Invite to Our blog, a space where curiosity meets details, and where day-to-day subjects come to be appealing conversations. Whether you're seeking insights on way of living, modern technology, or a bit of everything in between, you've landed in the best location. Join us on this exploration as we dive into the realms of the average and phenomenal, understanding the globe one blog post each time. Your trip into the remarkable and diverse landscape of our Are 529 Plan Contributions Tax Deductible In Colorado starts right here. Check out the fascinating web content that awaits in our Are 529 Plan Contributions Tax Deductible In Colorado, where we unwind the ins and outs of various topics.

Are 529 Plan Contributions Tax Deductible In Colorado

Are 529 Plan Contributions Tax Deductible In Colorado

Can 529 Be Used For Rent A Student s Guide ApartmentGuide

Can 529 Be Used For Rent A Student s Guide ApartmentGuide

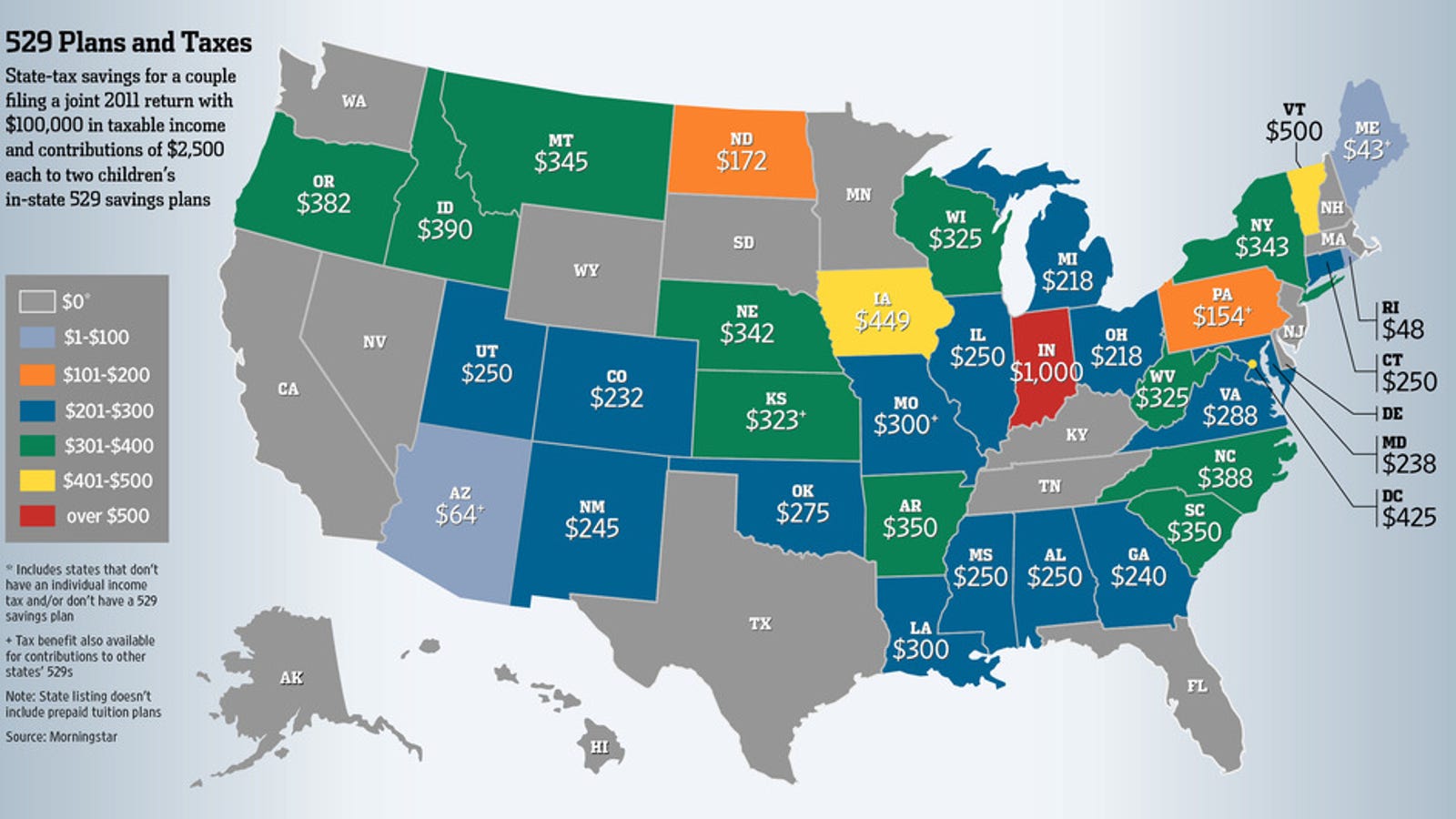

The Tax Benefits Of College 529 Savings Plans Compared By State

