Are Benefits Taxable In Canada The Canadian Revenue Agency CRA defines a taxable benefit as a benefit where an employee receives an economic advantage that can be measured in money such as

What are taxable benefits Taxable benefits are non monetary perks or advantages provided by employers to employees These benefits are considered a form of compensation and can There are primarily two types of taxable benefits that Canadians usually run into employee benefits and shareholder benefits Section 6 of the Income Tax Act governs the rule around employee benefits while section 15

Are Benefits Taxable In Canada

/BusinessmanInCar-56cb3af43df78cfb379b7958.jpg)

Are Benefits Taxable In Canada

https://www.thebalancesmb.com/thmb/47mbjEdupvaQXj4Y9ZiKK7zWgvU=/3869x2579/filters:fill(auto,1)/BusinessmanInCar-56cb3af43df78cfb379b7958.jpg

Is Life Insurance Taxable In Canada CanadaWise

https://canadawise.ca/wp-content/uploads/2022/06/is-life-insurance-taxable-in-canada-1536x1024.jpg

Is Disability Income Taxable In Canada Lionsgate Financial Group

https://www.lionsgatefinancialgroup.ca/wp-content/uploads/2021/11/Investing-3-1200x800-layout1194-1gnv4d6.png

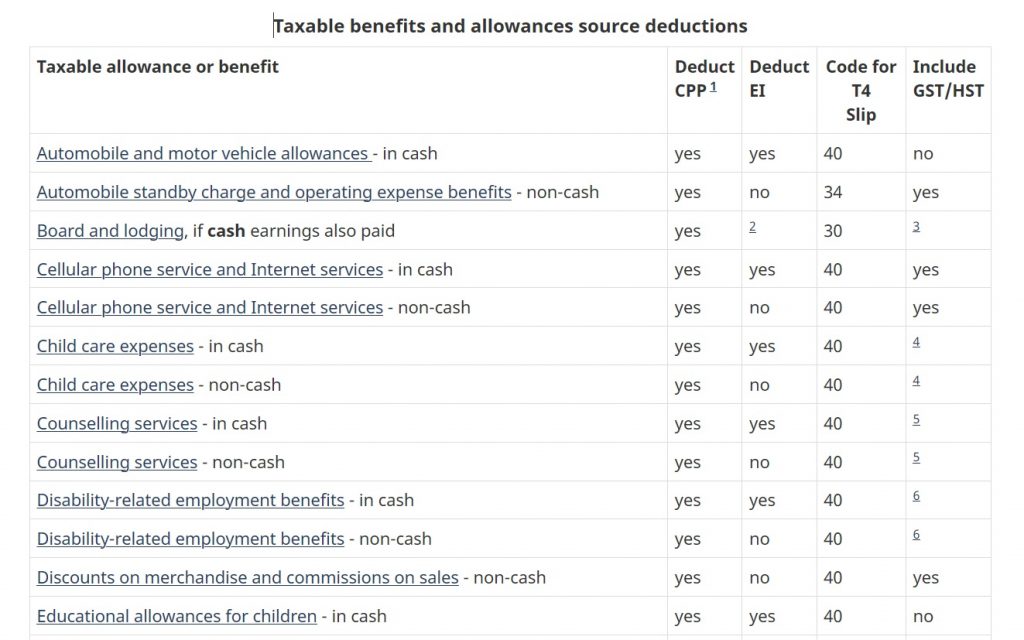

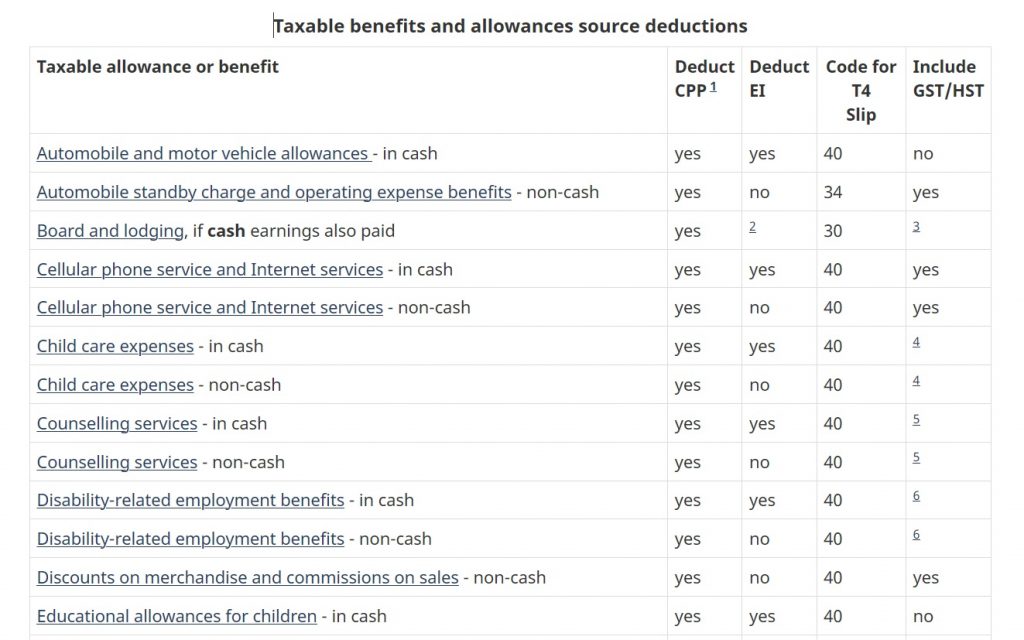

Unfortunately the rules behind which benefits are and aren t taxable isn t a straightforward answer Check out this chart from the Canadian government to learn whether your benefit gift or allowance is Canada Taxable benefits are employer provided non cash forms of compensation that are considered taxable income for employees Expected taxable benefits include company

A taxable benefit is a payment from an employer to an employee that is considered a positive benefit and can be in the form of cash or another type of payment A If the policy is structured as a non taxable benefit the employee pays 100 of the premiums but the benefit is tax free at the time of claim Life Accidental Death Dismemberment AD D and Critical Illness premiums

Download Are Benefits Taxable In Canada

More picture related to Are Benefits Taxable In Canada

Are Alimony Payments Taxable In Canada Know The Facts

https://moosejawdivorcelawyer.ca/wp-content/uploads/2022/06/Are-Alimony-Payments-Taxable-in-Canada-Featured-Image.jpg

Introduction To Taxable Income In Canada Part II Davis Martindale Blog

https://www.davismartindale.com/app/uploads/2020/03/Taxable-Income-Part-II-LG.png

