Are Business Rebates Taxable Shankar establishes a precedent regarding the amount and timing of the taxable event for rewards programs The redemption of the

Many companies offer cash back rewards for purchasing their product but is this reward considered taxable income Watch this video to learn more about cash back rewards Business credit card rewards are not considered income which means they are not taxable Instead credit card rewards are considered rebates on items you

Are Business Rebates Taxable

Are Business Rebates Taxable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/63638715cda5ce39da72168b_Blog banners 2400x1348px3.png

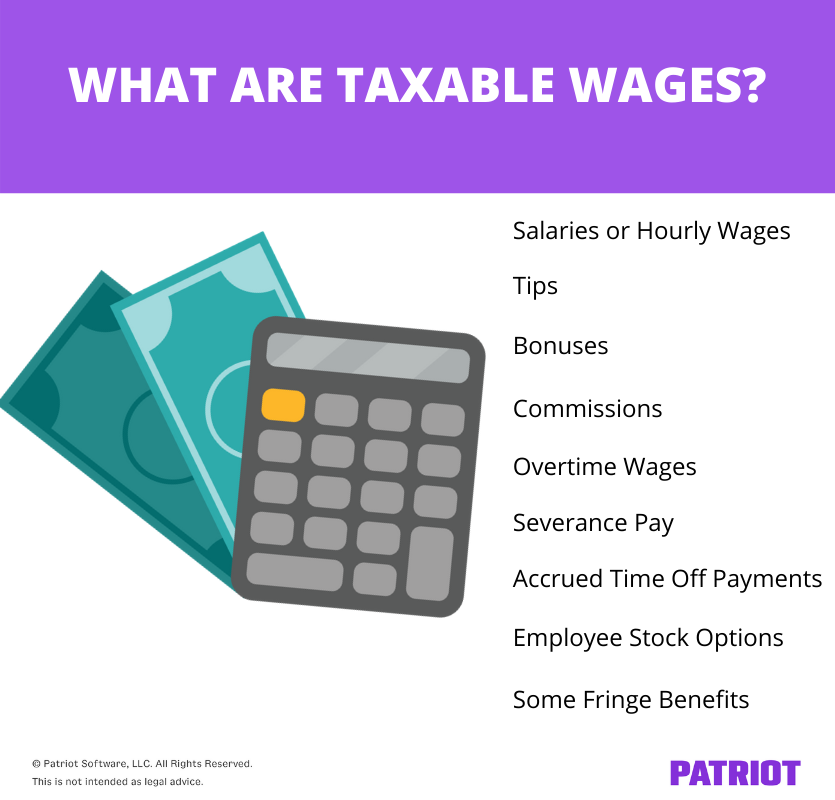

What You Need To Know About Taxable Wages 3 Things

https://www.patriotsoftware.com/wp-content/uploads/2016/01/what-are-taxable-wages.png

