Are 529 Contributions Tax Deductible In Virginia As for state income tax filings Virginia529 account owners who are Virginia taxpayers may deduct contributions up to 4 000 per account per year with an unlimited carryforward to future tax years

With a Virginia 529 account Virginia taxpayers who own 529 accounts may contribute what they d like to the 529 account and then deduct on their state tax return contributions up to 4 000 per account Contributions to a Virginia 529 plan of up to 4 000 per account per year are deductible in computing Virginia taxable income with an unlimited carry forward of excess contributions Contributions are

Are 529 Contributions Tax Deductible In Virginia

Are 529 Contributions Tax Deductible In Virginia

https://img.money.com/2016/03/160311_em_campaigncontributions.jpg

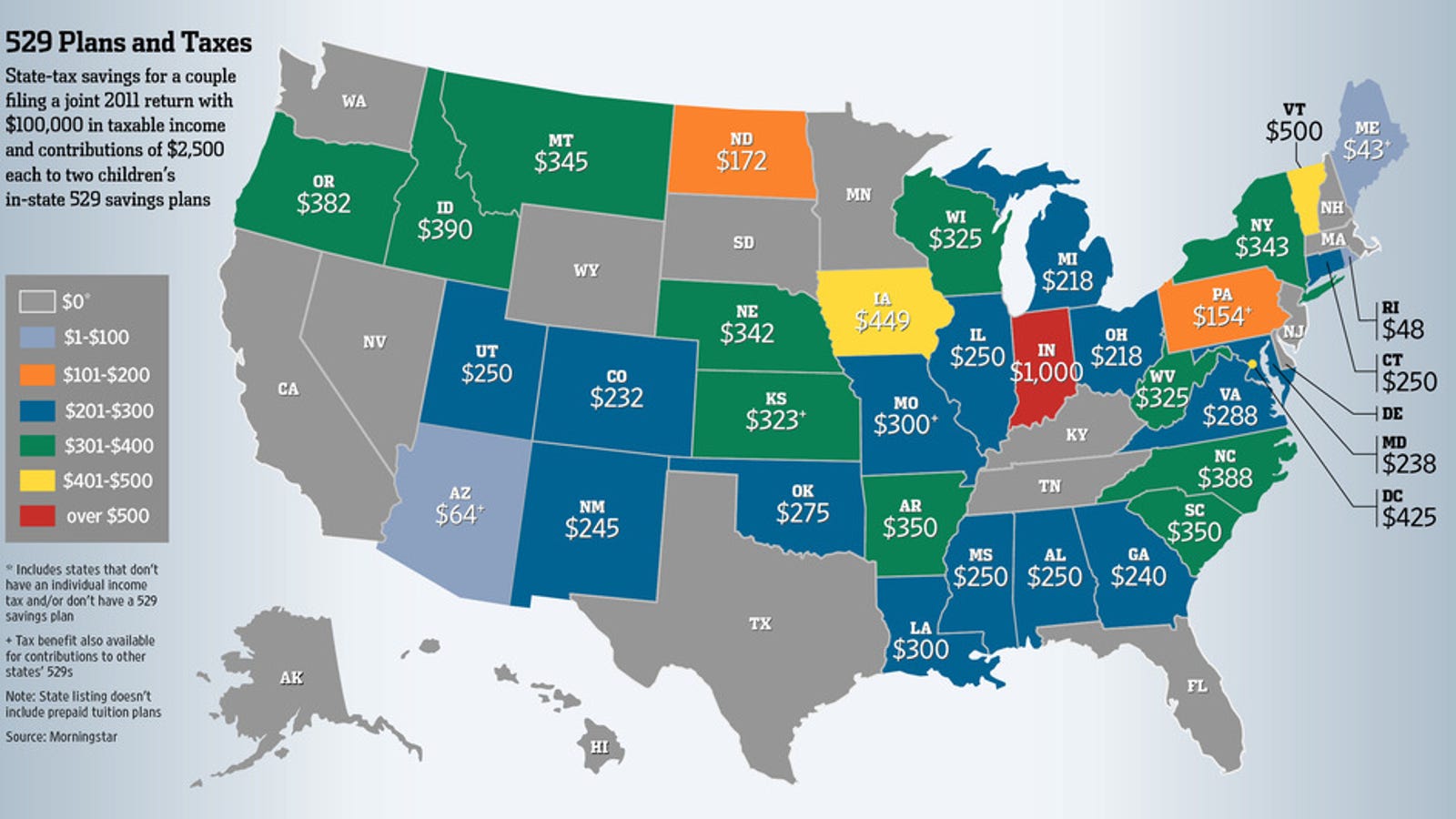

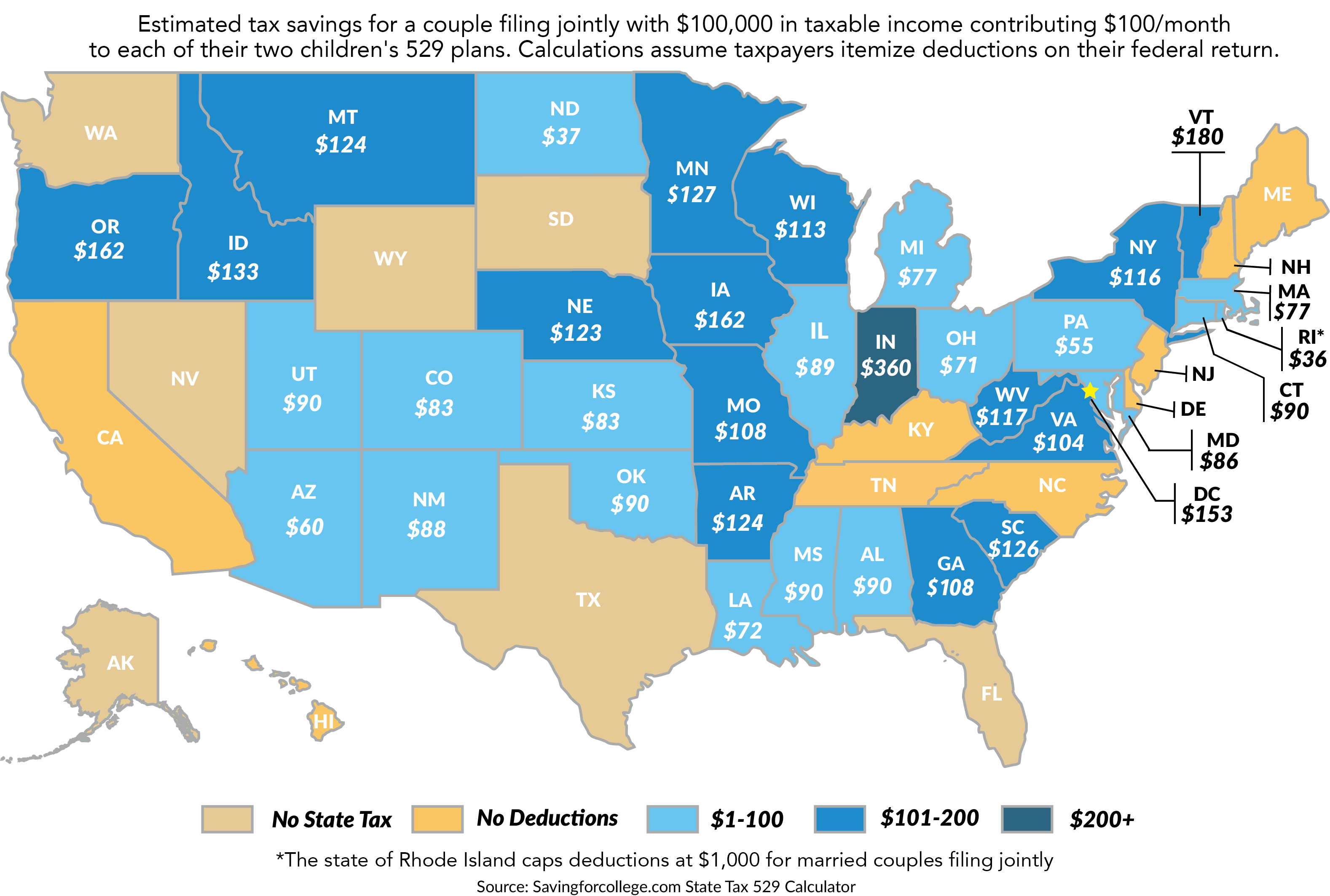

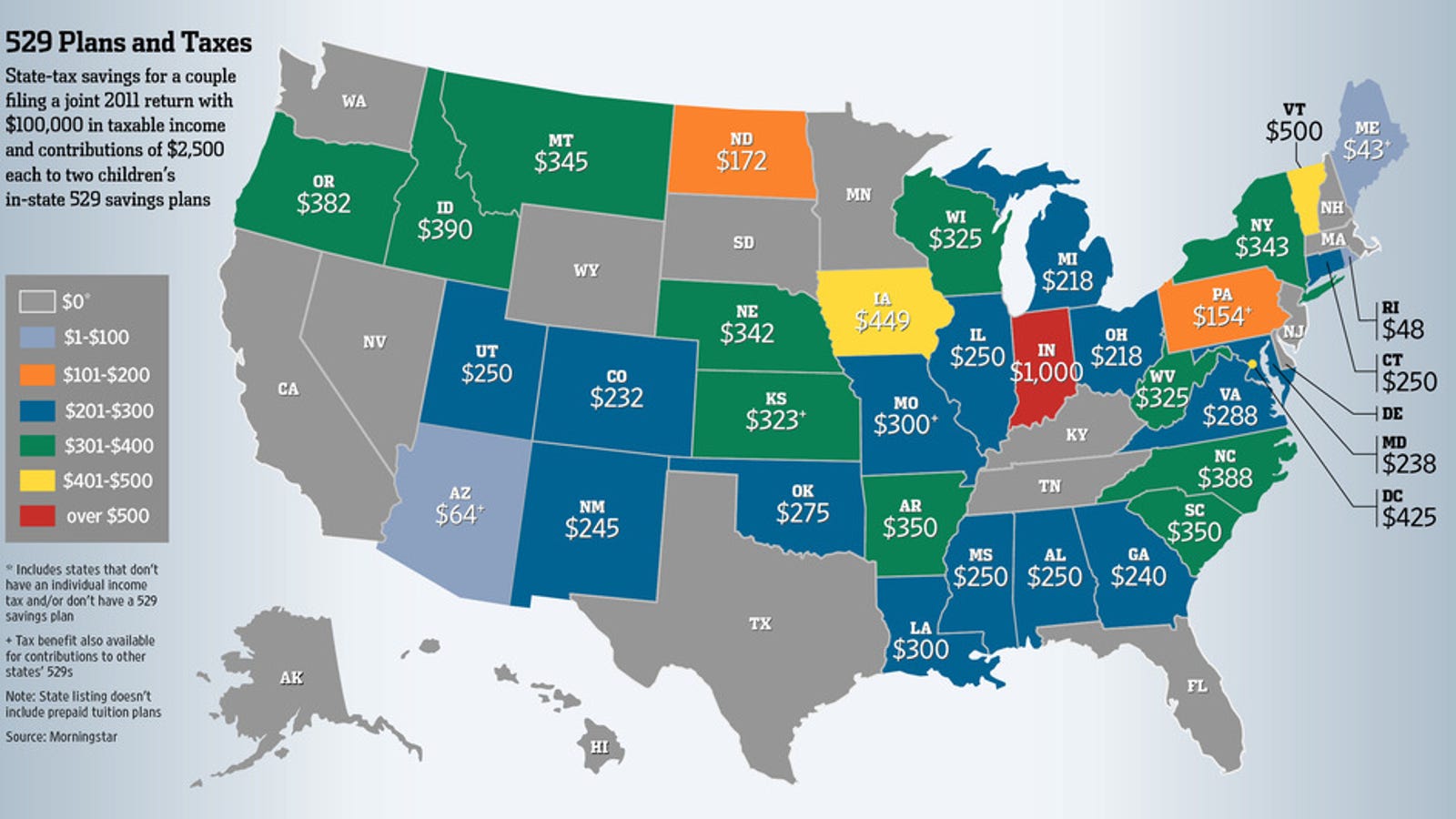

How Much Is Your State s 529 Plan Tax Deduction Really Worth

https://webresources-savingforcollege.s3.amazonaws.com/images/original-state-map-2017-12.png