Foreign Social Security Taxable In Us TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

You may have valuable company benefits like a cell phone tuition reimbursement or service awards But you may or may not have to include the value of these benefits in income Here s how the Canada Revenue Agency Some of the most common benefits that are taxable in Canada include personal use of a company vehicle transit passes gym memberships employer provided parking and personal

Benefits are often taxable and may be subject to statutory deductions including Canadian Income Tax CIT Canada Pension Plan and Employment Insurance EI Some examples of If you are an employer who provides benefits or allowances to your employees you know the importance of calculating taxable benefits accurately for payroll and T4

Are Disability Insurance Benefits Taxable In Canada

https://briansoinsurance.com/wp-content/uploads/2021/11/Are-Disability-Insurance-Benefits-Taxable-In-Canada-768x576.jpg

Taxable Benefits In Canada What You Should Know As An Employer Kevin

https://ml2gqn5rfgol.i.optimole.com/ctLlDOQ.-BWa~25210/w:1024/h:535/q:mauto/f:avif/https://rattray.cpa/wp-content/uploads/2021/11/Taxable-benefits-1200x627-1.jpg

/BusinessmanInCar-56cb3af43df78cfb379b7958.jpg?w=186)

https://www.simplybenefits.ca/blog/a-guide-to...

The Canadian Revenue Agency CRA defines a taxable benefit as a benefit where an employee receives an economic advantage that can be measured in money such as

https://www.canadalife.com/insurance/group...

What are taxable benefits Taxable benefits are non monetary perks or advantages provided by employers to employees These benefits are considered a form of compensation and can

Are Long Term Disability Benefits Taxable In Canada Cochrane Personal

Are Disability Insurance Benefits Taxable In Canada

Are Employee Benefits Taxable In Canada

Pre i Mokra ov Letm Income Tax Calculator Bc Norma Kamera Drevo

Disability Insurance Benefits Taxable In Canada

Helpful Resources For Calculating Canadian Employee Taxable Benefits

Helpful Resources For Calculating Canadian Employee Taxable Benefits

Unemployment Taxable Income Updated For COVID 19 2020 How The IRS

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Are Property Insurance Proceeds Taxable In Canada The Pinnacle List

Are Benefits Taxable In Canada - Whether or not a group benefit is taxable in Canada depends on the type of benefit and how it is funded Generally speaking employer paid premiums for group life