Are Buyer Agent Commission Rebates Taxable In NYC YouTube

https://i.ytimg.com/vi/aJwAZbWrXb4/maxresdefault.jpg

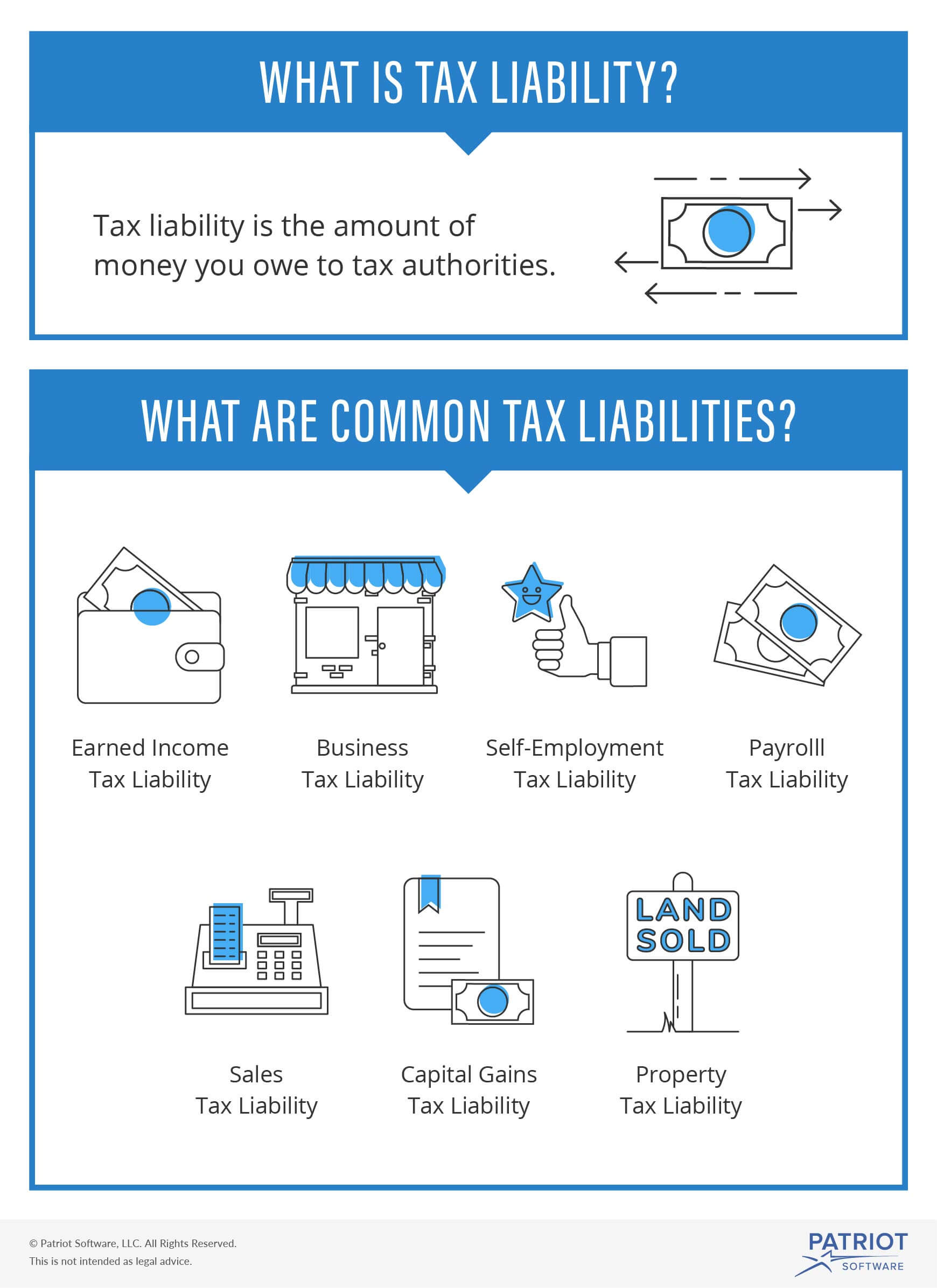

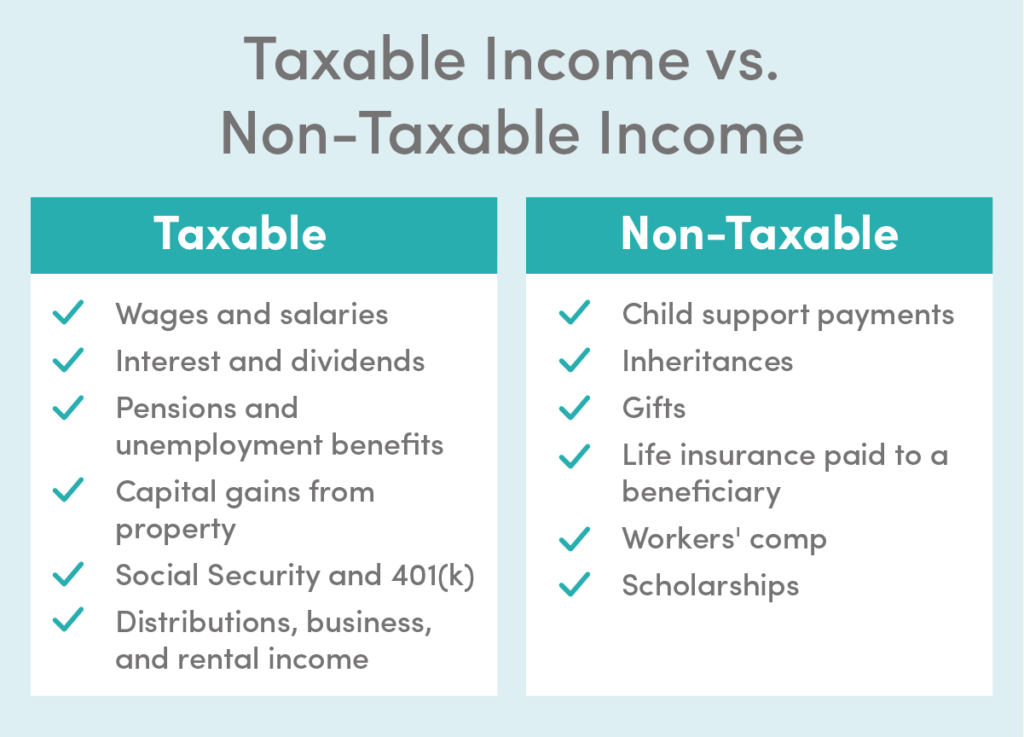

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject Before turning to the business context one important question is whether credit card rewards in general are considered to be taxable income Fortunately for

Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit Taxpayers will make purchases with the credit cards and as a result of those purchases will be entitled to receive rebates The rebates are based on a percentage of

