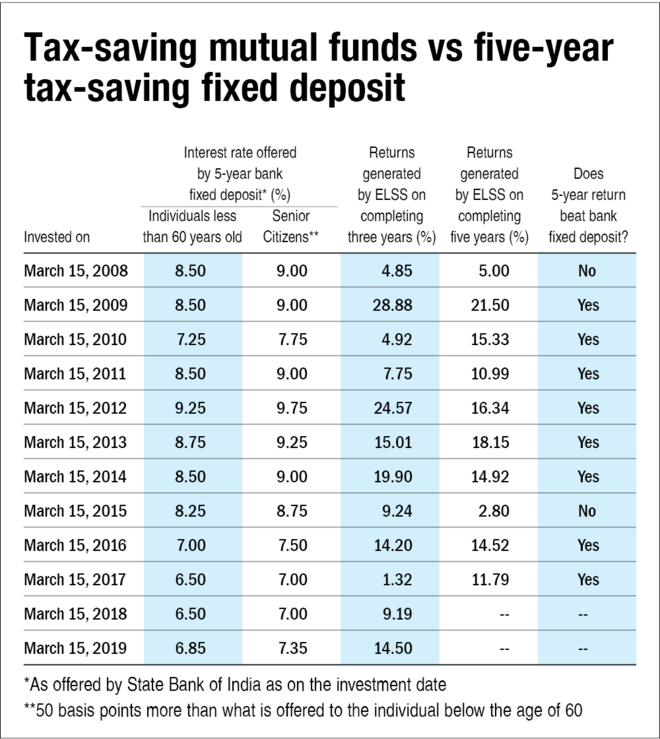

https://www.valueresearchonline.com/content-assets/images/50686_20220406-elss_vs_fd-table__w660__.png

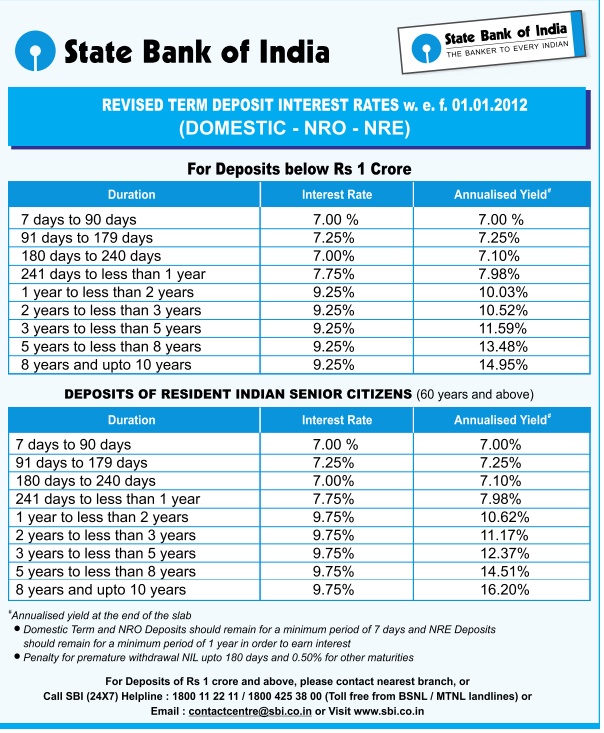

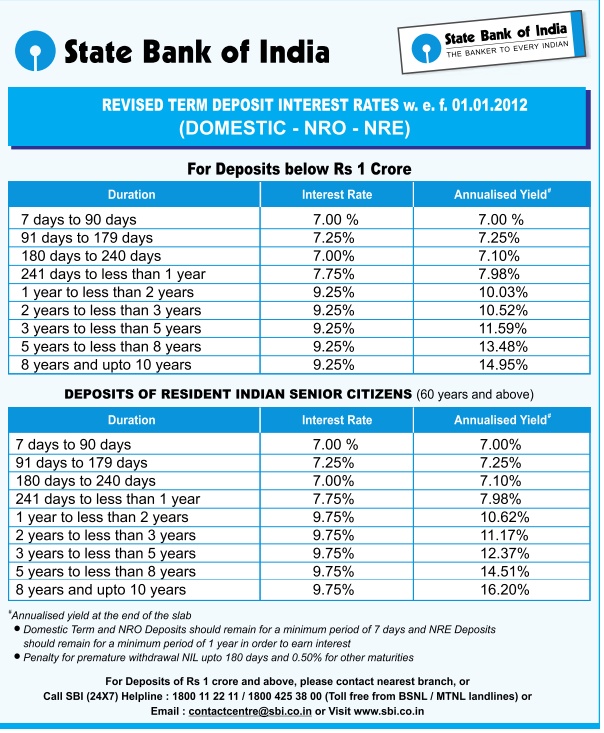

SBI Fixed Deposit Rates For January 2012

https://www.apnaplan.com/wp-content/uploads/2012/01/sbi_fixed_deposit_interest_rate.jpg