Deductibility Of Donations Should Be Expanded Archyde

https://www4.nachrichten.at/images/og_image/?ogimg=https://www.nachrichten.at/storage/image/6/5/0/0/2880056_facebook_1ADK3H_bBjWyl.jpg

Residents over the age of 70 who own a 529 account are not limited to the 4k they can actually deduct the entire contribution made to a Virginia 529 but please consult your tax advisor to check on your specific tax Virginia taxpayers can deduct 529 contributions up to 4 000 per account per year virginia529 Washington Washington has no personal income tax so there are no deductions wastate529 wa gov

Yes Anyone may contribute to your Virginia529 account but only account owners may take the Virginia state income tax deduction for contributions Tax Benefits and Investment Fees How Virginia 529 plan compares to other 529 plans Virginia state taxpayers can deduct up to 4 000 contribution per year per beneficiary This is the same whether

Download Are 529 Contributions Tax Deductible In Virginia

More picture related to Are 529 Contributions Tax Deductible In Virginia

Are 529 Plans Tax Deductible Edelman Financial Engines

https://s7d9.scene7.com/is/image/financialengines/WEB_ED-529-contributions

Is Alimony Tax Deductible In Virginia

https://hellodivorce.com/hubfs/raw_assets/public/Groove/modules/topnav/services.png

Understanding 529 Contributions And Tax Deductions In Pennsylvania

https://linesville.net/wp-content/uploads/2023/05/tamlier_unsplash_Understanding-529-Contributions-and-Tax-Deductions-in-Pennsylvania_1685327579.webp

VA residents can claim a tax deduction for contributions to a VA 529 plan Contributions are deductible in computing state taxable income 529 plan contributions grow tax free Virginia offers a state tax deduction for contributions to a 529 plan of up to 4 000 for all tax filing statuses The state also allows unlimited carry forward of excess contributions allowing for super funding

In New Mexico South Carolina and West Virginia 529 plan contributions are fully deductible in computing state income tax Most taxpayers are not required to hold funds in a 529 plan for a specified If you re over 70 your contribution to a 529 account is fully deductible from your taxes Virginia residents can contribute up to 550 000 in total to 529 plans

The Tax Benefits Of College 529 Savings Plans Compared By State

https://i.kinja-img.com/gawker-media/image/upload/s--1ZmmFPnG--/c_fill,fl_progressive,g_center,h_900,q_80,w_1600/1005722794300725574.jpg

Understanding Nondeductible Expenses For Business Owners

https://cdn.shopify.com/s/files/1/0070/7032/files/non-deductible-expenses.png?format=jpg&quality=90&v=1666892015

https://www.virginia529.com › blog

As for state income tax filings Virginia529 account owners who are Virginia taxpayers may deduct contributions up to 4 000 per account per year with an unlimited carryforward to future tax years

https://www.marottaonmoney.com

With a Virginia 529 account Virginia taxpayers who own 529 accounts may contribute what they d like to the 529 account and then deduct on their state tax return contributions up to 4 000 per account