Download Are Business Rebates Taxable

More picture related to Are Business Rebates Taxable

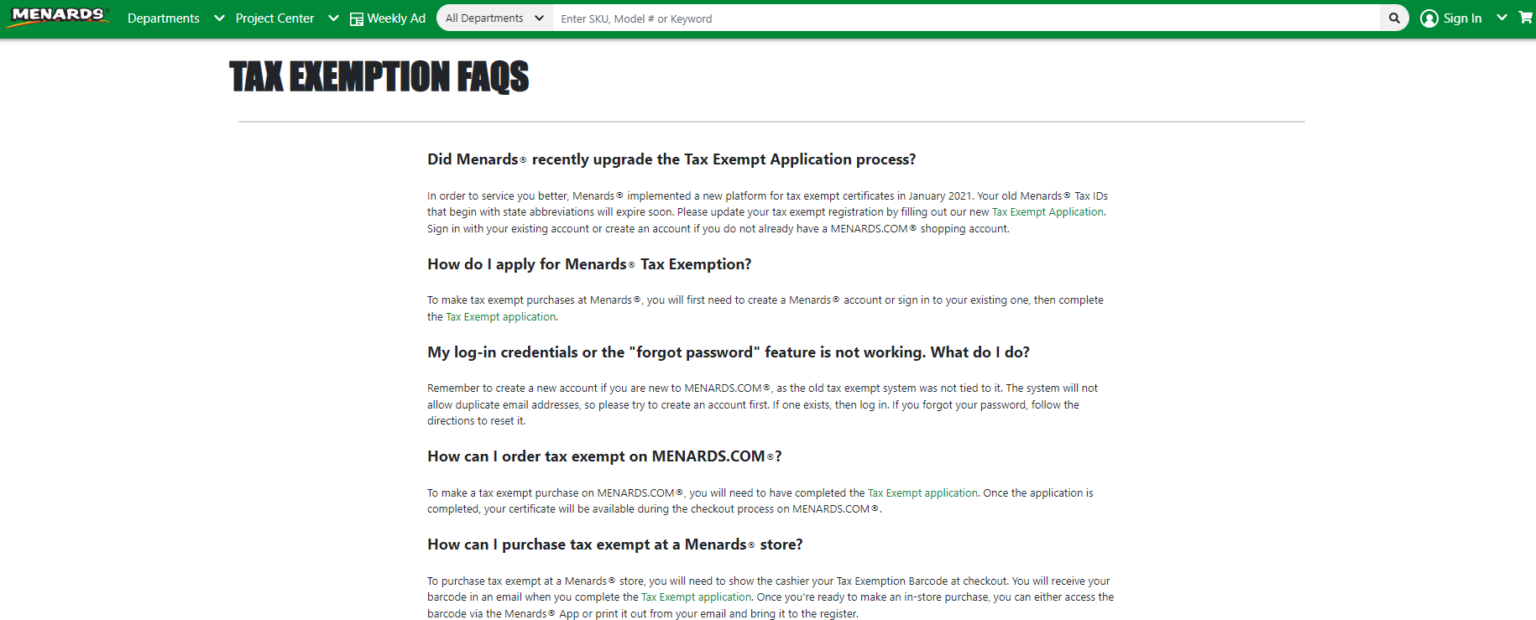

Are Menards Rebates Taxable Menards Rebate Form 2023

https://www.menardsrebateform.com/wp-content/uploads/2023/03/Menards-Rebates-Taxable-1536x620.png

Are 2022 Tax Rebates Considered taxable Income YouTube

https://i.ytimg.com/vi/Kqpil_lM9jY/maxresdefault.jpg

Putting The Spotlight On Taxable Commissions And Rebates HomeServices

https://homeservicesrelocation.com/wp-content/media/Sample-Pricing-Table.jpg

Typically you can deduct business expenses against business income But if you re earning rewards that is a discount on a purchase through a business credit card you can deduct only the If you itemized only the portion of the refund that gave you a tax benefit is treated as taxable income The taxable portion is reported on line 10 of Form 1040

Rewards that are treated as rebates on spending Rewards that are treated as income in exchange for performing a service From a redemption perspective you Tax offsets also referred to as rebates directly reduce the amount of tax payable on your taxable income Offsets can reduce your tax payable to zero but can t get you a refund

Small Business Tax Deductions Tax Deductible Business Expenses

https://www.communitytax.com/wp-content/uploads/2019/04/Small-Business-Tax-Deductions-1.png

Are NYC Buyer Broker Commission Rebates Taxable FAQ On IRS Tax And

https://i.pinimg.com/736x/eb/b3/3c/ebb33cbffc298bae44d1b3d363b6feff.jpg

https://www.thetaxadviser.com/issues/2…

Shankar establishes a precedent regarding the amount and timing of the taxable event for rewards programs The redemption of the

https://turbotax.intuit.com/tax-tips/irs-tax...

Many companies offer cash back rewards for purchasing their product but is this reward considered taxable income Watch this video to learn more about cash back rewards

5 Common Ways To Lower Your Taxable Income In 2022 My Business Web Space

Small Business Tax Deductions Tax Deductible Business Expenses

Does The IRS Tax Customer Rebates Points And Rewards

What is taxable income Financial Wellness Starts Here

How To Reduce Your Tax Liability Headassistance3

How To Reduce Your Taxable Income 2023

How To Reduce Your Taxable Income 2023

Business Rebates Illustrations Royalty Free Vector Graphics Clip Art

Maths Literacy 2020 Taxable Income And Tax Rebates YouTube

Taxable Income Formula Financepal

Are Business Rebates Taxable - Before turning to the business context one important question is whether credit card rewards in general are considered to be taxable income Fortunately for