Latest Fixed Deposit Interest Rates Of Major Banks Yadnya Investment

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/05/FD-Interest-Rates-of-Major-Banks-for-Tenure-Less-than-1-year-June-2020_Featured.png?fit=1276%2C871&ssl=1

Web 17 avr 2022 nbsp 0183 32 FDR interest is taxable income as per the Income Tax Act Even the banks are obliged to deduct TDS on the FDR interest they pay to the depositors If you have Web Tax on FD interest income must be paid by the due date of the tax return for the year in which the interest was earned Generally this means that the tax must be paid by April 15th of the following year For example if you

Web 22 mars 2023 nbsp 0183 32 Since the interest earned on an FD comes under the Income from Other Sources category it is therefore fully taxable if the annual interest exceeds 40 000 After adding the interest to your gross Web 10 sept 2023 nbsp 0183 32 How are fixed income investments taxed compared with stocks Money generated from fixed income assets is counted as income and taxed at your income tax

Download Fixed Deposit Interest Rebate In Income Tax

More picture related to Fixed Deposit Interest Rebate In Income Tax

SBI NRE NRO Senior Citizen Domestic Fixed Deposit Rates March 2012

http://apnaplan.com/wp-content/uploads/2012/03/SBI-Fixed-deposit-NRE-NRO-Interest-Rate1.png

12 Interest Rate Bank Deposit For You

https://i0.wp.com/blog.investyadnya.in/wp-content/uploads/2020/09/FD-Interest-Rates-of-Small-Finance-Banks-for-Tenure-Less-than-1-year-Oct-2020_Featured.png?fit=1336%2C839&ssl=1

Maybank Fixed Deposit Rate

https://www.finko.com.sg/images/mortgage-articles/uob-fd-rates.jpg

Web 8 sept 2023 nbsp 0183 32 Turn to these stocks for high dividend growth and free cash flow yield Wolfe says Michelle Fox This income fund has a yield of more than 5 and is cheap Web 8 f 233 vr 2023 nbsp 0183 32 While incomes from the fixed deposit and recurring deposit are taxable interest from the savings bank account and post office deposits are tax deductible to a

Web 3 sept 2023 nbsp 0183 32 It provides a deduction of Rs 10 000 on interest Income and this is available to an Individual and HUF Deductions Allowed under 80TTA The deduction Web The interest income you earn from an FD is fully taxable The interest earnings form a part of your total tax liability You must also know that when you earn interest on an FD in a

Best Fixed Deposit Rates

https://myinvestmentideas.com/wp-content/uploads/2019/01/Best-Bank-Fixed-Deposit-FD-Rates-in-India-for-January-2019.jpeg

Latest Fixed Deposit Interest Rates Of Major Banks Yadnya Investment

https://i0.wp.com/blog.investyadnya.in/wp-content/uploads/2020/06/FD-Interest-Rate-of-Major-Banks-for-Tenure-less-than-1-year-July-2020_Featured.png?fit=1157%2C855&ssl=1

https://navi.com/blog/taxability-of-interest-on-fixed-deposits

Web 18 janv 2022 nbsp 0183 32 The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable To calculate income tax on interest

https://www.valueresearchonline.com/stories/50686/fixed-deposits...

Web 6 avr 2022 nbsp 0183 32 To be eligible for a deduction from taxable income a fixed deposit must have a lock in period of five years In other words only specific five year tax saving fixed

5 year Tax Saver Fixed Deposit Latest Interest Rates Yadnya

Best Fixed Deposit Rates

Indian Bank Fixed Deposit Interest Rates

12 Interest Rate Bank Deposit For You

Fixed Deposit TDS On FD And How To Show Interest Income From FD In ITR

Fixed Deposit Interest Rate Hiked 1 FD

Fixed Deposit Interest Rate Hiked 1 FD

SBI PNB Increase FD Interest Rates Check How Much Return You Will Get

10 Tax saving Fixed Deposits That Offer The Best Interest Rates

Best Fixed Deposit Interest Rates

Fixed Deposit Interest Rebate In Income Tax - Web 10 sept 2023 nbsp 0183 32 How are fixed income investments taxed compared with stocks Money generated from fixed income assets is counted as income and taxed at your income tax