Rebates On High Efficiency Furnace Web 30 d 233 c 2022 nbsp 0183 32 Federal Income Tax Credits and Incentives for Energy Efficiency Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower

Web Earn Cash for Improving Your Heating and Cooling Get rebates on eligible furnaces air conditioners heat pumps and thermostats You can also get a rebate for tuning up a qualified heating and cooling system It s easy participating contractors file the Web Get up to 1 000 in rebates when you replace your old natural gas furnace with an eligible high efficiency ENERGY STAR 174 model

Rebates On High Efficiency Furnace

Rebates On High Efficiency Furnace

https://chcl.constanthomecomfort.com/wp-content/uploads/2022/12/Furnace-Rebates-1.jpg

80 Efficiency Vs 95 Efficiency Furnaces Dor Mar Heating Air

https://www.dormarhvac.com/wp-content/uploads/2020/02/lady-adjusting-thermostat-1024x683.jpg

The Inflation Reduction Act And The New Tax Incentives Rebates For High

https://www.damarheating.com/wp-content/uploads/2022/10/Inflation-reduction-act-learn-more-New-Tax-Incentives-and-Rebates-for-High-Efficiency-Heat-Pumps-845x321.jpg

Web On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act IRA into law The law includes 391 billion to support clean energy and address climate change including 8 8 billion in rebates for home energy efficiency and electrification Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year

Web 15 ao 251 t 2023 nbsp 0183 32 This program which is run by the U S Environmental Protection Agency EPA and U S Department of Energy DOE to promote energy efficiency offers rebates and special offers based on a Web 1 janv 2023 nbsp 0183 32 Heat pumps and biomass stoves and boilers with a thermal efficiency rating of at least 75 qualify for a credit up to 2 000 per year Costs may include labor for installation Qualified improvements include new Electric or natural gas heat pumps

Download Rebates On High Efficiency Furnace

More picture related to Rebates On High Efficiency Furnace

High Efficiency Federal Rebates Blog

https://image.pbs.org/bento3-prod/wedu-bento-live-pbs/Sustain/Blogs/011323 Federal Rebates/00c49961ad_High-Efficiency_Electric_Home_Rebate.jpg?resize=1199x

High Efficiency Rebates Available Through Your Utility Company SoCo

https://www.socoheatingandcooling.com/blog/wp-content/uploads/2021/08/shutterstock_1065251282.jpg

High Efficiency Furnace Venting What You Need To Know HVAC Training

https://hvactrainingshop.com/wp-content/uploads/2022/07/High-Efficiency-Furnace-Venting-What-You-Need-to-Know.jpg

Web 30 d 233 c 2022 nbsp 0183 32 Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available Web Tax Credits Rebates amp Savings Department of Energy Energy gov Tax Credits Rebates amp Savings Please visit the Database of State Incentives for Renewables amp Efficiency website DSIRE for the latest state and federal incentives and rebates 1000

Web Home Efficiency Project with at least 20 predicted energy savings 80 of project costs up to 4 000 50 of project costs up to 2 000 maximum of 200 000 for a multifamily building Home Efficiency Project with at least 35 predicted energy savings 80 of Web SaskEnergy Residential Rebates Up to 650 for a furnace Up to 1 000 for water heater Up to 2 000 for a boiler Find out how you could receive a rebate of up to 650 by upgrading your furnace up to 1 000 when upgrading to a tankless water heater and up

Goodman GMEC96 Two Stage Gas Furnace High Efficiency 1Click Heating

https://1clickheat.com/wp-content/uploads/2020/09/1ClickHeat-GMEC96-Two-Stage-Gas-Furnace.png

High Efficiency Air Conditioner Rebates Heating And Cooling Rebates

https://www.afmheatcool.com/wp-content/uploads/AFM-DTE-Rebate-Promo-09-18-900x470.jpg

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 Federal Income Tax Credits and Incentives for Energy Efficiency Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower

https://www.consumersenergy.com/.../rebates/heating-and-cooling

Web Earn Cash for Improving Your Heating and Cooling Get rebates on eligible furnaces air conditioners heat pumps and thermostats You can also get a rebate for tuning up a qualified heating and cooling system It s easy participating contractors file the

Government Rebates For New High Efficiency Furnace Maple Furnace

Goodman GMEC96 Two Stage Gas Furnace High Efficiency 1Click Heating

How To Choose Between A Heat Pump Vs A Furnace

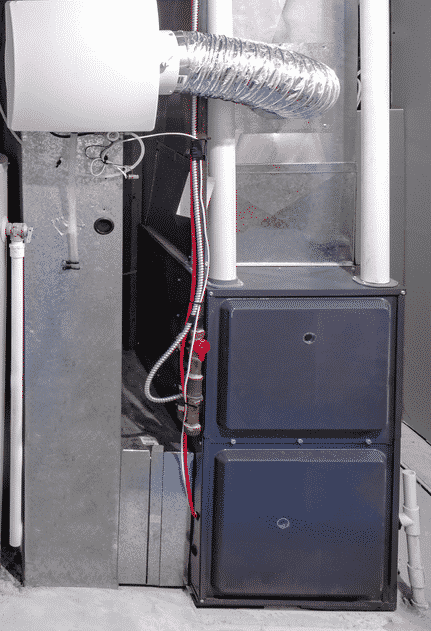

What Is High Efficiency Furnace Venting HVAC BOSS

Understanding Rebates Genuine Comfort Heating Air

AC Furnace Boiler And Plumbing Repair In Albany NY

AC Furnace Boiler And Plumbing Repair In Albany NY

High Efficiency Furnace Services In Central Indiana

Electric V Gas Which Furnace Is More Efficient

High Efficiency Furnace Condensate Drain 2022

Rebates On High Efficiency Furnace - Web Upgrade to a high efficiency model and get rebates up to 500 How it works A participating contractor will come to your home with information about furnace equipment that qualifies for rebates After you select a new model your contractor will Properly