The Tax Benefits Of College 529 Savings Plans Compared By State

Gallery Image for Are 529 Plan Contributions Tax Deductible In Colorado

Blank Ohio Form It 1040Ez Fill Out And Print PDFs

Are Retirement Plan Contributions Tax Deductible Human Interest

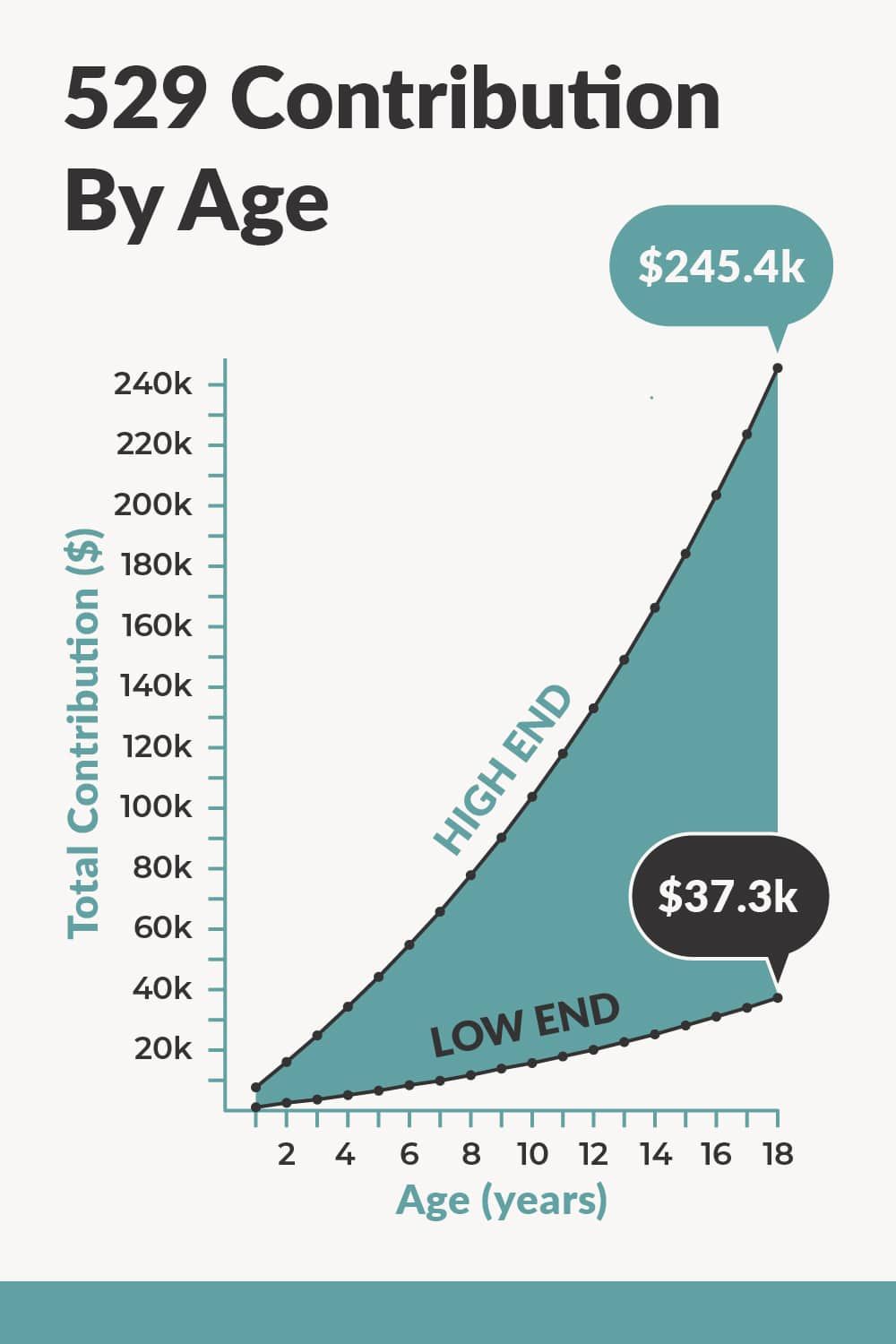

How Much Can You Contribute To A 529 Plan

The Complete Guide To CHET 529 College Savings Plans

529 Plan Qualified Expenses Using The 529 To Pay Off Campus Rent

5498 Esa 2018 2024 Form Fill Out And Sign Printable PDF Template

5498 Esa 2018 2024 Form Fill Out And Sign Printable PDF Template

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

New 529 Plan Rules 2024 Changes Rona Vonnie

Thanks for picking to explore our internet site. We truly wish your experience surpasses your assumptions, which you discover all the information and sources about Are 529 Plan Contributions Tax Deductible In Colorado that you are looking for. Our commitment is to offer an user-friendly and insightful system, so feel free to browse via our web pages effortlessly.