Are Oklahoma 529 Contributions Tax Deductible Diamond Carranza

The Tax Benefits Of College 529 Savings Plans Compared By State

The Complete Guide To Virginia 529 Plans For 2024

School Supplies Are Tax Deductible Wfmynews2

Maryland 2023 Tax Form Printable Forms Free Online

How Does A 529 Savings Plan Work Answered

How Does A 529 Savings Plan Work Answered

Is Oregon 529 College Savings Plan Tax Deductible EverythingCollege info

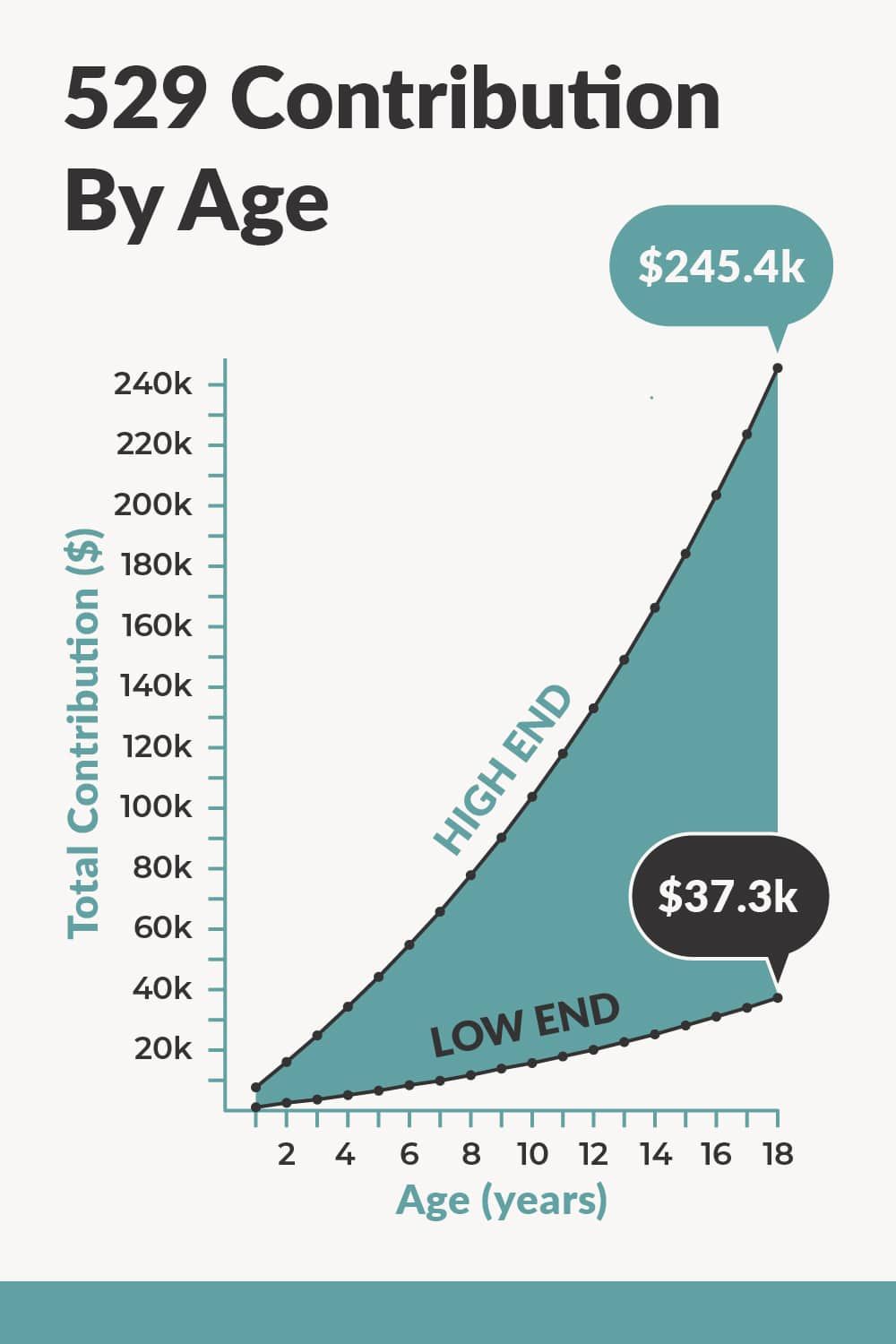

What Should You Have In A 529 Plan Based On Your Age

Virginia Homeowners Insurance Quotes InsureOne Insurance

Are 529 Contributions Tax Deductible In Virginia - If your state is one of those states that has a 529 plan deduction TurboTax will prompt you to enter your 529 contributions when you get to the credits deductions